PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906057

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906057

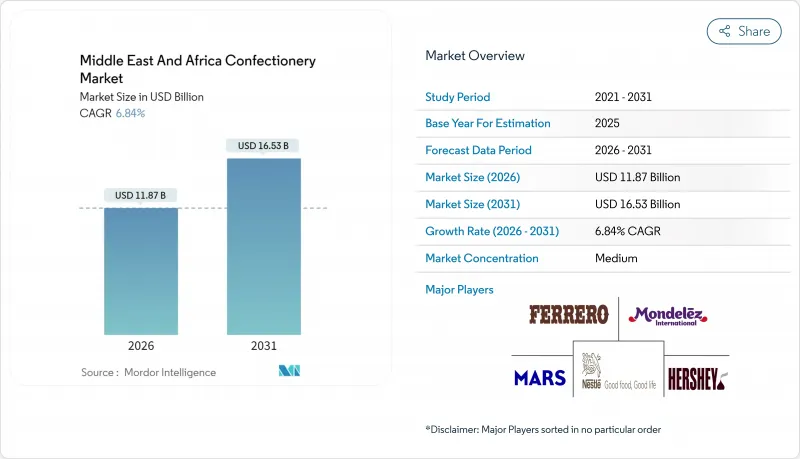

Middle East And Africa Confectionery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Middle East and Africa confectionery market was valued at USD 11.11 billion in 2025 and estimated to grow from USD 11.87 billion in 2026 to reach USD 16.53 billion by 2031, at a CAGR of 6.84% during the forecast period (2026-2031).

The market's trajectory is primarily attributed to several key factors, including heightened health consciousness among the consumer base, escalating demand for premium confectionery offerings, and the systematic expansion of retail and e-commerce distribution networks. The regional market is undergoing a significant transformation due to increased exposure to global consumption patterns, the progressive adoption of Western lifestyle preferences, and the strategic expansion of international confectionery manufacturers. Furthermore, the continuous development of sophisticated retail infrastructure has substantially enhanced product accessibility and market penetration, particularly within metropolitan regions, facilitating broader market reach and consumer engagement.

Middle East And Africa Confectionery Market Trends and Insights

Rising health awareness among consumers

Health consciousness is driving significant changes in the Middle East and Africa confectionery market. Consumers' increased understanding of sugar consumption's negative health impacts, including obesity, diabetes, and cardiovascular diseases, has led to a shift toward healthier alternatives. This trend has increased demand for low-sugar, sugar-free, organic, and functional confectionery products. Urban consumers and younger populations specifically seek products that balance indulgence with health benefits, compelling manufacturers to develop new formulations using natural sweeteners and enhanced nutritional profiles. The implementation of a 50% sugar tax on high-sugar products in Saudi Arabia and the United Arab Emirates, following World Health Organization (WHO) recommendations, has made traditional sugary confectionery less economically attractive. This taxation has encouraged both manufacturers and consumers to transition toward reduced-sugar and lower-calorie options, expanding the market for health-conscious confectionery products.

Cultural and religious events driving seasonal consumption

Religious celebrations, particularly Ramadan and Eid festivals, drive significant seasonal demand in regional confectionery consumption. During these periods, consumption increases substantially, with traditional sweets and premium chocolates serving as essential elements of cultural celebrations and social gatherings. Manufacturers adapt to these predictable demand patterns by introducing specialized products, seasonal packaging, and locally preferred flavors. The gifting customs during Eid boost premium product sales, while Ramadan's iftar meals include confectionery as traditional desserts. This integration into religious practices provides confectionery products with sustained market presence, as religious observances remain stable regardless of economic conditions. The pattern extends beyond Middle Eastern markets into African nations with large Muslim populations, creating growth opportunities for companies that incorporate cultural considerations in their product development and marketing strategies.

Strict regulatory compliance requirements

The diverse regulatory requirements across the Middle East and Africa create significant compliance challenges, particularly for small manufacturers and new entrants establishing regional distribution networks. The varying nutritional labeling requirements between countries, including front-of-pack warning systems in some markets and traditional nutritional panels in others, require manufacturers to produce multiple packaging variants for regional distribution. Halal certification adds further compliance requirements, especially for international brands targeting Muslim consumers, who form the majority demographic in many regional markets. Companies must also navigate distinct import regulations, tariff structures, and local content requirements while maintaining competitive pricing. This fragmented regulatory environment limits the potential for economies of scale in compliance investments and hinders regional market integration, affecting overall market efficiency and growth.

Other drivers and restraints analyzed in the detailed report include:

- Introduction of innovative flavors and product varieties

- Growth in the tourism industry supporting market growth

- Limited cold chain infrastructure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In the Middle East and Africa confectionery market, chocolates maintain a dominant position with a 43.32% market share in 2025, supported by cultural preferences and established consumption patterns. Chocolates remain integral to social gatherings, festivals, gift-giving customs, and personal consumption across diverse consumer groups. The region's cocoa production capabilities enhance this market dominance. According to the International Cocoa Organization (ICCO), cocoa production for 2023/24 reached 1.8 million metric tons in Cote d'Ivoire and 0.58 million metric tons in Ghana. As major global cocoa producers, these countries ensure a consistent supply of cocoa beans to support local and regional chocolate manufacturing. This supply reliability enables product innovation and diverse consumer offerings across the Middle East and Africa, reinforcing chocolate's market leadership.

The snack bars segment demonstrates significant market potential, exhibiting a projected CAGR of 8.03% during the forecast period 2026-2031. This growth trajectory is primarily attributed to increasing consumer health consciousness and the transformation of dietary preferences in the region. The segment's expansion is further facilitated by the strategic development of distribution networks, encompassing both digital commerce platforms and traditional retail establishments. These distribution channels enhance product accessibility and availability throughout the Middle Eastern and African markets, effectively addressing the increasing consumer demand for nutritious, portable food options.

The MEA Confectionery Market is Segmented by Product Type (Chocolates, Gums, Sugar Confectionery, Snack Bars and Others), by Packaging Type (Flexible Packaging, Rigid Packaging, Blister Packs, and Others), by Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Retail Stores, and Other Distribution Channel), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mars, Incorporated

- Mondel?z International, Inc.

- Nestle S.A.

- Ferrero SpA

- The Hershey Company

- Chocoladefabriken Lindt & Sprungli

- Pladis (Global / Ulker)

- Perfetti Van Melle

- Patchi SAL

- Al Nassma Chocolate LLC

- Bateel International

- Tiger Brands Ltd (Beacon)

- Afrikoa Chocolate

- COTE d'OR (Modecor Group)

- Haribo GmbH

- Darrell Lea (AMEA export)

- Crown Confectionery Co. Ltd.

- Storck KG

- Arcor SAIC

- Chocodate (Al Barari)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising health awareness among consumers

- 4.2.2 Cultural and religious events driving seasonal consumption

- 4.2.3 Introduction of innovative flavors and product varieties

- 4.2.4 Growth in the tourism industry supports the market growth

- 4.2.5 Expansion of modern retail chains and e-grocery platforms

- 4.2.6 Increasing demand for premium and artisanal chocolates

- 4.3 Market Restraints

- 4.3.1 Strict regulatory compliance requirements

- 4.3.2 Competition from traditional local sweets

- 4.3.3 Fluctuating raw material prices

- 4.3.4 Limited cold chain infrastructure

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter''s Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Chocolates

- 5.1.2 Gums

- 5.1.3 Sugar Confectionery

- 5.1.3.1 Hard Candy

- 5.1.3.2 Lollipops

- 5.1.3.3 Mints

- 5.1.3.4 Pastilles, Gummies, and Jellies

- 5.1.3.5 Toffes and Nougats

- 5.1.3.6 Others

- 5.1.4 Snack Bars

- 5.1.5 Others

- 5.2 By Packaging Type

- 5.2.1 Flexible Packaging

- 5.2.2 Rigid Packaging

- 5.2.3 Blister Packs

- 5.2.4 Others

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Convenience Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channels

- 5.4 By Country

- 5.4.1 South Africa

- 5.4.2 Saudi Arabia

- 5.4.3 United Arab Emirates

- 5.4.4 Nigeria

- 5.4.5 Egypt

- 5.4.6 Morocco

- 5.4.7 Turkey

- 5.4.8 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Mars, Incorporated

- 6.4.2 Mondel?z International, Inc.

- 6.4.3 Nestle S.A.

- 6.4.4 Ferrero SpA

- 6.4.5 The Hershey Company

- 6.4.6 Chocoladefabriken Lindt & Sprungli

- 6.4.7 Pladis (Global / Ulker)

- 6.4.8 Perfetti Van Melle

- 6.4.9 Patchi SAL

- 6.4.10 Al Nassma Chocolate LLC

- 6.4.11 Bateel International

- 6.4.12 Tiger Brands Ltd (Beacon)

- 6.4.13 Afrikoa Chocolate

- 6.4.14 COTE d'OR (Modecor Group)

- 6.4.15 Haribo GmbH

- 6.4.16 Darrell Lea (AMEA export)

- 6.4.17 Crown Confectionery Co. Ltd.

- 6.4.18 Storck KG

- 6.4.19 Arcor SAIC

- 6.4.20 Chocodate (Al Barari)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK