PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906066

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906066

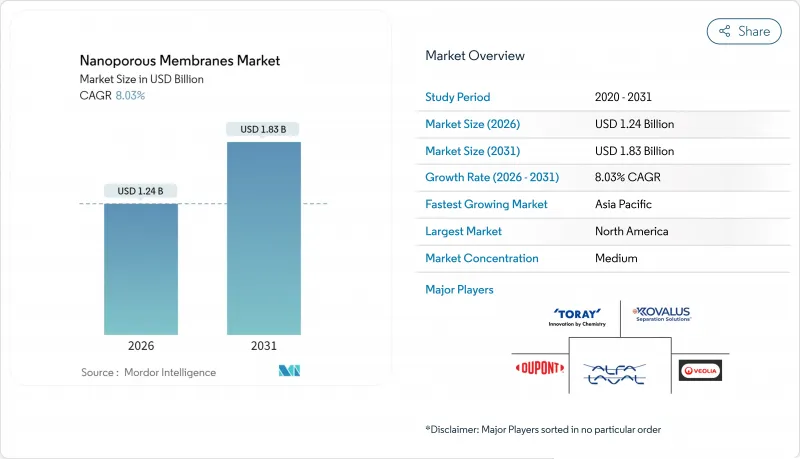

Nanoporous Membranes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Nanoporous Membranes Market was valued at USD 1.15 billion in 2025 and estimated to grow from USD 1.24 billion in 2026 to reach USD 1.83 billion by 2031, at a CAGR of 8.03% during the forecast period (2026-2031).

Growing demand for high-performance separation in water treatment, fuel cells, and biomedical processes is the primary engine behind this expansion. Regulatory tightening on industrial effluents, aggressive global desalination build-outs, and rising bioprocessing throughput needs all favor the rapid adoption of advanced membrane platforms. Technology suppliers are positioning around hybrid organic-inorganic designs and AI-enabled performance modeling to reduce energy use, tackle fouling, and shorten development cycles. Competitive intensity is rising as incumbents acquire niche innovators to secure scale advantages in manufacturing and broaden application coverage.

Global Nanoporous Membranes Market Trends and Insights

Growing Need for Waste- and Waste-Water Re-Use

Municipal and industrial operators are scaling membrane bioreactor lines and nanofiltration polishing steps to close water loops, achieve potable-reuse goals, and meet stringent discharge caps. A silk-based nanofiltration platform from the University of Hong Kong purifies water 10 times faster while cutting energy use by 80%, illustrating the step-change efficiency gains now possible. Utilities prioritize membranes that balance high contaminant rejection with fouling resistance, driving capital spending toward hybrid systems that pair biological pretreatment with nano-scale filtration. As asset owners adopt performance-based contracts, suppliers offering predictive maintenance and low-pressure designs gain traction. The result is accelerating investment in modular plants that can be deployed rapidly in water-scarce urban corridors.

Desalination Capacity Additions in Water-Scarce Regions

Mega-scale brackish and seawater desalination hubs in Egypt, Algeria, and Gulf states are catalyzing record demand for ultra-high-pressure reverse-osmosis elements. Egypt's newly completed 7.5 million m3/day station underscores the volumetric scale now targeted by government water-security programs. EU facilities, 2,178 plants producing 6.86 million m3/day, are layering renewable power and energy-recovery devices onto membrane trains to slash operating costs. Suppliers are, in turn, engineering membranes rated for 250,000 ppm feed, longer lifespans, and harsh pretreatment chemistries. Subsurface intakes and brine-mining pilots add further durability requirements, elevating the value of composite and ceramic substrates in niche high-salinity settings.

Low Adoption in Price-Sensitive Developing Countries

Capital constraints and limited skilled labor curb membrane roll-outs, despite urgent needs for safe water. Algeria's desalination roadmap highlights financing hurdles even as project pipelines swell. Dependence on imported modules inflates life-cycle costs, while sparse local manufacturing capacity delays spare-part deliveries. Development-finance initiatives attempt to bridge funding gaps, yet scaling remains slow relative to demand. Without cost-down advances in module fabrication and service models, adoption in rural and peri-urban centers will remain muted.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Industrial Effluent Discharge Norms

- Bioprocessing Demand for High-Purity Filtration

- Fouling and Cleaning-Cycle Cost Penalties

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Organic membranes command 63.44% of the nanoporous membranes market size and are projected for an 8.47% CAGR through 2031, sustaining their lead via cost-effective roll-to-roll production and strong salt-rejection performance. Polyamide thin-film-composite sheets dominate desalination and industrial wastewater service because they marry high selectivity with scalable fabrication. Recent advances in sulfonated poly(ether ether ketone) provide low-cost proton-exchange options for fuel cells, challenging premium fluoropolymer incumbents.

Hybrid designs blending polymer matrices with inorganic fillers such as graphene oxide or zirconia are expanding fastest within the nanoporous membranes market, pairing the processability of organics with ceramic durability. Chitosan-derived membranes highlight renewable feedstocks that add biodegradability while maintaining mechanical integrity, appealing to customers pursuing circular-economy metrics. Manufacturing cost curves still favor pure organics for high-volume bids, yet ceramics and hybrids are gaining footholds in high-temperature, solvent-rich environments where extended module life offsets up-front premiums.

The Nanoporous Membranes Report is Segmented by Material Type (Organic, Inorganic, and Hybrid), Application (Water Treatment, Fuel Cell, Biomedical, Food Processing, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained a 37.20% revenue lead in 2025 on the back of rigorous environmental oversight and expansive water-infrastructure budgets. Texas alone operates 60 municipal desalination units producing 172 million gallons daily, with coastal seawater projects in feasibility review. The region is also a hotbed for lithium-brine purification, where DuPont's FilmTec LiNE-XD nanofiltration line targets direct-lithium-extraction flows with high lithium passage and divalent-metal rejection.

Asia-Pacific is forecast to register the fastest 9.22% CAGR, buoyed by China's massive membrane manufacturing base, India's urban water-treatment build-out, and Japan's fuel-cell supply-chain expansion. Chinese firms such as Guochu Technology integrate membranes across industrial, pharma, and municipal installations, underscoring the region's dual role as producer and consumer. Singapore's NEWater strategy drives sustained research and development spend on fouling-resistant nanofiltration, while South-East Asian nations adopt low-pressure systems to address rural sanitation needs.

Europe remains a mature yet innovative hub, running 2,178 desalination plants and increasingly pairing them with renewable-energy inputs. German research consortia trial atomically thin membranes to trim pressure requirements, and Mediterranean states are implementing brine-valorization pilots to enhance project economics. The Middle East and Africa, led by Egypt's world-scale desal plant, offer high-volume opportunities balanced against financing complexities. South America's build-outs in Brazil and Argentina are nascent but accelerating as water scarcity dents hydro-power reliability.

- Alfa Laval

- Applied Membranes Inc.

- AXEON Water Technologies Inc.

- BASF

- DuPont

- Hunan Keensen Technology Co. Ltd

- Hydranautics - A Nitto Group Company

- inopor GmbH

- InRedox LLC

- Kovalus Separation Solutions

- MICRODYN-NADIR GmbH

- Osmotech Membranes Pvt Ltd

- Pure-Pro Water Corporation

- SiMPore Inc.

- SmartMembranes GmbH

- Synder Filtration Inc.

- TORAY INDUSTRIES, INC.

- Veolia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Need for Waste- and Waste-Water Re-Use

- 4.2.2 Desalination Capacity Additions in Water-Scarce Regions

- 4.2.3 Stricter Industrial Effluent Discharge Norms

- 4.2.4 Bioprocessing Demand for High-Purity Filtration

- 4.2.5 Lab-on-Chip Diagnostics Adopting Nano-Scale Membranes

- 4.3 Market Restraints

- 4.3.1 Low Adoption in Price-Sensitive Developing Countries

- 4.3.2 Fouling and Cleaning-Cycle Cost Penalties

- 4.3.3 Volatile Supply and Pricing of Specialty Nanomaterials

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Organic

- 5.1.2 Inorganic

- 5.1.3 Hybrid

- 5.2 By Application

- 5.2.1 Water Treatment

- 5.2.2 Fuel Cell

- 5.2.3 Biomedical

- 5.2.4 Food Processing

- 5.2.5 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global Overview, Market-level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Alfa Laval

- 6.4.2 Applied Membranes Inc.

- 6.4.3 AXEON Water Technologies Inc.

- 6.4.4 BASF

- 6.4.5 DuPont

- 6.4.6 Hunan Keensen Technology Co. Ltd

- 6.4.7 Hydranautics - A Nitto Group Company

- 6.4.8 inopor GmbH

- 6.4.9 InRedox LLC

- 6.4.10 Kovalus Separation Solutions

- 6.4.11 MICRODYN-NADIR GmbH

- 6.4.12 Osmotech Membranes Pvt Ltd

- 6.4.13 Pure-Pro Water Corporation

- 6.4.14 SiMPore Inc.

- 6.4.15 SmartMembranes GmbH

- 6.4.16 Synder Filtration Inc.

- 6.4.17 TORAY INDUSTRIES, INC.

- 6.4.18 Veolia

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment