PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906071

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906071

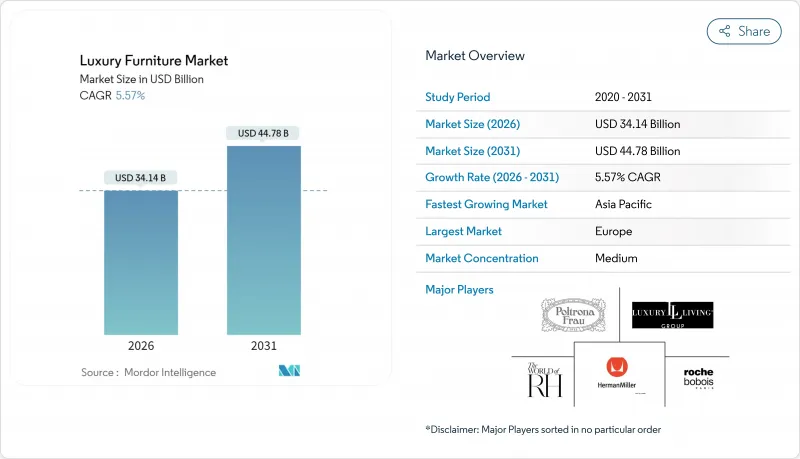

Luxury Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Luxury Furniture market size in 2026 is estimated at USD 34.14 billion, growing from 2025 value of USD 32.34 billion with 2031 projections showing USD 44.78 billion, growing at 5.57% CAGR over 2026-2031.

Rising high-net-worth individual wealth, post-pandemic lifestyle shifts that prioritize premium residential interiors, and vigorous luxury hospitality pipelines underpin demand resiliency. Heritage European craftsmanship, omnichannel retail advances that fuse immersive galleries with augmented reality visualization, and accelerating material innovation reinforce the luxury furniture market growth outlook. Brands intensify differentiation through provenance storytelling, smart-home functionality, and limited-edition collaborations that lift average selling prices while drawing younger affluent cohorts. Consolidation among regional chains unlocks scale efficiencies without diluting exclusivity, supporting faster penetration of high-growth Asian wealth hubs and steady expansion in mature North American design centers.

Global Luxury Furniture Market Trends and Insights

Rising Disposable Incomes of HNWIs Drive Premium Demand

Global expansion of millionaire households feeds a steady influx of first-time luxury furniture buyers. These consumers treat statement pieces as portable investments that signal cultural capital, spurring demand for limited production runs and bespoke craftsmanship. Designer collaborations and heritage provenance stories resonate strongly with this segment, allowing brands to raise average selling prices without noticeable volume erosion. Technology and finance entrepreneurs, now a dominant share of new HNWIs, favor contemporary silhouettes with discreet smart-home features that harmonize with connected lifestyles. Geographic hotspots include Shenzhen, Bengaluru, and Miami, where rapid wealth generation aligns with premium real-estate purchases, embedding furniture orders within broader interior design contracts. As wealth distribution broadens, tier-two cities emerge as incremental growth nodes, encouraging brands to adopt franchise showrooms and mobile pop-up concepts to capture local demand.

Expansion of Luxury Real Estate and Hospitality Projects

Record pipelines of five-star hotels, branded residences, and ultra-prime resorts create recurring, large-volume procurement streams that smooth cyclical swings in retail demand. Developers in Saudi Arabia's NEOM, Indonesia's Bali west coast, and Florida's Gulf Coast specify contract-grade furniture that must combine exquisite aesthetics with commercial-use durability. Purchase orders often bundle guestroom case goods, public-area seating, and outdoor cabanas, pushing order values into seven-figure ranges and locking suppliers into multi-year service agreements. Brands with in-house design studios and BIM-ready digital libraries gain an edge in tender processes that prioritize speed and compliance documentation. Hospitality clients increasingly mandate ESG disclosures, favoring suppliers using FSC-certified woods and low-VOC finishes. These projects offer built-in showrooms that expose international travelers to the furniture brand, driving post-stay residential sales.

Price Sensitivity During Macro-Economic Slowdowns

Luxury furniture demand, though resilient, remains tethered to sentiment; affluent consumers often defer major purchases when equity markets wobble or property transactions stall. 2024's housing downturn in the United States illustrated this dynamic when showroom traffic fell even as household net worth stayed intact. Retailers countered by introducing phased delivery plans that allow clients to furnish priority rooms first and complete the ensemble later, preserving cash flow without overt discounting. Marketing shifted to emphasize timeless value and emotional well-being rather than conspicuous consumption, aligning with the subdued public mood. Brands with diversified geographic footprints cushioned the impact as Middle East and Southeast Asian sales offset softness in Western markets. After macro clouds clear, pent-up demand often releases abruptly, underscoring the importance of inventory flexibility to capture rebound windows.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Online Luxury Furniture Retail

- Smart-Home Integration Boosts ASPs

- Volatile Hardwood and Leather Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Luxury home furniture generated 58.64% of 2025 revenue, cementing its primacy within the luxury furniture market. Living-room seating remains the top contributor as modular sectionals adapt to hybrid entertainment-work patterns, while dining suites regain relevance amid at-home hosting resurgence. Bedroom ensembles incorporate wellness sensors and ambient lighting that sync with circadian rhythms, turning private quarters into restorative sanctuaries. Outdoor collections witness double-digit growth in temperate zones where pandemic-era patio upgrades matured into full alfresco living concepts, often specifying weather-resistant teak and quick-dry performance fabrics. Entry-level luxury buyers gravitate toward curated "room packages" that simplify decision-making yet preserve bespoke fabric and finish options. Designers leverage virtual stagers to upsell ancillary decor-rugs, lighting, art-raising order values and strengthening brand stickiness.

Hospitality furniture is forecast to advance at a 5.96% CAGR, overtaking office as the fastest-growing commercial application by 2027. Global resort pipelines-covering Red Sea islands, Japanese wellness ryokans, and Caribbean eco-lodges-demand differentiated aesthetics reflecting local culture while adhering to international durability standards. Suppliers with in-house testing labs certify abrasion, UV, and salt-spray resistance, winning long-term maintenance contracts that include refurbishment cycles. Branded residence developers bundle furniture packages into unit prices, simplifying buyer move-in and ensuring interior cohesion. Cruise ship refurbishments present niche opportunities for modular, lightweight pieces engineered to withstand marine regulations. Collectively, these trends diversify revenue streams and reduce reliance on discretionary residential cycles.

The Luxury Furniture Market Report is Segmented by Application (Luxury Home Furniture, Luxury Office Furniture, Luxury Hospitality Furniture, Other Applications), Material (Wood, Metal, Glass, Leather, Plastic, and More), Distribution Channel (B2C/Retail, B2B/Project), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe preserved 36.88% global revenue of 2025 in the luxury furniture market, leveraging centuries-old craft clusters in Italy's Brianza, France's Alsace, and Germany's North Rhine-Westphalia. Italian exports of EUR 19.4 billion demonstrate robust external demand despite labor-cost headwinds. Regional brands capitalize on proximity to design capitals-Milan, Paris, and Cologne, which host influential fairs that set global trend agendas. EU regulations on deforestation, chemical finishes, and waste recovery push manufacturers toward transparent supply chains, reinforcing Europe's reputation for responsible luxury. However, a shrinking artisan workforce threatens capacity; apprenticeship subsidies and robotic assistive devices emerge as parallel solutions to sustain output while safeguarding craftsmanship DNA.

Asia-Pacific registers the fastest trajectory at a 6.92% CAGR through 2031, propelled by urban affluence in China, India, and Southeast Asia. Chinese tier-two cities foster fresh showroom expansion as rising professionals remodel newly acquired apartments to reflect global taste. Japan's weak yen continues to attract inbound shoppers who take advantage of duty-free schemes to ship Italian sofas home, creating a transactional bridge between European makers and Asian consumers. Australia's design-savvy homeowners drive demand for outdoor teak ensembles that withstand coastal climates, while Singapore and Hong Kong maintain hub status for regional e-commerce fulfillment thanks to efficient port systems.

North America holds a steady share, buoyed by coastal metropolitan wealth and resilient renovation activity. California leads showroom innovation: Restoration Hardware's Palm Desert design hub integrates architectural planning, landscape design, and furniture curation under one roof, capturing complete project spend. East-Coast pent-up demand surfaces in vacation-home corridors from the Hamptons to Palm Beach, where clients favor transitional styles that bridge classical detailing with modern comfort. Canadian luxury purchases benefit from favorable currency hedging versus European imports, making Montreal and Toronto critical distribution nodes. Integrated supply chains across Mexico provide upholstered frames, underscoring NAFTA's role in cost and lead-time optimization.

The Middle East and Africa evolve into opportunity frontiers driven by sovereign diversification strategies. Saudi Arabia's Vision 2030 giga-projects specify museum-grade interiors for hotels and cultural institutions, while the UAE's luxury retail ecosystem channels European brands into wider Gulf Cooperation Council demand. In Africa, Nigeria's burgeoning upper-middle class fuels interest in statement dining sets, albeit constrained by import duties and logistical hurdles. South Africa's hospitality upgrades ahead of international sporting events open contract channels for European and local manufacturers partnering on mixed-material lounge collections adapted for harsher UV exposure. Collectively, these markets, though smaller, offer outsized margins when paired with localized service models and compliant import documentation.

- Restoration Hardware (RH)

- Roche Bobois

- Herman Miller-Knoll

- Poltrona Frau

- Luxury Living Group (Fendi Casa)

- BandB Italia

- Minotti

- Ligne Roset

- Hooker Furniture

- Natuzzi

- Scavolini

- Fritz Hansen

- Eichholtz

- Boca do Lobo

- Turri

- Duresta

- Muebles Pico

- Laura Ashley

- Giovanni Visentin

- Nella Vetrina

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising disposable incomes of HNWIs

- 4.2.2 Expansion of luxury real-estate and hospitality projects

- 4.2.3 Growth of online luxury furniture retail

- 4.2.4 Smart-home integration boosts ASPs

- 4.2.5 Adoption of bio-based sustainable materials

- 4.2.6 3-D printing enables on-demand customization

- 4.3 Market Restraints

- 4.3.1 Price sensitivity during macro-economic slow-downs

- 4.3.2 Volatile hardwood and leather prices

- 4.3.3 Counterfeit luxury furniture trade

- 4.3.4 Shortage of master artisans for bespoke output

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights Into The Latest Trends And Innovations in the Market

- 4.7 Insights On Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, Etc.) In The Market

5 Market Size and Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Luxury Home Furniture

- 5.1.1.1 Chairs and Sofas

- 5.1.1.2 Tables (Side, Coffee, Dressing, etc.)

- 5.1.1.3 Beds

- 5.1.1.4 Wardrobes

- 5.1.1.5 Dining Tables / Dining Sets

- 5.1.1.6 Kitchen Cabinets

- 5.1.1.7 Other Home Furniture (Bathroom, Outdoor, etc.)

- 5.1.2 Luxury Office Furniture

- 5.1.2.1 Chairs

- 5.1.2.2 Tables

- 5.1.2.3 Storage Cabinets

- 5.1.2.4 Desks

- 5.1.2.5 Sofas and Other Soft Seating

- 5.1.2.6 Other Office Furniture

- 5.1.3 Luxury Hospitality Furniture

- 5.1.4 Other Applications (Educational Furniture, Healthcare Furniture, Retail Malls, Government Offices, etc.)

- 5.1.1 Luxury Home Furniture

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Glass

- 5.2.4 Leather

- 5.2.5 Plastic and Other Synthetics

- 5.2.6 Sustainable / Green Materials

- 5.3 By Distribution Channel

- 5.3.1 B2C / Retail

- 5.3.1.1 Home Centers

- 5.3.1.2 Specialty Furniture Stores

- 5.3.1.3 Online

- 5.3.1.4 Flagship Store

- 5.3.1.5 Other Distribution Channels

- 5.3.2 B2B / Project

- 5.3.1 B2C / Retail

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX

- 5.4.3.7 NORDICS

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South-East Asia

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Restoration Hardware (RH)

- 6.4.2 Roche Bobois

- 6.4.3 Herman Miller-Knoll

- 6.4.4 Poltrona Frau

- 6.4.5 Luxury Living Group (Fendi Casa)

- 6.4.6 BandB Italia

- 6.4.7 Minotti

- 6.4.8 Ligne Roset

- 6.4.9 Hooker Furniture

- 6.4.10 Natuzzi

- 6.4.11 Scavolini

- 6.4.12 Fritz Hansen

- 6.4.13 Eichholtz

- 6.4.14 Boca do Lobo

- 6.4.15 Turri

- 6.4.16 Duresta

- 6.4.17 Muebles Pico

- 6.4.18 Laura Ashley

- 6.4.19 Giovanni Visentin

- 6.4.20 Nella Vetrina

7 Market Opportunities and Future Outlook

- 7.1 Expansion of Luxury Hospitality and Resorts

- 7.2 Digitalization Driving Online Luxury Furniture Sales

- 7.3 Increasing Demand for Custom Office Suites