PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906084

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906084

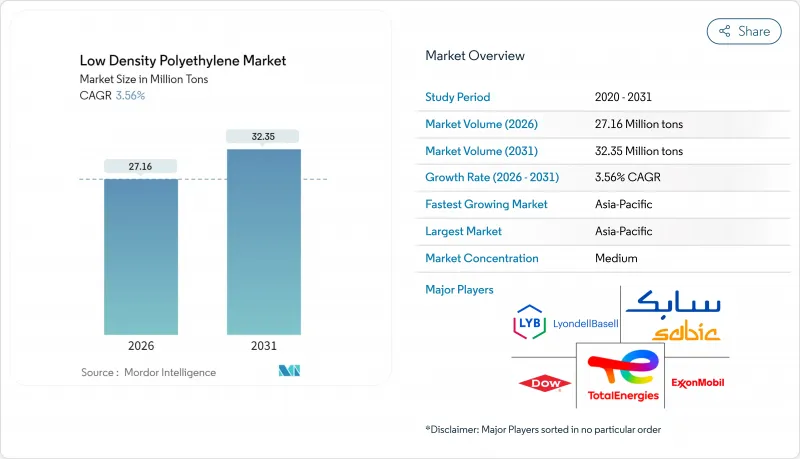

Low Density Polyethylene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Low Density Polyethylene market is expected to grow from 26.23 million tons in 2025 to 27.16 million tons in 2026 and is forecast to reach 32.35 million tons by 2031 at 3.56% CAGR over 2026-2031.

This trajectory reflects entrenched consumption in flexible films, insulation, coatings, and agricultural products, even as regulatory pressures accelerate the shift toward circular packaging solutions. Films retain primacy because converters value LDPE's seal integrity and optical clarity, while sustained capacity additions in Asia-Pacific underpin a supply landscape that feeds renewable-energy infrastructure, precision farming, and e-commerce fulfillment. Technology licensing, particularly in China, is widening access to advanced tubular and autoclave processes that yield higher-value grades. Meanwhile, circular-economy mandates in the European Union are reshaping procurement strategies by rewarding post-consumer-recycled content and penalizing complex multilayer structures. Input-cost volatility tied to crude-driven ethylene prices keeps margin management at the forefront of corporate strategy, encouraging producers to optimize product slates toward specialty applications that command pricing power.

Global Low Density Polyethylene Market Trends and Insights

Growth in E-commerce Flexible Packaging Drives Film Innovation

Surging parcel volumes push converters to engineer lightweight, puncture-resistant mono-material films that slash shipping mass and simplify recycling streams. ExxonMobil's full-polyethylene laminated platforms, built on Exceed and Enable polymers, deliver pouches composed of 97% PE while achieving high oxygen barriers. Logistics operators benefit from down-gauged structures that cut material intensity without sacrificing seal integrity, and the format aligns with European fee modulation schemes that penalize difficult-to-recycle multilayers. Retailers are specifying LDPE grades with narrow molecular-weight distributions that balance dart-impact resistance and clarity, driving incremental demand within the low density polyethylene market.

Agricultural Films Benefit from Sustainability and Productivity Imperatives

Precision farming, greenhouse cultivation, and silage preservation are accelerating LDPE consumption in mulch, fumigation, and greenhouse covers. BASF estimates annual agricultural-film demand at 7 million tons and a 7% growth rate, underscoring the material's role in boosting crop yields by limiting moisture loss and weed pressure. Yet regulators are tightening end-of-life controls, prompting trials of bio-based and photodegradable blends. Producers are countering substitution risk by commercializing oxo-biodegradable masterbatches that retain film strength during field use but accelerate chain scission once recovered, ensuring LDPE remains competitive in high-performance installations.

Competition from LLDPE and HDPE Intensifies in Commodity Applications

Metallocene catalyst advances have narrowed the performance gap between LDPE and its linear and high-density counterparts. Modern LLDPE delivers higher puncture resistance and downgauging potential in heavy-duty shipping sacks, eroding traditional LDPE contract volumes. HDPE, meanwhile, continues to gain traction in t-shirt bags and thin-wall containers, where stiffness and environmental stress crack resistance are prized. LDPE producers are defending share by steering capacity toward niche areas, such as heavy-duty shrink hoods and hot-melt-adhesive backings, where branching architecture delivers heat-seal and optical benefits unattainable with linear grades.

Other drivers and restraints analyzed in the detailed report include:

- Extrusion-Coated Applications Expand Through Technical Innovation

- Advanced Recycling Technologies Enable Premium Grade Recovery

- Ethylene Feedstock Price Volatility Constrains Margin Predictability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Films accounted for 56.60% of low density polyethylene market size in 2025, reflecting entrenched usage in flexible food pouches, industrial liners, and agricultural covers. Converter interest in downgauged mono-material structures has intensified, enabling 15-micron oriented webs that cut resin input without compromising tear strength. Wire and cable insulation, although representing a smaller volume base, is set to post a 4.07% CAGR through 2031 as renewable-energy grids and electric-vehicle harnesses proliferate. The low density polyethylene market share commanded by blow-molded containers remains steady due to their balance of clarity and impact resistance, whereas injection-molded components satisfy chemical-resistant caps and closures.

Continuing substitution pressure from linear grades forces LDPE suppliers to cultivate high-melt-strength resins for foams and sheet applications that demand energy absorption and softness. Foam bedding and sports-flooring producers value LDPE's cell-structure stability, while construction wrap manufacturers leverage its moisture-barrier attributes. Specialty reactor lines equipped with peroxide-free autoclave technology further broaden the offering by delivering ultra-clean grades tailored to medical device over-molding, underscoring the evolving product mix inside the low density polyethylene market.

The Low Density Polyethylene Market Report is Segmented by Product Type (Blow Molded, Films, Injection Molded, Sheets, Foams, and More), End-User Industry (Agriculture, Electrical and Electronics, Packaging, Construction, Automotive, Consumer Goods, Healthcare and Pharma), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific held 47.30% of low density polyethylene market share in 2025, buoyed by China's large-scale capacity additions and Southeast Asia's manufacturing growth. Chinese resin output surged as new tubular and swing-plant projects came online in Ningxia and Shandong provinces, many underpinned by technology licenses from LyondellBasell.

North America enjoys feedstock cost leadership owing to an ethane-rich shale inventory. Integrated producers strategically export surplus LDPE to Latin America and Asia, while domestic converters leverage material availability to support sustainable film programs. Europe confronts stringent directives such as the Packaging and Packaging Waste Regulation, steering investment into advanced recycling infrastructure and post-consumer-recycled LDPE grades. Although virgin-resin growth is modest, value-added circular offerings open premium niches for European suppliers.

The Middle East and Africa capitalize on competitively priced feedstocks and rapid demographic growth. LDPE plants integrated with ethane crackers in the Arabian Gulf ship substantial volumes eastward, but burgeoning domestic construction and agriculture are lifting local off-take. South America, especially Brazil and Argentina, sustains moderate demand tied to crop-protection films and consumer packaging, though currency fluctuation and economic volatility temper investment decisions. India's tightening quality-standard framework for virgin polyethylene is expected to enhance supply-chain transparency while supporting infrastructure expansion in agriculture and fast-moving consumer goods.

- Borealis AG

- Braskem S.A.

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation.

- Dow

- ExxonMobil Corporation

- Formosa Plastics Corporation

- Hanwha Solutions Chemical Division Corporation

- INEOS Group

- LG Chem

- LyondellBasell Industries Holdings BV

- Mitsui Chemicals, Inc.

- NOVA Chemicals Corporation

- PetroChina

- PTT Global Chemical PLC

- Qatar Chemical Company Ltd

- Reliance Industries Limited

- Repsol S.A.

- SABIC

- Sumitomo Chemical Co., Ltd.

- TotalEnergies SE

- Versalis S.p.A. (Eni)

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in e-commerce flexible packaging

- 4.2.2 Rising demand for agricultural films

- 4.2.3 Preference for extrusion-coated applications

- 4.2.4 Advanced recycling enabling premium LDPE grades

- 4.2.5 Solar-panel encapsulant film uptake

- 4.3 Market Restraints

- 4.3.1 Competition from LLDPE and HDPE

- 4.3.2 Ethylene feedstock price volatility

- 4.3.3 EU bans on mono-layer polyolefin films

- 4.3.4 Capital shift to bio-based polyolefins

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Blow Molded

- 5.1.2 Films

- 5.1.3 Injection Molded

- 5.1.4 Sheets

- 5.1.5 Foams

- 5.1.6 Wire and Cable Insulation

- 5.2 By End-user Industry

- 5.2.1 Agriculture

- 5.2.2 Electrical and Electronics

- 5.2.3 Packaging

- 5.2.4 Construction

- 5.2.5 Automotive

- 5.2.6 Consumer Goods

- 5.2.7 Healthcare and Pharma

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Borealis AG

- 6.4.2 Braskem S.A.

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 China Petrochemical Corporation.

- 6.4.5 Dow

- 6.4.6 ExxonMobil Corporation

- 6.4.7 Formosa Plastics Corporation

- 6.4.8 Hanwha Solutions Chemical Division Corporation

- 6.4.9 INEOS Group

- 6.4.10 LG Chem

- 6.4.11 LyondellBasell Industries Holdings BV

- 6.4.12 Mitsui Chemicals, Inc.

- 6.4.13 NOVA Chemicals Corporation

- 6.4.14 PetroChina

- 6.4.15 PTT Global Chemical PLC

- 6.4.16 Qatar Chemical Company Ltd

- 6.4.17 Reliance Industries Limited

- 6.4.18 Repsol S.A.

- 6.4.19 SABIC

- 6.4.20 Sumitomo Chemical Co., Ltd.

- 6.4.21 TotalEnergies SE

- 6.4.22 Versalis S.p.A. (Eni)

- 6.4.23 Westlake Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment