PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906092

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906092

Latin America Jewelry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

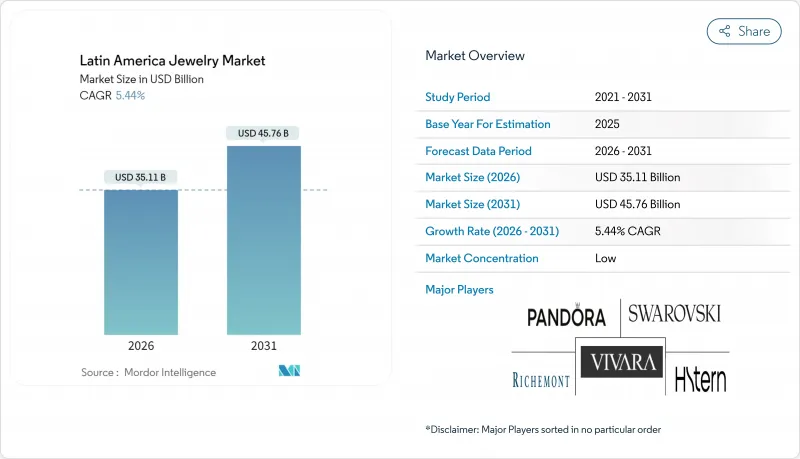

Latin America jewelry market size in 2026 is estimated at USD 35.11 billion, growing from 2025 value of USD 33.30 billion with 2031 projections showing USD 45.76 billion, growing at 5.44% CAGR over 2026-2031.

This trajectory reflects structural shifts in consumer behavior, with self-gifting and investment-oriented purchases now accounting for a larger share of transactions than traditional occasion-driven demand. Brazil commands 45.91% of the regional revenue in 2024, yet Argentina is poised to outpace all peers at 6.74% CAGR through 2030, propelled by macroeconomic stabilization and a forecast GDP rebound of around 5.0% in 2025. The divergence between Brazil's mature installed base and Argentina's accelerating growth underscores how currency normalization and policy reforms can unlock latent luxury demand faster than incremental wealth accumulation. Elevated gold and silver prices, the rollout of lab-grown stones, and amplified celebrity marketing are reshaping assortment strategies, while supply-chain transparency moves from premium differentiator to baseline expectation. Omnichannel execution is increasingly decisive because first-time luxury buyers begin their journeys online even when final purchases still occur in stores. Competitive intensity remains high, but formal players that couple retail expansion with responsible sourcing are positioned to consolidate share as regulatory scrutiny rises and informal vendors struggle to meet traceability standards

Latin America Jewelry Market Trends and Insights

Rising Popularity of Customized and Personalized Jewelry Pieces

Customization has evolved from niche engraving services to full co-design platforms where consumers select metals, stones, and motifs, a shift that increases average transaction values and repeat-purchase rates. H.Stern's Genesis collection, launched in 2025 with price points ranging from USD 2,900 to USD 47,000, exemplifies this trend by offering modular designs that allow buyers to swap colored stones and adjust settings post-purchase. The economics favor brands with flexible manufacturing, as personalized pieces command 20% to 30% premiums over catalog items while reducing inventory risk. Social commerce accelerates adoption, with small and medium-sized jewelers in Brazil leveraging WhatsApp and Instagram to co-create designs with clients, a practice that bypasses traditional retail overhead and compresses time-to-market from weeks to days. This democratization of customization pressures established players to invest in digital configurators and agile supply chains or risk ceding share to artisans who can iterate designs in real time.

Celebrity Endorsements Boosting Jewelry Brand Awareness

Celebrity partnerships now function as demand-generation engines rather than passive brand associations, with measurable sales lifts tied to campaign launches. David Yurman's appointment of Mexican actress Eiza Gonzalez as global brand ambassador for its Spring 2025 Sculpted Cable campaign signals a strategic pivot toward Latin American and U.S. Hispanic audiences, leveraging Gonzalez's 8.6 million Instagram followers and her narrative of immigrant heritage to build cultural affinity. Swarovski's naming of Ariana Grande as global ambassador in May 2025 follows a similar playbook, targeting younger consumers who prioritize pop-culture relevance over heritage. The impact extends beyond awareness, as celebrity-endorsed collections often sell out within hours of launch, creating scarcity-driven demand and secondary-market premiums. For Latin American brands, the challenge lies in securing regional ambassadors with cross-border appeal, as evidenced by True Religion's use of Brazilian pop star Anitta in February 2025 to anchor its "Own Your True" platform, a campaign designed to reach music and fashion audiences across Latin America and the U.S. diaspora.

High Risk of Jewelry Counterfeiting and Imitation Products

Counterfeiting has escalated from low-quality knockoffs to near-perfect replicas that deceive even trained buyers, eroding brand equity and diverting revenue from legitimate channels. U.S. Customs and Border Protection intercepted USD 3.5 million in counterfeit Van Cleef & Arpels jewelry in October 2025, while INTERPOL's Operation Crete II seized 2,478 counterfeit items valued at USD 523,000 in Chile between August and September 2024, demonstrating that Latin America is both a destination and transit route for fake goods . The proliferation of counterfeit jewelry on e-commerce platforms and social media marketplaces forces brands to invest in authentication technologies such as blockchain provenance tracking and micro-engraving, raising operational costs without directly generating revenue. For consumers, the risk of purchasing counterfeits undermines confidence in online channels, slowing the shift to digital retail and reinforcing the importance of authorized dealer networks. Brands that fail to police their trademarks or educate buyers on authentication cues risk permanent damage to pricing power, as widespread availability of convincing fakes establishes a lower reference price in consumers' minds.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Ethically Sourced and Sustainable Jewelry

- Expansion of Retail Chains and Boutique Stores

- Complex Import/Export Regulations for Precious Metals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bracelets are forecast to expand at a 6.90% CAGR from 2026 to 2031, the fastest rate among product types, as stackable designs encourage consumers to purchase multiple units and layer them for personalized looks. Rings held 36.33% market share in 2025, anchored by engagement and wedding bands that benefit from stable demographic demand, yet the category's maturity limits incremental growth. Necklaces and chains with pendants appeal to gifting occasions and self-purchase, with pendant modularity allowing buyers to refresh existing chains by swapping charms, a strategy that increases lifetime customer value. Earrings remain a staple, particularly in markets like Brazil, where pierced ears are near-universal among women, though innovation has stagnated relative to bracelets and rings. Other product types, including decorative hair jewelry and anklets, occupy niche segments but are gaining traction among younger consumers influenced by festival fashion and social-media trends.

The shift toward bracelets reflects broader changes in how consumers wear jewelry, with stacking enabling self-expression and signaling affiliation with brands or causes through charm selection. Pandora's Essence collection, launched in 2024, capitalizes on this trend by offering beads that represent values such as courage and compassion, allowing buyers to curate bracelets that tell personal stories. The commercial implication is that brands must design for modularity and cross-selling, as consumers increasingly view jewelry purchases as building blocks for evolving collections rather than standalone items. This dynamic favors players with broad SKU assortments and loyalty programs that incentivize repeat purchases, while pressuring single-product specialists to expand into adjacent categories or risk commoditization.

Mixed materials, combining precious metals with ceramics, leather, or lab-grown stones, are forecast to grow at a 6.31% CAGR from 2026 to 2031, outpacing precious metals and base metals. The appeal lies in differentiation and affordability, as mixed-material pieces offer design complexity to 30 to 50% Gen Z buyers entering the market. Precious metals retain dominance in fine jewelry, driven by investment demand and cultural preferences for gold in gifting, yet the segment's growth is constrained by input-cost inflation, with gold prices. Base metals serve the costume-jewelry segment, where rapid trend cycles and disposable pricing models prioritize aesthetics over durability, though environmental concerns around mining and waste are prompting some brands to explore recycled base metals.

Pandora's commitment to 100% recycled gold and silver by 2025 signals that sustainability is becoming a material-selection criterion alongside cost and aesthetics, particularly for brands targeting environmentally conscious consumers. The rise of lab-grown diamonds and synthetic gemstones further blurs material boundaries, as these stones can be set in both precious and mixed-material designs, allowing brands to offer diamond jewelry at accessible price points. For Latin American consumers, mixed materials resonate because they enable participation in jewelry trends without the financial commitment of pure precious-metal pieces, a dynamic that is particularly relevant in Argentina and Colombia, where currency volatility and income uncertainty make aspirational purchases more discretionary. The challenge for brands is maintaining perceived quality, as mixed materials risk being dismissed as costume jewelry unless marketing emphasizes craftsmanship and design rather than material purity.

The Latin America Jewelry Market is Segmented Into Product Type (Necklaces, Rings, Earrings, and More), Category (Fine Jewelry and Costume Jewelry), Material (Precious Metals, Base Metals, and Mixed Materials), End-User (Women, Men, and Children), Distribution Channel (Offline Retail Stores and Online Retail Stores), and Geography (Brazil, Argentina, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Vivara Participacoes S.A.

- HStern Industria e Comercio SA

- Pandora A/S

- Manoel Bernardes S.A.

- Compagnie Financiere Richemont SA

- LVMH Moet Hennessy Louis Vuitton SE

- Kering

- Swarovski Group

- Morana

- Pepe Dominguez Silver Jewelry

- Tous (Joyeria TOUS, S.A.)

- Zanfeld S.A. de C.V.

- Sabelli S.A. de C.V.

- Fonelli S.A. de C.V.

- Bulgari S.p.A.

- Buccellati Holding Italia S.p.A.

- Tiffany & Co.

- Gallery Gang

- Varon

- Joyeria Bauer

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising popularity of customized and personalized jewelry pieces

- 4.2.2 Celebrity endorsements boosting jewelry brand awareness

- 4.2.3 Demand for ethically sourced and sustainable jewelry

- 4.2.4 Expansion of retail chains and boutique stores

- 4.2.5 Increasing awareness of jewelry as investment assets

- 4.2.6 Rising demand for lab-grown and synthetic gemstones

- 4.3 Market Restraints

- 4.3.1 High risk of jewelry counterfeiting and imitation products

- 4.3.2 Complex import/export regulations for precious metals

- 4.3.3 Fluctuating availability of precious stones and metals

- 4.3.4 High competition from local unorganized jewelry vendors

- 4.4 Consumer Demand Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Product Type

- 5.1.1 Necklaces

- 5.1.2 Rings

- 5.1.3 Earrings

- 5.1.4 Bracelets

- 5.1.5 Chains and Pendants

- 5.1.6 Other Product Types

- 5.2 Material

- 5.2.1 Precious Metals

- 5.2.2 Base Metals

- 5.2.3 Mixed Materials

- 5.3 Category

- 5.3.1 Fine Jewelry

- 5.3.2 Costume/Fashion Jewelry

- 5.4 End User

- 5.4.1 Women

- 5.4.2 Men

- 5.4.3 Children

- 5.5 Distribution Channel

- 5.5.1 Offline Retail Stores

- 5.5.2 Online Retail Stores

- 5.6 Geography

- 5.6.1 Brazil

- 5.6.2 Argentina

- 5.6.3 Colombia

- 5.6.4 Chile

- 5.6.5 Peru

- 5.6.6 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Vivara Participacoes S.A.

- 6.4.2 HStern Industria e Comercio SA

- 6.4.3 Pandora A/S

- 6.4.4 Manoel Bernardes S.A.

- 6.4.5 Compagnie Financiere Richemont SA

- 6.4.6 LVMH Moet Hennessy Louis Vuitton SE

- 6.4.7 Kering

- 6.4.8 Swarovski Group

- 6.4.9 Morana

- 6.4.10 Pepe Dominguez Silver Jewelry

- 6.4.11 Tous (Joyeria TOUS, S.A.)

- 6.4.12 Zanfeld S.A. de C.V.

- 6.4.13 Sabelli S.A. de C.V.

- 6.4.14 Fonelli S.A. de C.V.

- 6.4.15 Bulgari S.p.A.

- 6.4.16 Buccellati Holding Italia S.p.A.

- 6.4.17 Tiffany & Co.

- 6.4.18 Gallery Gang

- 6.4.19 Varon

- 6.4.20 Joyeria Bauer

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK