PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906098

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906098

Europe Testing, Inspection And Certification (TIC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

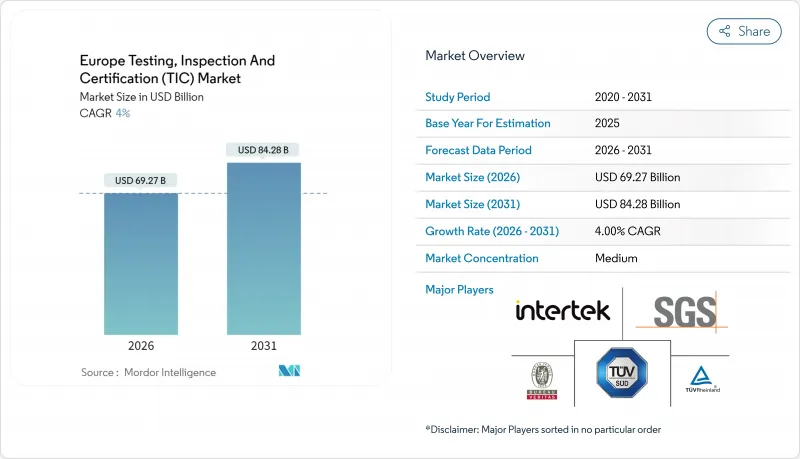

The European TIC market was valued at USD 66.61 billion in 2025 and estimated to grow from USD 69.27 billion in 2026 to reach USD 84.28 billion by 2031, at a CAGR of 4.00% during the forecast period (2026-2031).

The market's structural momentum is anchored in escalating regulatory demands under the EU Digital Operational Resilience Act, Corporate Sustainability Reporting Directive, and Cyber Resilience Act, each of which now compels demonstrable third-party assurance across financial, sustainability, and connected-product domains. Accelerated renewable-energy build-outs, a sustained shift toward outsourced verification, and the rapid emergence of AI-enabled inspection technologies further reinforce growth prospects even as economic sentiment remains uneven across member states. At the same time, the European TIC market is navigating cybersecurity constraints that temper full-scale remote inspection uptake, while cost pressures on small and medium enterprises keep price sensitivity elevated. Consolidation attempts such as the terminated SGS-Bureau Veritas merger illustrate both the strategic value and complexity of achieving scale in one of the world's most heavily regulated business services arenas.

Europe Testing, Inspection And Certification (TIC) Market Trends and Insights

Growing Regulatory Compliance Complexity Across EU Industries

DORA, CSRD, and the Cyber Resilience Act became enforceable during 2024, compelling financial firms, large corporates, and connected-product manufacturers to secure multi-layered third-party assurance for ICT risk, sustainability disclosures, and product cybersecurity, respectively. Compliance budgets now allocate roughly 30% to external audits, translating into fresh revenue pools for end-to-end providers able to cover cyber, ESG, and operational-resilience scopes in a single engagement. Demand aggregation across these domains amplifies cross-selling potential, particularly for providers with integrated digital audit platforms. Because the European TIC market is one of the few service categories legally mandated for market entry, spending remains relatively inelastic even amid broader cost-containment drives. Medium-term growth, therefore, hinges on providers' capacity to scale multidisciplinary expertise while assuring data-integrity standards acceptable to supervisory authorities.

Expansion of Renewable Energy Projects Requiring Specialized Certification

Record wind and solar build-outs under the REPowerEU plan require exhaustive verification of turbine integrity, power-curve performance, and grid-integration safety, creating high-margin opportunities for TIC specialists in marine classification and environmental impact assessment. Project developers face certification bottlenecks as national authorities uphold stringent technical codes but streamline permitting deadlines, magnifying the strategic value of accredited labs with deep domain know-how. Offshore wind growth in the North Sea alone commands premium fees because of complex subsea cabling tests and harsh-environment material qualification. As renewable-asset owners adopt AI-driven drone monitoring to manage aging fleets, certification bodies able to validate both hardware and data analytics algorithms gain a competitive advantage. The European TIC market consequently secures a long-run growth engine that is closely tied to the continent's net-zero timetable.

High Cost of Accreditation and Certification for SMEs

Certification expenses often equal 2-3% of SME revenue, pressuring smaller firms to postpone full compliance and, in some cases, forgo export opportunities. Multiple national accreditation bodies, despite mutual-recognition accords, still impose duplicative paperwork that raises administrative burdens. While digital audit portals are lowering transaction costs, the economics of maintaining ISO-accredited capacity continue to favor large service groups, creating an access gap that can inhibit broader European TIC market penetration, particularly in Eastern Europe, where purchasing power is lower.

Other drivers and restraints analyzed in the detailed report include:

- Rising Outsourcing Trend for TIC Services Among Manufacturers

- Emergence of ESG-Linked Financing Mandating Independent Verification Audits

- Fragmented Regulatory Framework Across Non-EU European States

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Testing services contributed USD 36.09 billion, equivalent to 54.20% of the European TIC market in 2025, as advanced electronics, medical devices, and automotive components all require multi-disciplinary performance assessments before commercialization. Digital workflows such as cloud-based test-data portals shorten turnaround times and enhance client transparency, deepening competitive moats for early adopters. Certification, though smaller today, is forecast to compound at 4.58% annually, driven by CSRD-mandated assurance and expanding management-system standards that now cover cybersecurity, business continuity, and social responsibility. Inspection maintains steady relevance in infrastructure life-cycle management, especially in legacy manufacturing hubs where periodic structural assessments are compulsory.

Integrated platforms that unify test scheduling, real-time analytics, and certificate issuance are blurring boundaries between traditional service silos. Providers that can bundle lab tests with on-site and remote inspection in a single engagement are capturing wallet share as clients pursue one-stop compliance solutions. Investment is flowing into AI-enabled defect-recognition algorithms that raise lab throughput while preserving data integrity, reinforcing Testing's primacy within the European TIC market.

Outsourced verification accounted for 63.05% of the European TIC market size in 2025, reflecting a decisive shift away from capital-intensive in-house labs. Manufacturers in aerospace and automotive segments, faced with material science advances and evolving safety standards, prefer variable cost models that align spending with production volumes. Outsourced services also provide immediate access to global accreditations, which accelerate time-to-market for exports and mitigate regulatory risk.

Outcome-based contracts under which TIC firms assume compliance responsibility for a defined scope are expanding, generating recurring revenue, and incentivizing continuous process improvement. Although intellectual-property concerns keep some testing activities internal, the broader outsourcing trend is expected to sustain a 4.37% CAGR, positioning the European TIC market for stable double-digit revenue contribution from service contracts linked to long-term framework agreements.

The Europe TIC Market Report is Segmented by Service Type (Testing, Inspection, and Certification), Sourcing Type (In-House and Outsourced), Industry Vertical (Consumer Goods and Retail, ICT and Telecom, Automotive and Transportation, and More), Mode of Service Delivery (On-Site, Off-site/Laboratory, and Remote/Digital), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- SGS SA

- Bureau Veritas SA

- Intertek Group plc

- TUV SUD AG

- TUV Rheinland AG

- DEKRA SE

- Applus+ Servicios Tecnologicos S.L.U.

- Eurofins Scientific SE

- DNV AS

- Kiwa NV

- Lloyd's Register Group Limited

- British Standards Institution (BSI Group)

- RINA S.p.A.

- UL Solutions Inc.

- ALS Limited

- Element Materials Technology Group Ltd.

- MISTRAS Group, Inc.

- TUV NORD Group

- VDE Testing and Certification Institute

- PhAST GmbH

- Safety Assessment Federation (SAFed)

- Exova Group Ltd.

- IAF International Accreditation Forum, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing regulatory compliance complexity across EU industries

- 4.2.2 Expansion of renewable energy projects requiring specialized certification

- 4.2.3 Rising outsourcing trend for TIC services among manufacturers

- 4.2.4 Stringent food-safety standards under EU Farm-to-Fork strategy

- 4.2.5 Rapid proliferation of AI-enabled inspection drones in infrastructure maintenance

- 4.2.6 Emergence of ESG-linked financing mandating independent verification audits

- 4.3 Market Restraints

- 4.3.1 High cost of accreditation and certification for SMEs

- 4.3.2 Fragmented regulatory framework across non-EU European states

- 4.3.3 Talent shortage of advanced NDT specialists

- 4.3.4 Cyber-security concerns hampering remote/digital inspections

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 Testing

- 5.1.2 Inspection

- 5.1.3 Certification

- 5.2 By Sourcing Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.3 By Industry Vertical

- 5.3.1 Consumer Goods and Retail

- 5.3.2 ICT and Telecom

- 5.3.3 Automotive and Transportation

- 5.3.4 Aerospace and Defense

- 5.3.5 Oil, Gas and Petrochemicals

- 5.3.6 Energy and Utilities

- 5.3.7 Industrial Manufacturing and Machinery

- 5.3.8 Chemicals and Materials

- 5.3.9 Construction and Infrastructure

- 5.3.10 Life Sciences and Healthcare

- 5.3.11 Food, Agriculture and Beverage

- 5.3.12 Other Industry Verticals (Environment, Sustainability, etc.)

- 5.4 By Mode of Service Delivery

- 5.4.1 On-site

- 5.4.2 Off-site / Laboratory

- 5.4.3 Remote / Digital

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Russia

- 5.5.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SGS SA

- 6.4.2 Bureau Veritas SA

- 6.4.3 Intertek Group plc

- 6.4.4 TUV SUD AG

- 6.4.5 TUV Rheinland AG

- 6.4.6 DEKRA SE

- 6.4.7 Applus+ Servicios Tecnologicos S.L.U.

- 6.4.8 Eurofins Scientific SE

- 6.4.9 DNV AS

- 6.4.10 Kiwa NV

- 6.4.11 Lloyd's Register Group Limited

- 6.4.12 British Standards Institution (BSI Group)

- 6.4.13 RINA S.p.A.

- 6.4.14 UL Solutions Inc.

- 6.4.15 ALS Limited

- 6.4.16 Element Materials Technology Group Ltd.

- 6.4.17 MISTRAS Group, Inc.

- 6.4.18 TUV NORD Group

- 6.4.19 VDE Testing and Certification Institute

- 6.4.20 PhAST GmbH

- 6.4.21 Safety Assessment Federation (SAFed)

- 6.4.22 Exova Group Ltd.

- 6.4.23 IAF International Accreditation Forum, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment