PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906100

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906100

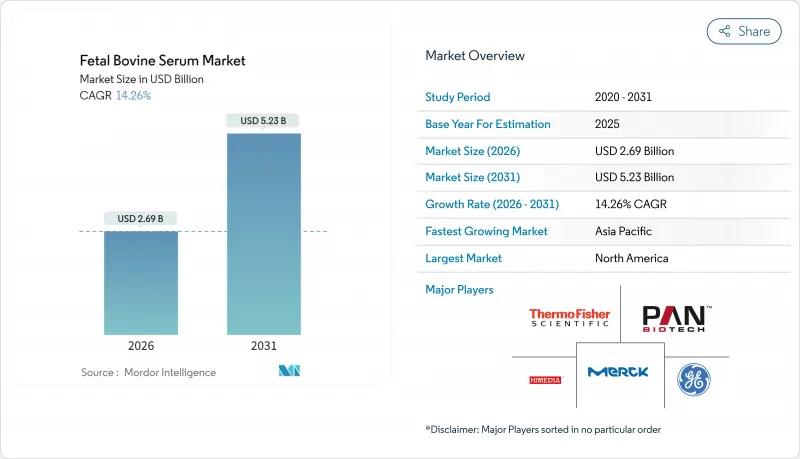

Fetal Bovine Serum - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The fetal bovine serum market was valued at USD 2.35 billion in 2025 and estimated to grow from USD 2.69 billion in 2026 to reach USD 5.23 billion by 2031, at a CAGR of 14.26% during the forecast period (2026-2031).

Tight raw-material supply caused by the U.S. cattle-herd contraction, record beef prices, and rising regulatory scrutiny are driving parallel investment in premium FBS grades and serum-free alternatives. Biopharmaceutical manufacturers are qualifying multiple suppliers and stockpiling inventory, while CMOs leverage single-use bioreactor platforms that favor ready-to-use serum formats. Continuous manufacturing lines are consuming more FBS per batch even as development timelines shorten, keeping demand resilient. Concurrently, research at Hebrew University validated whey-protein supplements and sub-USD 1 per liter serum-free media that match cell-growth performance, signaling a long-term structural shift.

Global Fetal Bovine Serum Market Trends and Insights

Rapid Biopharma Scale-up Post-COVID-19

Therapeutics developers doubled down on capacity additions in 2024, typified by Thermo Fisher Scientific's USD 2 billion outlay for bioprocessing infrastructure. Accelerated clinical timelines pushed producers to favor continuous bioreactors, which can raise FBS demand per production run even as batch numbers fall. Premium-grade bottles reached USD 3,200 per 500 mL in some markets amid heightened safety testing requirements. Multiple-vendor qualification strategies spread procurement risk but have entrenched a seller's market. These pressures simultaneously catalyzed investment in serum-free media, where cost savings and process consistency appeal to commercial manufacturers. Altogether, the growth engine keeps the fetal bovine serum market expanding despite compelling alternatives.

Expanding Cell & Gene Therapy Pipelines

Stem-cell-qualified and gamma-irradiated lots gained traction as pipeline assets moved into late-stage trials subject to FDA draft guidance on animal-derived components. Traceability and viral safety testing now feature in tender specifications, raising barriers for small suppliers. Concurrently, animal-component-free media capable of sustaining 130 billion cells per liter at USD 0.63 per liter were demonstrated in academic labs, offering a disruptive cost-curve advantage. Developers confront a dual-track reality: legacy programs stay with validated FBS protocols to avoid comparability studies, while new modalities pursue serum-free platforms from first-in-human dosing. Suppliers are therefore broadening portfolios to include recombinant growth factor cocktails, positioning for demand whichever path wins out.

Price Volatility Linked to Beef-Industry Cycle

Record beef prices in 2024 fed directly into serum costs, with some manufacturers reporting 40% year-over-year increases that strained budgets for clinical programs. The fundamental linkage to slaughter rates places FBS supply outside biopharma control, compelling firms to expand inventory buffers and tie up working capital. Sudden cost swings distort cost-of-goods forecasts and erode margins, particularly for smaller biotech entities. Suppliers attempt to smooth fluctuations via long-term contracts indexed to cattle futures, but counter-party adherence can falter when spot prices soar. Such volatility accelerates risk mitigation through alternative media, capping long-run upside for the fetal bovine serum market.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Animal & Human Vaccine Output

- Rise of Contract Cell-Culture Manufacturing (CMOs/CROs)

- Acceleration of Serum-Free Media Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment generated USD 0.89 billion in 2025, with Standard/Regular FBS retaining 37.86% share due to universal applicability across immortalized lines. Stem-Cell-Qualified FBS, though a smaller base, is forecast to post a 7.03% CAGR, propelled by late-stage autologous and allogeneic therapy pipelines that require stringent viral safety clearance. Commodity lots face margin compression, whereas exosome-depleted, gamma-irradiated, and chromatographically purified variants enjoy double-digit pricing premiums. Suppliers differentiate via traceability certificates and lot-specific growth-promotion assays, anchoring customer loyalty. Competitive rivalry has shifted from volume to specification depth, solidifying a tiered structure in the fetal bovine serum market.

Commercialization of niche grades also improves mix; exosome-depleted FBS supports the burgeoning extracellular-vesicle field, and low-IgG lots prevent downstream analytical interference in antibody manufacturing. Dialyzed preparations target metabolic-flux studies needing precise nutrient control, and heat-inactivated serum remains essential for complement-sensitive assays. These layers create a catalog breadth that shields incumbents from single-product commoditization. As advanced therapies scale, premium grades are poised to outpace the broader fetal bovine serum market size growth trajectory.

The Fetal Bovine Serum Report is Segmented by Product Type (Standard/Regular FBS, Heat-Inactivated FBS, and More), Application (Biopharmaceutical Production, Vaccine Manufacturing, and More), End User (Biotechnology & Pharmaceutical Companies, Academic & Research Institutes, Cmos & CROs, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 36.88% of 2025 revenue, anchored by its mature biologics sector and robust funding ecosystem. U.S. regulatory familiarity with FBS testing enables shorter qualification cycles, yet domestic supply constraints intensify import reliance from Australia and Latin America. Canada leverages government grants to expand cell-therapy incubators, whereas Mexico's cost-efficient facilities attract secondary sourcing programs. Collectively, the region remains the demand center even as price sensitivity rises.

Europe follows closely in value terms, characterized by stringent animal-welfare statutes and sophisticated pharmacovigilance regimes. Germany and the United Kingdom drive industrial uptake, complemented by France and Italy's academic consumption. EU regulations mandate traceability back to the slaughterhouse, pushing costs higher but favoring premium producers. Ongoing transition toward animal-component-free protocols tempers volume but raises average selling price, stabilizing regional returns for the fetal bovine serum market.

Asia-Pacific is the expansion frontier at a forecast 7.05% CAGR. China channels biologics manufacturing to Southeast Asian satellites, creating fresh import corridors. India's diagnostics boom adds steady commodity demand, while Japan and South Korea emphasize high-specification serum for regenerative medicine. Australia, with strong cattle husbandry practices, supplies both regional and global buyers, offsetting North American shortages. Regulatory harmonization under ICH guidelines accelerates market access, positioning Asia-Pacific for outsized growth within the fetal bovine serum market size landscape.

- Avantor Inc. (VWR)

- Bio-Techne Corp.

- Biowest - Sera Scandia SA

- Biosera Ltd.

- Bovogen Biologicals Pty Ltd.

- Capricorn Scientific GmbH

- Corning

- Danaher Corp. (Cytiva)

- HiMedia Laboratories Pvt Ltd.

- Merck

- PAN-Biotech GmbH

- Proliant Biologicals LLC

- Rocky Mountain Biologicals LLC

- Sartorius AG (Biological Industries)

- Serana GmbH

- South Pacific Sera Ltd.

- TCS Biosciences Ltd.

- Thermo Fisher Scientific

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid biopharma scale-up post-COVID-19

- 4.2.2 Expanding cell & gene therapy pipelines

- 4.2.3 Growth in animal & human vaccine output

- 4.2.4 Rise of contract cell-culture manufacturing (CMOs/CROs)

- 4.2.5 Cultured-meat R&D funding surge (under-reported)

- 4.2.6 U.S. cattle-herd decline tightening FBS supply (under-reported)

- 4.3 Market Restraints

- 4.3.1 Price volatility linked to beef-industry cycle

- 4.3.2 Ethical concerns & regulatory scrutiny

- 4.3.3 Acceleration of serum-free media adoption (under-reported)

- 4.3.4 Recombinant albumin substitutes gaining traction (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2024-2030)

- 5.1 By Product Type

- 5.1.1 Standard/ Regular FBS

- 5.1.2 Heat-Inactivated FBS

- 5.1.3 Charcoal/ Dextran Stripped FBS

- 5.1.4 Dialyzed FBS

- 5.1.5 Chromatographically Purified (Low-IgG) FBS

- 5.1.6 Stem-Cell-Qualified FBS

- 5.1.6.1 Embryonic SC-Qualified

- 5.1.6.2 Mesenchymal SC-Qualified

- 5.1.7 Exosome-Depleted FBS

- 5.1.8 Gamma-Irradiated FBS

- 5.2 By Application

- 5.2.1 Biopharmaceutical Production

- 5.2.2 Vaccine Manufacturing (Human & Animal)

- 5.2.3 Cell Culture Maintenance & Expansion

- 5.2.4 Stem-Cell Research & Therapy

- 5.2.5 Diagnostics / IVD

- 5.2.6 IVF & Reproductive Medicine

- 5.2.7 Exosome Studies

- 5.2.8 Antibody Production & Hybridoma

- 5.3 By End User

- 5.3.1 Biotechnology & Pharmaceutical Companies

- 5.3.2 Academic & Research Institutes

- 5.3.3 CMOs & CROs

- 5.3.4 Cell Banks & Biorepositories

- 5.3.5 Diagnostic Laboratories

- 5.3.6 Veterinary Clinics & Research

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, and Recent Developments)

- 6.3.1 Avantor Inc. (VWR)

- 6.3.2 Bio-Techne Corp.

- 6.3.3 Biowest - Sera Scandia SA

- 6.3.4 Biosera Ltd.

- 6.3.5 Bovogen Biologicals Pty Ltd.

- 6.3.6 Capricorn Scientific GmbH

- 6.3.7 Corning Incorporated

- 6.3.8 Danaher Corp. (Cytiva)

- 6.3.9 HiMedia Laboratories Pvt Ltd.

- 6.3.10 Merck KGaA (Sigma-Aldrich)

- 6.3.11 PAN-Biotech GmbH

- 6.3.12 Proliant Biologicals LLC

- 6.3.13 Rocky Mountain Biologicals LLC

- 6.3.14 Sartorius AG (Biological Industries)

- 6.3.15 Serana GmbH

- 6.3.16 South Pacific Sera Ltd.

- 6.3.17 TCS Biosciences Ltd.

- 6.3.18 Thermo Fisher Scientific Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment