PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906102

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906102

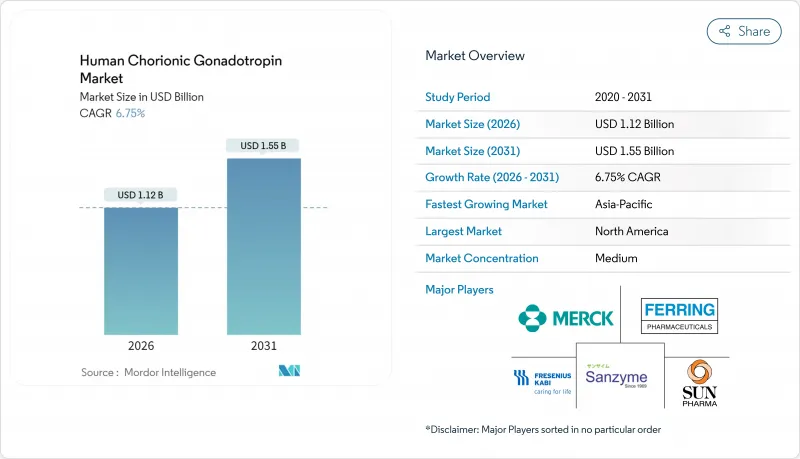

Human Chorionic Gonadotropin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

hCG market size in 2026 is estimated at USD 1.12 billion, growing from 2025 value of USD 1.05 billion with 2031 projections showing USD 1.55 billion, growing at 6.75% CAGR over 2026-2031.

Demographic shifts toward later parenthood, persistent growth in assisted reproductive technology (ART) cycles, and recombinant-DNA manufacturing gains are accelerating demand across fertility clinics, diagnostic laboratories, and emerging home-care settings. North America retains the leading revenue position, supported by well-insured ART users and established clinical protocols, while Asia-Pacific delivers the fastest regional expansion on the back of clinic build-outs and medical-tourism inflows. Within product classes, recombinant formulations continue winning share by addressing purity and safety concerns that surround urinary-derived products. At the same time, rising therapeutic adoption for male hypogonadism, broader application in point-of-care testing, and ongoing veterinary deployment broaden revenue channels for the hCG market.

Global Human Chorionic Gonadotropin Market Trends and Insights

Rising Global Infertility Rates & Expanding ART Cycles

Infertility now affects roughly one in seven couples worldwide, with incidence climbing as average maternal age rises in developed economies. Each IVF cycle requires multiple injections of hCG to trigger final oocyte maturation and support the luteal phase, directly linking procedure growth to higher unit volumes in the hCG market. Asia-Pacific shows the sharpest gains: India is expected to shift from 250,000 IVF cycles in 2024 to 500,000-600,000 cycles by 2030, doubling hCG consumption in the process. With ART outcomes improving and social acceptance broadening, fertility centers continue standardizing hCG-based protocols, reinforcing demand consistency.

Growing Therapeutic Adoption for Male Hypogonadism & Azoospermia

Clinical guidelines increasingly endorse hCG monotherapy or hCG + FSH regimens for men seeking to restore endogenous testosterone and spermatogenesis, avoiding the fertility-suppressing effect of exogenous testosterone replacement. Recent trials report a 95.2% biochemical response rate to hCG alone and 74% success in regaining sperm production after combined therapy, underscoring the molecule's utility beyond traditional female applications. As awareness spreads among urologists, the male-health subsegment is expected to outpace total hCG market growth and diversify revenue streams.

Increasing Use of GnRH Agonists as Alternative Ovulation Triggers

GnRH-agonist triggers curb ovarian hyperstimulation syndrome by producing a shorter, physiologic LH surge, and their use is climbing in high-responder IVF protocols. Dual-trigger strategies pair low-dose hCG with GnRH agonists, diminishing standalone hCG volumes in advanced clinics. The shift necessitates differentiated positioning for hCG manufacturers to retain relevance in cutting-edge reproductive centers.

Other drivers and restraints analyzed in the detailed report include:

- Advances in Recombinant-DNA Manufacturing Improving Purity & Safety

- Expansion of Fertility Clinic Infrastructure and Medical Tourism

- High Therapy Cost & Limited Reimbursement for ART Medicines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The urinary-derived segment controlled 66.98% revenue in 2025, yet recombinant products are set to post the fastest 8.01% CAGR, signaling a structural pivot in the hCG market. Clinicians in North America and Europe now routinely favor recombinant vials for superior purity, an edge amplified by strict pharmacovigilance rules. As biosimilar versions enter Asia-Pacific, price gaps narrow and adoption widens. Manufacturers that master large-scale CHO-cell engineering and cost-efficient downstream purification will likely capture incremental share. Simultaneously, sustained need for affordable therapy in price-sensitive geographies preserves a sizeable, if gradually shrinking, urinary base. Collectively, technology differentiation drives robust competitive dynamics and underpins value migration across the hCG market.

Recombinant uptake also raises manufacturing-quality barriers. FDA warning letters to facilities with poor aseptic controls emphasize the regulatory premium on cGMP compliance, effectively shielding high-quality producers from commoditization risk. Capital-intensive bioprocessing and analytical validation expertise thus form durable moats for incumbents, shaping future consolidation trajectories within the hCG market.

Human Chorionic Gonadotropin Market is Segmented by Product (Naturally Extracted and Recombinant), Application (Male Hypogonadism, Female Infertility Treatment, Oligospermic Treatment, and Other Applications), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Provides the Value (in USD Million) for the Above-Mentioned Segments.

Geography Analysis

North America captured 34.78% of 2025 revenue, anchored by advanced IVF programs, partial insurance coverage in several U.S. states, and steady inflows of international patients seeking cost-moderate Mexican services. Strong professional-society guidelines standardize hCG dosing, ensuring predictable order volumes for suppliers. Canada's publicly funded cycles add further base demand, and regulatory vigilance favors high-purity recombinant lines, fostering premium pricing latitude. Regional growth is steady rather than explosive, yet purchasing power keeps North America the single largest contributor to the global hCG market size.

Asia-Pacific is projected to log a 8.74% CAGR through 2031, the fastest worldwide, as economic development lifts disposable income and governments incentivize reproductive-health infrastructure. India alone opens more than 60 new fertility clinics each year, and its IVF cycles are set to more than double by decade-end. China's relaxation of family-planning rules and healthcare reforms funnel new patient cohorts into ART pipelines, while Thailand and Malaysia sharpen medical-tourism value propositions. Cross-border traffic, attracted by sub-USD 3,000 IVF pricing in India, continues to broaden the regional customer base. Local fill-and-finish capacity additions by multinationals further reduce supply-chain risk, reinforcing Asia-Pacific's status as growth engine of the hCG market.

Europe maintains a balanced position: generous public reimbursement in Germany, France, and portions of the United Kingdom ensures steady demand, while stringent EMA quality requirements tilt the mix toward recombinant products. Eastern Europe, led by Bulgaria and Czech Republic, leverages lower IVF package prices of roughly USD 12,000 for multiple cycles to lure inbound couples from Western Europe. Brexit-related customs complexities have been largely mitigated through regional distribution hubs, preserving supply continuity. Overall, Europe remains a mature yet opportunity-rich theater for suppliers able to meet exacting regulatory and pharmacovigilance standards.

- Merck

- Organon

- Ferring Pharmaceuticals SA

- IBSA Institut Biochimique SA

- Bharat Serums and Vaccines

- Livzon Pharmaceutical Group Inc.

- Aspen Pharmacare Holdings Ltd

- Teva Pharmaceutical Industries

- Hikma Pharmaceuticals

- Cipla

- SPD Swiss Precision Diagnostics GmbH

- Sun Pharmaceuticals Industries

- Gedeon Richter Plc

- Siemens Healthineers

- QuidelOrtho

- Bio-Rad Laboratories

- Thermo Fisher Scientific

- Hologic

- Beckton Dickinson

- Roche

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global infertility rates & expanding ART cycles

- 4.2.2 Growing therapeutic adoption for male hypogonadism & azoospermia

- 4.2.3 Advances in recombinant-DNA manufacturing improving purity & safety

- 4.2.4 Expansion of fertility clinic infrastructure and medical tourism

- 4.2.5 Single-B-hCG protocol uptake in low-resource settings boosting assay demand

- 4.2.6 Veterinary deployment of rhCG to enhance livestock fertility

- 4.3 Market Restraints

- 4.3.1 High therapy cost & limited reimbursement for ART medicines

- 4.3.2 Increasing use of GnRH agonists as alternative ovulation triggers

- 4.3.3 Regulatory scrutiny over impurities in urinary-derived hCG products

- 4.3.4 Ethical backlash from off-label hCG weight-loss programs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 Technology (Value)

- 5.1.1 Urinary-Derived hCG

- 5.1.2 Recombinant hCG

- 5.2 Therapeutic Area (Value)

- 5.2.1 Female Infertility Treatment

- 5.2.2 Male Hypogonadism & Oligospermia

- 5.2.3 Cryptorchidism

- 5.2.4 Pregnancy & Fertility Test Kits

- 5.2.5 Oncology & Other Indications

- 5.3 End User (Value)

- 5.3.1 Fertility & IVF Clinics

- 5.3.2 Hospitals

- 5.3.3 Diagnostic Laboratories

- 5.3.4 Home-care Settings

- 5.3.5 Research Institutes

- 5.4 Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Merck KGaA (EMD Serono)

- 6.3.2 Organon & Co.

- 6.3.3 Ferring Pharmaceuticals SA

- 6.3.4 IBSA Institut Biochimique SA

- 6.3.5 Bharat Serums and Vaccines Ltd

- 6.3.6 Livzon Pharmaceutical Group Inc.

- 6.3.7 Aspen Pharmacare Holdings Ltd

- 6.3.8 Teva Pharmaceutical Industries Ltd

- 6.3.9 Hikma Pharmaceuticals plc

- 6.3.10 Cipla Ltd

- 6.3.11 SPD Swiss Precision Diagnostics GmbH

- 6.3.12 Sun Pharmaceutical Industries Ltd

- 6.3.13 Gedeon Richter Plc

- 6.3.14 Siemens Healthineers AG

- 6.3.15 QuidelOrtho Corporation

- 6.3.16 Bio-Rad Laboratories, Inc.

- 6.3.17 Thermo Fisher Scientific Inc.

- 6.3.18 Hologic, Inc.

- 6.3.19 Becton, Dickinson and Company

- 6.3.20 Roche Holding AG

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment