PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906103

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906103

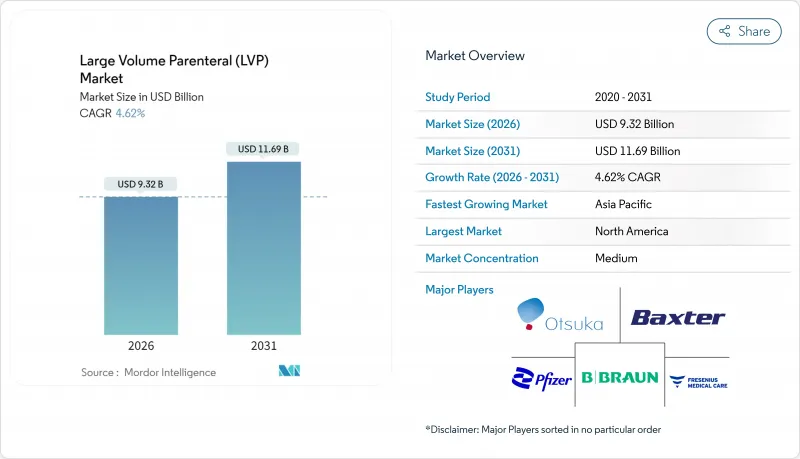

Large Volume Parenteral (LVP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The large volume parenteral market size in 2026 is estimated at USD 9.32 billion, growing from 2025 value of USD 8.91 billion with 2031 projections showing USD 11.69 billion, growing at 4.62% CAGR over 2026-2031.

Rising surgical case counts, an expanding chronic disease burden, and broader adoption of automated aseptic processing collectively underpin this stable trajectory. Demand also benefits from home-based infusion programs that shift IV therapy outside hospitals, while regulatory recognition of Blow-Fill-Seal (BFS) technology accelerates capacity expansion. Supply chain investments in polymer bags and pharmaceutical-grade water infrastructure continue to improve manufacturing resilience, even as glass vial shortages linger. Competitive strategies center on scale, vertical integration, and technology upgrades, indicating a structurally moderate but steadily evolving landscape for the large volume parenteral market.

Global Large Volume Parenteral (LVP) Market Trends and Insights

Rising Surgical Volumes Worldwide

Elective procedure throughput recovered sharply in 2024, exceeding 2019 baselines by 12% as hospitals addressed pandemic-era backlogs. Each surgical event typically consumes 2-4 L of IV fluids, increasing aggregate demand for the large volume parenteral market. Growing robotic surgery uptake-up 18% in 2024-extends operating times and thus elevates perioperative fluid requirements. An aging patient cohort intensifies this pattern because individuals over 65 often need additional volume for hemodynamic stability.

Growing Chronic Disease Prevalence & Fluid Replacement Therapy Adoption

Chronic kidney disease affects 850 million people, and dialysis protocols alone represent a USD 2.8 billion fluid segment. Heart failure reached 64 million global cases in 2024, spurring demand for specialized electrolyte solutions. The Centers for Disease Control and Prevention recorded a 23% rise in diabetes-related hospitalizations requiring IV therapy, where typical diabetic ketoacidosis care involves 6-8 L of fluids per episode.

Complex Formulation & Extractables-Leachables Compliance Challenges

FDA and USP updates released in 2024 force exhaustive analytical testing of container-closure systems, extending validation timelines to as long as 24 months and adding USD 2.8 million in compliance costs per product. Requirements to quantify extractables down to 0.15 µg/day strain smaller firms and slow product introductions, tempering the growth of the large volume parenteral market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Home-Based Infusion & Parenteral Nutrition Programs

- Adoption of BFS & Other Automated Aseptic Technologies

- Price Pressures & Reimbursement Caps in High-Volume Hospital Tenders

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The >2,000 mL category will post a 9.08% CAGR through 2031, buoyed by oncology and critical-care protocols that demand continuous delivery for 24-48 hours. Manufacturing advances have shaved 18% off production costs for these ultra-large containers since 2024. Meanwhile, the 500-1,000 mL range retained 39.12% large volume parenteral market share in 2025, due to standardized intra-operative and emergency guidelines that specify this mid-sized format. Regulatory bodies favor larger units to minimize line changes, further anchoring growth. Smaller segments serve pediatric and outpatient needs and collectively add resilience by diversifying end-use profiles in the large volume parenteral market.

Therapeutic injections dominated 2025 revenues at 45.10%, covering antibiotics, chemotherapy agents, and specialty drugs that require dilution in large volumes for safe infusion. Nutritious formulations, however, are accelerating at a 9.88% CAGR on the back of expanded HPN coverage and longer shelf-life stability. Customized amino-acid and lipid blends now match patient-specific metabolic profiles, supporting premium price points that offset volume discounts elsewhere in the large volume parenteral market.

The Large Volume Parenteral Market Report is Segmented by Volume (100 ML - 250 ML, 250 ML - 500 ML, and More), Application (Therapeutic Injections, and More), Type of Packaging (Bottles, and Flexible Bags), Manufacturing Technology (Traditional Aseptic Fill-Finish and Blow-Fill-Seal (BFS)), End User (Hospitals and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 35.25% of 2025 revenues, anchored by high procedure counts, advanced reimbursement systems, and established regulatory pathways. Market leaders leverage dense distribution networks that secure timely deliveries to urban and rural facilities alike. Robust insurance coverage also cushions price pressures in the large volume parenteral market.

Asia-Pacific is the fastest-growing territory at 8.63% CAGR through 2031. India's Production Linked Incentive scheme injected more than USD 2 billion into sterile injectable facilities, lifting domestic output 25%. China slashed approval timelines by 40% in 2024, enabling local firms to capture share in both domestic and export channels. Aging populations in Japan and South Korea further amplify demand.

Europe retains a sizable footprint owing to stringent but harmonized EMA standards that streamline multi-country registrations. Sustainability mandates push hospitals toward recyclable polymer bags, giving European suppliers an early-adopter advantage in green packaging. Germany leads adoption of hybrid BFS lines, reinforcing the competitive position of the European large volume parenteral market.

Emerging regions in Latin America, the Middle East, and Africa report double-digit unit growth, albeit from small bases. Infrastructure upgrades, donor-funded health programs, and gradual regulatory modernization provide incremental tailwinds, but supply chain gaps persist.

- Amanta Healthcare

- B. Braun

- BAG Healthcare GmbH

- Baxter

- Becton Dickinson & Co.

- Eurofarma

- Fresenius

- Grifols

- ICU Medical

- JW Life Science

- Kelun Pharma

- Otsuka Pharmaceutical Co.

- Pfizer

- Salius Pharma

- Taj Pharma

- Terumo Corp.

- Teva Pharmaceutical Industries

- Vifor Pharma Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Surgical Volumes Worldwide

- 4.2.2 Growing Chronic Disease Prevalence & Adoption of Fluid Replacement Therapies

- 4.2.3 Expansion of Home-Based Infusion & Parenteral Nutrition Programs

- 4.2.4 Adoption of Blow-Fill-Seal (BFS) & Other Automated Aseptic Technologies

- 4.2.5 Shift Toward Large-Volume Wearable/SC Injectors Reducing Hospital Time

- 4.2.6 Supply-Chain Investments In Water-For-Injection (WFI) & Ready-To-Use Multichamber Bags

- 4.3 Market Restraints

- 4.3.1 Complex Formulation & Extractables-Leachables (E&L) Compliance Challenges

- 4.3.2 Price Pressures & Reimbursement Caps in High-Volume Hospital Tenders

- 4.3.3 Glass-Packaging Shortages & Material Recall Risks

- 4.3.4 Emerging Shift of Some Biologics From IV to SC Reducing LVP Demand

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Volume

- 5.1.1 100 - 250 mL

- 5.1.2 250 - 500 mL

- 5.1.3 500 - 1,000 mL

- 5.1.4 1,000 - 2,000 mL

- 5.1.5 More Than 2,000 mL

- 5.2 By Application

- 5.2.1 Therapeutic Injections

- 5.2.2 Fluid-Balance Injections

- 5.2.3 Nutritious/Parenteral Nutrition Injections

- 5.3 By Type of Packaging

- 5.3.1 Bottles (Glass)

- 5.3.2 Flexible Bags (PVC, Non-PVC)

- 5.4 By Manufacturing Technology

- 5.4.1 Traditional Aseptic Fill-Finish

- 5.4.2 Blow-Fill-Seal (BFS)

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Home-Care & Alternate Site Infusion

- 5.5.3 Ambulatory Surgical Centers

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Amanta Healthcare

- 6.3.2 B. Braun SE

- 6.3.3 BAG Healthcare GmbH

- 6.3.4 Baxter International

- 6.3.5 Becton Dickinson & Co.

- 6.3.6 Eurofarma

- 6.3.7 Fresenius Kabi AG

- 6.3.8 Grifols S.A.

- 6.3.9 ICU Medical Inc.

- 6.3.10 JW Life Science

- 6.3.11 Kelun Pharma

- 6.3.12 Otsuka Pharmaceutical Co.

- 6.3.13 Pfizer Inc.

- 6.3.14 Salius Pharma

- 6.3.15 Taj Pharma

- 6.3.16 Terumo Corp.

- 6.3.17 Teva Pharmaceutical Industries

- 6.3.18 Vifor Pharma Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment