PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906108

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906108

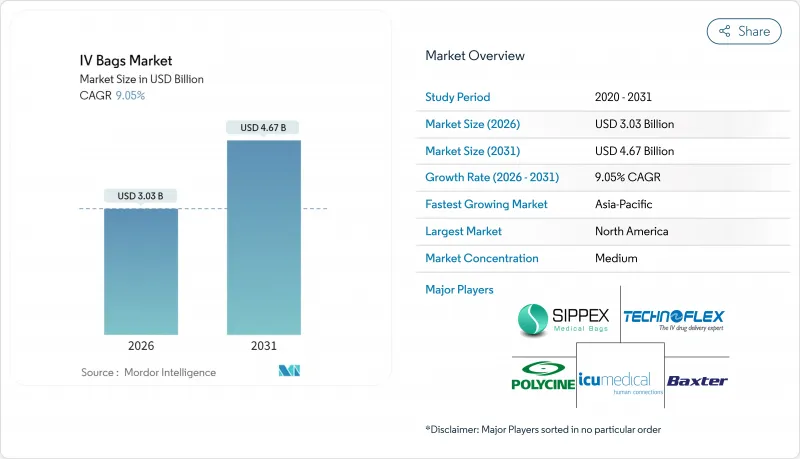

IV Bags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The IV bags market is expected to grow from USD 2.78 billion in 2025 to USD 3.03 billion in 2026 and is forecast to reach USD 4.67 billion by 2031 at 9.05% CAGR over 2026-2031.

Demand stems from chronic-disease prevalence, the regulatory push toward DEHP-free formulations, and expanding home-infusion infrastructure. Hospitals still account for the bulk of purchases, yet value-based care is re-routing intravenous therapy toward outpatient and residential settings. California's DEHP ban has accelerated global adoption of non-PVC materials, while recent hurricane-related shortages exposed the need for supply-chain redundancy. North America retains the largest revenue pool, but Asia-Pacific delivers the fastest unit growth as governments modernize clinical capacity and medical-tourism flows rebound.

Global IV Bags Market Trends and Insights

Rising Prevalence of Chronic Diseases

An aging population and surging incidence of diabetes, cancer, and cardiovascular disorders lengthen hospital stays and intensify intravenous drug use. Medications with poor oral bio-availability often rely on continuous infusion, raising per-episode bag consumption. Oncology regimens and dialysis further amplify fluid volumes. Because value-based reimbursement centers on outcome quality rather than unit cost, clinicians prefer precise IV formulations that optimize therapeutic efficacy.

Growing Preference for Single-Use IV Bags

Post-pandemic infection-control protocols elevated disposable devices from tactical choice to strategic standard. Single-use bags eliminate sterilization labor, cut cross-contamination liability, and streamline pharmacy workflows despite higher purchase prices. Hospitals and outpatient centers now calculate total life-cycle costs, reinforcing premium, ready-to-administer solutions.

Volatile Prices of Medical-Grade Polymers

PVC, EVA, and polypropylene resins track crude-oil swings. Limited supplier diversity inflates price amplitude during geopolitical shocks. Smaller manufacturers unable to hedge long-term contracts pass surcharges on, delaying tenders and tempering adoption of premium non-PVC bags.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Non-PVC, DEHP-Free Materials

- Expansion of Decentralised Compounding Pharmacies

- Lengthy Regulatory Approval Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-PVC formulations captured 46.25% of 2025 revenue and are forecast to log a 10.55% CAGR through 2031. EVA's chemical inertness makes it ideal for oncology drugs, while polyolefins offer steam-sterilization stability for parenteral nutrition. The IV bags market size attributable to non-PVC lines is estimated at USD 2.36 billion by 2031, reflecting the shift away from plasticizer-laden PVC. California and Massachusetts have already mandated DEHP-free procurement, and donor-funded green tenders in Africa signal broader global catch-up.

PVC remains entrenched in price-sensitive segments, yet its total-cost advantage erodes once disposal levies and carbon accounting enter the calculus. Mold-replacement cycles after 2027 provide a natural pivot point at which converters are likely to reinvest in future-proof tooling compatible with EVA or PP. This material re-mix raises switching barriers and enlarges profit pools for first movers.

Bags sized 500-1,000 ml held 36.45% share in 2025 as they meet standard peri-operative hydration needs. Containers exceeding 1,000 ml are projected to clock an 11.05% CAGR, fueled by longer organ-transplant and trauma procedures requiring continuous resuscitation. The IV bags market share for large-volume formats could crest 25.30% by 2031, aided by Terumo's lightweight TERUPACK Eco design that trims resin use 23%, lowering freight emissions and waste charges.

Micro-volume 0-250 ml bags service pediatrics and niche biologics. Their unit volumes outpace revenue, but emerging closed-system connectors promise margin uplift by bundling safety technology. Across all capacities, RFID tagging expedites expiry tracking and reduces pharmacy spoilage, making digital labeling an implicit tender requirement for hospital procurement teams.

The IV Bags Report is Segmented by Material (PVC, Non-PVC), Capacity (0-250 Ml, 250-500 Ml, 500-1, 000 Ml, >1, 000 Ml), Port Type (Single Port, Dual Port), Fluid Type (Crystalloids, Colloids, Blood & Blood Products), End User (Hospitals, Clinics, Home Care, Ambulatory Surgical Centers, Others), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 41.80% of 2025 revenue, equating to USD 1.16 billion. Federal incentives promote domestic sterile-fluid output, while California's DEHP ban cements material migration toward EVA. The IV bags market size for the United States is forecast to touch USD 2.18 billion by 2031. Recent hurricane-sparked shortages led Congress to propose tax credits for redundant manufacturing lines, making geographic diversification a procurement criterion.

Europe displays slower topline expansion yet sharper product sophistication. Germany and France already report non-PVC adoption above 60%, and the United Kingdom trialed a closed-loop polyolefin recycling scheme that cut clinical-plastic emissions 28%, with national rollout slated by 2027. MDR compliance costs escalate entry barriers, protecting incumbents endowed with regulatory bandwidth.

Asia-Pacific delivers the fastest 11.45% CAGR. China's ongoing hospital build-out and India's expanding surgical volumes underpin unit demand, albeit still skewed toward PVC on price grounds. Australia committed AUD 20 million (USD 13.2 million) to scale Baxter's Western Sydney plant, bolstering self-reliance and signalling broader regional industrial policy shifts. Medical-tourism hubs like Thailand upgrade to dual-port EVA systems, aligning with visiting-patient expectations for Western-grade safety.

South America and the Middle East & Africa each contribute under 12% of revenue but promise pockets of double-digit growth. Brazil's private hospital chains are standardizing single-use protocols, while Gulf states procure large-volume parenterals for trauma centers aligned with expanding road-infrastructure.

List of Companies Covered in this Report:

- Baxter

- Fresenius

- B. Braun

- ICU Medical

- Otsuka Pharmaceutical Co. Ltd.

- Grifols

- Terumo

- RENOLIT

- Technoflex SAS

- JW Life Science Corp.

- Huaren Pharmaceutical Co. Ltd.

- Sichuan Kelun Pharmaceutical Co. Ltd.

- Shandong Weigao Group Medical

- Smiths Medical (as part of ICU Medical)

- PolyCine GmbH

- Wipak Walsrode GmbH

- Sealed Air Corp.

- Haemotronic SpA

- Beckton Dickinson

- Nipro

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of chronic diseases

- 4.2.2 Growing preference for single-use IV bags

- 4.2.3 Shift toward non-PVC, DEHP-free materials

- 4.2.4 Expansion of decentralized compounding pharmacies

- 4.2.5 Growth of home-infusion therapy models

- 4.2.6 Rising demand in veterinary medicine

- 4.3 Market Restraints

- 4.3.1 Volatile prices of medical-grade polymers

- 4.3.2 Lengthy regulatory approval timelines

- 4.3.3 Supply-chain concentration in polymer film extruders

- 4.3.4 Environmental disposal concerns

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Material

- 5.1.1 PVC

- 5.1.2 Non-PVC

- 5.1.2.1 Polyolefin (PP)

- 5.1.2.2 Ethylene Vinyl Acetate (EVA)

- 5.1.2.3 Others

- 5.2 By Capacity

- 5.2.1 0-250 ml

- 5.2.2 250-500 ml

- 5.2.3 500-1,000 ml

- 5.2.4 More than 1,000 ml

- 5.3 By Fluid Type

- 5.3.1 Crystalloids

- 5.3.1.1 Normal Saline (0.9 % NaCl)

- 5.3.1.2 Dextrose Solutions

- 5.3.1.3 Ringer's Lactate

- 5.3.2 Colloids

- 5.3.2.1 Albumin

- 5.3.2.2 Dextran & Others

- 5.3.3 Blood & Blood Products

- 5.3.1 Crystalloids

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Clinics

- 5.4.3 Home Care

- 5.4.4 Ambulatory Surgical Centers

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Baxter International Inc.

- 6.3.2 Fresenius Kabi AG

- 6.3.3 B. Braun Melsungen AG

- 6.3.4 ICU Medical Inc.

- 6.3.5 Otsuka Pharmaceutical Co. Ltd.

- 6.3.6 Grifols S.A.

- 6.3.7 Terumo Corporation

- 6.3.8 RENOLIT SE

- 6.3.9 Technoflex SAS

- 6.3.10 JW Life Science Corp.

- 6.3.11 Huaren Pharmaceutical Co. Ltd.

- 6.3.12 Sichuan Kelun Pharmaceutical Co. Ltd.

- 6.3.13 Shandong Weigao Group Medical

- 6.3.14 Smiths Medical (as part of ICU Medical)

- 6.3.15 PolyCine GmbH

- 6.3.16 Wipak Walsrode GmbH

- 6.3.17 Sealed Air Corp.

- 6.3.18 Haemotronic SpA

- 6.3.19 Becton, Dickinson & Co.

- 6.3.20 Nipro Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment