PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906109

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906109

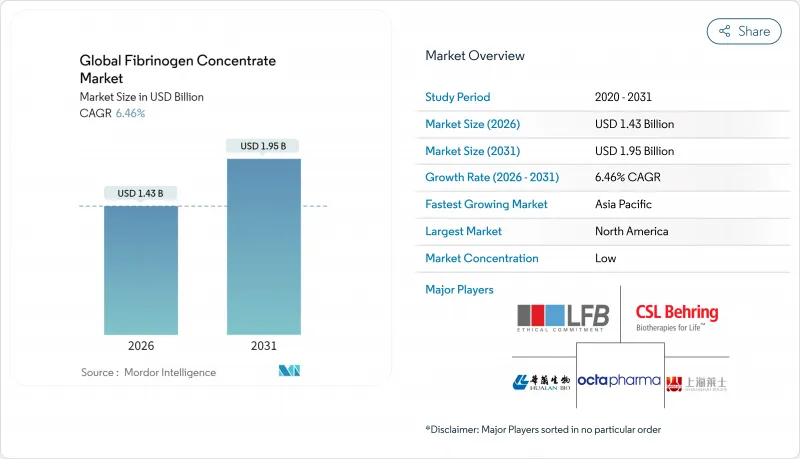

Global Fibrinogen Concentrate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The fibrinogen concentrate market is expected to grow from USD 1.34 billion in 2025 to USD 1.43 billion in 2026 and is forecast to reach USD 1.95 billion by 2031 at 6.46% CAGR over 2026-2031.

Growing recognition of fibrinogen deficiency, wider regulatory approvals, and rapid progress in recombinant technology underpin this expansion. Hospital protocols increasingly replace cryoprecipitate with concentrates because standardized dosing shortens intervention times and lowers transfusion needs. Venture capital inflows support plant-based and recombinant platforms that overcome plasma supply limits, while investments in plasma fractionation across Asia-Pacific remove import bottlenecks. Shelf-stable liquid formats gain momentum in trauma and military care where seconds matter and refrigeration is scarce.

Global Fibrinogen Concentrate Market Trends and Insights

Rising Prevalence of Congenital & Acquired Bleeding Disorders

Improved diagnostics and wider genetic testing uncover more cases of congenital hypofibrinogenemia each year, while trauma, obstetrics, and major surgeries frequently trigger acquired fibrinogen depletion, elevating demand in both chronic and acute settings. A novel FGG mutation confirmed in Chinese families broadens the genotype-phenotype map and sparks updated screening guidelines. The British Society for Haematology now recommends maintaining fibrinogen above 1.0 g/L for high-risk procedures, giving hospitals a clear therapeutic trigger. Aging populations in developed regions and urban injury patterns in emerging markets together widen the addressable case mix. As awareness climbs, specialist centers report rising prophylactic use to prevent bleeding sequelae, creating predictable recurring volumes. Collectively, these epidemiologic and clinical forces add a sustained 1.2% lift to the long-range CAGR.

Substitution of Cryoprecipitate with Safer Concentrates in Trauma & Surgery

Clinical guidelines increasingly cite concentrates as the first choice when fibrinogen falls below 1.5 g/L during perioperative hemorrhage because they eliminate variable potency and preparation delays that accompany cryoprecipitate. Cardiothoracic centers in France reported 92.3% success in curbing major bleeding with Fibryga, surpassing historical outcomes tied to frozen plasma products. Hospitals that convert realize shorter operating room hold times and lower overall blood product usage. These operational gains offset higher unit prices, helping finance teams approve formularies more readily. Because emergency departments and trauma units embrace rapid-mix dosing kits, adoption accelerates across North America and Europe before migrating to Asia-Pacific teaching hospitals.

High Therapy Cost & Uneven Reimbursement

Episode costs often run into thousands of dollars because of high dose requirements, specialized cold-chain logistics, and donor plasma sourcing premiums. CMS furnishing fees for clotting factors rose to USD 0.250 per unit in 2023, squeezing U.S. hospital budgets. Many public payers in emerging economies still limit reimbursement to cryoprecipitate, forcing clinicians to reserve concentrates only for dire emergencies. Private insurers negotiate steep rebates that smaller manufacturers struggle to absorb, dampening competitive entry. Cost-effectiveness models undercount downstream savings from reduced transfusions and shorter stays, which slows formulary inclusion. The net result shaves 1.4% off the global CAGR forecast.

Other drivers and restraints analyzed in the detailed report include:

- Broader Regulatory Approvals and Guideline Endorsements

- Expanded Plasma-Fractionation Capacity in Emerging Markets

- Thrombotic-Event Safety Concerns Prompting Extra Surveillance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Human plasma-derived concentrates controlled 86.72% of fibrinogen concentrate market share in 2025 as legacy infrastructure dominates supply chains. Robust viral inactivation processes and decades of post-marketing data sustain clinician confidence. However, recombinant and synthetic analogues advance at 7.14% CAGR, leveraging cell-free bioreactors and plant platforms that sidestep donor limitations. Firms such as Asahi Kasei augment safety with next-gen viral filters that reduce breakthrough risk and cut process time. Venture-backed entrants design shelf-stable gels compatible with robotic surgery, widening clinical utility.

Demand for plasma-derived material will persist in hematology clinics where product interchangeability eases procurement. Yet many trauma units plan dual sourcing, pairing bulk lyophilized vials with small batch recombinant kits for high-risk cardiac and obstetric cases. Strategic alliances between fractionators and biotech startups accelerate technology transfer, blending established supply chains with novel expression systems. As supply security and pathogen safety remain top purchase criteria, buyers allocate larger budgets to platform diversity, further fragmenting supplier shares over the forecast window.

Congenital deficiency retained 46.03% share of fibrinogen concentrate market size in 2025 because hereditary cases require lifelong therapy and centralized care networks simplify forecasting. These patients receive prophylactic infusions during invasive procedures, locking in predictable quarterly demand. The fibrinogen concentrate market, however, gains its fastest incremental sales from trauma and surgical bleeding, which is climbing at a 7.52% CAGR. Mass casualty planning pushes hospitals to stock rapid-mix vials, elevating emergency usage.

Obstetric hemorrhage guidelines now include concentrates in postpartum protocols, further diversifying usage in maternity units across Asia-Pacific. Neurosurgeons explore micro-dosed sprays to stabilize intracranial bleeds where traditional clotting factors cannot cross the blood-brain barrier effectively. As surgical robotics proliferate, precise hemostatic agents with quick gelation become integral to minimizing camera-vision obscuration. This blend of chronic and emergent indications cushions revenue streams against procedural seasonality.

The Fibrinogen Concentrate Market Report is Segmented by Source (Human Plasma-Derived Concentrates, Recombinant/Synthetic Analogues), Application (Congenital Fibrinogen Deficiency, Trauma & Surgery-Related Hemorrhage, and More), End User (Hospitals, and More), Form (Lyophilized Powder Vials, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led revenue with 41.78% share in 2025 supported by mature trauma networks, ample insurance coverage, and swift FDA clearances that speed hospital adoption. Canada's trauma registry mandates fibrinogen level checks in massive transfusion protocols, further cementing demand. Military contracts add high-margin volumes because shelf-stable kits align with expeditionary medicine strategies. Europe follows with disciplined growth as EMA and national guidelines converge on concentrate-first recommendations for perioperative bleeding, while local fractionation in Germany and Spain ensures supply stability.

Asia-Pacific is the growth engine at 8.96% CAGR. China expands surgical capacity and pursues recombinant innovations, potentially displacing part of its plasma import bill. India's rapid rise in road traffic injuries prompts trauma centers to stock concentrates even in tier-two cities. Japan and South Korea maintain high per-capita usage thanks to aging demographics and universal coverage. Australia's processing transition bolsters concentrate uptake in cardiac and obstetric wards.

South America shows steady acceleration as Brazil invests in regional hemophilia hubs. Middle East and Africa record early-stage adoption, hampered by reimbursement gaps but buoyed by private hospital investment in Gulf states. Emerging local fractionation projects aim to cut lead times and duties, improving affordability over the long term. Collectively, these regional patterns diversify the global revenue base and insulate suppliers against single-market policy swings.

List of Companies Covered in this Report:

- CSL Behring

- Octapharma

- Grifols

- Kedrion Biopharma

- Biotest

- Shanghai RAAS Blood Products Co. Ltd.

- Jiangxi Boya Biological Technology Co. Ltd.

- Hualan Biological Engineering Co. Ltd.

- GC Pharma (Green Cross Corp.)

- Bharat Serums & Vaccines Ltd.

- LFB S.A.

- Sanquin Plasma Products B.V.

- Bio Products Laboratory Ltd. (BPL)

- China National Pharmaceutical Group (Sinopharm)

- ADMA Biologics

- Intas Pharmaceutical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of congenital & acquired bleeding disorders

- 4.2.2 Substitution of cryoprecipitate with safer concentrates in trauma & surgery

- 4.2.3 Broader regulatory approvals and guideline endorsements

- 4.2.4 Expanded plasma-fractionation capacity in emerging markets

- 4.2.5 Recombinant & plant-based fibrinogen innovations attracting VC funding

- 4.2.6 Growth in military & aerospace demand for shelf-stable haemostatics

- 4.3 Market Restraints

- 4.3.1 High therapy cost & uneven reimbursement

- 4.3.2 Thrombotic-event safety concerns prompting extra surveillance

- 4.3.3 Fragile plasma-supply logistics and export restrictions

- 4.3.4 Competitive threat from synthetic fibrin sealants & mimetics

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Source

- 5.1.1 Human Plasma-derived Concentrates

- 5.1.2 Recombinant / Synthetic Analogues

- 5.2 By Application

- 5.2.1 Congenital Fibrinogen Deficiency

- 5.2.2 Trauma & Surgery-Related Hemorrhage

- 5.2.3 Obstetric & Gynecological Bleeding

- 5.2.4 Others (Intracranial, Cardiac etc.)

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Specialty Clinics & Hemophilia Centers

- 5.3.3 Military & Emergency Medical Services

- 5.4 By Form

- 5.4.1 Lyophilized Powder Vials

- 5.4.2 Ready-to-use Liquid Formulations

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 CSL Behring

- 6.3.2 Octapharma AG

- 6.3.3 Grifols S.A.

- 6.3.4 Kedrion S.p.A.

- 6.3.5 Biotest AG

- 6.3.6 Shanghai RAAS Blood Products Co. Ltd.

- 6.3.7 Jiangxi Boya Biological Technology Co. Ltd.

- 6.3.8 Hualan Biological Engineering Co. Ltd.

- 6.3.9 GC Pharma (Green Cross Corp.)

- 6.3.10 Bharat Serums & Vaccines Ltd.

- 6.3.11 LFB S.A.

- 6.3.12 Sanquin Plasma Products B.V.

- 6.3.13 Bio Products Laboratory Ltd. (BPL)

- 6.3.14 China National Pharmaceutical Group (Sinopharm)

- 6.3.15 ADMA Biologics Inc.

- 6.3.16 Intas Pharmaceuticals Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment