PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906116

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906116

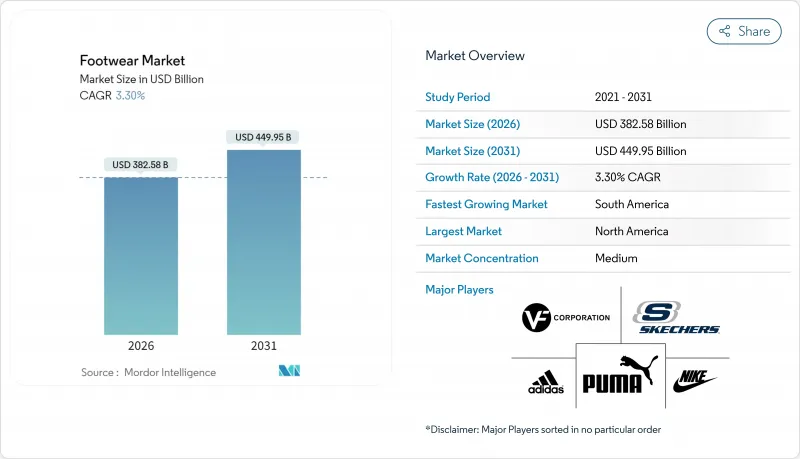

Footwear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The footwear market was valued at USD 370.36 billion in 2025 and estimated to grow from USD 382.58 billion in 2026 to reach USD 449.95 billion by 2031, at a CAGR of 3.30% during the forecast period (2026-2031).

As the sector adapts to the rising trend of athleisure, embraces sustainability mandates, and witnesses the ascent of direct-to-consumer (D2C) brands, it continues to expand steadily. The growing popularity of athleisure reflects changing consumer preferences for versatile and comfortable apparel, while sustainability mandates are driving innovation in materials and production processes. The rise of D2C brands is reshaping traditional retail models by enabling brands to establish direct relationships with consumers, enhancing customer experience and loyalty. While Asia-Pacific stands as a hub for both production and consumption, global design and supply-chain strategies are being influenced by regulatory shifts, notably the EU's Ecodesign for Sustainable Products Regulation (ESPR), which aims to improve product sustainability and reduce environmental impactacross the footwear industry. The landscape is further complicated by consolidation efforts from financial sponsors and retailers, as companies seek to strengthen their market positions through mergers and acquisitions. Heightened competition due to fluctuating material prices is pressuring profit margins, while the emergence of new revenue streams through increased digital engagement, such as e-commerce and social media platforms, is creating opportunities for growth and innovation in the footwear market.

Global Footwear Market Trends and Insights

Surging demand for athleisure footwear

Athleisure is increasingly merging the realms of sports and casual wear, becoming a staple in daily wardrobes and driving robust sales, even in established markets. In 2024, Adidas experienced a 17% surge in footwear sales, primarily driven by performance-oriented designs. Modern brands are integrating lightweight foams and energy-return plates into their lifestyle designs, allowing a single piece to seamlessly transition from the gym to the office and social events. This blending is not only drawing market share away from conventional fashion brands but also compelling luxury names to introduce sport-themed collections. The growing popularity of athleisure has also led to significant shifts in consumer preferences, with a heightened demand for products that combine functionality, comfort, and style. In response, retailers are reshaping their offerings throughout the footwear industry, dedicating more space to running-centric sneakers and adaptable trainers, while also investing in marketing strategies that highlight the versatility and performance of these products in the footwear market.

Aggressive marketing and influencer collaborations

Brand discovery in social commerce is increasingly leaning on genuine creator partnerships, driving swift conversions, particularly with Gen Z. These partnerships enable brands to connect with their target audience on a more personal level, fostering trust, loyalty, and deeper engagement. Micro-influencers, offering niche credibility, achieve this at a fraction of the cost of traditional media, allowing challenger brands to scale swiftly and compete effectively in the market. Their ability to resonate with specific communities makes them a valuable asset for brands aiming to establish a strong foothold. Today's success is tied to constant content updates and clear disclosures; audiences swiftly lose interest if collaborations seem rehearsed or inauthentic. To address this shift, traditional players are bolstering their in-house studios, investing in content creation capabilities, and experimenting with live-stream shopping pilots to maintain their relevance and adapt to the evolving consumer behavior in the footwear industry. These strategies aim to bridge the gap between traditional approaches and the dynamic demands of social commerce.

Extensive availability of counterfeit products

Illicit shoes, worth a staggering USD 467 billion, flood the global e-commerce landscape, undermining trust and diverting sales from legitimate sources. The intricate web of supply chains makes tracing the origin of these products a challenge, as counterfeiters exploit gaps in transparency and oversight to distribute fake goods. These counterfeit operations often involve multiple intermediaries, making it even harder to pinpoint their source. Marketplace algorithms, despite advancements, struggle to distinguish between genuine items and high-quality counterfeits, allowing these products to proliferate unchecked. Birkenstock's recent court-mandated inspections of factories in India underscore the costly enforcement challenges that genuine rights-holders encounter, as they are forced to invest heavily in legal actions, factory audits, and monitoring measures to protect their intellectual property. These enforcement efforts often require collaboration with local authorities and legal systems, further increasing the complexity and cost. As brands ramp up their spending on protection measures, this not only drains resources from research and development but also escalates operating costs throughout the footwear industry, ultimately impacting profitability, innovation, and the ability to compete in an increasingly saturated market.

Other drivers and restraints analyzed in the detailed report include:

- Rise of sustainable and bio-based materials

- Growth of D2C digital-native footwear brands

- Volatile raw-material prices and supply-chain disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, non-athletic footwear dominated the market, capturing 57.23% of total sales revenue. Sneakers, merging trendy designs with comfort-driven technology, have become a staple for many consumers. Boots, a seasonal favorite, benefit from changing weather and cultural trends. Meanwhile, flip-flops find their niche among budget-conscious beachgoers. Innovations like advanced cushioning and knit uppers, once exclusive to performance footwear, have blurred the lines between casual and athletic shoes. Leading brands, recognizing this shift, are blending casual and athletic lines, ensuring their offerings resonate with consumers throughout the week. This fusion of styles and technologies solidifies non-athletic footwear's position as a market frontrunner, celebrated for its adaptability and wide-ranging appeal in the footwear industry.

Athletic footwear is now the industry's fastest-growing segment, projected to achieve a CAGR of 4.67% through 2031, outpacing its non-athletic counterparts. Continuous innovations, such as smart midsoles and bio-based foams, are redefining comfort and performance, allowing brands to command premium prices. Running shoes, riding the wave of the wellness trend and increasing marathon participation, are striking a chord with health-conscious consumers. At the same time, outdoor trekking footwear is witnessing a surge in demand, spurred by a boom in adventure tourism, particularly in North America and Asia-Pacific. For instance, the Sports and Fitness Industry Association reported that approximately 247.1 million Americans engaged in sports and fitness activities in 2024. The distinction between athletic and lifestyle shoes is increasingly blurred, with elite sports features seamlessly integrating into mainstream designs, broadening market appeal. However, this rapid innovation pace is shortening product lifecycles, compelling brands to adopt agile inventory strategies in the footwear market to keep pace with consumer trends. This dynamic landscape not only fuels the sector's growth but also presents lucrative opportunities for brands that emphasize agility and innovation.

In 2025, women's footwear dominates the market, raking in USD 180.51 billion and accounting for 48.74% of total sales. This dominance is fueled by a wide array of styles, from classic pumps to trendy athleisure, catering to diverse occasions and tastes. Such a broad selection not only entices frequent purchases but also sees consumers regularly updating their choices to align with fashion trends and seasonal shifts. Innovative features, like breathable fabrics and antimicrobial treatments, keep women's footwear lines fresh, addressing the growing demand for comfort, functionality, and health-conscious materials. The rising trend of unisex styles and sizing in women's collections signals a significant industry shift towards inclusivity, prioritizing style over traditional gender norms. Major brands are capitalizing on these trends, crafting collections for varied lifestyle archetypes, broadening their market reach, and refining their product lines. This comprehensive approach solidifies women's footwear as the industry's largest and most dynamic segment.

On the other hand, children's footwear is the segment to watch, with projections pointing to a robust 4.55% CAGR in the coming years. This surge is driven by heightened parental awareness of proper foot development and increased participation in school and sports, leading to more frequent replacements. Leading brands are seizing this opportunity, introducing adult-level innovations, like breathable knit materials and antimicrobial liners, to their youth and kids' lines. This strategy not only elevates average selling prices for smaller-sized shoes but also meets parental demands for functionality and health benefits. Consequently, children's footwear has evolved beyond basic styles and traditional school shoes, now embracing fashion-forward and athletic designs that resonate with adult and teen trends. The industry's shift towards inclusive, gender-neutral designs and shared size grids between kids and adults further underscores this convergence. With messaging increasingly focused on healthy lifestyles and active play, the children's footwear segment is set to continue its upward trajectory in the global footwear industry.

The Global Footwear Market Report is Segmented by Product Type (Athletic Footwear, Non-Athletic Footwear), End User (Men, Women, Kids), Category (Mass, Premium), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail Stores, Other Distribution Channels), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America, accounting for 31.26% of global demand, stands as the largest footwear market. The region's consumers are driving demand for sustainable and tech-integrated products, from carbon-neutral snowboard boots to Bluetooth-enabled running shoes, underscoring a willingness to pay premiums for innovation. At the same time, tariff pressures in Vietnam and rising labor costs are squeezing margins, prompting firms to diversify supply chains toward Mexico and Central America. Market consolidation is also reshaping retail dynamics, exemplified by Dick's USD 2.4 billion acquisition of Foot Locker in 2025, which strengthens bargaining power with suppliers and redefines channel leverage in the footwear industry.

South America is the fastest-growing market, projected at a 4.83% CAGR. Rising incomes, rapid urbanization, and expanding retail penetration are accelerating demand, particularly in affordable and mid-tier segments. Brands are leveraging cost advantages and favorable trade policies to scale presence across the region, though macroeconomic instability and currency fluctuations remain headwinds for premium imports, limiting the expansion of high-end categories within the footwear industry.

Asia-Pacific continues to function as the global manufacturing hub, with supply chains concentrated in China, Vietnam, and India ensuring efficiency through shorter production cycles and reduced lead times. Tamil Nadu in particular secured INR 17,550 crore (USD 2.1 billion) in non-leather investments from Nike, Puma, Crocs, and Adidas in 2024, expected to generate 230,000 jobs and reinforce the region's strategic importance. Europe, meanwhile, is setting the global benchmark for sustainability through regulatory measures such as the ESPR, with companies in Germany and Scandinavia leading adoption of bio-based leather alternatives to meet consumer demand for eco-friendly products throughout the footwear industry. ghlighted by Dick's strategic acquisition of Foot Locker for USD 2.4 billion in 2025. This consolidation is reshaping channel leverage, enabling retailers to strengthen their market position and negotiate better terms with suppliers.

- Nike, Inc.

- Adidas AG

- Puma SE

- VF Corporation

- Skechers USA, Inc.

- ASICS Corporation

- Under Armour, Inc.

- New Balance Athletics, Inc.

- Deckers Outdoor Corp.

- Anta Sports Products Ltd.

- Li-Ning Company Ltd.

- ABC Mart

- Kering SA (Gucci)

- Wolverine World Wide, Inc.

- Fila Holdings Corp.

- LVMH Moet Hennessy Louis Vuitton SE (Louis Vuitton)

- Brooks Sports, Inc.

- Bata India

- Columbia Sportswear Company

- Crocs Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Demand for Athleisure Footwear

- 4.2.2 Aggressive Marketing and Influencer Collaborations

- 4.2.3 Rise of Sustainable and Bio-based Materials

- 4.2.4 Growth of D2C Digital-Native Footwear Brands

- 4.2.5 Mass Adoption of Smart and Connected Footwear

- 4.2.6 Expansion of Resale and Sneakerhead Culture

- 4.3 Market Restraints

- 4.3.1 Extensive Availability of Counterfeit Products

- 4.3.2 Volatile Raw-Material Prices and Supply-Chain Disruptions

- 4.3.3 ESG Scrutiny on Labor Practices

- 4.3.4 Anti-Plastic Legislation Limiting Synthetic Uppers

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Athletic Footwear

- 5.1.1.1 Running Shoes

- 5.1.1.2 Sports Shoes

- 5.1.1.3 Trekking/Hiking Shoes

- 5.1.1.4 Other Athletic Footwear

- 5.1.2 Non-Athletic Footwear

- 5.1.2.1 Boots

- 5.1.2.2 Flip-Flops/Slippers

- 5.1.2.3 Sneakers

- 5.1.2.4 Other Non-Athletic Footwear

- 5.1.1 Athletic Footwear

- 5.2 By End User

- 5.2.1 Men

- 5.2.2 Women

- 5.2.3 Kids

- 5.3 By Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Specialty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Netherlands

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Indonesia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nike, Inc.

- 6.4.2 Adidas AG

- 6.4.3 Puma SE

- 6.4.4 VF Corporation

- 6.4.5 Skechers USA, Inc.

- 6.4.6 ASICS Corporation

- 6.4.7 Under Armour, Inc.

- 6.4.8 New Balance Athletics, Inc.

- 6.4.9 Deckers Outdoor Corp.

- 6.4.10 Anta Sports Products Ltd.

- 6.4.11 Li-Ning Company Ltd.

- 6.4.12 ABC Mart

- 6.4.13 Kering SA (Gucci)

- 6.4.14 Wolverine World Wide, Inc.

- 6.4.15 Fila Holdings Corp.

- 6.4.16 LVMH Moet Hennessy Louis Vuitton SE (Louis Vuitton)

- 6.4.17 Brooks Sports, Inc.

- 6.4.18 Bata India

- 6.4.19 Columbia Sportswear Company

- 6.4.20 Crocs Inc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK