PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906119

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906119

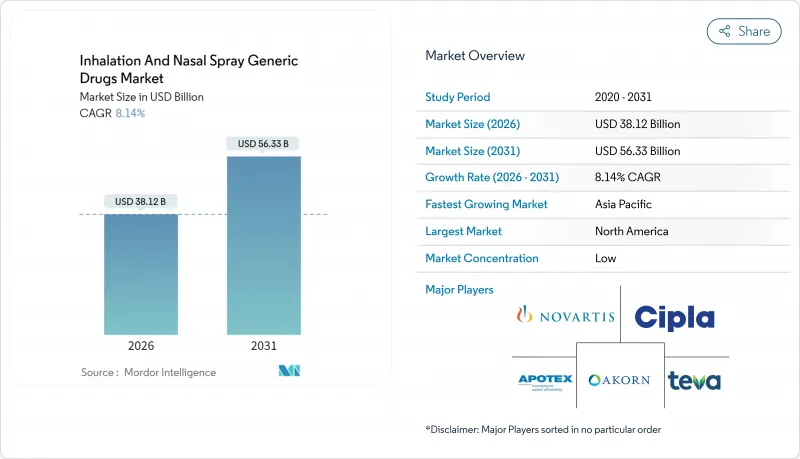

Inhalation And Nasal Spray Generic Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The inhalation and nasal spray generic drugs market size in 2026 is estimated at USD 38.12 billion, growing from 2025 value of USD 35.25 billion with 2031 projections showing USD 56.33 billion, growing at 8.14% CAGR over 2026-2031.

Robust growth reflects the sharp patent cliff facing blockbuster inhalers, streamlined fast-track ANDA pathways, and mounting environmental regulations that push manufacturers toward propellant-efficient formulations. Generic entrants are capitalizing on expiring asthma and COPD franchises, while contract development and manufacturing organizations (CDMOs) supply end-to-end expertise that lowers development risk for smaller companies. Regulatory harmonization across the United States, Europe, and key Asia-Pacific markets narrows approval timelines, and smart-inhaler add-ons help payers justify wider generic adoption. Meanwhile the shift to low-GWP propellants is accelerating product switch-outs, favoring manufacturers that master new formulation science and device compatibility.

Global Inhalation And Nasal Spray Generic Drugs Market Trends and Insights

Surging Prevalence of Asthma & COPD

Worldwide, asthma affects 262 million people, and COPD mortality is rising sharply in low- and middle-income countries where 85% of cases occur. Aging populations in developed economies compound the clinical burden, while treatment affordability gaps in emerging markets make low-priced generics indispensable. The World Health Organization places inhaled corticosteroids and bronchodilators on the essential medicines list, reinforcing policy momentum for broad generic availability . As payers pursue value-based care, cost-effective respiratory generics remain recession-resistant necessities that underpin the inhalation and nasal spray generic drugs market.

Affordable Pricing Post-Patent-Expiry

The approval of Breyna, the first generic Symbicort, in March 2025 illustrates how patent expiries cut branded inhaler prices by 40-60% within a year. Formulary resets following the Flovent withdrawal further accelerate substitution to authorized generics, with Texas Medicaid lifting prior-authorization blocks on generic fluticasone. Tiered reimbursement frameworks consistently place generics at preferred levels, driving durable share gains across the inhalation and nasal spray generic drugs market.

Stringent Bio-Equivalence & Device Sameness Tests

FDA now requires in-vitro plus in-vivo crossover trials that cost USD 15-25 million per candidate, extending timelines by up to two years. EMA's 2025 inhaler guidance demands full comparative data when excipient or device differences exist. The capital hurdle restrains smaller entrants, narrowing the competitive field within the inhalation and nasal spray generic drugs market.

Other drivers and restraints analyzed in the detailed report include:

- Favorable Fast-Track ANDA Pathways

- Transition to Low-GWP Propellants Accelerates Product Switch-Outs

- CDMO One-Stop Inhalation Platforms Lower Entry Barriers

- Smart-Inhaler Add-Ons Boost Payer Acceptance

- 'Device-Patent Thickets' Delaying Generic Launches

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corticosteroids accounted for 34.92% of 2025 revenue, making them the anchor of the inhalation and nasal spray generic drugs market. Market acceptance rests on proven anti-inflammatory efficacy across asthma and COPD protocols, aided by widespread familiarity among prescribers. Following key patent expirations, generic fluticasone and budesonide realized rapid uptake, creating significant cost savings for payers and driving volume growth.

Combination ICS/LABA therapies show the fastest 9.11% CAGR through 2031 as clinicians embrace dual-mechanism control that improves lung-function metrics, adherence, and quality of life. The Symbicort generic launch paved the way, and additional combos await imminent patent cliffs. For manufacturers, the higher margin of complex blends offsets the investment in bioequivalence trials and device alignment, bolstering profitability across the inhalation and nasal spray generic drugs industry.

Bronchodilators continue steady demand as rescue medications, whereas antihistamines and decongestant sprays occupy narrower seasonal niches. Emerging classes such as leukotriene modifiers and anticholinergics diversify pipelines, but their current base is small compared with flagship corticosteroids. Nevertheless, each class contributes incremental revenue that collectively enlarges the inhalation and nasal spray generic drugs market size over the forecast horizon.

Asthma represented 46.20% of 2025 sales and remains the single largest clinical application. Decades of guideline-driven therapy have normalized inhaled generics in both pediatric and adult populations. Fast-track approvals guarantee ready substitutes whenever branded supply disruptions occur, safeguarding patient access.

COPD treatments are expanding at a 8.98% CAGR thanks to demographic aging and better diagnostics that uncover previously untreated segments. Combination maintenance inhalers dominate this growth. The inhalation and nasal spray generic drugs market size for COPD drugs is projected to widen sharply as payers demand lower-cost maintenance regimens for an enlarging elderly cohort.

Rhinitis, nasal polyposis, and sinusitis applications maintain moderate growth based on allergen exposure cycles and incremental innovation in nasal spray technology. Smoking cessation and pulmonary arterial hypertension represent nascent but high-value segments where inhalation delivery offers pharmacokinetic advantages, promising future diversification within the inhalation and nasal spray generic drugs market.

The Inhalation and Nasal Spray Generic Drugs Market Report is Segmented by Drug Class (Corticosteroids, Bronchodilators, and More), Indication (Asthma, COPD, and More), Device Type (pMDI, DPI, and More), Distribution Channel (Retail, Hospital, Online Pharmacies), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 42.90% of global 2025 revenue, underpinned by FDA fast-track ANDA pathways, established coverage systems, and high asthma and COPD prevalence. The post-Flovent withdrawal episode underscored the region's agility, with authorized generics rapidly filling supply gaps. Policymakers emphasize domestic manufacturing resilience after finding that 83 of the top 100 generics have no U.S. API source . These dynamics secure continued leadership for the inhalation and nasal spray generic drugs market in North America.

Asia-Pacific is the fastest-growing region at 10.18% CAGR through 2031, driven by healthcare expansion, regulatory harmonization, and cost-efficient manufacturing in India and China. Local governments integrate generics into universal health schemes, yet medication still exceeds daily wages for many patients, leaving substantial unmet need. Affordable inhalers therefore play a critical public-health role, propelling the inhalation and nasal spray generic drugs market across Asia-Pacific.

Europe faces dual challenges of environmental compliance and supply shortages. A June 2024 salbutamol deficit across 21 EU member states exposed reliance on limited suppliers. Simultaneously, the region enforces strict carbon reduction targets, spurring investment in low-GWP devices that could tilt share toward early adopters. Though generic medicine revenues slipped 26% over the past decade, propellant transition mandates reinvigorate innovation within the inhalation and nasal spray generic drugs market. South America benefits from regulatory modernization and wider insurance coverage. Together, these emerging territories add depth and diversification to the global inhalation and nasal spray generic drugs market, albeit from smaller revenue bases.

- Teva Pharmaceutical Industries

- Viatris

- Cipla

- Hikma Pharmaceuticals

- Sandoz (Novartis)

- Sun Pharmaceuticals Industries

- Apotex

- Akorn

- Beximco Pharma

- Glenmark Pharma

- Lupin

- Aurobindo Pharma

- Dr Reddy's Laboratories

- Amneal Pharma

- Perrigo Company

- Chiesi Farmaceutici

- Boehringer Ingelheim

- AstraZeneca

- GlaxoSmithKline

- Accord Healthcare

- Orion

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging Prevalence Of Asthma & COPD

- 4.2.2 Affordable Pricing Post-Patent-Expiry

- 4.2.3 Favourable Fast-Track Anda Pathways

- 4.2.4 Transition To Low-Gwp Propellants Accelerates Product Switch-Outs

- 4.2.5 Cdmo One-Stop Inhalation Platforms Lower Entry Barriers

- 4.2.6 Smart-Inhaler Add-Ons Boost Payer Acceptance Of Generics

- 4.3 Market Restraints

- 4.3.1 Stringent Bio-Equivalence & Device Sameness Tests

- 4.3.2 'Device-Patent Thickets' Delaying Generic Launches

- 4.3.3 Impending HFA-134A Supply Squeeze Under F-Gas Rules

- 4.3.4 Post-Flovent Withdrawal Formulary Volatility & Stocking Gaps

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Drug Class

- 5.1.1 Corticosteroids

- 5.1.2 Bronchodilators (LABA, SABA)

- 5.1.3 Combination ICS/LABA

- 5.1.4 Antihistamines

- 5.1.5 Decongestant Sprays

- 5.1.6 Others (Leukotriene modifiers, Anticholinergics)

- 5.2 By Indication

- 5.2.1 Asthma

- 5.2.2 COPD

- 5.2.3 Allergic & Non-allergic Rhinitis

- 5.2.4 Nasal Polyposis & Sinusitis

- 5.2.5 Smoking Cessation & PAH

- 5.3 By Device Type

- 5.3.1 Pressurised Metered-Dose Inhalers (pMDI)

- 5.3.2 Dry-Powder Inhalers (DPI)

- 5.3.3 Soft-Mist Inhalers

- 5.3.4 Unit/Bi-Dose Nasal Sprays

- 5.3.5 Nebulisers

- 5.4 By Distribution Channel

- 5.4.1 Retail Pharmacies

- 5.4.2 Hospital Pharmacies

- 5.4.3 Online Pharmacies & DTC Platforms

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Teva Pharmaceutical Industries

- 6.3.2 Viatris

- 6.3.3 Cipla

- 6.3.4 Hikma Pharmaceuticals

- 6.3.5 Sandoz (Novartis)

- 6.3.6 Sun Pharma

- 6.3.7 Apotex

- 6.3.8 Akorn

- 6.3.9 Beximco Pharma

- 6.3.10 Glenmark Pharma

- 6.3.11 Lupin Ltd

- 6.3.12 Aurobindo Pharma

- 6.3.13 Dr Reddy's Laboratories

- 6.3.14 Amneal Pharma

- 6.3.15 Perrigo Company

- 6.3.16 Chiesi Farmaceutici

- 6.3.17 Boehringer Ingelheim

- 6.3.18 AstraZeneca

- 6.3.19 GlaxoSmithKline

- 6.3.20 Accord Healthcare

- 6.3.21 Orion Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment