PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906120

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906120

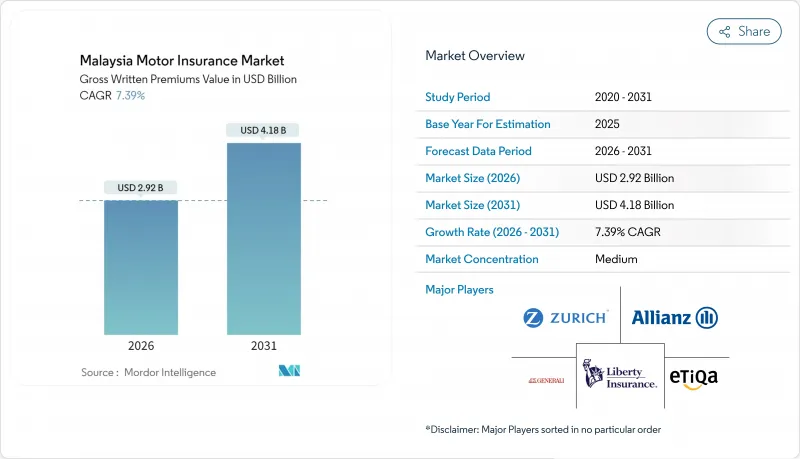

Malaysia Motor Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Malaysia motor insurance market size in 2026 is estimated at USD 2.92 billion, growing from 2025 value of USD 2.72 billion with 2031 projections showing USD 4.18 billion, growing at 7.39% CAGR over 2026-2031.

Consistent economic growth, rising wages, and the post-2017 shift to risk-based pricing are widening the premium base while encouraging product innovation. Digital distribution, bancassurance alliances, and telematics-driven underwriting are lowering acquisition costs and improving loss-ratio management. However, the March 2024 rise in service tax to 8% is squeezing affordability in price-sensitive segments even as higher new-vehicle prices lift insured values. Competitive intensity is escalating as incumbents and digital entrants vie to differentiate on claims speed, usage-based offers, and electric-vehicle (EV) add-ons.

Malaysia Motor Insurance Market Trends and Insights

Post-tariff liberalization accelerates product innovation & risk-based pricing

The 2017 removal of tariff-fixed motor premiums catalyzed a market pivot toward data-driven underwriting that prices policies by vehicle age, driver profile, and usage intensity. Insurers now roll out mileage-capped or pay-how-you-drive covers such as Chubb's "MY Smart Car Insurance," which lets low-mileage users top up only when needed. Liberalization has also enabled niche packages for EVs, fleets, and vintage cars, widening customer choice. Regulatory guardrails from Bank Negara Malaysia ensure consumer protection while encouraging actuarial experimentation. Over the medium term, the practice is expected to lift underwriting margins and stimulate cross-segment product differentiation.

Rapid digital & bancassurance uptake widens policy reach

Malaysia's 96.4% household internet penetration and near-universal 4G coverage underpin a quick migration to online quoting, instant payment, and e-claims channels. Bancassurance alliances leverage that connectivity; AmBank's app-enabled workflow helped drive a 11.6% year-over-year jump in gross written premium to RM 835.8 million in 2024. Digital Insurer and Takaful Operator (DITO) licenses, now in the pilot phase, lower entry barriers for technology-first underwriters. Early gains concentrate in Klang Valley, Penang, and Johor Bahru, but nationwide take-up is expected within two years as mobile onboarding outperforms branch visits on speed and convenience. By integrating artificial intelligence for fraud checks and chatbot servicing, carriers are shaving costs and boosting customer retention.

Escalating repair costs for high-tech vehicles inflate claims

Advanced driver-assistance systems, lidar sensors, and aluminum body panels demand specialized equipment and scarce technicians, pushing up labor and parts costs. Longer repair lead times increase storage expenses and Compensation for Assessed Repair Time payouts. Supply-chain disruptions for imported modules exacerbate downtime especially for premium marques. These pressure points drag on underwriting profitability and force carriers to reassess deductibles and premium adequacy. Short-run loss-ratio spikes are likely until local repair ecosystems catch up with technological complexity.

Other drivers and restraints analyzed in the detailed report include:

- Rising new-vehicle prices boost premium base

- Government EV incentives spur demand for EV-specific covers

- Surge in traffic accidents raises loss ratios

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Personal vehicles retained the dominant position in Malaysia's motor insurance landscape, capturing 73.55% of total written premiums in 2025. High household car-ownership rates, competitive auto-financing packages, and growing middle-class incomes underpin this large share. Consumers increasingly favor comprehensive plans that bundle flood, windscreen, and electronic-systems protection, reinforcing premium volume. Urbanization and daily commuting needs further sustain private-car policy demand, making personal lines the anchor of overall portfolio stability within the Malaysia motor insurance market.

Commercial vehicle cover, while smaller in absolute terms, is advancing at an 8.02% CAGR through 2031-the fastest among all vehicle categories. E-commerce expansion, last-mile delivery growth, and Malaysia's role as a regional logistics hub are multiplying fleet sizes and insurance requirements. Telematics-enabled usage-based products allow trucking and ride-hailing operators to calibrate premiums to real-time mileage and driving behavior, improving affordability and risk management. As government infrastructure projects and cross-border trade intensify road freight activity, commercial lines are set to outpace personal lines in incremental premium contribution over the forecast horizon, enhancing diversification in the Malaysia motor insurance market.

The Malaysia Motor Insurance Market Report is Segmented by Vehicle Type (Personal, Commercial), Insurance Type (Third-Party, Comprehensive), and Distribution Channel (Direct, Agents, Brokers, Banks, Other Distribution Channels). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Etiqa

- Allianz Malaysia

- Generali Malaysia

- Zurich Malaysia

- Liberty General / Kurnia

- MSIG Malaysia

- Tokio Marine Malaysia

- AIG Malaysia

- QBE Malaysia

- Takaful Malaysia

- Tune Protect Malaysia

- Berjaya Sompo

- Pacific & Orient Insurance

- Chubb Insurance Malaysia

- RHB Insurance

- AXA Affin Life (legacy motor add-ons)

- Great Eastern General

- Prudential BSN Takaful (motor riders)

- Hong Leong Assurance

- AmGeneral Insurance

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-tariff liberalisation accelerates product innovation & risk-based pricing

- 4.2.2 Rapid digital & bancassurance uptake widens policy reach

- 4.2.3 Rising new-vehicle prices boost premium base

- 4.2.4 Government EV incentives spur demand for EV-specific covers

- 4.2.5 Mandatory Claims Service Charter (PD CSP) lifts consumer trust

- 4.2.6 Usage-based insurance for ride-hailing & fleets gains traction

- 4.3 Market Restraints

- 4.3.1 Escalating repair costs for high-tech vehicles inflate claims

- 4.3.2 Surge in traffic accidents raises loss ratios

- 4.3.3 8 % Service Tax hike squeezes affordability

- 4.3.4 Limited comprehensive cover for ?20-year-old cars shifts risk to MMIP

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Vehicle Type (Value)

- 5.1.1 Personal

- 5.1.2 Commercial

- 5.2 By Insurance Type (Value)

- 5.2.1 Third-Party

- 5.2.2 Comprehensive

- 5.3 By Distribution Channel (Value)

- 5.3.1 Direct

- 5.3.2 Agents

- 5.3.3 Brokers

- 5.3.4 Banks

- 5.3.5 Other Distribution Channels

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Etiqa

- 6.4.2 Allianz Malaysia

- 6.4.3 Generali Malaysia

- 6.4.4 Zurich Malaysia

- 6.4.5 Liberty General / Kurnia

- 6.4.6 MSIG Malaysia

- 6.4.7 Tokio Marine Malaysia

- 6.4.8 AIG Malaysia

- 6.4.9 QBE Malaysia

- 6.4.10 Takaful Malaysia

- 6.4.11 Tune Protect Malaysia

- 6.4.12 Berjaya Sompo

- 6.4.13 Pacific & Orient Insurance

- 6.4.14 Chubb Insurance Malaysia

- 6.4.15 RHB Insurance

- 6.4.16 AXA Affin Life (legacy motor add-ons)

- 6.4.17 Great Eastern General

- 6.4.18 Prudential BSN Takaful (motor riders)

- 6.4.19 Hong Leong Assurance

- 6.4.20 AmGeneral Insurance

7 Market Opportunities & Future Outlook

- 7.1 Expansion of Climate and Disaster-Resilient Add-On Covers

- 7.2 Targeting Urban Vehicle Ownership Growth