PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906121

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906121

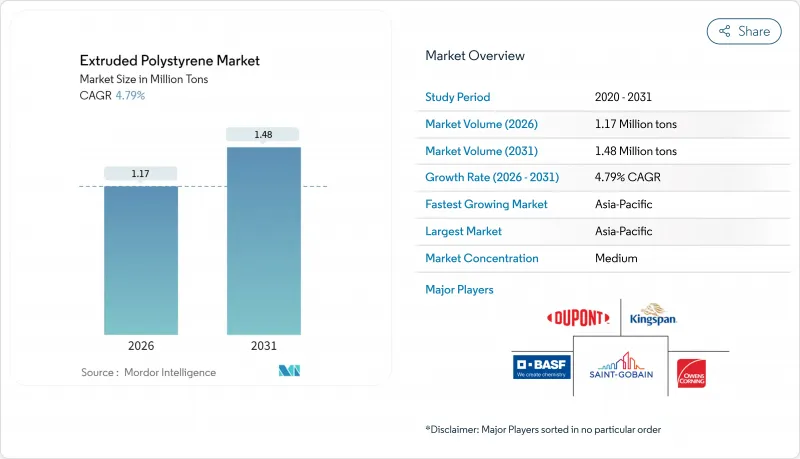

Extruded Polystyrene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Extruded Polystyrene Market was valued at 1.12 million tons in 2025 and estimated to grow from 1.17 million tons in 2026 to reach 1.48 million tons by 2031, at a CAGR of 4.79% during the forecast period (2026-2031).

This growth rests on the material's closed-cell structure, which delivers superior thermal resistance and moisture tolerance compared with alternative foams. Volume gains track the acceleration of global construction activity, the hardening of energy-efficiency mandates, and mounting renovation demand in mature building stocks. Competitive advantages also stem from the product's compressive strength, which supports rooftop equipment, and from its dimensional stability, which reduces long-term energy loss. Strategic focus on low-global-warming-potential blowing agents further reinforces long-range demand resilience under tightening climate regulations.

Global Extruded Polystyrene Market Trends and Insights

Growing Demand for Energy-Efficient Buildings

Government and utility incentives amplify the payback of high-R-value insulation, steering architects toward extruded polystyrene boards for walls, roofs, and foundations. Continuous insulation requirements in the International Energy Conservation Code elevate adoption in commercial envelopes where thermal bridging must be minimized. Building owners associate the material's higher upfront cost with reliable HVAC savings over building life. Resilience to bulk water and vapor diffusion protects installed R-value in humid climates. Certification schemes such as LEED v4 link whole-building energy performance to material selection, sustaining long-term demand. As energy grids decarbonize, insulation remains a primary low-cost efficiency measure, encouraging deeper retrofit scopes.

Rapid Urbanization and Infrastructure Expansion

Asia-Pacific's urban population adds millions of residents each year, driving high-rise housing, mass-transit stations, and commercial districts that specify robust envelope insulation. China's and India's infrastructure programs anchor regional consumption, while Southeast Asian smart-city projects multiply design wins for extruded polystyrene market participants. Middle-class consumer expectations for thermal comfort encourage code writers to raise minimum R-values. Public housing schemes in Indonesia and the Philippines adopt insulation guidelines that previously applied only to premium projects. These secular forces extend the extruded polystyrene market footprint into second-tier cities that are experiencing rapid construction booms.

Eco-Friendly Insulation Substitutes Gaining Share

Wood-fiber boards and recycled cellulose insulation win specifications in green building projects that benchmark lifecycle impacts. European regulatory pressure on plastic waste bolsters demand for bio-based solutions, nudging some architects away from fossil-derived foams. Circular-economy policies promote material reuse, which favors insulation systems with demonstrated recyclability. These shifts are still concentrated in premium segments, yet cost curves are improving as production scales. Extruded polystyrene suppliers counteract by investing in take-back programs and bio-sourced blowing agents to shore up environmental credentials.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Building Codes Mandating Thermal Insulation

- Cold-Chain Warehousing Boom for Biologics and E-Grocery

- Kigali-Driven HFC Blowing-Agent Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Boards accounted for 61.50% of the extruded polystyrene market share in 2025, underscoring their versatility across roofs, walls, and foundations, where structural integrity and walkability are critical. The extruded polystyrene market size tied to boards continues to rise as builders prioritize compressive strength and closed-cell moisture resistance in exposed conditions. Panels, meanwhile, are projected to register a 4.86% CAGR to 2031, benefiting from their suitability for prefabricated assemblies that streamline onsite labor.

Blocks remain a niche for perimeter foundations and below-grade waterproofing where thickness needs exceed conventional board limits. Pipe sections serve mechanical room and process-industry insulation, capturing emerging opportunities in cold-chain expansion. Product innovation now centers on edge profiles that promote tight interlocks and on surface textures that improve adhesion in multi-layer roof systems.

The Extruded Polystyrene Report is Segmented by Product Type (Boards, Panels, Blocks, and Pipe Sections), Application (Roof Insulation, Wall Insulation, and Others), End-User Industry (Residential, Commercial, and Infrastructure), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa, ). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific held 44.20% of global volume in 2025, and the region is projected to log a 4.93% CAGR through 2031 on the back of robust urbanization, infrastructure megaprojects, and government housing programs. China's Belt and Road Initiative generates spill-over demand in participating nations, while India's Smart Cities Mission embeds energy-efficiency standards that elevate insulation specifications.

North America is buoyed with code updates in Canada and the United States mandating higher R-values for roofs and walls in new builds. Renovation activity picks up as utilities expand rebate programs targeting envelope improvements. Cold-storage construction accelerates due to strong e-grocery adoption, reinforcing product pull-through in industrial real estate. The extruded polystyrene market in this region remains consolidated around vertically integrated producers able to navigate styrene price swings.

Europe maintains a sizable base despite slower construction volume growth, supported by strict energy-performance legislation and public funding for deep-renovation projects. Adoption of alternative insulation materials exerts gradual share pressure; however, extruded polystyrene still dominates below-grade and inverted-roof applications because of its water-resistance profile. Manufacturers operate circular-economy take-back programs to align with regional recycling mandates, which helps preserve specification preference among sustainability-conscious builders.

- Austrotherm

- BASF

- DuPont

- Emirates Extruded Polystyrene L.L.C.

- JACKON Insulation GmbH

- Kingspan Group

- Knauf Insulation

- Owens Corning

- Polyfoam XPS

- Saint-Gobain

- Soprema Group

- Supreme Petrochem Ltd.

- Synthos

- TECHNONICOL

- URSA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for energy-efficient buildings

- 4.2.2 Rapid urbanization and infrastructure expansion

- 4.2.3 Stringent building codes mandating thermal insulation

- 4.2.4 Cold-chain warehousing boom for biologics and e-grocery

- 4.2.5 Uptake of off-site modular construction systems

- 4.3 Market Restraints

- 4.3.1 Eco-friendly insulation substitutes gaining share

- 4.3.2 Raw-material (styrene) price volatility

- 4.3.3 Kigali-driven HFC blowing-agent restrictions

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Boards

- 5.1.2 Panels

- 5.1.3 Blocks

- 5.1.4 Pipe Sections

- 5.2 By Application

- 5.2.1 Roof Insulation

- 5.2.2 Wall Insulation

- 5.2.3 Others (Floor, Basement, Cavity and Perimeter)

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Infrastruture

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Austrotherm

- 6.4.2 BASF

- 6.4.3 DuPont

- 6.4.4 Emirates Extruded Polystyrene L.L.C.

- 6.4.5 JACKON Insulation GmbH

- 6.4.6 Kingspan Group

- 6.4.7 Knauf Insulation

- 6.4.8 Owens Corning

- 6.4.9 Polyfoam XPS

- 6.4.10 Saint-Gobain

- 6.4.11 Soprema Group

- 6.4.12 Supreme Petrochem Ltd.

- 6.4.13 Synthos

- 6.4.14 TECHNONICOL

- 6.4.15 URSA

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Innovations in Extruded Polystyrene Manufacturing