PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906125

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906125

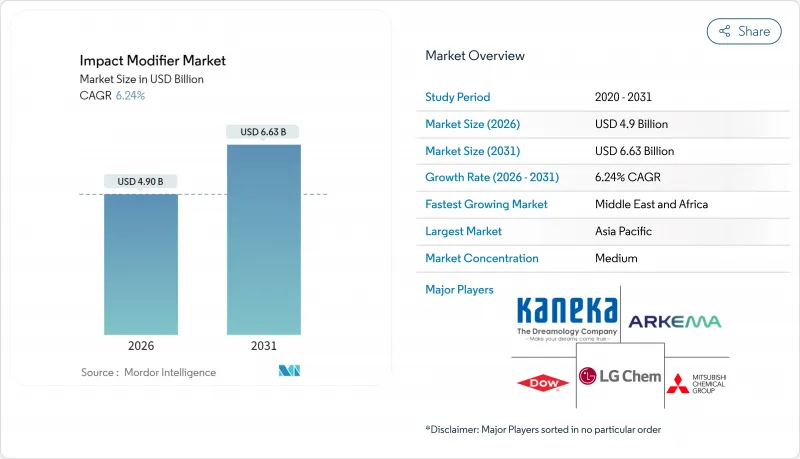

Impact Modifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Impact Modifier market size in 2026 is estimated at USD 4.9 billion, growing from 2025 value of USD 4.61 billion with 2031 projections showing USD 6.63 billion, growing at 6.24% CAGR over 2026-2031.

Growth rests on the material's ability to toughen polymers that enable lightweight automotive parts, resilient construction components and downgauged packaging films. Asia-Pacific's building boom anchors demand, accounting for a 47.26% volume share in 2024, while automotive applications increase at a 6.45% CAGR as vehicle makers pursue aggressive weight-reduction strategies. Acrylonitrile Butadiene Styrene (ABS) remains the largest product type with 33.48% share in 2024, but Acrylic Impact Modifiers (AIM) deliver the fastest 6.42% CAGR as outdoor applications require weatherable compounds. Polyvinyl Chloride (PVC) dominates usage with 42.67% share in 2024 on the strength of pipe and profile demand, whereas engineering plastics climb at 6.63% CAGR as automakers adopt impact-modified composites for crash-relevant parts.

Global Impact Modifier Market Trends and Insights

Growing Packaging Demand

Packaging converters deploy impact-modified compounds so thinner walls survive drop tests encountered in e-commerce distribution, meeting FDA food-contact requirements while reducing resin mass. Rigid packaging formulators add modifiers to downgrade thickness and keep structural integrity, especially in reusable containers targeted at closed-loop programs. Brand owners prioritize compatibility with recycled streams, spurring demand for hybrid modifier-compatibilizer systems that maintain clarity and toughness. Material suppliers respond by tailoring melt-flow characteristics that suit high-speed film lines. The ongoing shift toward mono-material formats intensifies the need for modifiers that balance stiffness and impact for downgauged packages.

PVC Pipe and Profile Boom

Asia-Pacific infrastructure projects favor large-diameter PVC pipes where modifiers raise resistance to installation damage and pressure cycling. Building codes in typhoon-prone regions specify impact-modified PVC window profiles to withstand wind loads and thermal stress. As cities expand underground utility grids, contractors require rugged conduits that last decades without cracking. Standards such as ASTM D1784 and ISO 4422 dictate minimum impact thresholds, pushing compounders to optimize modifier loading. GCC countries replicate these specifications, accelerating penetration into Middle Eastern water projects.

Raw-Material Price Volatility (Styrene, Acrylates)

Styrene and acrylate monomer swings compress producer margins, prompting spot-pricing and shorter contracts that unsettle converters. Supply interruptions tied to unplanned cracker outages can lift delivered costs sharply, forcing compounders to ration allocations. Buyers hedge through multi-source strategies, yet differentiation remains difficult when feedstock disruptions cascade through the chain. Some OEMs lock in tolling deals to cushion volatility but accept higher inventory risk. Volatile energy costs in Asia's feedstock centers compound unpredictability in delivered modifier prices.

Other drivers and restraints analyzed in the detailed report include:

- Construction-Led Resin Uptake in Asia-Pacific

- Automotive Lightweighting and Safety Focus

- Tightening VOC and PVC Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

ABS retained 32.92% of impact modifier market share in 2025, anchoring appliance housings and interior automotive trim. AIM, however, leads growth with a 6.36% CAGR as its superior UV durability supports exterior body panels and window profiles. The impact modifier market size attributable to AIM is projected to expand steadily as building facades demand longer service life under harsh climates. ASA serves niche fuel-contact parts needing chemical resistance, while MBS enables clear PVC packaging that combines transparency with drop-test integrity. EPDM and CPE round out the suite where flame-retardant or elastomeric performance is paramount. Across all types, recyclate compatibility becomes a decisive purchase factor as manufacturers align with circular-economy targets.

Continued AIM uptake also reflects tight automotive styling gaps that require materials to keep glossy surfaces free from stress-whitening. ABS remains indispensable in dashboard and pillar areas thanks to its balance of rigidity, heat resistance and coloring flexibility. Long-term, producers anticipate hybrid solutions blending acrylic cores with elastomeric shells to satisfy stricter crash-energy dissipation metrics. The interplay between modifier chemistry and recycled polyolefin streams is a research priority because regional mandates now require post-consumer resin thresholds in new cars and buildings.

The Impact Modifier Market Report is Segmented by Type (Acrylonitrile Butadiene Styrene, Acrylic Impact Modifiers, Acrylonitrile Styrene Acrylate, and More), Application (Polyvinyl Chloride, Nylon, Polybutylene Terephthalate, and More), End-User Industry (Packaging, Construction, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's commanding 46.78% share in 2025 stems from China's megaproject pipeline and India's swelling auto output. Impact-modified PVC pipe systems form the backbone of new municipal water grids, and engineering plastics capture dashboard, pillar, and battery applications across regional OEM plants. Japanese automakers deploy modified PP and PC/ABS blends to cut vehicle weight without compromising side-impact scores. ASEAN manufacturers-benefiting from shifts in supply chains-expand appliance exports that rely on ABS modifiers for gloss and toughness.

The Middle East & Africa enjoys a 6.50% CAGR as petrochemical feedstock proximity lowers modifier production cost. Saudi Arabia's giga-projects specify impact-resistant profiles for curtain walls that withstand sandstorms and high UV exposure. South Africa's auto assemblers adopt modifiers to meet local crash regulations while reducing part weight. North America's policy push for domestic battery plants stimulates demand for modified polyamide shields, and construction starts supported by federal infrastructure funds lift PVC conduit consumption. Europe's stringent REACH rules spur the rollout of low-VOC modifiers in flooring and cable ducts. South America's highways, financed by multilateral banks, absorb large-diameter pressure pipes made from AIM-enhanced PVC; meanwhile Brazilian automakers trial EPDM-grafted modifiers in under-hood ducts to handle ethanol-rich fuel blends.

- Akdeniz Kimya

- Arkema

- BASF

- CLARIANT

- Dow

- Evonik Industries

- Formosa Plastics Corporation

- INEOS Styrolution Group GmbH

- Kaneka Corporation

- LANXESS

- LG Chem

- Mitsubishi Chemical Corporation

- Plastics Color Corporation

- Shandong Novista Chemicals Co.,Ltd.

- Shandong Ruifeng Chemical Cp.Ltd

- SI Group, Inc.

- SONGWON

- Sundow Polymers Co., Ltd.

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing packaging demand

- 4.2.2 PVC pipe and profile boom

- 4.2.3 Construction-led resin uptake in Asi-Pacific

- 4.2.4 Automotive lightweighting and safety focus

- 4.2.5 Recycled-content plastics need compatibilizer-IM hybrids

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility (styrene, acrylates)

- 4.3.2 Tightening VOC and PVC regulations

- 4.3.3 Processing issues with high-recycle resin streams

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value )

- 5.1 By Type

- 5.1.1 Acrylonitrile Butadiene Styrene (ABS)

- 5.1.2 Acrylic Impact Modifiers (AIM)

- 5.1.3 Acrylonitrile Styrene Acrylate (ASA)

- 5.1.4 Methacrylate-Butadiene- Styrene (MBS)

- 5.1.5 Ethylene Propylene Diene Monomer (EPDM)

- 5.1.6 Chlorinated Polyethylene (CPE)

- 5.1.7 Other Types

- 5.2 By Application

- 5.2.1 Polyvinyl Chloride (PVC)

- 5.2.2 Nylon

- 5.2.3 Polybutylene Terephthalate (PBT)

- 5.2.4 Engineering Plastics

- 5.2.5 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Packaging

- 5.3.2 Construction

- 5.3.3 Automotive

- 5.3.4 Consumer Goods

- 5.3.5 Electrical and Electronics

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akdeniz Kimya

- 6.4.2 Arkema

- 6.4.3 BASF

- 6.4.4 CLARIANT

- 6.4.5 Dow

- 6.4.6 Evonik Industries

- 6.4.7 Formosa Plastics Corporation

- 6.4.8 INEOS Styrolution Group GmbH

- 6.4.9 Kaneka Corporation

- 6.4.10 LANXESS

- 6.4.11 LG Chem

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 Plastics Color Corporation

- 6.4.14 Shandong Novista Chemicals Co.,Ltd.

- 6.4.15 Shandong Ruifeng Chemical Cp.Ltd

- 6.4.16 SI Group, Inc.

- 6.4.17 SONGWON

- 6.4.18 Sundow Polymers Co., Ltd.

- 6.4.19 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment