PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906130

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906130

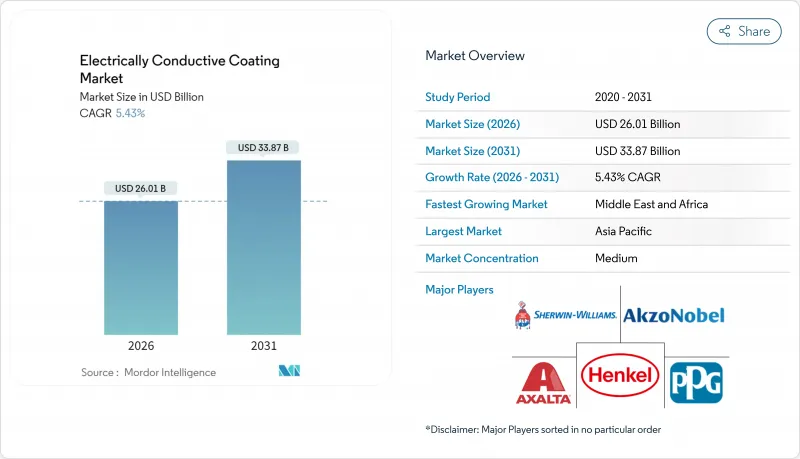

Electrically Conductive Coating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Electrically Conductive Coating market is expected to grow from USD 24.67 billion in 2025 to USD 26.01 billion in 2026 and is forecast to reach USD 33.87 billion by 2031 at 5.43% CAGR over 2026-2031.

The electrically conductive coating market is shifting from legacy anti-static roles to value-added electromagnetic interference (EMI) shielding, supporting 5G infrastructure rollouts and device miniaturization. Silver-filled acrylics remain the mainstream choice; however, the electrically conductive coating market now favors copper-based and polyurethane systems that strike a balance between conductivity, flexibility, and cost. Asia-Pacific's dense electronics supply chains keep procurement cycles short, while North American and European original equipment manufacturers (OEMs) pay premiums for coatings that deliver millimeter-wave shielding, thermal stability, and REACH compliance. Competitive rivalry intensifies as specialty materials firms bring nano-filler dispersion know-how to applications ranging from battery enclosures to medical implants, further widening the electrically conductive coating market opportunity.

Global Electrically Conductive Coating Market Trends and Insights

Rising Applications for Anti-Static Protection

Electrostatic discharge control has become mission-critical in semiconductor fabs, cleanrooms, and advanced vehicle assembly lines, driving sustained demand for thin anti-static layers that maintain surface resistivity without adding bulk. Carbon-nanotube-reinforced acrylics exhibit greater abrasion resistance than traditional carbon-black-filled systems, thereby extending maintenance intervals in high-traffic production zones. Automotive suppliers are now coating fuel modules and HVAC housings that previously had no shielding requirements, in response to a 2024 update of IEC 61340 test protocols that tightened pass-fail margins. Aerospace and medical device OEMs specify low-outgassing anti-static films to protect high-value electronics during transcontinental shipment, effectively making static control a default design parameter rather than a last-minute fix.

Growing Demand from Electrical and Electronics Industry

OEMs embed coatings into product architecture at the CAD stage, turning the electrically conductive coating market into an engineering-driven rather than procurement-driven purchase. Flexible polyimide boards and ceramic composites rely on spray-applied coatings that stretch with odd-shaped enclosures. IoT nodes with integrated antennas opt for thin polymeric films over metal cans to prevent detuning, prompting suppliers to ensure predictable surface impedance. Joint-development agreements now stipulate co-location of process engineers during pre-production, embedding material expertise inside consumer-electronics roadmaps.

Toxicity and Environmental Concerns of Heavy-Metal Fillers

REACH Annex XVIII consultations in 2024 flagged antimony trioxide and cadmium oxide as substances of very high concern, compelling formulators to pivot to graphene and carbon nanotube systems, despite higher per-kilogram prices. Automotive tier-1 suppliers utilize life-cycle assessments to evaluate materials, prioritizing coatings based on their recyclability at the end of life. Medical and aerospace buyers now request supplier declarations that no lead or mercury enters the formulation pipeline, adding audit overhead for legacy lines that still rely on metal-flake loading.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Adoption of EMI/RFI Shielding in 5G Infrastructure

- Rapid Miniaturization in Wearable Electronics

- Volatility in Silver and Copper Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylics held a 33.58% share of the electrically conductive coating market in 2025, underpinned by robust Asian supply chains and waterborne grades that meet regional air-quality mandates. Polyurethanes are the growth engine, expanding at a 5.95% CAGR as electric vehicles and wearables rely on their elasticity to survive vibration and flexing. Aerospace continues to specify high-temperature epoxies rated to 200 °C, a niche that holds steady but rarely scales.

Polyester chemistries provide low-cost consumer cases. Silicones protect satellites exposed to atomic oxygen, while fluoropolymers cover implantable leads that require hemocompatibility. ISO 9001 protocols have emphasized process repeatability, resulting in inline resistivity scanners that validate every meter of coated film. End-market diversification insulates acrylics, yet the shift to flexible devices positions polyurethanes as the future volume leader within the electrically conductive coating market.

The Electrically Conductive Coating Market Report is Segmented by Type (Acrylics, Epoxy, Polyesters, Polyurethanes, and Other Types), Conductive Filler Material (Copper, Aluminum, Silver, and Other Material Types), Application (Electronics and Electrical, Automotive, Aerospace and Defense, and Other Applications), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 47.85% of the electrically conductive coating market in 2025, anchored by China's consumer-electronics exports and Taiwan's foundry complexes. Regional governments subsidize local supply chains, cutting logistics lead times to days. South Korea's memory fabs embrace in-line sputterable coatings, while Japan refines zero-VOC recipes for high-end hybrid vehicles. North America holds a significant share, where defense primes insist on coatings that shield radar avionics. Europe advances additive-free chemistries to comply with future REACH amendments, positioning itself as the hub for green formulations.

The Middle-East and Africa are projected to grow at a 5.75% CAGR, driven by the United Arab Emirates' free-zone incentives that attract contract electronics manufacturers. Saudi Arabia bundles conductive-coating plants into Vision 2030 industrial parks, thereby reducing its dependence on imports. South America sees localized automotive electronics lines as auto majors diversify beyond Asia for risk mitigation, creating pockets of regional demand.

- A & A Coatings

- Akzo Nobel NV

- Ameetuff Technical Paints Industries

- Axalta Coating Systems

- BeDimensional

- CAIG

- Creative Materials Inc.

- Cromas Paints

- Gelest Inc.

- Henkel AG & Co. KGaA

- Holland Shielding Systems BV

- MG Chemicals

- Parker-Hannifin Corporation

- PPG Industries Inc.

- RS Coatings

- Specialty Coating Systems Inc.

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising applications for anti-static protection

- 4.2.2 Growing demand from electrical and electronics industry

- 4.2.3 Surge in adoption of EMI/RFI shielding in 5G infrastructure

- 4.2.4 Rapid miniaturization in wearable electronics

- 4.2.5 Emergence of conductive bio-compatible coatings for implants

- 4.3 Market Restraints

- 4.3.1 Toxicity and environmental concerns of heavy-metal fillers

- 4.3.2 Volatility in silver and copper prices

- 4.3.3 Dispersion challenges of nano-fillers causing defects

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Acrylics

- 5.1.2 Epoxy

- 5.1.3 Polyesters

- 5.1.4 Polyurethanes

- 5.1.5 Other Types

- 5.2 By Conductive Filler Material

- 5.2.1 Copper

- 5.2.2 Aluminum

- 5.2.3 Silver

- 5.2.4 Other Material Types

- 5.3 By Application

- 5.3.1 Electronics and Electrical

- 5.3.2 Automotive

- 5.3.3 Aerospace and Defense

- 5.3.4 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Egypt

- 5.4.5.4 South Africa

- 5.4.5.5 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 A & A Coatings

- 6.4.2 Akzo Nobel NV

- 6.4.3 Ameetuff Technical Paints Industries

- 6.4.4 Axalta Coating Systems

- 6.4.5 BeDimensional

- 6.4.6 CAIG

- 6.4.7 Creative Materials Inc.

- 6.4.8 Cromas Paints

- 6.4.9 Gelest Inc.

- 6.4.10 Henkel AG & Co. KGaA

- 6.4.11 Holland Shielding Systems BV

- 6.4.12 MG Chemicals

- 6.4.13 Parker-Hannifin Corporation

- 6.4.14 PPG Industries Inc.

- 6.4.15 RS Coatings

- 6.4.16 Specialty Coating Systems Inc.

- 6.4.17 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment