PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906131

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906131

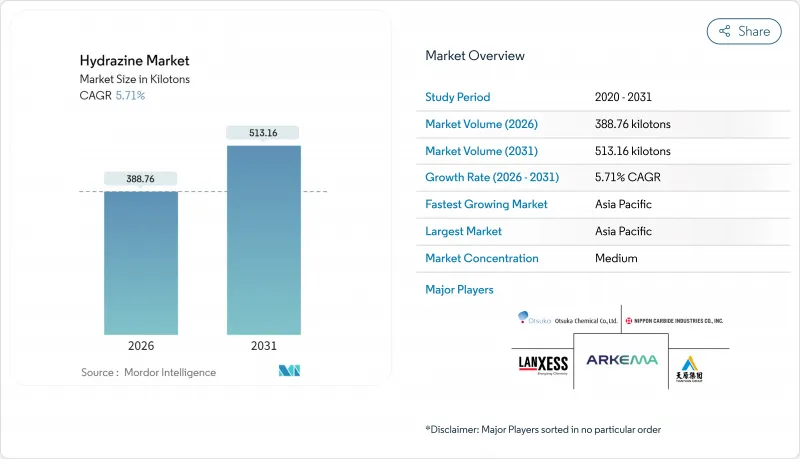

Hydrazine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Hydrazine Market was valued at 367.75 kilotons in 2025 and estimated to grow from 388.76 kilotons in 2026 to reach 513.16 kilotons by 2031, at a CAGR of 5.71% during the forecast period (2026-2031).

Demand resilience stems from hydrazine's irreplaceable role in agrochemicals, corrosion control, polymer foams, and emerging energy systems. Regulatory scrutiny in Europe and North America continues to tighten, yet capacity additions in Asia-Pacific offset potential volume losses elsewhere. Supply-side investments concentrate on safer production routes for hydrazine hydrate, while downstream users in pharmaceuticals and fuel-cell technology create fresh growth avenues. Competitive positioning focuses on vertical integration and long-term contracts to secure feedstock and manage compliance costs.

Global Hydrazine Market Trends and Insights

Rising Demand from Agrochemicals

Escalating agricultural intensification in China, India, and Brazil keeps pesticide consumption high, and hydrazine remains the indispensable intermediate for maleic hydrazide, isoxazolidinone, and other growth-regulator actives. Large Chinese producers report dedicated capacities above 200,000 tons that feed both domestic and export pipelines, supporting supply security for formulating companies. Research into nano-engineered hydrazine derivatives achieves full pest mortality at lower dosage, signaling potential for reduced environmental loading while preserving efficacy. Regulatory focus on food security in these regions outweighs immediate environmental bans, thus sustaining the hydrazine market.

Growing Use as Pharmaceutical Intermediate

Hydrazine scaffolds enable the selective synthesis of anti-tubercular, anti-inflammatory, and antidepressant molecules, and recent process innovations deliver 89-97% yields under mild, solvent-efficient conditions. Clinical candidates such as pyrrole hydrazones inhibit Mycobacterium tuberculosis at therapeutic concentrations, widening demand among active pharmaceutical ingredient (API) manufacturers in the United States and India. To tackle toxicity concerns, producers are scaling indirect routes that avoid bulk hydrazine handling, yet still leverage its unique nucleophilic profile. As a result, the pharmaceutical segment is expected to remain the fastest-growing user base within the hydrazine market.

Highly Toxic Nature and Tightening Regulations

Hydrazine features on the European Chemicals Agency's Substances of Very High Concern list, triggering strict authorization and occupational exposure limits. Compliance now demands sealed transfer lines, scrubber systems, and continuous air monitoring, pushing operating costs higher for formulators across Germany, France, and the United States. Liability linked to liver toxicity and carcinogenicity also forces insurers to raise premiums, discouraging new entrants. Although Asia-Pacific regulations are comparatively lenient today, multinational customers increasingly require global compliance, slowly extending higher safety standards worldwide.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption as Blowing Agent in Polymer Foams

- Expansion of Water-Treatment Infrastructure

- Shift Toward Green Monopropellants in Space

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydrazine hydrate accounted for 60.17% of 2025 volume within the hydrazine market and recorded the segment-leading 5.89% CAGR outlook. Preference for aqueous grades stems from lower vapor pressure, simplified ISO-tank logistics, and smoother regulatory certification versus anhydrous material. Boiler-water treatment, polymer foaming, and API synthesis plants install dedicated hydrate storage to reduce on-site risk profiles, reinforcing demand stability. Specialty salts such as hydrazine sulfate serve electronics and analytical niches where tighter stoichiometric control is essential.

Regulators now explicitly recommend hydrate grades when feasible, catalyzing supplier investments in high-purity, low-metal formulations engineered for pharmaceutical compliance. Fuel-cell developers also gravitate toward monohydrate for liquid-carrier prototypes that balance power density with managed volatility, sustaining incremental offtake. Collectively, these trends entrench hydrazine hydrate's leadership and shield the segment from the full force of impending restrictions on anhydrous forms, supporting the broader hydrazine market.

The Hydrazine Report is Segmented by Type (Hydrazine Hydrate, Hydrazine Nitrate, Hydrazine Sulfate, and Other Types), Application (Corrosion Inhibitor, Explosives, Rocket Fuel, Medicinal Ingredient, and More), End-User Industry (Pharmaceuticals, Agrochemicals, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific dominated the hydrazine market with a 55.51% hydrazine market share in 2025 and is forecast to post the fastest 6.05% CAGR through 2031. China's integrated value chain, from ammonia feedstock to downstream pesticides, confers cost leadership, while India's pharmaceutical build-out boosts high-purity hydrate imports. Government incentives for local specialty-chemical production stimulate further capacity additions despite safety headwinds.

North America remains a mature yet evolving arena. Regulatory compliance elevates operating costs, but defense applications and corrosion-control contracts sustain baseline hydrazine consumption. The 2024 private-equity acquisition of Calca Solutions underscores investor belief in steady free cash flow and future volume support from next-generation solid rocket motor programs.

Europe confronts the stiffest hurdles as REACH authorization pressures escalate. Several mid-tier formulators have trimmed capacity or shifted sourcing to affiliates in Turkey and Eastern Europe to circumvent licensing delays. Collectively, divergent regulatory regimes create a two-speed hydrazine market in which Asia-Pacific accelerates while Europe consolidates and North America balances between risk management and strategic necessity.

- Acuro Organics Limited

- Arkema

- BroadPharm

- Calca Solutions (AE Industrial Partners)

- Gujarat Alkalies and Chemicals Limited

- HPL Additives Limited

- Lanxess

- Loba Chemie Pvt. Ltd.

- MERU CHEM PVT.LTD.

- Nippon Carbide Industries Co., Inc.

- Otsuka Chemical Co.,Ltd.

- Yibin Tianyuan Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand from Agrochemicals

- 4.2.2 Growing Use as Pharmaceutical Intermediate

- 4.2.3 Increasing Adoption as Blowing Agent in Polymer Foams

- 4.2.4 Expansion of Water-Treatment Infrastructure

- 4.2.5 Hydrazine-Based Hydrogen Carrier for Fuel-Cell Systems

- 4.3 Market Restraints

- 4.3.1 Highly Toxic Nature and Tightening Regulations

- 4.3.2 Volatility in Ammonia Prices

- 4.3.3 Shift Toward Green Monopropellants (HAN/H2O2) in Space

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Hydrazine Hydrate

- 5.1.2 Hydrazine Nitrate

- 5.1.3 Hydrazine Sulfate

- 5.1.4 Other Types

- 5.2 By Application

- 5.2.1 Corrosion Inhibitor

- 5.2.2 Explosives

- 5.2.3 Rocket Fuel

- 5.2.4 Medicinal Ingredient

- 5.2.5 Precursor To Pesticides

- 5.2.6 Blowing Agent

- 5.2.7 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Pharmaceuticals

- 5.3.2 Agrochemicals

- 5.3.3 Industrial

- 5.3.4 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Acuro Organics Limited

- 6.4.2 Arkema

- 6.4.3 BroadPharm

- 6.4.4 Calca Solutions (AE Industrial Partners)

- 6.4.5 Gujarat Alkalies and Chemicals Limited

- 6.4.6 HPL Additives Limited

- 6.4.7 Lanxess

- 6.4.8 Loba Chemie Pvt. Ltd.

- 6.4.9 MERU CHEM PVT.LTD.

- 6.4.10 Nippon Carbide Industries Co., Inc.

- 6.4.11 Otsuka Chemical Co.,Ltd.

- 6.4.12 Yibin Tianyuan Group

7 Market Opportunities and Future Outlook

- 7.1 Hydrazine as hydrogen-rich liquid fuel for next-gen fuel cells

- 7.2 Bio-route production via anammox bacteria