PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906132

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906132

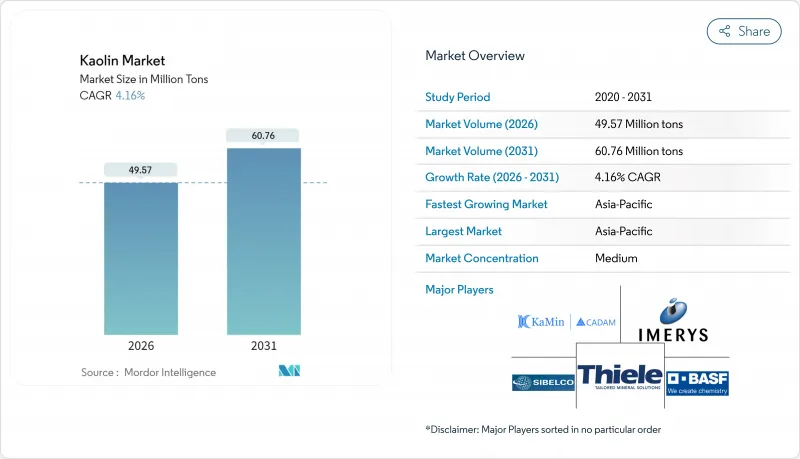

Kaolin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Kaolin Market market is expected to grow from 47.59 Million tons in 2025 to 49.57 Million tons in 2026 and is forecast to reach 60.76 Million tons by 2031 at 4.16% CAGR over 2026-2031.

Demand is widening from traditional ceramics into battery separators, specialty papers, and clean-label cosmetics, all of which prize kaolin's brightness, chemical inertness, and low electrical conductivity. Capacity additions in Asia Pacific, a push for premium packaging grades in North America and Europe, and investments in calcined products for electric-vehicle batteries are reinforcing the positive outlook. Producers with integrated mining, energy-efficient calcination, and application-specific processing technologies are securing multi-year supply agreements. Short-term cost pressure from rising fuel prices and complex mine-site permitting in mature regions is tempering the overall growth trajectory, yet most end-use segments continue to substitute toward kaolin where it offers demonstrable performance advantages.

Global Kaolin Market Trends and Insights

Booming Sanitary-ware & Tile Manufacturing in Asia Pacific

Rising urbanization and residential upgrades are stimulating vast new tile and sanitary-ware output across China, India, Vietnam, and Indonesia. Domestic producers are scaling kilns capable of firing large-format porcelain panels that require high-whiteness kaolin to achieve consistent aesthetic standards. Regional manufacturers also favor local supply chains to limit input costs and shorten delivery cycles, spurring long-term offtake pacts with kaolin mines in Guangxi, Fujian, and Gujarat. Modern tunnel-kiln designs improve firing uniformity but raise specification thresholds for rheology and thermal stability, supporting the premiumization of kaolin grades. Governments encouraging housing starts and public infrastructure are further underpinning the ceramics pipeline, ensuring steady pull-through demand across the kaolin market.

Shift to High-Brightness Packaging Paper in North America & Europe

Brand owners are differentiating e-commerce parcels with unbleached kraft outers paired with bright white or pastel inner liners that elevate the unboxing experience. This design trend increases the consumption of ultra-fine kaolin as a coating pigment that delivers high opacity without impairing recyclability. Paper mills are debottlenecking blade-coater sections and upgrading dispersion systems to handle finer particle distributions. Consolidation activities-such as International Paper's agreement to acquire DS Smith-demonstrate a strategic pivot toward value-added packaging niches and reinforce tight supply relationships with specialty kaolin producers. Mills unable to source consistent high-brightness grades risk yield losses and coating defects, cementing kaolin's central role in premium board production.

High Energy Intensity & Cost Inflation in Calcination Operations

Calcination requires temperatures from 650 °C to 1 200 °C, making fuel costs a major input. European natural gas prices surged in 2024-2025, swelling cash-cost curves for regional producers by double digits. FlashCalx and RotaCalx firing designs cut residence time by up to 30% and recover sensible heat, yet capital budgets near USD 15 million per line limit adoption to integrated majors. Calix Limited has piloted electric-powered indirect calcination that reduces CO2 intensity by 30%, but commercial throughput remains under evaluation. Smaller miners without low-cost fuel or process innovation risk margin compression, encouraging consolidation within the kaolin market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Calcined Kaolin in Li-ion Battery Separator Coatings

- Growing Demand from Paper and Rubber Industries

- Stringent Mine-Site Environmental Permitting in Europe and North America

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Processed kaolin captured 69.35% of the kaolin market in 2025, underpinning its indispensability in premium ceramics, high-gloss papers, and engineered polymers. Beneficiation stages-screening, magnetic separation, flotation, and chemical bleaching-lift brightness above 90 ISO and pare down titania and iron impurities. End-users pay a premium for these attributes, reflecting the superior performance threshold relative to crude clay. The kaolin market size for processed grades is forecast to climb alongside deeper penetration in battery separator coatings and in thermal-insulation mortars used in energy-efficient construction.

Crude/unprocessed clay is projected to advance at 4.72% CAGR through 2031 thanks to ceramic clusters in Asia outsourcing trimming and micronizing to local toll processors. Producers in Thailand and Malaysia are co-locating rudimentary washing plants near deposits to control logistics costs. As regional processors invest in column flotation and high-gradient magnetic separators, a share of crude supply will progressively shift to semi-finished and finished material, reinforcing a gradual migration up the value chain within the kaolin market.

The Kaolin Market Report is Segmented by Form (Crude/Unprocessed Kaolin and Processed Kaolin), Grade (Hydrous Kaolin, Calcined Kaolin, Delaminated Kaolin, and Others), Application (Ceramics, Cement, Paper, Refractories, Paints and Coatings, Plastics, and Others) and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia Pacific commanded 42.55% of the kaolin market in 2025 and is on track for 4.70% CAGR through 2031. China anchors regional demand with its integrated tile corridors in Guangdong and Shandong, while India scales sanitary-ware clusters in Morbi and Rajasthan. Government infrastructure programs and steady export orders sustain kiln utilization rates, ensuring consistent pull for hydrous and calcined grades. Southeast Asian capacity additions, notably in Vietnam and Indonesia, deepen intra-regional trade and reinforce Asia's leading position.

North America constitutes a mature yet technologically advanced hub. The United States mined 7.11 million tons of kaolin in 2025, largely from Georgia's Cretaceous deposits. Investments in battery-grade calcined kaolin plants leverage existing rail and port infrastructure, targeting domestic gigafactories eager to localize critical mineral supply. Environmental regulations elevate baseline operating costs, prompting producers to adopt regenerative thermal oxidizers and closed-loop water circuits to safeguard operating permits.

Europe offers high-purity reserves in the Czech Republic and United Kingdom. Tightening carbon policy under the EU Emissions Trading System accelerates the search for low-energy processing methods. Producers explore partial electrification of dryers and the use of biomass in burner lines. Specialty applications-advanced refractories, filtration media, and green cement-offset headwinds from conventional paper demand.

South America, led by Brazil, is emerging as a pivotal export base. Government incentives for critical mineral extraction and proximity to Atlantic shipping lanes underpin kaolin's contribution to national mining output. The world's largest activated clay plant under construction in Bahia will tap local kaolin feedstock to produce low-carbon cement additives. Competitive delivered-cost positions into North America and Europe reinforce Brazil's strategic relevance.

The Middle East and Africa remain smaller but growing. Saudi Arabia's Vision 2030 heavy-industrial diversification and South Africa's ceramic tile ambitions underpin incremental demand. Morocco and Egypt evaluate kaolin resources for white cement and refractories, hinting at future upstream development. Limited domestic beneficiation drives imports of intermediate or finished grades, sustaining global trade flows within the kaolin market.

- 20 Microns

- Active Minerals International LLC (J.M. Huber Corporation)

- Ashapura Group

- BASF SE

- Burgess Pigment Company

- EICL

- Gebruder Dorfner GmbH & Co.

- Imerys

- I-Minerals Inc.

- KaMin LLC. / CADAM

- Kaolin AD

- Keramost a.s.

- LASSELSBERGER Group GmbH

- LB MINERALS, Ltd.

- Quarzwerke GmbH

- Sibelco

- Thiele Kaolin Company

- Tokai Clay Industry Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Booming Sanitary-ware and Tile Manufacturing in Asia Pacific

- 4.2.2 Shift to High-Brightness Packaging Paper in North America and Europe

- 4.2.3 Rapid Adoption of Calcined Kaolin in Li-ion Battery Separator Coatings

- 4.2.4 Growing Demand from Paper and Rubber Industries

- 4.2.5 Cosmetics and Personal Care Industry Growth

- 4.3 Market Restraints

- 4.3.1 High Energy Intensity and Cost Inflation in Calcination Operations

- 4.3.2 Stringent Mine-Site Environmental Permitting in Europe and North America

- 4.3.3 Replacement by Other Subsitutes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Form

- 5.1.1 Crude/Unprocessed Kaolin

- 5.1.2 Processed Kaolin

- 5.2 By Grade

- 5.2.1 Hydrous Kaolin

- 5.2.2 Calcined Kaolin

- 5.2.3 Delaminated Kaolin

- 5.2.4 Others

- 5.3 By Application

- 5.3.1 Ceramics

- 5.3.2 Cement

- 5.3.3 Paper

- 5.3.4 Refractories

- 5.3.5 Paints and Coatings

- 5.3.6 Plastics

- 5.3.7 Others

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 20 Microns

- 6.4.2 Active Minerals International LLC (J.M. Huber Corporation)

- 6.4.3 Ashapura Group

- 6.4.4 BASF SE

- 6.4.5 Burgess Pigment Company

- 6.4.6 EICL

- 6.4.7 Gebruder Dorfner GmbH & Co.

- 6.4.8 Imerys

- 6.4.9 I-Minerals Inc.

- 6.4.10 KaMin LLC. / CADAM

- 6.4.11 Kaolin AD

- 6.4.12 Keramost a.s.

- 6.4.13 LASSELSBERGER Group GmbH

- 6.4.14 LB MINERALS, Ltd.

- 6.4.15 Quarzwerke GmbH

- 6.4.16 Sibelco

- 6.4.17 Thiele Kaolin Company

- 6.4.18 Tokai Clay Industry Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Growing Demand for Sanitary Ceramics