PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906133

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906133

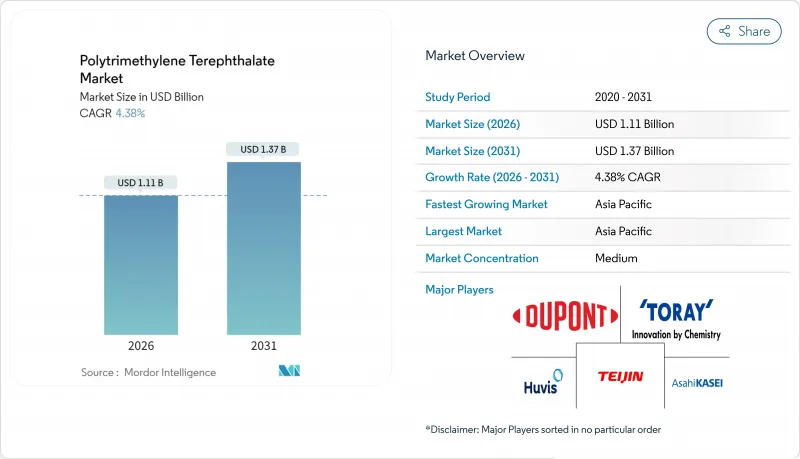

Polytrimethylene Terephthalate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Polytrimethylene Terephthalate Market was valued at USD 1.06 billion in 2025 and estimated to grow from USD 1.11 billion in 2026 to reach USD 1.37 billion by 2031, at a CAGR of 4.38% during the forecast period (2026-2031).

This moderate pace comes from the polymer's ability to bridge commodity PET and higher-end engineering plastics, offering elastic recovery above 95%, vivid dye uptake, and inherent stain resistance. Rising demand for comfort-stretch apparel, expanding carpet output, and mounting sustainability mandates continue to underpin steady volume gains in Asia-Pacific, North America, and Europe. Persistent headwinds include 20-30% higher production costs versus PET, feedstock price volatility for 1,3-propanediol, and entrenched competition from PET and PBT producers who are scaling up chemical-recycling routes. Nonetheless, the shift away from PFAS coatings in textiles effective January 2025 lifts the value proposition of PTT by making its built-in stain repellence more commercially attractive.

Global Polytrimethylene Terephthalate Market Trends and Insights

Rising Textile Demand for Stretch-Comfort Fibres

Global activewear and athleisure brands are specifying PTT because the fibre recovers its original length after stretching more reliably than standard polyester, extending garment life and fit. Asian fabric mills are scaling dedicated lines to blend PTT with spandex, and leading mills in China are quoting double-digit order growth for high-elastic knit fabrics. Teijin Frontier's multifunctional polyester fabric range illustrates how PTT can be paired with UV protection and breathability finishes without compromising comfort. As retailers shift merchandising toward higher-margin performance clothing, adoption accelerates even in price-sensitive segments.

Sustainability Push Toward Bio-Based and Recyclable Polyester

PTT can reach 31% bio-content when its 1,3-propanediol component is derived from corn glucose, an approach already commercialised by DuPont since 2015. Policy pressure in the EU and US on Scope 3 emissions is prompting apparel groups to sign multiyear offtake agreements for bio-based grades despite premiums of 15-20%. The nova-Institut estimated bio-polymer capacity at 4.4 million t in 2023, growing 17% annually, with PTT one of the few commercial aromatic polyesters in the mix. Chemical recyclers are now trialling enzymatic depolymerisation that processes PET and PTT together, opening circularity options while avoiding complex sorting.

High Production Costs

Biological 1,3-propanediol remains 25-30% dearer than petrochemically derived ethylene glycol, hampering cost parity with PET fabrics, particularly in mass-market T-shirts and packaging. Limited plant scales-none exceeding 200 ktpa-restrict fixed-cost dilution. Asian olefin margins tightened through 2024, further squeezing specialty polymer economics. PTT suppliers therefore target premium niches such as performance sportswear, carpets, and engineering compounding to defend margins.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Carpet/Flooring Applications Using Triexta

- Polytrimethylene Terephthalate Adoption in 3D Printing Filaments for Prototyping

- Competition from PET and PBT Incumbents

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Petro-based grades retained a 66.05% position within the Polytrimethylene Terephthalate market in 2025, reflecting entrenched supply chains and relative cost advantages. Yet bio-based output is expanding at a 5.29% CAGR as brand owners commit to 25-50% renewable content in polyester by 2030. This shift keeps the Polytrimethylene Terephthalate market size for bio grades on a steeper curve than overall industry demand. Fermentation improvements have trimmed unit costs for bio-PDO by 12% since 2023, while side-stream valorisation of glycerol lowers net feedstock expenses. The segment's revenue gains are strongest in the EU and US, where carbon-intensity disclosure rules raise the economic return on green-premium products.

Parallel investments in enzymatic recycling plants enable hybrid pellets that blend recycled and bio-based PTT without compromising yarn tenacity. Producers see the route as a hedge against corn-price swings because bio-feedstock share can flex depending on market signals. Once capacity reaches 400 kt annually by 2028, stakeholders expect operating scale to narrow the price gap with petro-PTT, reinforcing the long-term sustainability narrative of the Polytrimethylene Terephthalate market.

The Polytrimethylene Terephthalate Market Report is Segmented by Source (Petro-Based PTT and Bio-Based PTT), Application (Apparel, Household Textiles, Industrial Fabrics, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific captured 60.20% of Polytrimethylene Terephthalate market revenue in 2025 and is projected to register a 5.21% CAGR to 2031, propelled by China's vast yarn spinning base and the rapid adoption of Triexta carpet lines in the region. Sinopec's 3 million t PTA plant commissioned in Jiangsu during 2024 signals ongoing upstream strength, ensuring reliable terephthalic acid flows to integrated PTT producers. Japanese fibre makers emphasise precision spinning for ultra-microfilaments, while South Korean resin suppliers push bio-feedstock integration, supporting regional leadership.

North America remains the second-largest cluster, underpinned by DuPont's legacy in Triexta carpets and the migration of residential homeowners toward PFAS-free, easy-clean flooring. US floor-covering mills have installed new extrusion capacity dedicated to PTT bulk-continuous-filament yarns, and distribution chains now market the fibre under performance warranty programmes that resonate with pet-owning households.

Europe reflects a policy-driven pull, with eco-design directives and extended-producer-responsibility schemes elevating demand for low-carbon materials. Brands in Germany and Scandinavia specify bio-PTT fabrics to meet Science-Based Targets, and converters in Italy blend recycled PTT with virgin bio content for luxury fashion houses.

South America and the Middle East and Africa remain early-stage adopters, yet rising textile exports from Brazil and Egypt suggest latent potential once local yarn spinners establish supply agreements.

- Asahi Kasei Corporation

- DuPont

- Huvis

- RTP Company

- Shell plc

- Shenghong Holding Group Co., Ltd.

- Technip Energies N.V.

- Teijin Limited

- TORAY INDUSTRIES, INC.

- Xianglu Tenglong Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Textile Demand for Stretch-Comfort Fibres

- 4.2.2 Sustainability Push Toward Bio-Based and Recyclable Polyester

- 4.2.3 Expansion of Carpet/Flooring Applications using Triexta

- 4.2.4 Polytrimethylene Terephthalate (PTT) Adoption in 3-D-Printing Filaments for Prototyping

- 4.2.5 Use in EV Lightweight Composite Components

- 4.3 Market Restraints

- 4.3.1 High Production Costs

- 4.3.2 Competition from Polyethylene Terephthalate (PET) And Polybutylene Terephthalate (PBT) Incumbents

- 4.3.3 Feed-Stock Supply Volatility

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Source

- 5.1.1 Petro-based Polytrimethylene Terephthalate (PTT)

- 5.1.2 Bio-based Polytrimethylene Terephthalate (PTT)

- 5.2 By Application

- 5.2.1 Apparel

- 5.2.2 Household Textiles

- 5.2.3 Industrial Fabrics

- 5.2.4 Other Applications (Automotive Interior Parts, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Asahi Kasei Corporation

- 6.4.2 DuPont

- 6.4.3 Huvis

- 6.4.4 RTP Company

- 6.4.5 Shell plc

- 6.4.6 Shenghong Holding Group Co., Ltd.

- 6.4.7 Technip Energies N.V.

- 6.4.8 Teijin Limited

- 6.4.9 TORAY INDUSTRIES, INC.

- 6.4.10 Xianglu Tenglong Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment