PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906148

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906148

North America Fruits And Vegetables Juice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

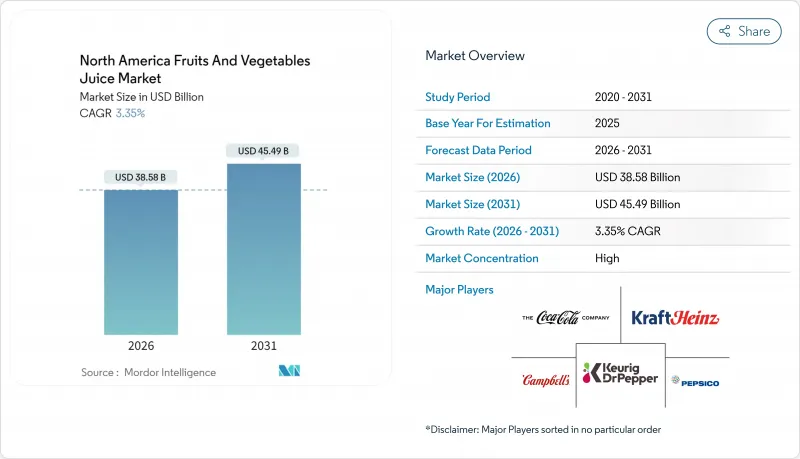

The North America fruit and vegetable juice market is expected to grow from USD 37.33 billion in 2025 to USD 38.58 billion in 2026 and is forecast to reach USD 45.49 billion by 2031 at 3.35% CAGR over 2026-2031.

As regulators emphasize sugar disclosures, companies are pivoting towards cleaner labels, driving a health-centric premiumization trend. This shift reflects growing consumer demand for transparency and healthier product options, pushing brands to innovate and reformulate their offerings. A projected 33% drop in Florida's citrus yield for the 2024-2025 season has not only tightened the availability of raw materials but also spurred increased sourcing from Mexico, highlighting the importance of diversifying supply chains to mitigate risks. The rise of high-pressure processing, the growth of online grocery shopping, and the trend of procuring upcycled produce are reshaping cost structures and product positioning. These advancements enable brands to enhance product quality, reduce waste, and meet evolving consumer preferences. These shifts particularly benefit brands willing to invest in technology and embrace an omnichannel approach, ensuring they remain competitive in a dynamic market landscape. While competitive intensity remains moderate, established players enjoy scale advantages but face challenges from nimble newcomers capitalizing on digital platforms and the growing emphasis on functional nutrition.

North America Fruits And Vegetables Juice Market Trends and Insights

Health-conscious consumer migration from carbonated beverages

Shifting preferences are evident as consumers turn away from sugary sodas, opting instead for juices they view as more natural. The FDA's enforcement of added-sugar disclosure rules, set for 2024-2025, has prompted beverage manufacturers to highlight the natural sugars in 100% juice and curtail the use of artificial sweeteners in their blended offerings. Similarly, changes in nutrition labeling by Health Canada bolster this trend, enabling brands to associate fruit and vegetable consumption with a reduced risk of heart disease. Furthermore, academic research focusing on polyphenol recovery from juice waste is now being commercially leveraged, allowing brands to make functional claims that appeal to health-conscious consumers. However, there's a challenge: since 2020, retail prices for orange juice have nearly doubled, straining household budgets. Yet, this surge in price hasn't deterred consumers from purchasing premium 100% juice. Research from the University of Florida underscores this resilience, revealing that demand remains robust even amidst inflationary pressures, signaling a steadfast commitment to health.

Cold-pressed and functional juice innovation

Health Canada has validated high-pressure processing (HPP) equipment, which operates at 80,000 psi for durations of up to nine minutes, for various juice types. This endorsement enables marketers to assure consumers of a "raw-like" taste while maintaining pasteurization-level safety, a significant advancement for the juice industry. However, mandatory Process Authority reviews and HACCP plans pose challenges, primarily surmountable by well-capitalized firms due to the high costs and stringent compliance requirements. Guidelines from Michigan State University emphasize these burdens, highlighting the need for substantial financial and operational resources to meet regulatory standards. Companies are now leveraging patented methods to incorporate citrus pomace fibers, helping them counteract rising fruit costs while enhancing antioxidant content, which is increasingly appealing to health-conscious consumers. Given the ongoing litigation surrounding "raw" claims, companies must exercise heightened vigilance in their labeling practices to avoid potential legal and reputational risks.

Sugar-reduction regulatory pressure

FDA and Health Canada regulations equate the natural sugars in juice with added sugars. This has compelled brands to either reformulate their products or pivot towards vegetable blends with reduced sugar content to meet regulatory requirements and consumer demand for healthier options. Tropicana's introduction of a zero-sugar line underscores the necessity for established brands to invest in advanced sweetener technologies that preserve the desired taste and texture, ensuring consumer satisfaction and maintaining brand loyalty. However, as research and development expenses mount, smaller companies find themselves at a disadvantage, unable to conduct the extensive sensory trials needed to perfect their formulations. This limitation significantly hampers their pace of innovation, restricts their ability to diversify product offerings, and reduces their competitiveness in the evolving market landscape.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce grocery penetration

- Upcycled produce in supply chains

- Citrus and berry price volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, fruit varieties commanded a dominant 60.85% share of North America's fruit and vegetable juice market, highlighting their strong shelf presence and consumer preference for familiar tastes. This segment raked in roughly USD 22.72 billion in revenue, though its growth prospects appear limited due to market maturity. On the other hand, vegetable juice lines are emerging as a dynamic growth driver, projected to achieve a 5.66% CAGR and contribute an additional USD 1.46 billion in sales by 2031. These products, emphasizing health benefits like low intrinsic sugar and high fiber content, are tailored to meet stringent labeling requirements. Brands like Campbell's V8 are leveraging dual fruit-vegetable blends to maintain customer loyalty and counter the rising allure of smoothie brands. Furthermore, investments in cutting-edge processing technologies, such as flash-steam peeling and cold-break pasteurization, safeguard vital nutrients like chlorophyll and beta-carotene, enhancing color vibrancy, a key factor in consumer attraction.

The renewed surge in vegetable juice adoption is intricately tied to sustainability narratives. By harnessing typically discarded vegetable parts-such as broccoli stalks and carrot peels to craft nutrient-rich purees, producers not only curtail waste costs but also appeal to eco-conscious consumers. Partnerships with enzyme experts facilitate the transformation of insoluble fiber into a smoother texture, bolstering product appeal. Retailers bolster this premium image by showcasing High Pressure Processed (HPP) vegetable shots priced above USD 5 per single-serve bottle on prominent chilled end-cap displays. Companies boasting vertically integrated supply chains can validate product origins, a crucial edge as consumers increasingly utilize QR codes to trace products from field to bottle. This blend of innovation, sustainability, and transparency is reshaping the vegetable juice market landscape.

In 2025, conventional SKUs command a dominant 80.65% share of the North American fruit and vegetable juice market. Yet, as consumers increasingly gravitate towards premium options, the growth of these conventional SKUs is beginning to wane. In stark contrast, organic products are on a robust trajectory, boasting a 7.60% CAGR. This surge is especially pronounced in online subscription box sales, which are witnessing double-digit growth. While organic juices held an 19.35% market share in 2025, projections suggest they could surpass the 25% mark by 2031, contingent on addressing supply constraints. Certification seals, such as USDA Organic, not only alleviate consumer health apprehensions but also empower producers to claim retail shelf space, even amidst higher wholesale costs.

Supply challenges emerge as the primary hurdle for organic expansion. The process of converting orchards to organic status spans three years, curtailing swift acreage growth. To ease these supply constraints, juice manufacturers are turning to imports, sourcing organic puree concentrates from Latin America. These are then blended domestically, all while strictly adhering to USDA Organic standards. Price elasticity is notably favorable; consumer research reveals a readiness to pay a premium of up to 15% for products that are both verified organic and non-GMO. Capitalizing on this trust, brands are innovating with multi-ingredient wellness shots like the fusion of organic turmeric and acerola, significantly boosting their gross margins in this lucrative niche.

The North America Fruit and Vegetable Juice Market Report is Segmented by Product Type (Fruit Juice, Vegetable Juice, Nectar), Category (Conventional, Organic), Packaging Type (PET/Glass Bottles, Tetra Pack, Others), Distribution Channel (Foodservice, Retail), and Geography (United States, Canada, Mexico, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PepsiCo Inc. (Tropicana, Naked, Kevita)

- The Coca-Cola Company (Minute Maid, Simply, Odwalla\*)

- Keurig Dr Pepper

- Kraft Heinz Company (Capri-Sun, V8)

- Campbell Soup Company (Bolthouse Farms)

- Del Monte Foods Inc.

- Citrus World Inc.

- Welch Foods Inc.

- Suja Life LLC

- Pressed Juicery Inc.

- SunOpta Inc.

- Ocean Spray Cranberries Inc.

- Hain Celestial Group (BluePrint)

- Old Orchard Brands LLC

- Santa Cruz Organic (JM Smucker)

- RW Knudsen Family (JM Smucker)

- Lakewood Organic

- Natalie's Orchid Island Juice Co.

- Evolution Fresh (Starbucks)

- Innocent Drinks (Coca-Cola)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Health-conscious consumers are shifting from carbonated drinks to juices

- 4.2.2 There's a rising demand for cold-pressed and functional juice formulations

- 4.2.3 Online grocery shopping is seeing accelerated penetration

- 4.2.4 Supply chains are now utilizing upcycled "imperfect" produce

- 4.2.5 Smart packaging and QR codes are enhancing product provenance

- 4.2.6 The food service industry is witnessing a rebound in single-serve offerings post-COVID

- 4.3 Market Restraints

- 4.3.1 There's increasing scrutiny on sugar and calorie reductions

- 4.3.2 Prices of fruits, especially citrus and berries, are volatile

- 4.3.3 High-pressure processing comes with significant CAPEX barriers

- 4.3.4 There's uncertainty in the US-Mexico agricultural trade policy

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Fruit Juice

- 5.1.2 Vegetable Juice

- 5.1.3 Nectar

- 5.2 By Category

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Packaging Type

- 5.3.1 PET/Glass Bottles

- 5.3.2 Tetra Pack

- 5.3.3 Others

- 5.4 Distribution Channel

- 5.4.1 Foodservice

- 5.4.2 Retail

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience Stores

- 5.4.2.3 Online Retail Retails

- 5.4.2.4 Others

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PepsiCo Inc. (Tropicana, Naked, Kevita)

- 6.4.2 The Coca-Cola Company (Minute Maid, Simply, Odwalla\*)

- 6.4.3 Keurig Dr Pepper

- 6.4.4 Kraft Heinz Company (Capri-Sun, V8)

- 6.4.5 Campbell Soup Company (Bolthouse Farms)

- 6.4.6 Del Monte Foods Inc.

- 6.4.7 Citrus World Inc.

- 6.4.8 Welch Foods Inc.

- 6.4.9 Suja Life LLC

- 6.4.10 Pressed Juicery Inc.

- 6.4.11 SunOpta Inc.

- 6.4.12 Ocean Spray Cranberries Inc.

- 6.4.13 Hain Celestial Group (BluePrint)

- 6.4.14 Old Orchard Brands LLC

- 6.4.15 Santa Cruz Organic (JM Smucker)

- 6.4.16 RW Knudsen Family (JM Smucker)

- 6.4.17 Lakewood Organic

- 6.4.18 Natalie's Orchid Island Juice Co.

- 6.4.19 Evolution Fresh (Starbucks)

- 6.4.20 Innocent Drinks (Coca-Cola)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK