PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906152

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906152

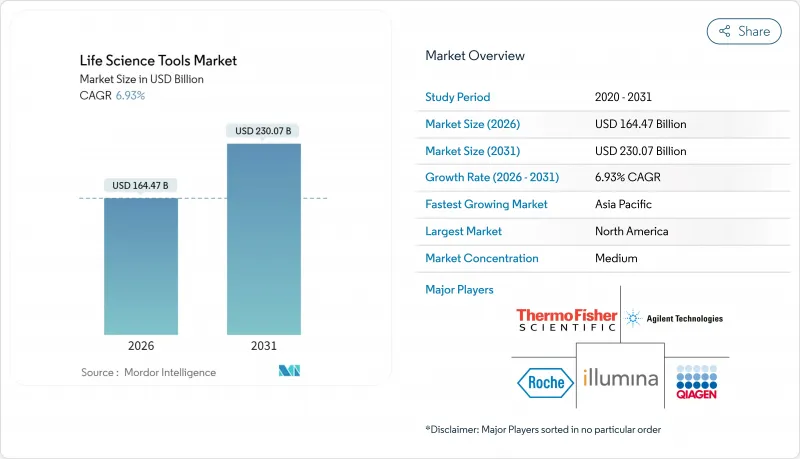

Life Science Tools - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The life science tools market is expected to grow from USD 153.81 billion in 2025 to USD 164.47 billion in 2026 and is forecast to reach USD 230.07 billion by 2031 at 6.93% CAGR over 2026-2031.

Sustained uptake of precision-medicine assays, next-generation sequencing (NGS) platforms, and AI-enabled laboratory automation keeps capital equipment and consumables spending firmly on a growth path. Rising public-sector outlays-such as the United States Congress' proposed USD 88 billion biotechnology package for 2025-coupled with stricter FDA oversight of lab-developed tests (LDTs) are reshaping compliance needs and driving fresh demand for validated instruments. North America continues to anchor the life science tools market with a 40.6% share in 2024, while Asia-Pacific leads growth at an 11.1% CAGR thanks to large-scale infrastructure investment in China, India, South Korea, and Singapore. Competitive momentum remains strong; established suppliers deploy mergers, acquisitions, and portfolio extensions to defend share and open new channels, yet lingering supply-chain fragilities and shortages of trained bioinformaticians temper the near-term outlook.

Global Life Science Tools Market Trends and Insights

Rise in Demand for Biopharmaceuticals & Growing Research Funding

Escalating focus on large-molecule therapeutics pushes laboratories to secure advanced mass spectrometers for protein characterization and high-parameter flow cytometers for cell therapy research. The U.S. ARPA-H budget of USD 2.5 billion earmarked for breakthrough health platforms underscores the government's commitment to cutting-edge instrumentation. European venture funding similarly rose, fueling orders for contract research organizations that now handle specialized analytics once kept in-house. Together, these forces accelerate capital buys and recurring consumables spend, reinforcing the life science tools market growth outlook.

Rising Incidence of Infectious Diseases & Genetic Disorders

WHO surveillance flagged heightened monkeypox and avian influenza activity in 2024, compelling public-health labs to broaden PCR testing capacity and stock multiplex NGS panels. In parallel, nationwide rare-disease screening in the United Kingdom expanded genomic testing access by 25%, boosting demand for automated sample-prep systems. The dual burden of infectious threats and hereditary conditions strengthens the case for scalable, rapid-turnaround platforms, advancing the life science tools market in clinical and research environments alike.

High Capital Cost of Advanced Instruments

Flagship mass spectrometry platforms surpass USD 1 million, placing acquisition out of reach for smaller laboratories. Academic budgets struggle to reconcile instrument upgrades with staffing needs, leading many to rely on fee-for-service core facilities. Such budget pressures slow adoption and dilute the near-term life science tools market expansion trajectory.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption of NGS & Single-Cell Analysis Platforms

- Expansion of CRISPR-Based Core-Facility Workflows

- Stringent Regulatory Requirements for Lab-Developed Tests

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services rose fastest at 11.35% CAGR as drug developers externalized analytics to control fixed costs and tap specialized expertise. Contract research organizations, now equipped with premium genomics and proteomics platforms, offer turnkey workflows that once demanded heavy in-house investment. Pharmaceutical clients value rapid capacity scaling and global site reach, propelling recurring fee income and enlarging the life science tools market.

Instruments maintained the largest 43.60% stake of the life science tools market share in 2025. Capital expenditure patterns remained resilient among top-tier pharma firms and research universities, while consumables supplied roughly 60% of recurring revenue for leading vendors. Hybrid models-leasing hardware bundled with services are taking hold, converting lump-sum equipment purchases into predictable operating outlays, and deepening customer lock-in.

Next-Generation Sequencing led technology expansion at 16.9% CAGR. Clinical labs increasingly swap single-gene PCR assays for multi-gene NGS panels that consolidate testing and uncover actionable variants. Population-scale genomics programmes from the United States to Singapore intensify instrument refresh cycles and spur computational infrastructure upgrades, sustaining the life science tools market.

PCR & qPCR, despite ceded growth momentum, still delivered 22.65% of the life science tools market size in 2025. Its entrenched role in rapid pathogen detection and gene-expression analysis preserves a steady consumables flow. Complementary technologies such as flow cytometry, mass spectrometry, and advanced separation systems broaden user options, ensuring diversified revenue pillars for suppliers.

The Life Science Tools Market Report is Segmented by Type (Instruments, Consumables, Services), Technology (PCR & QPCR, Sanger Sequencing, Separation Technologies, and More), Application (Proteomics Technology, Genomic Technology, and More), End User (Research Laboratories, Diagnostic Laboratories, and More), and Geography (North America, Europe, Asia Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 40.10% of the life science tools market in 2025, buoyed by National Institutes of Health funding and a cluster of global tool makers headquartered in the United States. Robust venture capital flows into Boston and San Francisco biotech corridors reinforce equipment refresh cycles, though ageing campus infrastructure and intensifying grant competition may nudge growth toward mid-single digits.

Asia-Pacific, advancing at an 10.95% CAGR, is the fastest-growing region. China directed more than USD 15 billion to biotech programmes in 2024, while India's USD 2.4 billion infusion supported distributed vaccine and biologics sites. South Korea and Singapore continue building world-class sequencing and cell-therapy hubs. These initiatives anchor long-run investments in high-capacity NGS, mass spectrometry, and automated bioprocessing, adding heft to the global life science tools market.

Europe posts stable, mid-single-digit gains as macroeconomic uncertainties and energy costs weighed on new capital projects. Post-Brexit, the United Kingdom sought U.S. partnerships to maintain research momentum, while France and Switzerland remained strongholds for biologics analytics. Emerging centers in Poland and the Czech Republic adopted modular lab formats, providing fresh demand for compact instruments and entry-level consumables.

- Thermo Fisher Scientific

- Danaher

- Agilent Technologies

- Illumina

- Beckton Dickinson

- Roche

- Merck

- Bio-Rad Laboratories

- Bruker

- QIAGEN

- PerkinElmer

- Waters Corporation

- GE HealthCare Technologies Inc.

- Abbott Laboratories

- Sartorius

- Eppendorf

- Tecan Group

- Standard BioTools Inc. (Fluidigm)

- Oxford Nanopore Technologies plc

- Pacific Bioscience

- Shimadzu

- Corning Incorporated (Life-Science)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise In Demand For Biopharmaceuticals & Growing Research Funding

- 4.2.2 Rising Incidence Of Infectious Diseases & Genetic Disorders

- 4.2.3 Increasing Adoption Of NGS & Single-Cell Analysis Platforms

- 4.2.4 Expansion Of CRISPR-Based Core-Facility Workflows

- 4.2.5 AI-Driven High-Throughput Automation For Multi-Omics Prep

- 4.2.6 Emergence Of Decentralized Bioprocess Labs In LMICs

- 4.3 Market Restraints

- 4.3.1 High Capital Cost Of Advanced Instruments

- 4.3.2 Stringent Regulatory Requirements For Lab-Developed Tests

- 4.3.3 Shortage Of Skilled Bioinformaticians

- 4.3.4 Reagent Supply-Chain Risks From Geopolitical Export Controls

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Instruments

- 5.1.2 Consumables

- 5.1.3 Services

- 5.2 By Technology

- 5.2.1 PCR & qPCR

- 5.2.2 Sanger Sequencing

- 5.2.3 Separation Technologies

- 5.2.4 Flow Cytometry

- 5.2.5 Nucleic Acid Microarray

- 5.2.6 Mass Spectrometry

- 5.2.7 Other Technologies

- 5.3 By Application

- 5.3.1 Proteomics Technology

- 5.3.2 Genomic Technology

- 5.3.3 Cell Biology Technology

- 5.3.4 Other Applications

- 5.4 By End User

- 5.4.1 Research Laboratories

- 5.4.2 Diagnostic Laboratories

- 5.4.3 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Danaher Corporation

- 6.3.3 Agilent Technologies Inc.

- 6.3.4 Illumina Inc.

- 6.3.5 Becton, Dickinson and Company

- 6.3.6 F. Hoffmann-La Roche Ltd

- 6.3.7 Merck KGaA

- 6.3.8 Bio-Rad Laboratories Inc.

- 6.3.9 Bruker Corporation

- 6.3.10 Qiagen N.V.

- 6.3.11 PerkinElmer Inc.

- 6.3.12 Waters Corporation

- 6.3.13 GE HealthCare Technologies Inc.

- 6.3.14 Abbott Laboratories

- 6.3.15 Sartorius AG

- 6.3.16 Eppendorf AG

- 6.3.17 Tecan Group Ltd.

- 6.3.18 Standard BioTools Inc. (Fluidigm)

- 6.3.19 Oxford Nanopore Technologies plc

- 6.3.20 Pacific Biosciences of California Inc.

- 6.3.21 Shimadzu Corporation

- 6.3.22 Corning Incorporated (Life-Science)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment