PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906156

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906156

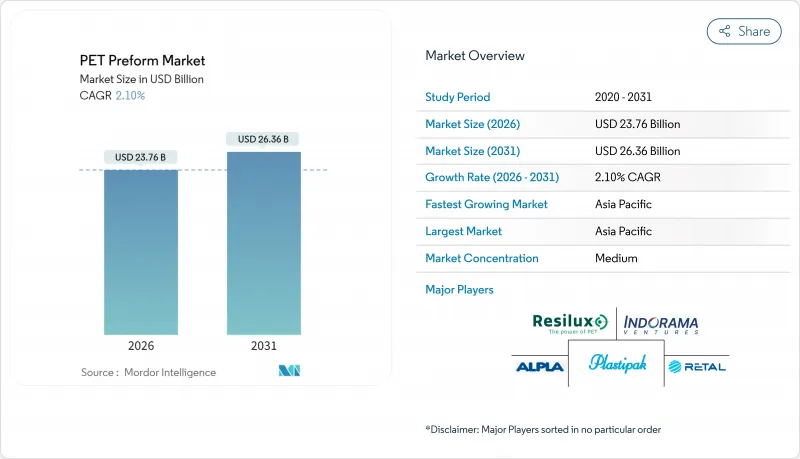

PET Preform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The PET Preform Market was valued at USD 23.27 billion in 2025 and estimated to grow from USD 23.76 billion in 2026 to reach USD 26.36 billion by 2031, at a CAGR of 2.10% during the forecast period (2026-2031).

This forward trajectory stems from incremental demand in beverages, expanding recycling mandates and ongoing lightweighting programs that collectively support modest but resilient expansion. Rising disposable incomes in emerging economies, the European Union's 30% recycled-content requirement for beverage bottles by 2030, and steady progress in electrified on-site blow-molding are steering converters toward material-efficient designs and vertically integrated recycling networks. Intensified feedstock volatility for purified terephthalic acid (PTA) and mono-ethylene glycol (MEG) continues to compress margins, prompting strategic procurement alliances and hedging practices. Meanwhile, the rapid commercialization of tethered-cap technology is driving tooling upgrades that favor suppliers able to bundle engineering support with high-cavitation mold capabilities. Competitive differentiation increasingly revolves around traceable recycled PET (rPET) streams, factory energy optimization, and multi-layer barrier know-how, underpinning a market environment that rewards operational scale and process innovation.

Global PET Preform Market Trends and Insights

Growing Demand from Beverage Industry

Robust beverage sales continue to anchor volume growth for the PET preforms market, especially in emerging economies where per-capita soft-drink and juice consumption rises alongside urbanization. Brazil's food-processing revenues touched USD 231 billion in 2024, underscoring a packaging pull that benefits preform converters. Lightweighting remains a critical strategic lever, enabled by next-generation mold cooling and improved resin IV control that together shave gram weight without compromising top-load strength. Converters also capitalize on premium ready-to-drink nutraceutical beverages, which demand preforms with high clarity and oxygen-scavenging additives. Partnerships between beverage fillers and machinery suppliers shorten design-to-market cycles, while digital twin simulations improve neck-finish performance and reduce trial runs. This evolving customer mix boosts tooling upgrades and after-sales service revenues for leading equipment makers.

Surge in Bottled-Water Consumption in Emerging Economies

Persistently uneven municipal water infrastructure fuels PET preform demand in South and Southeast Asia. Urban centers in India, Indonesia, and Vietnam record double-digit volume gains for branded bottled water, with local mandates now requiring minimum recycled content beginning in 2025. Recent capital commitments, such as SKC Group's USD 100 million biodegradable-plastic plant in Vietnam, demonstrate how investors scout for cost-advantaged sites capable of supplying both virgin and recycled resin streams. Although sustainability discourse intensifies, the immediate priority in many cities remains access to safe drinking water, reinforcing a consumption pattern that sustains high-performance order books. Cost sensitivity, however, forces converters to maintain lean operations and hedge PTA and MEG price swings that have widened since 2024.

Plastic-Tax Legislation and EPR Fees Tightening Profit Pools

European producers now budget for the United Kingdom's GBP 423/t plastics tax and Germany's Single-Use Plastics Fund levy, which together can erode EBITDA margins by up to 150 basis points. Administrative overhead also rises as firms invest in IT systems to track polymer origin and validate recycled content declarations. While large multinationals amortize costs across diverse portfolios, smaller regional players confront steeper per-unit compliance burdens, accelerating the flight toward strategic partnerships or acquisitions.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability Push for Recycled (rPET) Content

- Mandatory Tethered-Cap EU Directive Boosting Preform Redesign Volumes

- Shift to Refillable Glass in CSD Under EU 2029 Reuse Targets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Virgin PET dominated 75.38% of the PET preforms market in 2025, leveraged by entrenched supply chains and consistent melt properties that simplify high-speed molding. Recycled PET is, however, forecast to deliver a 3.18% CAGR to 2031, the swiftest rise among materials, as brand owners chase circularity targets and regulators mandate minimum rPET thresholds. The PET preforms market size for recycled grades is expected to outpace overall growth, driven by chemical-recycling breakthroughs that regenerate drop-in monomers compatible with food contact. Investors such as DePoly recently gathered USD 23 million to fund depolymerization capacity in Switzerland, reinforcing confidence in advanced recycling economics.

Beyond 2030, bio-based PET could gain more traction once feedstock scaling challenges abate. SpecialChem reports that Neste, ENEOS and Mitsubishi Corporation have started pilot runs using renewable naphtha as precursor feedstock, opening future avenues for low-carbon pellet supply. For now, high production costs and limited volumes confine bio-based PET to niche premium segments, yet the technology roadmap signals a long-term diversification path away from fossil resources. Ultimately, material-mix volatility places a premium on flexible drying, dosing and inspection systems able to handle variable IV and color specs without line stoppages.

The PET Preforms Report is Segmented by Material Type (Virgin PET, Recycled PET (rPET), and Bio-Based PET), Application (Carbonated Soft Drinks and Water, Food and Dairy, Personal Care and Cosmetics, Alcoholic Beverages, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific possesses the fulcrum of the PET preforms market, harnessing 46.20% revenue share in 2025 and tracking a 2.78% CAGR to 2031. China supplies cost-advantaged resin and molds, while India's April 2025 mandate for 30% recycled content in beverage bottles spurs unprecedented investment in washing and pelletizing lines. Indorama Ventures, Dhunseri and Varun Beverages formed a joint venture aimed at multiple recycling hubs across India to close the rPET gap and meet incoming compliance deadlines.

Europe follows as the most regulation-intensive market. Collection infrastructure already secures three-quarters of PET bottles, but tight food-grade rPET availability continues to underpin premium pricing. The tethered-cap law, effective 2024, triggered large-scale neck-finish conversions, often bundled with lightweight redesigns that trimmed resin use by 10-15%. Aggressive plastic-tax frameworks and evolving eco-modulation fee schedules encourage fillers to re-evaluate long-haul logistics costs and explore refillable glass pilots. Parallel research and development into enzymatic recycling underlines the region's aspiration to lead global polymer circularity best practices.

North America is characterized by solid demand for bottled water and functional beverages alongside increasing willingness to pay for recycled content. Chemical-recycling startups secure substantial venture funding, while state-level EPR legislation now extends to California, Oregon and Colorado. South America, dominated by Brazil's vibrant food-processing sector, registers steady expansion tempered by currency volatility and sporadic political uncertainty.

- Alpla

- CAIBA

- Chemco

- Doloop

- Duy Tan Plastic Company

- Esterform Ltd

- Indorama Ventures Public Company Limited

- KOKSAN PET VE PLASTIK AMBALAJ SANAYI VE TICARET AS

- NOVAPET SA

- Pet Star

- Petainer Ltd

- PGD PLASTIQUES

- Plastipak Holdings Inc.

- Polisan Hellas

- RESILUX NV

- Retal Industries Ltd

- Schwarz Produktion Stiftung & Co. KG

- SGT

- TPAC

- Valgroup Italia Srl

- Varioform PET

- Wiegand-Glas Holding GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand from beverage industry

- 4.2.2 Surge in bottled water consumption in emerging economies

- 4.2.3 Sustainability push for recycled (rPET) content

- 4.2.4 Mandatory tethered-cap EU directive boosting preform redesign volumes

- 4.2.5 Electrified on-site blow-molding enabling JIT customization

- 4.3 Market Restraints

- 4.3.1 Volatile PTA and MEG prices disrupting converter margins

- 4.3.2 Plastic-tax legislation and EPR fees tightening profit pools

- 4.3.3 Shift to refillable glass in CSD under EU 2029 reuse targets

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Virgin PET

- 5.1.2 Recycled PET (rPET)

- 5.1.3 Bio-based PET

- 5.2 By Application

- 5.2.1 Carbonated Soft Drinks and Water

- 5.2.2 Food and Dairy

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Alcoholic Beverages

- 5.2.5 Other Applications (Household Cleaning)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Vietnam

- 5.3.1.7 Thailand

- 5.3.1.8 Malaysia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 South Africa

- 5.3.5.5 Nigeria

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Alpla

- 6.4.2 CAIBA

- 6.4.3 Chemco

- 6.4.4 Doloop

- 6.4.5 Duy Tan Plastic Company

- 6.4.6 Esterform Ltd

- 6.4.7 Indorama Ventures Public Company Limited

- 6.4.8 KOKSAN PET VE PLASTIK AMBALAJ SANAYI VE TICARET AS

- 6.4.9 NOVAPET SA

- 6.4.10 Pet Star

- 6.4.11 Petainer Ltd

- 6.4.12 PGD PLASTIQUES

- 6.4.13 Plastipak Holdings Inc.

- 6.4.14 Polisan Hellas

- 6.4.15 RESILUX NV

- 6.4.16 Retal Industries Ltd

- 6.4.17 Schwarz Produktion Stiftung & Co. KG

- 6.4.18 SGT

- 6.4.19 TPAC

- 6.4.20 Valgroup Italia Srl

- 6.4.21 Varioform PET

- 6.4.22 Wiegand-Glas Holding GmbH

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment