PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906163

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906163

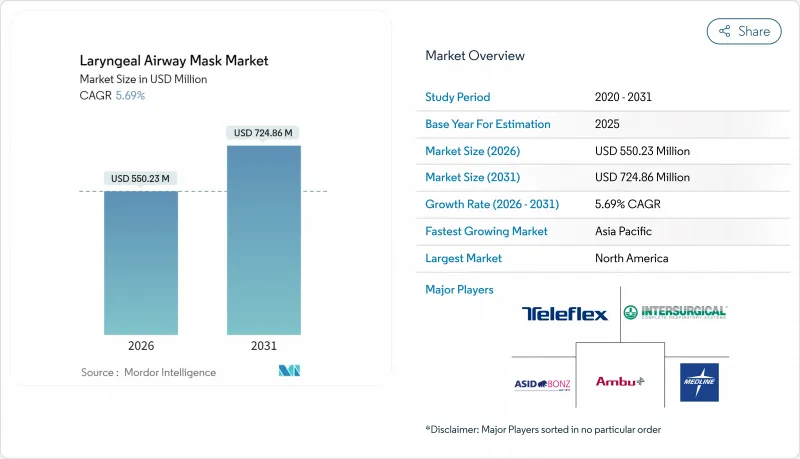

Laryngeal Airway Mask - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The laryngeal mask airways market is expected to grow from USD 520.6 million in 2025 to USD 550.23 million in 2026 and is forecast to reach USD 724.86 million by 2031 at 5.69% CAGR over 2026-2031.

Over the next five years, elective-surgery growth among aging populations, strong comparative-effectiveness data versus endotracheal tubes, and the post-pandemic shift to single-use supraglottic airway devices will sustain high replacement demand across operating rooms, ambulatory centers, and emergency services. Second-generation devices that integrate gastric drainage and achieve higher seal pressures expand clinical indications into laparoscopic, bariatric, and trauma cases, while office-based anesthesia and pre-hospital protocols pull the technology into new care settings. Competitive intensity remains moderate, yet innovation cycles are accelerating as suppliers defend brand loyalty through product upgrades, service contracts, and emerging sustainability claims.

Global Laryngeal Airway Mask Market Trends and Insights

Rising Global Surgical Volumes Among Aging Populations

Elective and urgent procedures keep climbing as life expectancy rises, pushing hospitals to favor devices that shorten turnover and minimize airway trauma. A 2024 propensity-score matched analysis in atrial-fibrillation ablation reported smoother emergence and fewer airway complications when laryngeal masks replaced endotracheal tubes. Comorbidity-laden seniors benefit from gentler airway options, making supraglottic devices integral to orthopedics, oncology, and cardiac surgery programs. Payment models now reward shorter recovery times, so operating-room directors increasingly standardize on LMAs to boost throughput.

Clinical Advantages Over Endotracheal Intubation

Randomized studies in pediatric cohorts documented lower respiratory adverse-event rates with LMAs versus tubes. Adult data echo the findings, citing reduced hemodynamic stress during neurosurgery and faster anesthesia induction in ENT procedures. These benefits dovetail with enhanced-recovery protocols, prompting guideline updates from professional societies.

Risk of Aspiration in High-Risk Patients

Despite gastric-drainage channels, many trauma and obstetric protocols still default to tubes for full-stomach patients. Newly revised combat-care guidelines omit supraglottic devices from certain phases due to aspiration fear.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Transition Toward Single-Use Devices

- Second-Generation LMAs With Gastric Drainage

- Environmental Sustainability Pushback on Disposable Plastics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Disposable masks generated 61.92% of laryngeal mask airways market revenue in 2025. Their infection-control edge convinced infection-prevention committees to adopt "single-use only" policies across many hospitals. Second-generation disposable units featuring gastric drainage and higher seal pressures are advancing at an 7.72% CAGR, raising average selling prices and offsetting commodity-line ASP compression. Reusables linger in resource-constrained health systems but lose ground as sterilization labor and traceability costs rise toward disposable parity. Specialty masks engineered for bariatric and robotic procedures carve out profitable micro-segments that encourage continuous R&D.

OEMs now optimize sterile-pouch logistics and lean inventory to match just-in-time surgery schedules. Regulatory audits spotlight sterilization process validation, favoring branded vendors with ISO-compliant quality systems. Environmental pushback is real, yet early-stage bioplastic prototypes indicate a feasible middle path between infection control and circular-economy mandates.

The Laryngeal Mask Airways Report is Segmented by Product Type (Disposable, Reusable, Specialty/Second-Generation), Age Group (Adult, Pediatric & Neonatal), End User (Hospitals, Ambulatory Surgical Centres, Specialty Clinics, Pre-Hospital Care), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 36.90% of global revenue in 2025 due to advanced OR infrastructure, anesthesiology training depth, and Medicare reimbursement stability. U.S. hospitals sign multi-year distributor contracts that bundle LMAs with regional block needles and monitoring disposables, locking in volume visibility. Canada mirrors these trends, while private hospitals in Mexico adopt second-generation masks to compete for cross-border medical tourism.

Asia-Pacific exhibits the fastest 8.85% CAGR to 2031, propelled by health-infrastructure spending and rapidly rising surgical capacity. Chinese provincial tenders bundle supraglottic devices with anesthesia circuits, and India's public-private hospitals specify single-use masks to meet infection-control targets. Multinational brands defend share in tier-1 centers through published clinical evidence and local manufacturing tie-ups, while domestic challengers compete on price in tier-2 cities. Regulatory convergence with ISO 13485 eases foreign registrations yet demands on-site audits, raising entry costs for smaller exporters. Europe delivers mid-single-digit growth but pioneers environmental regulation. The new electronic-instructions framework cuts paperwork costs for suppliers, yet 2026 packaging mandates heighten compliance spend. Middle East markets grow swiftly on hospital mega-projects in Saudi Arabia and the UAE, both reliant on high-acuity surgical caseloads. African demand remains concentrated in donor-funded trauma centers, while South American expansion is led by Brazil's MDR-aligned regulatory reforms. Together, these regional dynamics ensure that the laryngeal mask airways market continues to divide between high-income markets focused on premium innovations and emerging economies seeking accessible, cost-reliable solutions.

- Teleflex

- Ambu

- Medtronic

- Intersurgical

- Smiths Group

- Vyaire Medical

- Flexicare (Medical) Ltd

- SunMed LLC

- VBM Medizintechnik

- Wellead Medical Co. Ltd

- Henan Tuoren Medical Device Co. Ltd

- Armstrong Medical (Eakin Healthcare)

- Legend Medical Devices

- Medis Medical (Italian)

- Tuoren Medical USA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global surgical volumes among ageing populations

- 4.2.2 Clinical advantages over endotracheal intubation (reduced airway trauma)

- 4.2.3 Rapid transition toward single-use devices to curb cross-infection

- 4.2.4 Second-generation LMAs with gastric drainage and higher seal pressures

- 4.2.5 Expansion of office-based anaesthesia in ENT & dental settings

- 4.2.6 Adoption in pre-hospital military & emergency medicine

- 4.3 Market Restraints

- 4.3.1 Risk of aspiration in high-risk patients

- 4.3.2 Availability of alternative airway devices (video laryngoscopes, ETT)

- 4.3.3 Environmental sustainability pushback on disposable plastics

- 4.3.4 Reimbursement pressure in low-income health systems

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Supplier Power

- 4.7.2 Buyer Power

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 Disposable Laryngeal Masks

- 5.1.2 Reusable Laryngeal Masks

- 5.1.3 Specialty / Second-Generation Masks

- 5.2 By Age Group (Value)

- 5.2.1 Adult

- 5.2.2 Pediatric & Neonatal

- 5.3 By End User (Value)

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centres

- 5.3.3 Speciality Clinics

- 5.3.4 Pre-hospital Care Settings

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Teleflex Incorporated

- 6.3.2 Ambu A/S

- 6.3.3 Medtronic plc

- 6.3.4 Intersurgical Ltd

- 6.3.5 Smiths Medical (ICU Medical)

- 6.3.6 Vyaire Medical

- 6.3.7 Flexicare (Medical) Ltd

- 6.3.8 SunMed LLC

- 6.3.9 VBM Medizintechnik GmbH

- 6.3.10 Wellead Medical Co. Ltd

- 6.3.11 Henan Tuoren Medical Device Co. Ltd

- 6.3.12 Armstrong Medical (Eakin Healthcare)

- 6.3.13 Legend Medical Devices

- 6.3.14 Medis Medical (Italian)

- 6.3.15 Tuoren Medical USA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment