PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906166

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906166

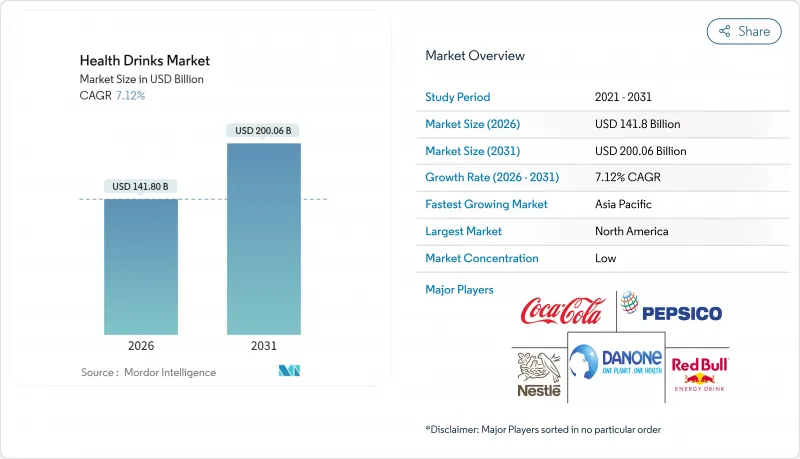

Health Drinks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The health drinks market was valued at USD 132.38 billion in 2025 and estimated to grow from USD 141.8 billion in 2026 to reach USD 200.06 billion by 2031, at a CAGR of 7.12% during the forecast period (2026-2031).

This growth is driven by changing demographics, rising healthcare spending, and clearer regulations, which are encouraging consumers to choose preventive nutrition and functional beverages. Increased digital access, advancements in ingredients, and eco-friendly packaging are also boosting demand. Regionally, North America holds the largest market share in 2024, while Asia-Pacific is the fastest-growing region through 2030. Among products, fruit and vegetable juices lead the market, while dairy and plant-based drinks are growing the fastest due to rising interest in plant-based options, concerns about lactose intolerance, and sustainability. Online retail stores are becoming the preferred distribution channel, surpassing traditional hypermarkets/supermarkets. Sustainable packaging innovations are driving the growth of Tetra Pack. The health drinks market is moderately fragmented, providing opportunities for smaller or new companies to enter and compete. This setup promotes innovation as brands can stand out with unique formulations, functional benefits, eco-friendly packaging, or focused marketing strategies. Companies often use collaborations, acquisitions, and regional expansions to strengthen their market presence.

Global Health Drinks Market Trends and Insights

Rising health and wellness awareness

The health drinks market is expanding rapidly as more people prioritize wellness and healthier lifestyles. Shifts in consumer habits during the pandemic, rising obesity rates, and a decline in physical activity have fueled demand for metabolic health drinks, which are viewed as a convenient way to support overall health. According to the World Health Organization, by 2025, an additional 1.5 billion people, ranging from 1.2 to 1.8 billion, are expected to experience improved health and well-being, underscoring the vast growth potential for health-focused beverages . This anticipated improvement in global health underscores a growing demand for products that promote preventive care and an active lifestyle. Younger consumers, in particular, are driving this shift, seeking clean-label products with transparent ingredient lists and scientifically validated benefits. Many rely on digital platforms and social media for real-time proof of these claims. In response, manufacturers are developing innovative, clinically tested formulations and strengthening credibility through evidence-based marketing positioning health drinks not just as nutritional supplements, but as aspirational lifestyle and premium wellness products.

Growing penetration of low-/no-sugar formulations

The shift toward healthier consumption habits is driving the growth of low- and no-sugar health drinks. This trend is driven by growing evidence that links sugary beverages to severe health conditions, including diabetes, which, as of 2024, impacts 589 million adults aged 20-79 globally, according to the International Diabetes Federation. Governments are encouraging this shift by introducing sugar taxes and restricting sugary drinks in schools, while organizations like the World Health Organization are promoting these measures to fight childhood obesity. Consumers are also changing their behavior, with the International Food Information Council (IFIC) 2024 survey showing that 66% of Americans are trying to reduce their sugar intake this year. To meet this demand, brands are launching more low-sugar options. For instance, in November 2024, Red Bull introduced Red Bull Zero, a sugar-free, zero-calorie version of its original energy drink, offering the same taste without the sugar.

Regulatory hurdles and safety concerns

Regulatory challenges and safety concerns are significant barriers to the health drinks market, as stricter rules increase compliance risks and legal issues. For example, in January 2025, Abbott faced lawsuits claiming misleading marketing of toddler milk due to its sugar content. Globally, regulations are becoming stricter, with a 2024 BioMed Central Public Health report showing that 73 countries limit caffeine levels or restrict energy drink sales to minors, making international launches more difficult. Companies now need to invest more in clinical research, detailed product documentation, and advanced monitoring systems while meeting various labeling and advertising rules. These challenges lead to higher compliance costs, longer product development times, and increased scrutiny, which can slow innovation and make it harder for new players to enter the market.

Other drivers and restraints analyzed in the detailed report include:

- Rise of fitness and sports culture

- Demand for natural and clean-label products

- Regulatory scrutiny on caffeine and novel ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fruit and vegetable juices remained the top segment in the health drinks market in 2025, holding 44.85% of the market share. Their popularity is driven by consumer familiarity, easy availability in stores, and the belief that juices are naturally healthy. Ready-to-drink beverage options, combined with their association with vitamins, minerals, and antioxidants that support immunity, make them a preferred choice. New products like cold-pressed juices, fortified blends, and low-sugar options are keeping them relevant as consumers look for both taste and health benefits.

On the other hand, dairy-based and plant-based health drinks are the fastest-growing segment, expected to grow at a CAGR of 7.32% through 2031. This growth is fueled by increasing awareness of lactose intolerance and the rising demand for sustainable, protein-rich alternatives. Plant-based drinks, in particular, are gaining popularity as consumers prioritize clean labels, ethical sourcing, and environmental sustainability. Innovations like almond-protein shakes and probiotic dairy alternatives are attracting both traditional dairy consumers and health-conscious buyers, making this segment a key driver of future growth in the health drinks market.

Bottled formats accounted for 65.10% of the health drinks packaging share in 2025, primarily because they are widely available, affordable, and convenient for consumers. Bottles are easy to use for both retail purchases and on-the-go consumption, making them a popular choice. Well-established production systems and strong distribution networks support their dominance. Features like lightweight materials and resealable caps make them practical for single-serve use, especially for outdoor activities or quick purchases. These factors have solidified bottles as the preferred packaging option for health drinks.

Tetra packs are the fastest-growing packaging type, with an expected CAGR of 7.34% through 2031. This growth is driven by increasing consumer and regulatory focus on sustainability, as cartons are often made with renewable materials and recycled content. They are also gaining popularity among health drink brands that want to emphasize freshness, longer shelf life, and an eco-friendly image. Cartons appeal to environmentally conscious consumers and align with the market's shift toward sustainable practices. This trend highlights how packaging is becoming a key tool for brands to communicate health, innovation, and sustainability to their customers.

The Health Drinks Market Report is Segmented by Product Type (Fruit and Vegetables Juices, Other Product Types, and More), Packaging Type (Bottles, and More), Health Application (Digestive Health, and More), Distribution Channel (Convenience Stores, Specialty Stores, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 36.10% of the health drinks market share in 2025, driven by high disposable incomes, a strong focus on health and wellness, and supportive regulations like the United States Food and Drug Administration's Generally Recognized as Safe framework. Consumers in the region are increasingly willing to spend on premium health drinks that offer innovative and clinically proven benefits. The presence of advanced research collaborations and nutraceutical start-ups has further strengthened the market, enabling the development of high-quality products. The region's well-established distribution networks and marketing strategies have made health drinks easily accessible to a wide audience. These factors collectively position North America as a leading market for health drinks.

Europe closely follows North America, supported by strong regulatory measures promoting sustainability and healthier product formulations. Governments in the region are actively encouraging manufacturers to reduce sugar content and adopt eco-friendly packaging solutions. This has led to the increased use of natural sweeteners and recycled materials, aligning with consumer preferences for environmentally friendly products. Transparency in product labeling and a focus on clean ingredients have also helped build consumer trust, driving steady growth in the market. With a growing demand for sustainable and health-focused beverages, Europe remains a significant contributor to the global health drinks market.

Asia-Pacific is the fastest-growing region, with a projected CAGR of 7.92% through 2031. The region's growth is fueled by rising incomes, urbanization, and increasing health awareness, particularly in countries like China, India, and Indonesia. Social media has played a key role in shaping consumer preferences, driving demand for health drinks that promote wellness and nutrition. Government initiatives, such as Japan's Foods with Function Claim (FFC) program and India's fortification campaigns, have further supported market expansion. Companies are also introducing products tailored to local nutritional needs, such as Abbott's PediaSure Nutri-Pull, which has gained popularity in the region. These factors make Asia-Pacific a critical driver of growth in the health drinks market.

- PepsiCo Inc.

- The Coca-Cola Company

- Danone S.A.

- Nestle S.A.

- Red Bull GmbH

- Abbott Laboratories

- Glanbia Plc

- Oatly Group

- Blue Diamond Growers

- General Nutrition Centers Inc.

- Celsius Holdings Inc.

- Vitamin Well

- Keurig Dr Pepper Inc.

- Suntory Holdings Ltd.

- Monster Beverage Corp.

- Yakult Honsha Co. Ltd.

- The Kraft Heinz Company

- Ocean Spray Cranberries Inc.

- BioSteel Sports Nutrition Inc.

- Generous Brands

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising health and wellness awareness

- 4.2.2 Growing penetration of low/no-sugar formulations

- 4.2.3 Increasing prevalence of lifestyle diseases

- 4.2.4 Demand for natural and clean-label products

- 4.2.5 Rise of fitness and sports culture

- 4.2.6 Influence of social media and trends

- 4.3 Market Restraints

- 4.3.1 Regulatory hurdles and safety concerns

- 4.3.2 Intense competition and product substitution

- 4.3.3 Regulatory scrutiny on caffeine and novel ingredients

- 4.3.4 Concerns over sugar and artificial additives

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Consumer Behaviour Analysis

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Fruit and Vegetable Juices

- 5.1.2 Sports and Energy Drinks

- 5.1.3 Herbal and Adaptogenic Drinks

- 5.1.4 Meal Replacement Drinks

- 5.1.5 Dairy and Plant-based Drinks

- 5.1.6 Other Product Types

- 5.2 By Packaging Type

- 5.2.1 Bottles

- 5.2.2 Cans

- 5.2.3 Tetra Packs

- 5.2.4 Others

- 5.3 By Health Application

- 5.3.1 Immunity Boosting

- 5.3.2 Digestive Health

- 5.3.3 Hydration and Recovery

- 5.3.4 Other Applications

- 5.4 By Distribution Channel

- 5.4.1 Hypermarkets / Supermarkets

- 5.4.2 Specialty Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Convenience Stores

- 5.4.5 Other Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Colombia

- 5.5.2.3 Chile

- 5.5.2.4 Peru

- 5.5.2.5 Argentina

- 5.5.2.6 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Poland

- 5.5.3.7 Belgium

- 5.5.3.8 Sweden

- 5.5.3.9 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Australia

- 5.5.4.5 Indonesia

- 5.5.4.6 South Korea

- 5.5.4.7 Thailand

- 5.5.4.8 Singapore

- 5.5.4.9 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 PepsiCo Inc.

- 6.4.2 The Coca-Cola Company

- 6.4.3 Danone S.A.

- 6.4.4 Nestle S.A.

- 6.4.5 Red Bull GmbH

- 6.4.6 Abbott Laboratories

- 6.4.7 Glanbia Plc

- 6.4.8 Oatly Group

- 6.4.9 Blue Diamond Growers

- 6.4.10 General Nutrition Centers Inc.

- 6.4.11 Celsius Holdings Inc.

- 6.4.12 Vitamin Well

- 6.4.13 Keurig Dr Pepper Inc.

- 6.4.14 Suntory Holdings Ltd.

- 6.4.15 Monster Beverage Corp.

- 6.4.16 Yakult Honsha Co. Ltd.

- 6.4.17 The Kraft Heinz Company

- 6.4.18 Ocean Spray Cranberries Inc.

- 6.4.19 BioSteel Sports Nutrition Inc.

- 6.4.20 Generous Brands

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK