PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906167

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906167

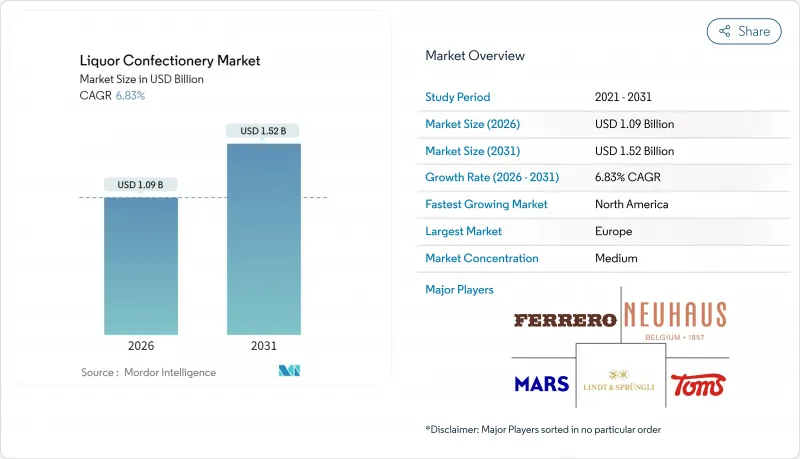

Liquor Confectionery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Liquor confectionery market size in 2026 is estimated at USD 1.09 billion, growing from 2025 value of USD 1.02 billion with 2031 projections showing USD 1.52 billion, growing at 6.83% CAGR over 2026-2031.

Consumer preferences for premium confectionery products remain strong, with many individuals willing to invest in high-quality treats even during periods of economic uncertainty. Manufacturers have strategically shifted their focus toward alcohol-flavored products in response to fluctuating cocoa prices, as these premium offerings provide better profit margins compared to conventional chocolates. The market demonstrates significant sales concentration during key gifting seasons, with the December holiday period and Valentine's Day generating substantial revenue. The expansion of e-commerce platforms, equipped with robust age-verification mechanisms, has created new opportunities for direct consumer sales. The industry continues to evolve through strategic partnerships between established chocolate manufacturers and artisanal distilleries, resulting in innovative product offerings that incorporate popular spirits such as tequila, mezcal, and small-batch bourbon.

Global Liquor Confectionery Market Trends and Insights

Rising Consumer Preference for Premium and Luxury Confectionery Products

Premium chocolate-liquor confections command 40-60% higher prices compared to conventional chocolates through artisanal production methods and heritage-based marketing. Consumers demonstrate selective purchasing behavior, choosing high-quality products for special occasions despite rising costs. Manufacturing processes focus on bean-to-bar production, utilizing advanced conching and tempering technologies to achieve precise flavor integration while maintaining chocolate quality. The corporate gifting segment generates significant sales volume during peak seasons, as luxury confections serve as business relationship-building tools. Premium consumers increasingly prioritize transparent sourcing practices for both cocoa and alcohol ingredients, making sustainability certifications important differentiators. Distribution primarily occurs through specialty retail partnerships and direct-to-consumer channels, which maintain premium positioning through carefully designed shopping experiences and necessary age verification.

Growing Demand for Unique and Innovative Liquor-Infused Flavors

The chocolate confectionery market has diversified its flavor portfolio beyond traditional European liqueurs to embrace craft spirits, particularly tequila and mezcal infusions, which demonstrate substantial market growth. Traditional production methods and small-batch processing resonate with consumers who actively seek distinctive taste experiences. The expanding craft spirits segment has fueled demand for confectionery products that showcase complex flavor profiles from artisanal distilleries. Strategic partnerships between chocolatiers and distilleries enable the development of sophisticated flavor combinations. Regional preferences significantly influence product development strategies, with European markets maintaining their focus on traditional liqueur-based offerings, while North American consumers demonstrate a strong preference for bourbon and whisky combinations that reflect their local distilling heritage. Companies typically assess market acceptance through limited-edition releases before proceeding with full-scale production. Advanced sensory analysis techniques ensure optimal alcohol integration while maintaining chocolate quality standards and shelf stability.

Stringent Regulations and Labeling Requirements Concerning Alcohol Content

The confectionery industry faces multiple regulatory hurdles when incorporating alcohol into products. Companies must navigate a complex system where TTB oversees products containing more than 7% ABV while FDA handles food labeling for lower alcohol content items. This dual oversight increases operational costs through required legal expertise and testing procedures. When expanding internationally, businesses encounter varying requirements across regions, such as differing EU and North American labeling standards, which impacts inventory management. The need for age verification limits retail placement options, especially in convenience stores where impulse purchases typically drive confectionery sales. Products containing over 12% ABV must meet specific TTB standards, often affecting product formulation and flavor profiles . E-commerce opportunities remain limited as many countries restrict shipping alcohol-containing foods through international mail. Companies expanding into new markets face additional costs from multilingual packaging requirements and region-specific warning labels, further complicating their packaging and inventory systems.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Popularity of Gourmet Chocolates and Artisanal Confectioneries

- Expansion of the Gifting Culture and Luxury Gifting Occasions

- Limited Consumer Awareness or Acceptance in Certain Conservative Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The alcoholic chocolate market shows a clear preference for bar configurations, which currently hold 34.25% of the market share in 2025. This format continues to outperform others with an impressive growth rate of 8.14% CAGR through 2031. Bars have become the go-to choice for manufacturers and consumers alike, offering precise portion control and an elevated presentation that appeals to modern consumers. The format's success is rooted in its manufacturing efficiency, allowing precise alcohol integration and optimal flavor delivery.

The market's second-largest segment belongs to tablets, which benefit from their familiar confectionery format that consumers readily understand and accept. Box assortments maintain their position in premium gifting, particularly during holiday seasons, while manufacturers continue to refine bar production through advanced tempering techniques to accommodate various spirit types. Though novelty shapes and seasonal configurations serve specific market niches, they face production challenges that limit their growth potential. The manufacturing sector continues to favor bar formats due to their streamlined production processes and consistent cooling requirements, offering significant advantages over more complex configurations.

The Liquor Confectionery Market Report is Segmented by Type (Bar, Tablets, Box Assortment, and Others), Alcohol Base (Whisky/Bourbon, Rum, Liqueurs, and More), Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail Stores, and Other Distribution Channels), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value and Volume (USD/ Tonnes).

Geography Analysis

The European market maintains its position as the leading segment with a substantial 44.80% market share in 2025, underpinned by its rich heritage in confectionery manufacturing and comprehensive understanding of alcohol-infused products. The region's deep-rooted chocolate-making traditions, spanning centuries, combined with widespread consumer acceptance of alcohol in food products, create a robust foundation for traditional liqueur applications. Major consumption markets, including Germany, United Kingdom, Italy, France, and Spain, benefit from sophisticated retail networks and advanced capabilities in premium product positioning. The region's inherent cultural acceptance of alcohol in confectionery significantly reduces the need for market education, facilitating smoother product launches and broader distribution channels. However, manufacturers must navigate complex EU-wide compliance requirements that vary across member states, particularly regarding alcohol content labeling and cross-border distribution.

North American markets emerge as the fastest-growing segment, demonstrating an impressive 8.09% CAGR through 2031. This remarkable growth trajectory is primarily fueled by the influential craft spirits movement and consumers' increasing appetite for experimental flavor combinations that extend beyond conventional European liqueur profiles. The market dynamics across the United States, Canada, and Mexico reflect diverse regulatory landscapes, with the US benefiting from standardized compliance frameworks under TTB oversight, while Canadian markets show increasing receptiveness to premium confectionery categories, creating new opportunities for market expansion.

Asia-Pacific and emerging markets represent a significant yet complex opportunity landscape, characterized by varying degrees of market readiness and regulatory frameworks. While urbanization trends and increasing disposable income levels drive demand for premium confectionery among affluent consumer segments, market penetration strategies must carefully consider regional cultural sensitivities. The market response varies considerably across different regions, with some markets showing enthusiasm for alcohol-flavored products, while others maintain strict religious or cultural restrictions that impact market accessibility and product acceptance.

- Toms Gruppen

- Ferrero Group

- Lindt & Sprungli

- Neuhaus

- Mars Inc.

- The Hershey Company

- Godiva

- Abtey Chocolate Factory

- Leonidas

- Ghirardelli

- Yildiz Holding (Ulker)

- Liqueur Fills GmbH

- Friars

- Confiserie Reber

- Patchi

- Fazer

- Butlers Chocolates

- August Storck

- Chocolat Bernrain

- Kalfany SuBe Werbung

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising consumer preference for premium and luxury confectionery products

- 4.2.2 Growing demand for unique and innovative liquor-infused flavors

- 4.2.3 Increasing popularity of gourmet chocolates and artisanal confectioneries

- 4.2.4 Expansion of the gifting culture and luxury gifting occasions

- 4.2.5 Increasing availability of liquor confectionery in specialty retail outlets

- 4.2.6 Collaborations between chocolatiers and liquor manufacturers for new offerings

- 4.3 Market Restraints

- 4.3.1 Stringent regulations and labeling requirements concerning alcohol content

- 4.3.2 Limited consumer awareness or acceptance in certain conservative markets

- 4.3.3 Health concerns related to alcohol consumption affecting buying behavior

- 4.3.4 Volatility and fluctuation in raw material prices such as cocoa and alcohol

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Type

- 5.1.1 Bar

- 5.1.2 Tablets

- 5.1.3 Box Assortment

- 5.1.4 Others

- 5.2 By Alcohol Base

- 5.2.1 Whisky / Bourbon

- 5.2.2 Rum

- 5.2.3 Liqueurs

- 5.2.4 Tequila / Mezcal

- 5.2.5 Wine / Champagne

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Specialty Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Toms Gruppen

- 6.4.2 Ferrero Group

- 6.4.3 Lindt & Sprungli

- 6.4.4 Neuhaus

- 6.4.5 Mars Inc.

- 6.4.6 The Hershey Company

- 6.4.7 Godiva

- 6.4.8 Abtey Chocolate Factory

- 6.4.9 Leonidas

- 6.4.10 Ghirardelli

- 6.4.11 Yildiz Holding (Ulker)

- 6.4.12 Liqueur Fills GmbH

- 6.4.13 Friars

- 6.4.14 Confiserie Reber

- 6.4.15 Patchi

- 6.4.16 Fazer

- 6.4.17 Butlers Chocolates

- 6.4.18 August Storck

- 6.4.19 Chocolat Bernrain

- 6.4.20 Kalfany SuBe Werbung

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK