PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906168

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906168

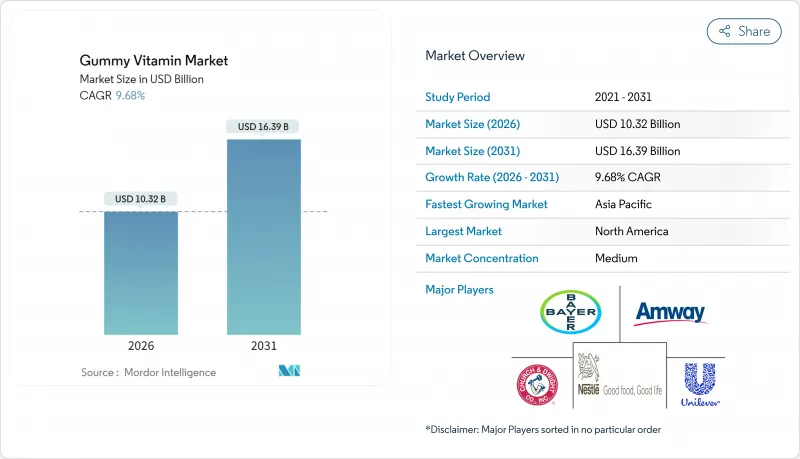

Gummy Vitamin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The gummy vitamins market was valued at USD 9.41 billion in 2025 and estimated to grow from USD 10.32 billion in 2026 to reach USD 16.39 billion by 2031, at a CAGR of 9.68% during the forecast period (2026-2031).

This growth is primarily driven by a consumer preference shift from traditional pills and capsules to more convenient and enjoyable formats. Gummy vitamins appeal to consumers due to their better taste, ease of consumption without water, and compatibility with fast-paced lifestyles. Additionally, advancements in production technologies, such as starch-free manufacturing, center-filled technology, and pectin-based formulations, are expanding the range of nutrients that can be effectively delivered in gummy form. The intensifying competition in the market has led to reduced prices while simultaneously fostering innovation. Furthermore, regulatory agencies are increasingly clarifying guidelines related to labeling, novel ingredients, and sugar content. These developments are encouraging larger firms to scale their production capacities and expand into new geographic markets, further driving the market's growth potential.

Global Gummy Vitamin Market Trends and Insights

Gummy vitamins offer a convenient and tasty alternative to traditional supplements.

Gummy vitamins are transforming supplement consumption patterns by addressing the global issue of "pill fatigue," which affects millions of individuals. These vitamins, recognized as dietary supplements by the U.S. Food and Drug Administration (FDA) under the Dietary Supplement Health and Education Act (DSHEA), are subject to strict regulations. Manufacturers must ensure product safety and accurate labeling, providing consumers with reliable nutritional support. This regulatory framework has fostered innovation in gummy vitamin formulations while maintaining high safety standards. Beyond their appealing taste, gummy vitamins offer practical benefits such as portion control and ease of consumption, making them a preferred choice for individuals who previously avoided traditional supplement formats. Additionally, Health Canada's stringent regulatory framework for natural health products ensures that gummy vitamins meet rigorous quality and safety standards, further enhancing consumer confidence in their efficacy and reliability. These factors collectively contribute to the growing adoption of gummy vitamins across diverse consumer demographics.

Rising health awareness fuels consumer demand for daily nutritional support.

Regulatory bodies worldwide are adapting their frameworks to accommodate innovative supplement formats, ensuring safety and fostering growth. The European Food Safety Authority (EFSA) plays a critical role in this landscape by providing comprehensive oversight of food supplements, including gummy vitamins. EFSA's regulations ensure that products meet harmonized safety standards across EU member states while encouraging advancements in functional nutrition. This supportive regulatory environment has led to the development of condition-specific formulations that address targeted health concerns, such as immune support and mental well-being, beyond basic nutritional needs. The post-pandemic era has further accelerated this shift, as consumers increasingly prioritize proactive health solutions. Immune health and mental wellness have emerged as key focus areas, reflecting a broader trend toward preventive care. Additionally, government health initiatives promoting preventive healthcare are indirectly bolstering the functional supplements market. These initiatives align with consumer preferences, as individuals increasingly choose supplements that adhere to official health guidelines on nutrition and wellness. This alignment underscores the growing integration of functional supplements into daily health routines, driven by both regulatory support and evolving consumer priorities.

High sugar content in many gummies raises health concerns among consumers.

The high sugar content in many gummy vitamins, despite their health-focused positioning, presents a significant challenge to the market's long-term growth. These products often conflict with broader nutritional guidelines, undermining their appeal to health-conscious consumers. Recently, the European Food Safety Authority rejected a proposal to increase the acceptable daily intake (ADI) for steviol glycosides, a widely used sweetener in reduced-sugar gummies, due to concerns about excessive consumption, particularly among children. This decision highlights the increasing regulatory scrutiny on sugar levels in functional foods and dietary supplements. Authorities are implementing stricter standards for supplement labeling and composition, aiming to address these contradictions. Simultaneously, consumer awareness of the disparity between health claims and sugar content is rising, intensifying market pressure on brands. To remain competitive, companies must innovate by developing reduced-sugar formulations that maintain the desired taste and texture, aligning with both regulatory requirements and consumer expectations.

Other drivers and restraints analyzed in the detailed report include:

- Gummies appeal to children and the elderly who dislike swallowing pills.

- Expansion of vegan and gelatin-free gummy options attracts plant-based consumers.

- Gummy vitamins are prone to melting and spoilage in high temperatures.

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, multivitamins hold a dominant 41.05% share of the global gummy vitamin market, driven by their positioning as comprehensive, all-in-one nutritional supplements. These products appeal to consumers seeking convenience, as they simplify daily health routines by delivering multiple essential nutrients in a single dosage. The growing emphasis on preventative healthcare and overall wellness, particularly among time-constrained urban populations, further strengthens the demand for multivitamins. Additionally, the increasing awareness of the benefits of balanced nutrition is encouraging consumers to adopt multivitamins as part of their daily regimen.

In contrast, single vitamins are emerging as the fastest-growing segment, with a projected CAGR of 13.82% from 2026 to 2031. This growth reflects a significant shift toward personalized nutrition, where consumers focus on targeted supplementation to address specific nutrient deficiencies or achieve particular health goals. Regulatory developments, such as the FDA's New Dietary Ingredient (NDI) guidelines, are fostering a safer and more innovative market environment, encouraging companies to invest in the development of novel ingredients. Moreover, advancements in technology, including 3D printing and microencapsulation, are enabling precise dosing and customized formulations. These innovations allow manufacturers to cater to niche consumer demands with high efficacy, accelerating the expansion of the single vitamins segment. The increasing consumer preference for tailored health solutions is expected to further drive the growth of this segment in the coming years.

In 2025, conventional gummy vitamins command a dominant 87.10% share of the global market. Their success hinges on cost-effectiveness, widespread availability, and robust brand recognition in mass-market retail channels. These vitamins cater to a diverse consumer base, particularly appealing to price-sensitive shoppers and families in search of budget-friendly health supplements. Streamlined manufacturing and efficient supply chains further bolster their dominance, ensuring consistent availability and reduced production costs.

On the other hand, the organic segment is on an upward trajectory, with projections indicating a robust CAGR of 12.33% from 2026 to 2031. This surge is driven by heightened consumer awareness surrounding clean-label products, sustainability, and ethical sourcing. Such sentiments resonate deeply with younger, health-conscious demographics. Regulatory endorsements, like those from Health Canada, further amplify the demand for organic gummy vitamins by assuring consumers of stringent safety and quality standards. As the modern consumer prioritizes transparency in ingredient sourcing and is often willing to invest more for perceived health and environmental advantages, the organic segment emerges as a pivotal growth engine in the dynamic supplement market.

The Gummy Vitamin Market is Segmented by Type (Single Vitamins and Multivitamins); by Source (Conventional and Organic); by Category (Kids, Adults, and Seniors); by Function (Immunity, Bone & Joint, and More); by Packaging (Bottles, Stand-Up Pouches, and More); by Distribution Channel (Supermarkets/Hypermarkets, and More); and by Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America commands the global gummy vitamins market with a 33.90% share, fueled by heightened consumer awareness, robust retail distribution, and a regulatory landscape that facilitates the market entry of innovative products. Major manufacturers bolster the region's dominance, while the FDA's thorough regulatory framework for dietary supplements not only ensures product safety but also fosters innovation.

Asia-Pacific is set to outpace others, with a projected 11.33% CAGR from 2026 to 2031, driven by a burgeoning middle class, heightened health consciousness, and a tilt towards preventive healthcare. In India,market is on a rapid ascent, bolstered by government-backed initiatives from the Food Safety and Standards Authority of India (FSSAI) aimed at attracting investments and elevating quality standard. China stands as a goldmine for gummy vitamin producers, thanks to governmental backing for the health and wellness sector. Japan boasts a seasoned market, with discerning consumers prioritizing high-quality, scientifically-backed products. In contrast, emerging markets like Indonesia, Thailand, and Vietnam offer fertile ground for brands adept at navigating diverse regulatory landscapes and local tastes.

Europe, while presenting a lucrative market, is also a maze of regulations. The European Food Safety Authority mandates rigorous standards for supplement ingredients and health claims. Consumers in the region lean heavily towards natural ingredients and transparent labeling. The EU's Food Supplement Directive strikes a balance, offering a unified regulatory framework that nurtures innovation yet prioritizes consumer safety. Germany, the U.K., and France lead the pack, with a noticeable consumer shift towards specialized functional gummies, especially those targeting beauty, sleep, and stress relief.

- Church & Dwight Co. Inc.

- Nestle S.A.

- Unilever PLC

- Bayer AG

- Pharmavite LLC

- Amway Corporation

- MaryRuth Organics, LLC

- Herbaland Naturals Inc

- NutraChamps Inc

- Lifeable LLC

- Dr. Willmar Schwabe GmbH & Co. KG

- Nordic Naturals Inc.

- Goli Nutrition Inc.

- NutraBlast

- Havasu Nutrition, LLC

- Life Science Nutritionals

- Hero Nutritionals, Inc.

- Servocare Lifesciences

- Haleon plc.

- SCN BestCo

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Gummy vitamins offer a convenient and tasty alternative to traditional supplements.

- 4.2.2 Rising health awareness fuels consumer demand for daily nutritional support.

- 4.2.3 Gummies appeal to children and the elderly who dislike swallowing pills.

- 4.2.4 Expansion of vegan and gelatin-free gummy options attracts plant-based consumers.

- 4.2.5 Social media marketing and influencer endorsements increase brand visibility.

- 4.2.6 Innovation in flavors and shapes enhances consumer interest and repeat purchases.

- 4.3 Market Restraints

- 4.3.1 High sugar content in many gummies raises health concerns among consumers.

- 4.3.2 Gummy vitamins are prone to melting and spoilage in high temperatures.

- 4.3.3 Regulatory hurdles differ across regions, complicating product launches.

- 4.3.4 Higher production costs compared to tablets or capsules impact pricing.

- 4.4 Regulatory Outlook

- 4.5 Technology Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD)

- 5.1 By Type

- 5.1.1 Single Vitamins

- 5.1.1.1 Vitamin C

- 5.1.1.2 Vitamin D3

- 5.1.1.3 Biotin

- 5.1.1.4 Other Single Vitamin

- 5.1.2 Multivitamins

- 5.1.1 Single Vitamins

- 5.2 By Source

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Category

- 5.3.1 Kids

- 5.3.2 Adults

- 5.3.3 Seniors

- 5.4 By Function

- 5.4.1 Immunity

- 5.4.2 Bone & Joint

- 5.4.3 Beauty/Skin-Hair-Nail

- 5.4.4 Digestive Health

- 5.4.5 Other Functions

- 5.5 By Packaging Type

- 5.5.1 Bottles

- 5.5.2 Stand-up Pouches

- 5.5.3 Blister Packs

- 5.5.4 Other Packaging

- 5.6 By Distribution Channel

- 5.6.1 Supermarkets/Hypermarkets

- 5.6.2 Convenience/Grocery Stores

- 5.6.3 Online Retail Stores

- 5.6.4 Other Distribution Channels

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.1.4 Rest of North America

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 Italy

- 5.7.2.4 France

- 5.7.2.5 Spain

- 5.7.2.6 Netherlands

- 5.7.2.7 Poland

- 5.7.2.8 Belgium

- 5.7.2.9 Sweden

- 5.7.2.10 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 Australia

- 5.7.3.5 Indonesia

- 5.7.3.6 South Korea

- 5.7.3.7 Thailand

- 5.7.3.8 Singapore

- 5.7.3.9 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Colombia

- 5.7.4.4 Chile

- 5.7.4.5 Peru

- 5.7.4.6 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 United Arab Emirates

- 5.7.5.4 Nigeria

- 5.7.5.5 Egypt

- 5.7.5.6 Morocco

- 5.7.5.7 Turkey

- 5.7.5.8 Rest of Middle East and Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Church & Dwight Co. Inc.

- 6.4.2 Nestle S.A.

- 6.4.3 Unilever PLC

- 6.4.4 Bayer AG

- 6.4.5 Pharmavite LLC

- 6.4.6 Amway Corporation

- 6.4.7 MaryRuth Organics, LLC

- 6.4.8 Herbaland Naturals Inc

- 6.4.9 NutraChamps Inc

- 6.4.10 Lifeable LLC

- 6.4.11 Dr. Willmar Schwabe GmbH & Co. KG

- 6.4.12 Nordic Naturals Inc.

- 6.4.13 Goli Nutrition Inc.

- 6.4.14 NutraBlast

- 6.4.15 Havasu Nutrition, LLC

- 6.4.16 Life Science Nutritionals

- 6.4.17 Hero Nutritionals, Inc.

- 6.4.18 Servocare Lifesciences

- 6.4.19 Haleon plc.

- 6.4.20 SCN BestCo

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK