PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906171

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906171

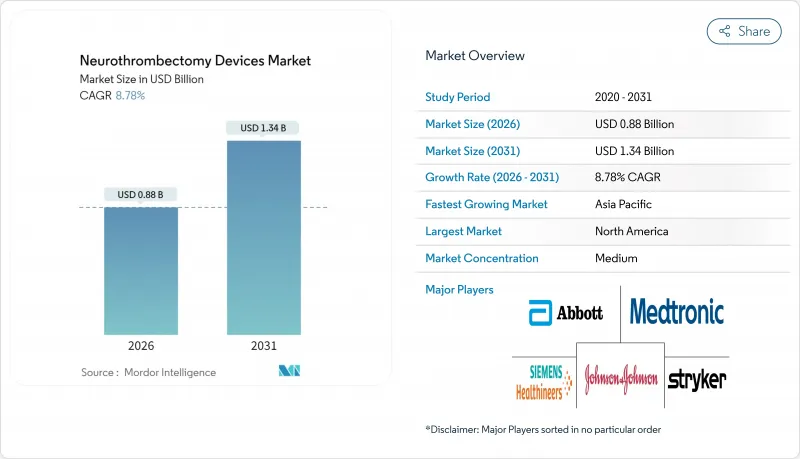

Neurothrombectomy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Neurothrombectomy devices market was valued at USD 0.81 billion in 2025 and estimated to grow from USD 0.88 billion in 2026 to reach USD 1.34 billion by 2031, at a CAGR of 8.78% during the forecast period (2026-2031).

Evidence from the DAWN and DEFUSE-3 trials has enlarged the treatment window to 24 hours and is the core catalyst behind the market's current growth trajectory. Wider insurance coverage in the United States, Germany, and Japan, paired with AI-enabled stroke triage tools that sharpen patient selection, continue to expand procedure volumes. Large-bore aspiration catheters that shorten procedure times and reduce radiation exposure add an economic advantage that resonates with cost-sensitive healthcare systems. At the same time, supply-chain fragility for nitinol and platinum-iridium alloys introduces pricing volatility that manufacturers must mitigate. Collectively, these forces shape a balanced outlook in which clinical evidence, reimbursement policy, and materials security must align for sustained growth of the Neurothrombectomy devices market.

Global Neurothrombectomy Devices Market Trends and Insights

Growing Guideline-Driven Adoption After DAWN/DEFUSE-3 Trials

The DAWN and DEFUSE-3 trials extended the treatment window for large-vessel occlusion strokes from 6 hours to 24 hours, which has directly enlarged the Neurothrombectomy devices market. International stroke societies integrated these findings into updated guidelines in 2024, and comprehensive stroke centers have since reported 40-60% procedure volume increases. Wider use of perfusion imaging now standardizes patient selection, reduces inter-hospital variability, and raises demand for both imaging and thrombectomy tools. Regulatory alignment, including FDA procedural guidance, further harmonizes practice patterns across U.S. facilities. As adoption spreads into community hospitals, guideline compliance will continue to lift procedure volumes and reinforce growth across established and emerging regions.

Favorable Reimbursement Expansions in U.S., Germany & Japan

CMS broadened codes for carotid and neurovascular interventions in 2023, signaling policy support that immediately improves hospital economics for thrombectomy. Germany's DRG model has introduced specific mechanical thrombectomy reimbursements, while Japan's national payer added advanced device coverage under clearly defined clinical criteria. Despite these improvements, U.S. Medicare still reimburses only 18-22% of billed charges, creating margin pressure for providers. Private insurers are closing the gap by updating prior authorization rules to mirror guideline changes, strengthening procedure access. As payer frameworks mature, additional Neurothrombectomy devices market gains hinge on formal recognition of posterior-circulation strokes and outpatient settings. Recent advocacy efforts aim to embed value-based codes that capture real-world cost savings and patient outcomes, setting the stage for continued reimbursement-driven demand.

High Device & Procedure Cost in Emerging Markets

Neurothrombectomy device costs account for up to 80% of total procedure expenses in low-resource settings. The PRAAN study from India estimated per-case spending at USD 3,500-5,000, equal to as much as fifteen times median monthly income. Supply-chain consolidation, exemplified by Johnson Matthey's divestiture of its Medical Device Components unit, has intensified raw-material pricing pressure for nitinol and platinum-iridium alloys. Limited public healthcare budgets, typically under 5% of national spending for specialized interventions, hamper device procurement. Hospitals often lack modern imaging or hybrid operating suites, forcing additional capital outlays before procedures can be offered. Without targeted funding or price-managed offerings, cost barriers will continue to cap Neurothrombectomy devices market penetration in several emerging economies.

Other drivers and restraints analyzed in the detailed report include:

- Large-Bore Aspiration Catheters Reduce Procedure Time & Cost

- AI-Enabled Stroke Triage Broadens Eligible Patient Pool

- Shortage of Trained Neuro-Interventionists Outside Urban Centers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Stent retrievers carried 63.78% of the Neurothrombectomy devices market share in 2025 and remain the procedural mainstay across comprehensive stroke centers. Their dominance reflects decades of clinical validation, including pivotal trials that confirm high reperfusion rates across clot morphologies. The segment benefits further from incremental design improvements, such as the NeVa NET 5.5 device that achieved 54.9% first-pass near-complete recanalization in multicenter evaluations. Despite premium pricing, hospitals continue to stock multiple stent retriever sizes, given high physician familiarity and versatile performance. In parallel, aspiration catheters command the fastest expansion path, with a 7.06% CAGR forecast through 2031, propelled by newer large-bore designs that streamline setup and reduce embolic complications. Combined mechanical systems appeal to specialists handling complex clot architectures but face moderate uptake due to higher cost and steeper learning curves. Balloon guide catheters and accessory lines grow in lockstep with core device adoption, ensuring integrated shelf solutions for stroke programs within the Neurothrombectomy devices market.

Price competition is unlikely to erode stent retriever dominance before 2030, yet the economic appeal of aspiration-first techniques continues to reshape procedural algorithms. Key manufacturers invest in coating technologies that enhance clot grip and minimize distal embolization, leveraging 510(k) pathways for accelerated U.S. clearance. The Neurothrombectomy devices market size for aspiration tools is set to benefit from these advances, while stent retriever vendors protect share through bundled service models, including hands-on training and AI-driven case planning. The interplay of efficacy evidence, cost containment, and workflow optimization underpins a healthy two-horse race that fuels continuous innovation in both categories.

The Neurothrombectomy Devices Market Report is Segmented by Device Type (Stent Retrievers, Aspiration Catheters, Combined Mechanical Thrombectomy Systems, Balloon Guide Catheters & Accessory Devices), End User (Hospitals, Specialty Neurosurgery Centers, Ambulatory Surgical Centers), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the Neurothrombectomy devices market with 41.86% share in 2025, underpinned by robust payer coverage, dense hospital networks, and early adoption of extended-window guidelines. Medicare's 2023 coverage expansion for carotid interventions signaled ongoing policy support, while private insurers moved quickly to harmonize authorizations. U.S. centers capitalize on AI-driven triage software to reduce treatment delays, whereas Canada leverages universal healthcare to equalize access across provinces. Mexico adds incremental growth through medical technology harmonization that eases cross-border device clearance, culminating in a continental ecosystem that sustains steady procedure volumes and advances the regional Neurothrombectomy devices market.

Asia-Pacific is projected to post a 7.06% CAGR to 2031, making it the fastest-growing region for Neurothrombectomy devices. Government investment programs in China and India are building neuro-ICU capacity in secondary cities, expanding the addressable patient pool beyond traditional tier-one hospitals. Japan continues to adopt premium thrombectomy platforms under its universal insurance, while South Korea and Australia drive high-end device demand through well-funded national health systems. This diverse yet converging environment elevates Asia-Pacific as a strategic growth frontier, where training partnerships and price-tiered product lines can unlock additional share for global and regional manufacturers.

Europe presents a mature but stable market landscape, with comprehensive reimbursement coverage and established national stroke pathways. Germany's DRG reimbursement specificity delivers predictable economics, and the United Kingdom's NHS integrates thrombectomy into standardized quality metrics. France, Italy, and Spain contribute through academic research that informs pan-European clinical practice. Harmonized CE-mark standards streamline market entry, but economic austerity in certain jurisdictions moderates procedural growth. Overall, steady replacement cycles and an emphasis on outcome-based procurement preserve Europe's contribution to the Neurothrombectomy devices market, even as regional growth rates trail those of Asia-Pacific.

- Medtronic

- Stryker

- Penumbra

- Johnson & Johnson (CERENOVUS)

- Terumo

- MicroPort

- Rapid Medical Ltd.

- Phenox

- Acandis

- Vesalio, LLC

- Control Medical Technology, LLC

- Wallaby Medical

- Zylox-Tonbridge Medical Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing guideline-driven adoption after DAWN/DEFUSE-3 trials

- 4.2.2 Favorable reimbursement expansions in U.S., Germany & Japan

- 4.2.3 Large-bore aspiration catheters reduce procedure time & cost

- 4.2.4 AI-enabled stroke triage broadens eligible patient pool

- 4.2.5 Rapid growth of neuro-ICU beds in tier-2 Chinese & Indian cities

- 4.3 Market Restraints

- 4.3.1 High device & procedure cost in emerging markets

- 4.3.2 Shortage of trained neuro-interventionists outside urban centers

- 4.3.3 Supply-chain vulnerability for nitinol & platinum-iridium alloys

- 4.3.4 Reimbursement delays for posterior-circulation thrombectomies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Device Type (Value)

- 5.1.1 Stent Retrievers

- 5.1.2 Aspiration Catheters

- 5.1.3 Combined Mechanical Thrombectomy Systems

- 5.1.4 Balloon Guide Catheters & Accessory Devices

- 5.2 By End User (Value)

- 5.2.1 Hospitals

- 5.2.2 Specialty Neurosurgery Centers

- 5.2.3 Ambulatory Surgical Centers

- 5.3 By Geography (Value)

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 GCC

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Stryker Corporation

- 6.3.3 Penumbra Inc.

- 6.3.4 Johnson & Johnson (CERENOVUS)

- 6.3.5 Terumo Corporation

- 6.3.6 MicroPort Scientific Corporation

- 6.3.7 Rapid Medical Ltd.

- 6.3.8 Phenox GmbH

- 6.3.9 Acandis GmbH

- 6.3.10 Vesalio, LLC

- 6.3.11 Control Medical Technology, LLC

- 6.3.12 Wallaby Medical

- 6.3.13 Zylox-Tonbridge Medical Technology Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment