PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906184

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906184

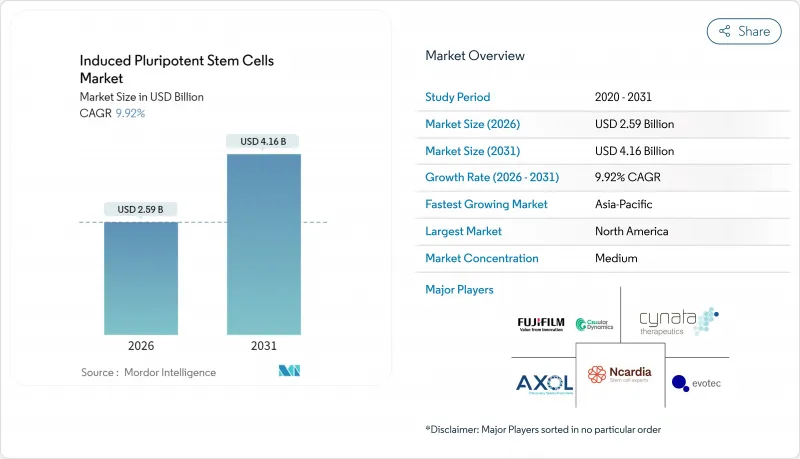

Induced Pluripotent Stem Cells - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

induced pluripotent stem cells market size in 2026 is estimated at USD 2.59 billion, growing from 2025 value of USD 2.36 billion with 2031 projections showing USD 4.16 billion, growing at 9.92% CAGR over 2026-2031.

Gains arise from clinical-grade manufacturing advances, growing therapeutic approvals and increasing regulatory support for cell-based products. North America continues to invest heavily through the National Institutes of Health (NIH) Regenerative Medicine Program, while Japan's expedited review pathway is catalyzing Asia-Pacific growth. Pharmaceutical companies use iPSC models to cut late-stage trial failures, and breakthrough Parkinson's and corneal regeneration trials have validated clinical relevance. Cost-efficient biomanufacturing platforms, artificial-intelligence-enabled quality controls and broader cross-sector consortia further accelerate market momentum.

Global Induced Pluripotent Stem Cells Market Trends and Insights

Increase in global R&D funding for iPSC-based drug discovery

Pharmaceutical pipelines are pivoting toward human iPSC models because the U.S. Food and Drug Administration's 2024 guidance formally accepted these platforms for toxicology submissions, giving developers regulatory clarity. FUJIFILM Cellular Dynamics scaled daily output to billions of cells for drug screens, underscoring industrial demand. Collaborations between contract research organizations and cell-line specialists further widen access to off-the-shelf, QC-tested lines. Venture funding increasingly targets AI-driven image analysis suites that automate culture monitoring, shrinking manual workloads and cycle times. Together, these developments strengthen confidence in the Induced pluripotent stem cells (iPSCs) market as an alternative to animal testing and accelerate time-to-candidate selection.

Growing prevalence of chronic and degenerative diseases spurring regenerative therapy demand

The global aging trend raises incidences of neurodegenerative and metabolic disorders, reshaping healthcare priorities toward curative solutions. Japan's clinical study that transplanted iPSC-derived pancreatic islet cells restored insulin production in type 1 diabetes patients, exemplifying therapeutic promise. Vision-restoration trials using corneal iPSC sheets achieved functional recovery with no rejection episodes, highlighting autologous benefits. Parkinson's disease trials in the United States applied patient-specific iPSCs to replace dopaminergic neurons, demonstrating durable motor improvement. These successes reinforce policy focus on regenerative medicine and sustain long-run expansion of the Induced pluripotent stem cells (iPSCs) market.

Persistently high manufacturing costs and limited scalability of GMP-grade production

Sub-50% utilization at several contract manufacturers signals process inefficiencies that inflate per-dose costs. LineaBio's off-the-shelf GMP lines and OmniaBio's AI-enabled facilities attempt to standardize yields, yet capital intensity remains a hurdle. Until unit costs fall, price-sensitive health systems may restrict reimbursements, tempering near-term adoption.

Other drivers and restraints analyzed in the detailed report include:

- Continuous technological advances in iPSC reprogramming and differentiation platforms

- Increasing pharmaceutical adoption of iPSC models for high-throughput drug screening and toxicity testing

- Complex, evolving global regulatory frameworks for cell-based therapeutics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cardiomyocytes captured 28.62% of total 2025 revenue, positioning them as the anchor for safety pharmacology and nascent heart-repair therapies. This dominance is tied to strict regulatory focus on drug-induced cardiotoxicity and to promising engineered-heart-muscle grafts that restored contractility in primate studies. The Induced pluripotent stem cells (iPSCs) market size for cardiomyocytes is projected to grow steadily in proportion to the expanding pipeline of biologics requiring rigorous cardiac screening. Neurons form the fastest-rising segment, advancing at an 10.96% CAGR as spinal-cord and Parkinson's trials underline disease-modifying capacity. Hepatocytes remain indispensable for microsomal metabolism studies, while fibroblasts and keratinocytes support tissue-repair research in dermal and musculoskeletal fields.

Manufacturing advances underpin wider distribution of functionally mature cardiomyocytes, including automated maturation protocols that align electrophysiology with adult-like phenotypes. Neuronal lineage protocols benefit from refined patterning factors that yield subtype-specific populations suitable for high-content screening. Availability of curated cell banks via the European Bank for Induced Pluripotent Stem Cells assures reproducibility across laboratories. As chemistries to purge undifferentiated cells improve, lot-release hurdles ease, broadening commercial uptake across the Induced pluripotent stem cells (iPSCs) market.

The Induced Pluripotent Stem Cells Market Report is Segmented by Derived Cell Type (Cardiomyocytes, Neurons, Hepatocytes, Fibroblasts, and More), Application (Drug Discovery and Development, Disease Modeling and More), End User (Academic and Research Institutes, Pharmaceutical and Biotechnology Companies and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 37.13% of 2025 revenue, supported by NIH allocations and an active venture-capital ecosystem. Regional hospitals hosted pivotal first-in-human Parkinson's and cardiomyopathy trials, demonstrating translational leadership. The FDA's progressive guidance on alternative methods accelerated uptake of in vitro panels, deepening domestic demand. Despite this, high labor and facility costs prompt firms to outsource certain manufacturing steps to lower-cost jurisdictions.

Asia-Pacific is projected to expand at a 12.14% CAGR to 2031, buoyed by Japan's fast-track approvals and significant sovereign funding. China deploys provincial subsidies for GMP plant construction, while South Korea leverages electronics-grade automation expertise to scale closed-system bioreactors. The Induced pluripotent stem cells market has thus seen cross-border alliances where North American developers license clinical candidates to Japanese partners for rapid path-to-market access.

Europe remains a mature but cautious participant. The European Medicines Agency has issued detailed advanced-therapy guidelines that safeguard patient safety yet prolong dossier preparation. Harmonized test-method consortia, backed by the European Bank for Induced Pluripotent Stem Cells, maintain scientific leadership. However, constrained reimbursement landscapes hinder broad clinical adoption, compelling firms to prioritize proof-of-concept studies.

Emerging regions-including the Middle East, Africa and South America-display pockets of interest, particularly in ophthalmology, but infrastructural gaps and nascent regulation limit immediate commercial scale within the Induced pluripotent stem cells (iPSCs) market.

- FUJIFILM

- Thermo Fisher Scientific

- Takara Bio

- Fate Therapeutics Inc.

- Ncardia BV

- Axol Bioscience

- Cynata Therapeutics Ltd.

- Evotec

- ViaCyte Inc.

- Sumitomo Pharma Co. Ltd.

- Lonza Group

- Century Therapeutics

- BlueRock Therapeutics

- BrainXell Inc.

- Stem Cell Technologies

- Pluricell Biotech

- ReproCELL Inc.

- Applied StemCell Inc.

- Cellular Dynamics International (CDI)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in global R&D funding for iPSC-based drug discovery

- 4.2.2 Growing prevalence of chronic & degenerative diseases spurring regenerative-therapy demand

- 4.2.3 Continuous technological advances in iPSC reprogramming & differentiation platforms

- 4.2.4 Increasing pharmaceutical adoption of iPSC models for high-throughput drug screening & toxicity testing

- 4.2.5 Expansion of cross-sector (academia-industry) consortia accelerating clinical translation

- 4.2.6 Government funding programs and favorable policies supporting regenerative medicine initiatives

- 4.3 Market Restraints

- 4.3.1 Persistently high manufacturing costs and limited scalability of GMP-grade iPSC production

- 4.3.2 Complex, evolving global regulatory frameworks for cell-based therapeutics

- 4.3.3 Safety concerns around genetic instability, tumorigenicity, and long-term efficacy

- 4.3.4 Limited reimbursement pathways and insufficient cost-benefit evidence hindering widespread adoption

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Derived Cell Type

- 5.1.1 Cardiomyocytes

- 5.1.2 Neurons

- 5.1.3 Hepatocytes

- 5.1.4 Fibroblasts

- 5.1.5 Keratinocytes

- 5.1.6 Other Cell Types

- 5.2 By Application

- 5.2.1 Drug Discovery and Development

- 5.2.2 Disease Modeling

- 5.2.3 Toxicity Testing

- 5.2.4 Regenerative Medicine

- 5.2.5 Cell Therapy

- 5.2.6 Tissue Engineering

- 5.2.7 Other Applications

- 5.3 By End User

- 5.3.1 Academic and Research Institutes

- 5.3.2 Pharmaceutical and Biotechnology Companies

- 5.3.3 Contract Research Organizations

- 5.3.4 Hospitals and Specialty Clinics

- 5.3.5 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 FUJIFILM Cellular Dynamics, Inc.

- 6.3.2 Thermo Fisher Scientific, Inc.

- 6.3.3 Takara Bio Inc.

- 6.3.4 Fate Therapeutics Inc.

- 6.3.5 Ncardia BV

- 6.3.6 Axol Bioscience Ltd.

- 6.3.7 Cynata Therapeutics Ltd.

- 6.3.8 Evotec SE

- 6.3.9 ViaCyte Inc.

- 6.3.10 Sumitomo Pharma Co. Ltd.

- 6.3.11 Lonza Group AG

- 6.3.12 Century Therapeutics

- 6.3.13 BlueRock Therapeutics

- 6.3.14 BrainXell Inc.

- 6.3.15 Stemcell Technologies Inc.

- 6.3.16 Pluricell Biotech

- 6.3.17 ReproCELL Inc.

- 6.3.18 Applied StemCell Inc.

- 6.3.19 Cellular Dynamics International (CDI)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment