PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906187

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906187

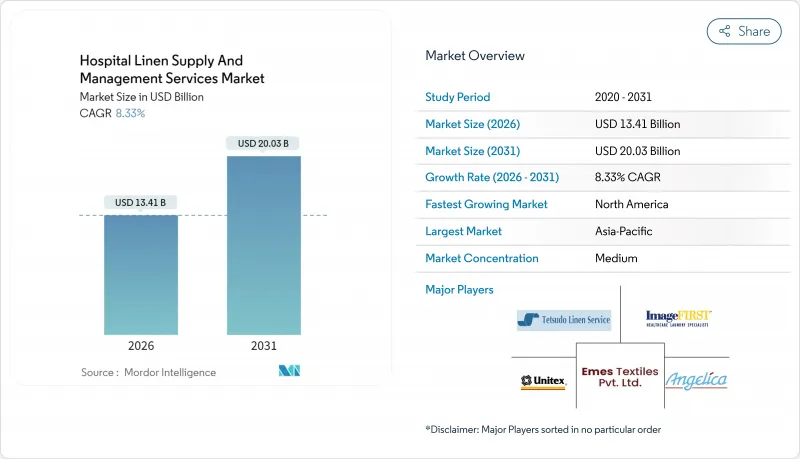

Hospital Linen Supply And Management Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The hospital linen supply and management services market size in 2026 is estimated at USD 13.41 billion, growing from 2025 value of USD 12.38 billion with 2031 projections showing USD 20.03 billion, growing at 8.33% CAGR over 2026-2031.

Persistent infection-control mandates, hospital outsourcing strategies, and demographic shifts in emerging economies underpin this momentum, with private equity-backed roll-ups injecting capital for technology upgrades that lower linen loss by more than 10%. North American providers profit from mature regulatory frameworks and high compliance costs that favor third-party contracts, while Asia-Pacific demand escalates as hospitals add thousands of new beds and medical-tourism volumes keep climbing. Material choices are evolving, with microfiber gaining on woven cotton because of faster drying times and sustainability credentials, even as microplastic scrutiny pressures suppliers to innovate. Meanwhile, volatile cotton and energy prices squeeze operating margins, prompting providers to deploy AI-driven demand-sensing tools that trim par-stock by 20% and offset cost spikes.

Global Hospital Linen Supply And Management Services Market Trends and Insights

Demographic-driven bed-capacity expansion in emerging economies

Rapid hospital construction in Asia-Pacific is escalating demand for professional linen outsourcing as administrators prioritize clinical services. India alone plans to add more than 22,000 private beds within five years, dwarfing additions recorded between FY19-24. Growing lifestyle diseases and a rising middle class underpin this pipeline. The scale of new capacity forces operators to outsource non-core tasks to achieve quicker ramp-up and regulatory compliance. Outsourced providers respond by installing regional mega-laundries that pool loads and exploit route density to keep unit costs down.

Stringent infection-control regulations elevating outsource demand

The Joint Commission's 2024 revision sharpened focus on surface cleanliness while trimming redundant clauses, increasing scrutiny on linen workflows. CDC guidance now requires segregated handling, PPE, and certified processing environments to curb pathogen transmission. U.S. federal rule 38 CFR 51.190 reinforces the obligation, putting executive liability on facility managers. Smaller hospitals struggle with documentation and capital outlays for compliant equipment, prompting a shift toward specialist contracts that bundle validated processes and staff training. Providers leverage compliance dashboards that timestamp every wash cycle, supplying auditable trails that satisfy regulators and insurers alike.

Volatile cotton & energy prices squeezing laundry margins

Cotton demand is climbing slightly faster than population growth, with China, Vietnam, and Bangladesh remaining top importers, amplifying supply-chain swing risk. Premiums on organic and sustainable cotton add cost layers that laundries struggle to pass through under multi-year fixed-price contracts. Meanwhile, natural-gas and electricity spikes erode margin buffers given the high-temperature cycles required for hospital sanitation. Providers respond by renegotiating fuel surcharges and installing heat-recovery systems, yet pricing pressure persists until energy futures stabilize.

Other drivers and restraints analyzed in the detailed report include:

- Digital RFID & IoT tagging enabling >10% linen loss reduction

- Private-equity roll-ups accelerating service quality benchmarks

- Hospital OPEX freezes delaying contract renewals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bed Sheets & Blankets generated the largest revenue pool, commanding 43.12% share of the hospital linen supply and management services market in 2025. Ubiquitous bed-turnover protocols compel hospitals to maintain multiple sets per mattress, driving high replacement cycles and stable contract volumes. Patient Gowns & Apparel represent the fastest-expanding line, set to grow at a 9.05% CAGR to 2031 as day-surgery counts rise and single-use rules tighten.

Infection-prevention programs favor frequent gown changes, boosting demand elasticity beyond census variability. Towels and bath linens see steady pull from long-term care centers, whereas surgical drapes advance with outpatient procedure volumes. Stimulus comes from privacy curtain rotations and blanket-warming programs that heighten patient-comfort metrics, giving providers scope to bundle premium-priced textiles with compliance tracking. RFID tagging now spans most high-turnover items, shrinking stockouts and supporting digital billing workflows that fortify client retention.

The Hospital Linen Supply and Management Services Market Report Segments the Industry Into by Product (Bed Sheet & Pillow Covers, Blanket, Bed Covers, Others), by Material (Woven, Non-Woven), by End User (Hospital, Diagnostic Centers, Standalone Clinics), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). Get Five Years of Historical Data and Five-Year Forecasts.

Geography Analysis

North America retained leadership with 41.88% share in 2025 thanks to entrenched outsourcing culture, rigorous infection-control enforcement, and provider willingness to pay for value-added services. Cintas posted USD 2.61 billion in fiscal Q3 2025 revenue with a 50.6% gross margin, underscoring pricing leverage in this mature region. Aramark's spinoff of Vestis signals strategic focus on specialized uniforms and healthcare linens, validating sustained demand.

Asia-Pacific is the fastest-growing territory at an 11.42% CAGR through 2031, propelled by bed additions exceeding 22,000 in Indian private hospitals and expanding Chinese capacity. Medical-tourism inflows intensify service-quality expectations, pushing providers to adopt western compliance benchmarks and digital tracking. Private-equity inflows fuel plant construction and technology transfer, compressing the gap with developed regions.

Europe remains steady, balancing aging infrastructure with stringent environmental directives that favor laundries boasting water-recovery systems. South America and the Middle East & Africa represent nascent but rising opportunities as healthcare spending grows and accreditation bodies promote standardized linen protocols. Early entrants partnering with local health ministries gain first-mover advantage and secure long-term concessions.

- Cintas Corporation

- Elis SA

- Aramark (Vestis)

- ImageFIRST

- Angelica Corporation

- Unitex Textile Rental

- Crothall Healthcare

- HHS (Hospital Housekeeping Sys.)

- Emerald Textiles

- Alsco Uniforms

- Mission Linen Supply

- Ecotex Healthcare Linen

- HandCraft Services

- Medline Industries

- Crown Health Care Laundry

- ABG Systems

- Oxwash

- LinenMaster

- AbilityOne

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demographic-driven bed-capacity expansion in emerging economies

- 4.2.2 Stringent infection-control regulations elevating outsource demand

- 4.2.3 Digital RFID & IoT tagging enabling >10 % linen loss reduction

- 4.2.4 Private-equity roll-ups accelerating service quality benchmarks

- 4.2.5 ESG-linked water-recycling mandates in hospital laundries

- 4.2.6 AI-powered demand-sensing platforms trimming par-stock by 20 %

- 4.3 Market Restraints

- 4.3.1 Volatile cotton & energy prices squeezing laundry margins

- 4.3.2 Hospital OPEX freezes delaying contract renewals

- 4.3.3 Growing micro-plastic scrutiny on microfiber sheets

- 4.3.4 On-premise robotics lowering outsource appeal for mega-hubs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Bed Sheets & Pillow Cover

- 5.1.2 Patient Gowns & Apparel

- 5.1.3 Towels & Bath Linens

- 5.1.4 Surgical Drapes & Wrappers

- 5.1.5 Blankets

- 5.1.6 Others (Curtains, Cubicle)

- 5.2 By Material

- 5.2.1 Woven Cotton & Blends

- 5.2.2 Non-Woven Disposables

- 5.2.3 Others

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.1.1 Large Hospitals (>500 beds)

- 5.3.1.2 Medium Hospitals (100-499 beds)

- 5.3.1.3 Small Hospitals (<100 beds)

- 5.3.2 Specialty Clinics & ASCs

- 5.3.3 Long-Term Care & Rehab Centers

- 5.3.1 Hospitals

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Cintas Corporation

- 6.3.2 Elis SA

- 6.3.3 Aramark (Vestis)

- 6.3.4 ImageFIRST

- 6.3.5 Angelica Corporation

- 6.3.6 Unitex Textile Rental

- 6.3.7 Crothall Healthcare

- 6.3.8 HHS (Hospital Housekeeping Sys.)

- 6.3.9 Emerald Textiles

- 6.3.10 Alsco Uniforms

- 6.3.11 Mission Linen Supply

- 6.3.12 Ecotex Healthcare Linen

- 6.3.13 HandCraft Services

- 6.3.14 Medline Industries

- 6.3.15 Crown Health Care Laundry

- 6.3.16 ABG Systems

- 6.3.17 Oxwash

- 6.3.18 LinenMaster

- 6.3.19 AbilityOne

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment