PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906190

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906190

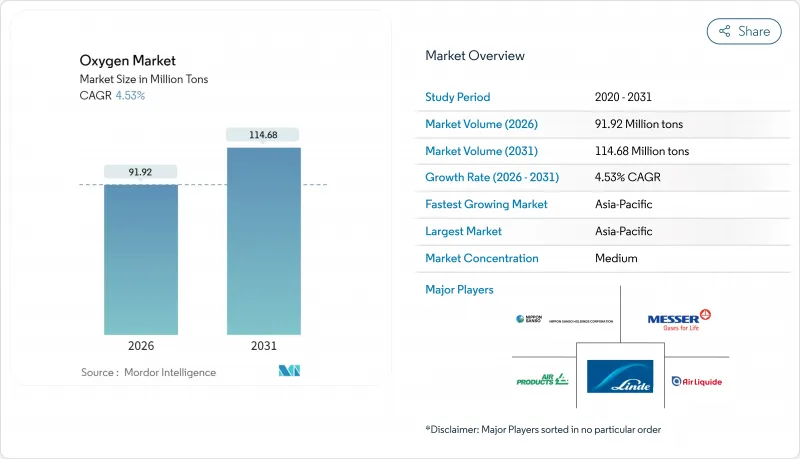

Oxygen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Oxygen Market is expected to grow from 87.93 million tons in 2025 to 91.92 million tons in 2026 and is forecast to reach 114.68 million tons by 2031 at 4.53% CAGR over 2026-2031.

Growing steel output in the Asia-Pacific, modernization of hospital infrastructure, and capacity additions for semiconductor-grade gases collectively underpin expansion. Ultra-high-purity demand in advanced-node chip fabrication and the build-out of clean-hydrogen projects are opening new revenue streams, while energy-efficiency upgrades in cryogenic air-separation units help producers defend margins. The oligopolistic supply structure supports rational pricing and long-term contracts, giving incumbents predictable cash flows.

Global Oxygen Market Trends and Insights

Rising incidence of acute and chronic respiratory disorders

Healthcare systems face mounting pressure as COPD, asthma, and age-related lung diseases grow alongside aging populations. Medical oxygen is a frontline therapy, and demand intensifies when hospitals pivot toward early discharge and home-based respiratory care. Portable concentrators and liquid portable systems help patients remain mobile, supporting adherence to therapy and reducing readmissions. Investments targeting uninterrupted oxygen supply in low- and middle-income nations unlock a sizeable addressable market, prompting equipment suppliers to localize production and training programs. Government and philanthropic financing bridge procurement gaps, accelerating the diffusion of PSA plants and concentrators.

Steel and non-ferrous metal production growth in Asia

Asia-Pacific's broadening steel capacity sustains bulk oxygen off-take, even as China retires inefficient mills. Electric-arc and hydrogen-based direct-reduction routes consume more oxygen per ton than the legacy blast-furnace process, raising intensity of use. Regional diversification toward Vietnam and India reduces single-country risk and stimulates greenfield air-separation investments. New iron-ore discoveries in Western Australia lengthen ore supply horizons, while rising aluminum and copper output in Indonesia and Chile expands non-ferrous demand clusters. Producers deploy oxy-fuel combustion to lift furnace efficiency and cut carbon emissions, keeping the oxygen market on a positive growth curve.

High electricity cost of cryogenic separation units

Power is the single largest operating expense in air-separation plants, and price surges in Europe and parts of Asia squeeze profit margins. Producers hedge partially via multi-year power purchase agreements, but spot-market exposure amplifies volatility. Process-control retrofits and waste-heat recovery deliver incremental efficiency gains yet require capital for modest savings. Some operators explore renewable-powered plants to shield against fossil-fuel price swings, although intermittency challenges persist. Energy-cost pass-through clauses provide limited relief when customers resist frequent price revisions.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of on-purpose hydrogen and oxy-fuel projects

- Hospital shift to PSA micro-plants in emerging markets

- Availability of alternate cutting/fuel gases (LPG, acetylene)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Liquid oxygen held a comparatively smaller share but recorded the swiftest trajectory, advancing at a 4.62% CAGR between 2026 and 2031. Bulk consumers value the expansion ratio that turns cryogenic deliveries into an uninterrupted gaseous supply on site, slashing truck movements and buffer-tank footprints. Investments in insulated ISO containers and telemetry-enabled fleet management shrink boil-off losses, raising distribution efficiency. Hospitals and regional supply depots deploy micro-liquefiers to shorten last-mile routes, enhancing business resilience during supply disruption events. Advancing regulatory frameworks, such as the United States Food and Drug Administration's labeling rule, prioritize safety and traceability for pressurized vessels.

Gaseous supply nonetheless retained an 87.62% foothold in 2025, backed by pipeline networks serving steel, glass, and chemical clusters adjacent to large air-separation complexes. Continuous-flow users prize the simplicity of pipeline ties that remove onsite storage risks. The resulting long-term contracts underpin financing for new plants, cementing the incumbents' presence. Solid oxygen remains confined to aerospace tests and cryogenic research owing to handling complexities. Over the forecast horizon, multiproduct hubs incorporating liquid production, high-pressure tube trailers, and onsite vacuum swing adsorbers will help vendors tailor supply modes to customer scale and purity needs, expanding the oxygen market.

The Oxygen Market Report is Segmented by Form (Gas, Liquid, and Solid), Type (Medical and Industrial), Application (Metals and Mining, Chemical Industry, Oil and Gas, Healthcare, Pharmaceutical, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific commanded 41.45% oxygen market share in 2025 and is positioned to grow at a 5.41% CAGR to 2031. Expanding steel and non-ferrous capacities in India, Vietnam, Indonesia, and semiconductor mega-fabs in South Korea and Taiwan, anchor regional demand clusters. Government-mandated hospital upgrades drive liquid-medical-oxygen consumption, while subsidies for green-hydrogen pilots boost future oxygen off-take. Local regulators, such as Singapore's revised chemical-storage rules effective 2025, compel suppliers to modernize logistics assets, enhancing safety and market professionalism.

Europe focuses on industrial decarbonization, fostering oxy-fuel initiatives and hydrogen-ready direct-reduction lines. The European Union's updated ozone-depleting-substances regulation reinforces the switch to environment-friendly processing gases, indirectly favoring high-purity oxygen. Healthcare systems shift toward home-based chronic-care models, broadening use of portable concentrators. North America remains a sizeable consumer, leveraging embedded pipeline grids and ramp-ups in blue-hydrogen hubs along the Gulf Coast. Air Products' Missouri membrane-solutions expansion illustrates supplier confidence in complementary nitrogen and biogas opportunities that share infrastructure with oxygen.

Latin America and Africa register accelerating hospital and mining investments. Brazil's automotive steel demand and Chile's copper smelters channel steady oxygen flows in South America, while healthcare-funding expansions in Nigeria, Kenya, and Egypt incentivize PSA plant deployments. In the Middle East, state-owned energy companies pursue carbon-capture and enhanced-oil-recovery schemes requiring oxygen injection, offsetting the region's historical concentration on conventional refining. Collectively, these dynamics keep the oxygen market firmly on a diversified regional footing.

- Air Liquide

- Air Products and Chemicals, Inc.

- AIR WATER INC

- Axcel Gases

- Gruppo SIAD

- Guangdong Huate Gas Co., Ltd.

- Gulfcryo

- Hangzhou Oxygen Group Co., Ltd.

- INOX-Air Products Inc.

- International Industrial Gases Ltd

- Iwatani Corporation

- Linde PLC

- Messer SE & Co. KGaA

- NIPPON SANSO HOLDINGS CORPORATION

- Sauerstoffwerk Friedrichshafen GmbH

- SOL Spa

- Steelman Gases Pvt. Ltd.

- Yingde Gas Shanghai

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of acute and chronic respiratory disorders

- 4.2.2 Steel and non-ferrous metal production growth in Asia

- 4.2.3 Expansion of on-purpose hydrogen and oxy-fuel projects

- 4.2.4 Hospital shift to PSA micro-plants in emerging markets

- 4.2.5 Ultra-high-purity O2 demand from advanced-node semiconductors

- 4.3 Market Restraints

- 4.3.1 High electricity cost of cryogenic separation units

- 4.3.2 Availability of alternate cutting/fuel gases (LPG, acetylene)

- 4.3.3 Global shortage of large-bore cryogenic tankers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Form

- 5.1.1 Gas

- 5.1.2 Liquid

- 5.1.3 Solid

- 5.2 By Type

- 5.2.1 Medical

- 5.2.2 Industrial

- 5.3 By Application

- 5.3.1 Metals and Mining

- 5.3.2 Chemical Industry

- 5.3.3 Oil and Gas

- 5.3.4 Healthcare

- 5.3.5 Pharmaceutical

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JVs, Agreements)

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Air Liquide

- 6.4.2 Air Products and Chemicals, Inc.

- 6.4.3 AIR WATER INC

- 6.4.4 Axcel Gases

- 6.4.5 Gruppo SIAD

- 6.4.6 Guangdong Huate Gas Co., Ltd.

- 6.4.7 Gulfcryo

- 6.4.8 Hangzhou Oxygen Group Co., Ltd.

- 6.4.9 INOX-Air Products Inc.

- 6.4.10 International Industrial Gases Ltd

- 6.4.11 Iwatani Corporation

- 6.4.12 Linde PLC

- 6.4.13 Messer SE & Co. KGaA

- 6.4.14 NIPPON SANSO HOLDINGS CORPORATION

- 6.4.15 Sauerstoffwerk Friedrichshafen GmbH

- 6.4.16 SOL Spa

- 6.4.17 Steelman Gases Pvt. Ltd.

- 6.4.18 Yingde Gas Shanghai

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment