PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906192

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906192

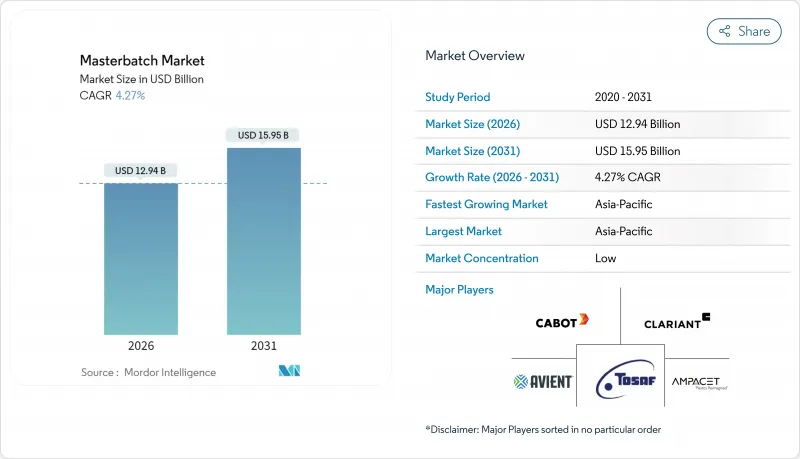

Masterbatch - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Masterbatch market size in 2026 is estimated at USD 12.94 billion, growing from 2025 value of USD 12.41 billion with 2031 projections showing USD 15.95 billion, growing at 4.27% CAGR over 2026-2031.

Growth is supported by sustained demand in packaging, automotive lightweighting, and telecom cable jacketing despite raw-material price swings. Asia Pacific retains leadership in the masterbatch market with a 45% revenue share, helped by rising plastic conversion capacity in China and India. White formulations account for 32% of sales because titanium-dioxide-based opacity and UV protection remain indispensable. Companies are directing R&D budgets toward bio-based carriers, antimicrobial additives, and formulations that improve the performance of recyclate-rich polypropylene, aligning with tightening global waste directives. Competitive intensity is moderate as multinationals focus on sustainable innovation to defend share against cost-driven regional suppliers.

Global Masterbatch Market Trends and Insights

Rising Demand in Plastic Packaging Industry

E-commerce growth and brand owners' quest for shelf differentiation keep packaging the single largest consumer of color and additive concentrates. Food contact regulations in the United States and the European Union are steering converters toward FDA- and EU-compliant grades that ensure color stability and processing efficiency. Antimicrobial and oxygen-barrier variants help extend product life in fresh-food formats, while recyclable carrier systems support circular-economy targets. Clariant and Ampacet offer food-grade solutions that allow processors to achieve consistent color across high-throughput lines while meeting migration limits in the masterbatch market.

Increasing Demand of Plastic in Automotive Industry

Vehicle platforms rely on polypropylene compounds to reduce weight, driving uptake of UV-, scratch- and flame-retardant masterbatches. GRAFE's Base Black series provides deep-black shades, enabling cost-effective interior trim coloration without multiple compounding steps. OEM directives for durability and lower volatile organic compound emissions further strengthen demand for purpose-built additive packages.

Feedstock Cost Volatility Challenges Masterbatch Manufacturers

Titanium dioxide and carbon black prices are prone to cyclical swings that inflate concentrate production costs. Volatility stems from pigment capacity outages, rising energy tariffs, and periodic export restrictions. Producers counter this exposure by dual-sourcing critical pigments, negotiating index-linked contracts, and formulating high-loading concentrates that lower cost per application dose.

Other drivers and restraints analyzed in the detailed report include:

- Fiber-Optic Cable Infrastructure Build-out

- Increased Use in Healthcare and Hygiene Products

- Strict Environmental Regulations Impact Product Development

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

White concentrates captured the largest 31.40% share of masterbatch market size in 2025, underpinned by their critical role in opacity and UV protection. High-purity titanium dioxide delivers brightness and heat stability needed in dairy bottles, caps, and facades. Color masterbatch is expected to post a 4.67% CAGR to 2031 due to premium packaging, consumer electronics, and automotive interiors seeking custom shades with consistent gloss. The black category retains strong demand in conductive and weatherable products, while special-effect formulations gain traction in luxury cosmetics, using pearlescent and metallic pigments for shelf appeal.

Renewed sustainability goals foster white and color solutions based on bio-sourced or recycled carriers. Suppliers are refining dispersion methods that lower titanium dioxide usage yet maintain opacity to manage pigment price pressure. Meanwhile, color developers exploit digital color-matching platforms to replicate brand hues at lower let-down ratios, shortening qualification cycles for new SKUs.

The Masterbatch Market Report Segments the Industry by Type (White Masterbatch, Black Masterbatch, Colour Masterbatch, Additive Masterbatch, and More), Polymer (Polypropylene, Polyethylene, High Impact Polystyrene, and More), End-User Industry (Building & Construction, Packaging, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific accounted for 44.60% of worldwide revenue in 2025 and is forecast to advance at 4.78% CAGR through 2031. Chinese processors lead volume consumption across film, fiber, and automotive parts, while Indian converters scale capacity in flexible packaging and white goods. China leads the regional masterbatch market due to its massive manufacturing base and growing domestic demand, while India is emerging as a significant growth center with expanding plastics processing capacity[2]. Government incentives for electronics manufacturing encourage local sourcing of color additives, increasing regional self-reliance. Rising disposable incomes continue to uplift demand for aesthetically appealing consumer products that rely on high-performance colorants.

North America represents a high-value but mature market characterized by stringent food-contact and automotive standards. The United States dominates regional sales, collaborating closely with compounders to develop concentrates compatible with chemically recycled resins. Canadian packaging firms adopt antimicrobial formulations for meat trays, and Mexican appliance producers specify scratch-resistant black PP compounds for exterior panels.

Europe maintains its reputation for advanced functionality and eco-compliance. Automotive hubs in Germany and Eastern Europe drive steady orders for UV-stable and low-VOC formulations. Upcoming recycled-content mandates in the European Union favor masterbatches designed for closed-loop polypropylene and polyethylene systems. Eastern Mediterranean processors tap into Middle-East feedstock advantages yet face rising pressure to comply with carbon-border adjustment mechanisms.

The Middle East and Africa, while still a smaller contributor, benefit from integrated petrochemical complexes supplying resin and pigment intermediates at competitive costs. Clariant's Saudi facility improves regional availability of color and additive concentrates for pipe, film, and fiber producers . Infrastructure projects in Gulf Cooperation Council countries stimulate demand for flame-retardant and weatherable compounds in electrical conduits and cable jacketing.

- Americhem

- Ampacet Corporation

- Astra Polymers

- Avient Corporation

- Scientific and Production Company "BARS-2"

- BASF

- Cabot Corporation

- Clariant

- Dainichiseika Color and Chemicals Mfg. Co. Ltd.

- Gabriel-Chemie GmbH

- Heubach Group

- Hubron International

- JJPlastalloys

- Penn Color Inc. Masterbatch & Color Concentrates

- Plastiblends

- Plastika Kritis S.A.

- RTP Company

- Samplast Plast

- Shanghai Janton Industrial Co., Ltd

- Sukano

- Tosaf Compounds Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand in Plastic Packaging Industry

- 4.2.2 Increasing Demand of Plastic in Automotive Industry

- 4.2.3 Shift Toward Lightweight Recyclate Rich PP Compounds Boosting White and Filler Masterbatch Usage

- 4.2.4 Fiber Optic Cable Infrastructure Build out Propelling Flame Retardant Masterbatch Demand

- 4.2.5 Increased Use in Healthcare and Hygiene Products

- 4.3 Market Restraints

- 4.3.1 Feedstock Cost Volatility

- 4.3.2 Strict Environmental Regulations

- 4.3.3 Competition from Liquid Colorants

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 White Masterbatch

- 5.1.2 Black Masterbatch

- 5.1.3 Colour Masterbatch

- 5.1.4 Additive Masterbatch

- 5.1.5 Special Effect Masterbatch

- 5.2 By Polymer

- 5.2.1 Polyethylene

- 5.2.2 Polypropylene

- 5.2.3 High Impact Polystyrene

- 5.2.4 Polyvinyl Chloride

- 5.2.5 Polyethylene Terephthalate

- 5.2.6 Others

- 5.3 By End-User

- 5.3.1 Packaging

- 5.3.2 Building and Construction

- 5.3.3 Automotive and Transportation

- 5.3.4 Electrical and Electronics

- 5.3.5 Consumer Goods

- 5.3.6 Agriculture

- 5.3.7 Others (Healthcare, Textile, etc.)

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Americhem

- 6.4.2 Ampacet Corporation

- 6.4.3 Astra Polymers

- 6.4.4 Avient Corporation

- 6.4.5 Scientific and Production Company "BARS-2"

- 6.4.6 BASF

- 6.4.7 Cabot Corporation

- 6.4.8 Clariant

- 6.4.9 Dainichiseika Color and Chemicals Mfg. Co. Ltd.

- 6.4.10 Gabriel-Chemie GmbH

- 6.4.11 Heubach Group

- 6.4.12 Hubron International

- 6.4.13 JJPlastalloys

- 6.4.14 Penn Color Inc. Masterbatch & Color Concentrates

- 6.4.15 Plastiblends

- 6.4.16 Plastika Kritis S.A.

- 6.4.17 RTP Company

- 6.4.18 Samplast Plast

- 6.4.19 Shanghai Janton Industrial Co., Ltd

- 6.4.20 Sukano

- 6.4.21 Tosaf Compounds Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Rising Demand for Biobased Masterbatch