PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906193

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906193

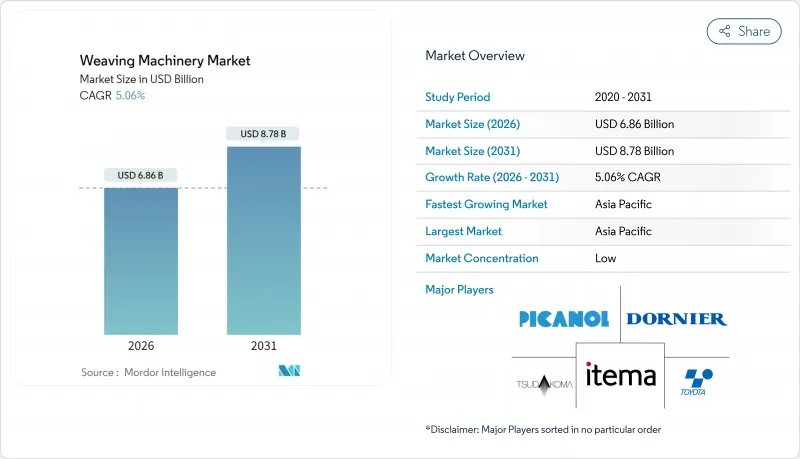

Weaving Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Weaving Machinery Market size in 2026 is estimated at USD 6.86 billion, growing from 2025 value of USD 6.53 billion with 2031 projections showing USD 8.78 billion, growing at 5.06% CAGR over 2026-2031.

Rapid uptake of Industry 4.0 platforms, rising demand for technical and industrial textiles, and policy-driven modernization programs keep capital expenditure robust despite cyclical headwinds. Investments in air-jet and water-jet technologies underpin efficiency gains, while digital-retrofit kits make advanced monitoring affordable for small and medium manufacturers. Regional production shifts toward Asia-Pacific sustain equipment orders, yet European and Japanese suppliers retain technology leadership by bundling IoT dashboards and predictive maintenance services. Volatility in raw-material prices and shortages of skilled operators in developed economies accelerate automation spending as mills target lower waste and higher uptime.

Global Weaving Machinery Market Trends and Insights

Rising Demand for Technical & Industrial Textiles

Technical fabrics for automotive interiors, medical disposables, geotextiles, and protective gear create premium orders for looms that can handle high-performance yarns. India's National Technical Textiles Mission, which cleared 168 projects worth USD 61 million, is a major catalyst. Mills adopt water-jet and air-jet platforms that manage synthetic filament tension with low defect rates. Electronic jacquards cater to intricate patterns needed in filtration and composite fabrics. Suppliers leverage this shift to upsell digital tension-control modules, justifying equipment costs with lower rework and higher margin products. The strong pipeline of infrastructure and medical applications signals sustained demand through the medium term.

Shift Toward Automation & High-Speed Looms (Industry 4.0)

Global manufacturers embed IoT sensors, machine-data interfaces, and edge-analytics boards in new looms to boost output speed and predictive maintenance. Rockwell Automation reports that integrated drive architectures trimmed unscheduled downtime by 20% in pilot mills. Real-time dashboards alert technicians to tension drift and air-pressure anomalies, curbing waste. Modular retrofit kits extend these gains to brownfield sites, expanding the weaving machinery market beyond greenfield builds. Cloud-linked quality vision cameras now spot weft breaks in under one second, preventing roll defects. As labor scarcity grows more acute, high-speed looms paired with automated doffing systems deliver measurable returns on investment across both OECD and emerging economies.

High Capital Investment & Maintenance Costs

Shuttle-less looms typically cost more than USD 500,000 per unit, creating steep financing barriers for micro and small enterprises that represent nearly 80% of India's textile capacity. Banks remain cautious because resale values drop quickly when technology cycles shorten beyond the sticker price, mills budget for annual maintenance contracts, specialized software updates, and training modules that together can reach 8% of acquisition cost. EU Machinery Regulation 2023/1230 adds documentation and cybersecurity expenses to any machine with embedded software. Leasing and vendor-managed-service models partly relieve cash-flow strain but are still nascent in emerging markets. Until depreciation periods lengthen or subsidy pools grow, cost pressures will curb the pace of equipment replacement.

Other drivers and restraints analyzed in the detailed report include:

- Growing Apparel Consumption in Emerging Economies

- Government Incentives for Textile Manufacturing

- Volatile Raw-Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air-jet technology held a 38.35% weaving machinery market share in 2025, thanks to versatility across cotton, blends, and artificial fibers. Customers value its ability to switch styles quickly without major mechanical changes, a critical factor for fashion mills managing weekly order cycles. The weaving machinery market size attributed to air-jet units is set to climb steadily as digital tension-control modules boost speed beyond 1,200 picks per minute without compromising quality. However, water-jet models are projected to grow at a 6.78% CAGR through 2031 by excelling in polyester and nylon processing, where moisture aids filament control. Chinese mills expanding synthetic apparel output adopt water-jet lines to achieve higher fabric luster and reduced yarn breakage. Rapier systems maintain a loyal base in home textiles and wool blends, where yarn variety demands gentle weft transfer. Projectile and shuttle formats stay relevant for decor fabrics requiring dense weaves, though their replacement cycle lengthens as niche demand stabilizes.

Air-jet suppliers increasingly bundle IoT starter packs that record airflow consumption and predict nozzle wear, enhancing competitive positioning against emerging Asian vendors. Retrofit kits extend these analytics to rapier lines, enlarging the total addressable aftermarket. Water-jet manufacturers invest in closed-loop filtration systems to comply with stricter wastewater norms, addressing a perceived barrier in Europe. Regional machine-tool alliances enable localized service networks, a decisive factor for mills in Vietnam and Bangladesh that cannot afford prolonged downtime. As synthetic fiber consumption grows faster than natural fibers, water-jet's speed advantage and fabric finish quality are expected to erode air-jet's dominance marginally, yet both platforms will co-exist in multi-line factories optimizing for yarn mix and order profile.

The Weaving Machinery Market Report is Segmented by Machine Type (Shuttle Loom, Rapier Loom, Air-Jet Loom, Water-Jet Loom, and More), by Shedding/Patterning (Cam, Dobby and Jacquard), by Application (Apparel & Fashion, Home Textiles & Upholstery, Automotive Textiles, and More), and by Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific captured 52.05% of 2025 revenue and is forecast to grow at a 5.47% CAGR through 2031 as governments bankroll modernization programs and brands localize sourcing. India's combined allocation of USD 1.48 billion across PLI, ATUFS, and the National Technical Textiles Mission directly subsidizes air-jet and rapier purchases, compressing payback to under four years for many mills. China maintains leadership in synthetic filament weaving, with regional provinces offering tax rebates on high-speed equipment that meets digital-connectivity standards. Vietnam, Indonesia, and Bangladesh attract foreign direct investment as brands diversify supply chains, stimulating multi-line greenfield plants that standardize on IoT-ready hardware.

Europe holds a smaller yet technologically sophisticated share, anchored by Germany, Italy, and Spain. The EU Machinery Regulation 2023/1230 compels mills to invest in compliant, cyber-secure looms, creating replacement demand despite modest consumption growth. VDMA member firms capture much of this spend by integrating safety-PLC architectures and noise-attenuation kits. Reshoring of premium fashion production to Portugal and France further boosts demand for flexible, short-run machines. Eastern European players in Poland and Romania leverage EU cohesion funds to install water-jet lines dedicated to recycled polyester, aligning with Green Deal priorities.

North America emphasizes technical and defense textiles, leveraging nearshoring strategies that favor mills in Mexico's Bajio region and the U.S. Southeast. Government procurement of protective equipment maintains baseline orders, while automotive seat-fabric contracts spur high-density weaving upgrades. South America experiences steady apparel and home-textile growth, with Brazil modernizing older shuttle fleets via blended-finance mechanisms. Middle East and Africa remain nascent but strategic, driven by Turkey's bridging role and Saudi Arabia's Vision 2030 diversification that earmarks funds for textile clusters. Collectively, these varied regional trajectories secure a broad demand base for the weaving machinery market.

- Picanol

- Itema S.p.A.

- Toyota Industries

- Dornier GmbH

- Tsudakoma Corp.

- Staubli Group

- SMIT Textile Machinery

- Van de Wiele

- Bonas

- Rieter

- Trutzschler

- Oerlikon

- J P Extrusiontech

- Jingwei

- Erfangji

- Zhejiang Tongda Textile Machinery

- Qingdao Tianyi Red Flag Machinery

- Lakshmi Machine Works

- Benninger AG

- Yantra Looms

- Cyber Mill

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for technical & industrial textiles

- 4.2.2 Shift toward automation & high-speed looms (Industry 4.0)

- 4.2.3 Growing apparel consumption in emerging economies

- 4.2.4 Government incentives for textile manufacturing

- 4.2.5 Adoption of digital-twin optimisation for looms

- 4.2.6 Demand for recycled-fibre capable weaving lines

- 4.3 Market Restraints

- 4.3.1 High capital investment & maintenance costs

- 4.3.2 Volatile raw-material prices

- 4.3.3 Skilled-operator shortage for advanced looms

- 4.3.4 Noise & vibration compliance costs in OECD markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Insights on the Global Textile Market

- 4.9 Impact of Geopolitical Events on Supply Chains

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Machine Type

- 5.1.1 Shuttle Loom

- 5.1.2 Rapier Loom

- 5.1.3 Air-Jet Loom

- 5.1.4 Water-Jet Loom

- 5.1.5 Projectile Loom

- 5.1.6 Others (Circular Loom, Narrow-fabric looms, Auxiliaries)

- 5.2 By Shedding / Patterning

- 5.2.1 Cam (Tappet)

- 5.2.2 Dobby (Mechanical, Electronic)

- 5.2.3 Jacquard (Electronic; Stitch Density/Number of Hooks)

- 5.3 By Application

- 5.3.1 Apparel & Fashion

- 5.3.2 Home Textiles & Upholstery

- 5.3.3 Automotive Textiles

- 5.3.4 Industrial, Technical & Filtration Textiles

- 5.3.5 Others (labesl, tapes, etc.)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Kuwait

- 5.4.5.5 Turkey

- 5.4.5.6 Egypt

- 5.4.5.7 South Africa

- 5.4.5.8 Nigeria

- 5.4.5.9 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)}

- 6.4.1 Picanol

- 6.4.2 Itema S.p.A.

- 6.4.3 Toyota Industries

- 6.4.4 Dornier GmbH

- 6.4.5 Tsudakoma Corp.

- 6.4.6 Staubli Group

- 6.4.7 SMIT Textile Machinery

- 6.4.8 Van de Wiele

- 6.4.9 Bonas

- 6.4.10 Rieter

- 6.4.11 Trutzschler

- 6.4.12 Oerlikon

- 6.4.13 J P Extrusiontech

- 6.4.14 Jingwei

- 6.4.15 Erfangji

- 6.4.16 Zhejiang Tongda Textile Machinery

- 6.4.17 Qingdao Tianyi Red Flag Machinery

- 6.4.18 Lakshmi Machine Works

- 6.4.19 Benninger AG

- 6.4.20 Yantra Looms

- 6.4.21 Cyber Mill

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment