PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906194

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906194

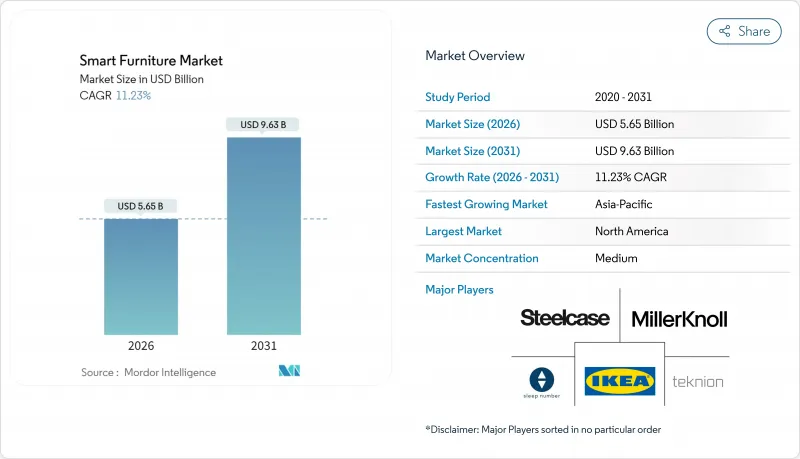

Smart Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Smart Furniture Market was valued at USD 5.08 billion in 2025 and estimated to grow from USD 5.65 billion in 2026 to reach USD 9.63 billion by 2031, at a CAGR of 11.23% during the forecast period (2026-2031).

Rising consumer expectations for connected living spaces, corporate demand for flexible workplaces, and the falling cost of embedded sensors are combining to sustain double-digit expansion. As home automation platforms mature, connected tables, beds, and storage units increasingly act as integration nodes for lighting, entertainment, and environmental controls. Corporations are also refurbishing offices with sensor-equipped desks and chairs that monitor occupancy, posture, and energy consumption to justify real-estate savings. Wider availability of sustainable materials and standardized IoT protocols is lowering entry barriers for mid-tier suppliers while giving premium brands room to differentiate through software updates and data services. Growing regulatory scrutiny around cybersecurity is nudging manufacturers toward privacy-by-design architectures that can earn consumer trust without eroding functionality. Together these forces are expected to keep the smart furniture market on a steady growth trajectory throughout the decade.

Global Smart Furniture Market Trends and Insights

IoT-enabled Smart Home Ecosystems

Interoperability standards such as Matter are propelling the shift from isolated devices toward unified home networks that treat furniture as data-rich nodes. IKEA's DIRIGERA hub now bridges into Samsung SmartThings, preserving device-specific functionality while enabling broader automations . Embedded sensors are beginning to support predictive maintenance, flagging hinge fatigue or fabric wear before they trigger warranty claims. Voice assistants embedded in side tables allow occupants to modulate lighting, temperature, and media without reaching for a separate controller. Manufacturers are also exploring edge AI chips that keep routine data processing on-device, cutting latency and allaying privacy concerns. As smart speakers turn into ambient computing interfaces, demand is rising for furniture that hides cables, integrates microphones, and offers acoustic dampening without compromising style. The result is a cohesive user experience that advances the smart furniture market as an integral layer of the connected-home stack.

Flexible Working & Home-Office Demand

Hybrid work has become the default scheduling model for much of the corporate world, spurring companies to redesign space for utilization levels hovering near 30% in 2024 . Height-adjustable desks with occupancy sensors allow facilities teams to reassign under-used workstations in real time. Employee-facing reservation apps interface with desk hardware so that lighting, sit-stand presets, and temperature follow an individual from one touchdown space to the next. Furniture suppliers are bundling APIs that stream utilization data into workplace-analytics dashboards, helping executives rationalize leases by floor rather than entire buildings. For remote staff, consumer demand has migrated from ad-hoc laptop stands to fully integrated sit-stand desks with cable management, wireless charging pads, and biometric login modules. The convergence of aesthetic-first home decor and enterprise-grade ergonomics is creating cross-channel opportunities that reinforce growth across both the residential and corporate portions of the smart furniture market.

High Upfront Cost vs. Traditional Furniture

Smart desks and chairs often retail at two to three times the price of analog equivalents, a gap that narrows slowly even as sensor costs decline. Integration work-from concealed wiring to embedded firmware-adds labor hours that smaller workshops cannot amortize over large production runs. Price sensitivity is most acute in emerging economies where discretionary income limits put basic comfort ahead of data-driven wellness features. Installment-payment programs from large retailers show promise but remain rare outside North America. Leasing models help corporate customers sidestep capital-budget hurdles yet introduce longer payback timelines that can delay adoption cycles. Until economies of scale push premium features into entry ranges, sticker shock is likely to shave points off the smart furniture market CAGR in price-constrained regions.

Other drivers and restraints analyzed in the detailed report include:

- Wellness-Focused Ergonomic Solutions

- Declining Cost of Sensors & Connectivity

- Data-Privacy & Cybersecurity Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Home furniture generated 66.98% of revenue in 2025, reflecting deep integration between smart beds, adjustable desks, and voice-assisted side tables in modern households. The segment is projected to compound at 12.05% through 2031, outstripping every other application cohort and reinforcing the central role of the home in shaping the smart furniture market. Monetizable data streams-ranging from sleep analytics subscriptions to predictive-maintenance alerts-are pushing vendors beyond a one-off sales mentality toward recurring-revenue models. Office furniture remains the second-largest application as employers tie procurement budgets to measurable gains in workspace utilization and employee wellbeing. Hospitality players are experimenting with guest-controlled ambiance furniture that lifts room-rate premiums, while educational and healthcare facilities adopt sensor-enabled fixtures to optimize space rotation and patient comfort.

The expansion of furniture-as-an-experience is most evident in bedrooms, where AI-driven mattresses calibrate temperature and firmness nightly and curate white-noise playlists based on historical sleep-stage data. Living-room coffee tables now integrate Qi-charging pads and display panels, turning passive surfaces into interactive hubs for family activity management. In the office subset, desks that remember each employee's standing height and lighting preference are becoming standard issue, and conference tables ship with beamforming microphones and occupancy analytics. Higher-education institutions pilot "smart lecture halls" furnished with chairs that sense butt-off events to auto-adjust HVAC zones, thereby reducing energy bills. Hospitals fit maternity wards with smart recliners that map pressure points to avert bedsores.

The Smart Furniture Market Report is Segmented by Application (Home Furniture, Office Furniture, Hospitality Furniture, Educational Furniture, Healthcare Furniture, Other Applications), Material (Wood, Metal, Plastic & Polymer, Other Materials), Distribution Channel (B2C/Retail, B2B/Project), and Geography (North America, South America, Europe, and Other). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led revenue with 36.25% in 2025, powered by early consumer adoption of smart speakers, robust 5G rollouts, and corporate wellness budgets that fund data-rich desks and chairs. State-level IoT security statutes, including California's SB-327, require baseline protections that increase buyer confidence without stifling innovation. Retailers leverage unified logistics networks to offer same-day delivery and on-site assembly, a convenience factor that accelerates conversion for bulky goods. Venture funding for home-automation start-ups continues to funnel new ideas into partnership pipelines with established furniture makers.

Asia-Pacific is set to expand at a 11.85% CAGR, reflecting a confluence of urban densification, rising disposable income, and local manufacturing advantages. Chinese factories are rolling out IoT-enabled production lines that slash unit costs and expedite mass customization runs. Domestic e-commerce giants integrate voice-assistant ecosystems that push connected furniture bundles during shopping festivals, exposing millions of new households to smart living concepts in a single day. India's booming sleep-economy campaigns invest sharply in advertising to promote AI-driven mattresses that promise personalized comfort profiles. Japanese consumer affinity for compact multifunctional furniture aligns neatly with robotics-powered transformable designs that free up floor space in micro-apartments.

Europe maintains a steady mid-single-digit trajectory anchored by strong sustainability regulations and circular-economy incentives that reward furniture with modular components and upgrade paths. The forthcoming Cyber Resilience Act is poised to mandate security-by-design and multi-year firmware-support commitments, favoring manufacturers that can absorb compliance costs early. Furniture-as-a-Service subscriptions are gaining traction among corporations that must align office footprints with volatile hybrid-attendance patterns, a circumstance that boosts recurring revenue potential for adaptive desks and seating solutions. Consumer demand skews toward eco-certified wood and biopolymer composites, driving innovation around recyclable and low-VOC finishes. Logistics networks optimized for cross-border e-commerce deliveries expand reach from dense urban centers to suburban locales without eroding delivery speed. Overall, Europe presents a balanced mix of regulatory rigor and environmental consciousness, providing fertile ground for sustainable, secure offerings within the smart furniture market.

- IKEA (Ingka Group)

- Steelcase Inc.

- MillerKnoll Inc.

- Sleep Number Corporation

- Teknion Corporation

- Haworth Inc.

- Herman Miller Healthcare

- OKIN Refined Electric Technology

- Hi-Interiors Srl

- Ori Living Inc.

- Nitori Holdings Co. Ltd

- Bumblebee Spaces

- DeRUCCI Smart Sleep

- Kettal

- Shenzhen Gujia Smart Furniture

- Inter IKEA Systems B.V.

- Fursys Inc.

- UE Furniture

- La-Z-Boy Inc.

- HNI Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 IoT-enabled smart home ecosystems

- 4.2.2 Flexible working & home-office demand

- 4.2.3 Wellness-focused ergonomic solutions

- 4.2.4 Declining cost of sensors/connectivity

- 4.2.5 Wireless charging surfaces for micro-mobility

- 4.2.6 Furniture-as-a-Service in co-living spaces

- 4.3 Market Restraints

- 4.3.1 High upfront cost vs. traditional furniture

- 4.3.2 Data-privacy & cybersecurity concerns

- 4.3.3 Interoperability gaps with building systems

- 4.3.4 Limited lifecycle service & firmware-update support

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

- 4.8 Insights on Regulatory Framework and Industry Standards for the Global Smart Furniture Industry in Key Geographies

5 Market Size & Growth Forecasts

- 5.1 By Application

- 5.1.1 Home Furniture

- 5.1.1.1 Smart Chairs

- 5.1.1.2 Smart Beds

- 5.1.1.3 Smart Sofas

- 5.1.1.4 Smart Tables

- 5.1.1.5 Smart Wardrobes

- 5.1.2 Office Furniture

- 5.1.2.1 Smart Chairs

- 5.1.2.2 Smart Desks & Tables

- 5.1.2.3 Smart Storage Cabinets

- 5.1.2.4 Smart Soft Seating

- 5.1.3 Hospitality Furniture

- 5.1.4 Educational Furniture

- 5.1.5 Healthcare Furniture

- 5.1.6 Other Applications

- 5.1.1 Home Furniture

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Other Materials

- 5.3 By Distribution Channel

- 5.3.1 B2C / Retail

- 5.3.1.1 Home Centers

- 5.3.1.2 Specialty Furniture Stores

- 5.3.1.3 Online

- 5.3.1.4 Other Retail Channels

- 5.3.2 B2B / Project

- 5.3.1 B2C / Retail

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX

- 5.4.3.7 NORDICS

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South-East Asia

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East & Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 IKEA (Ingka Group)

- 6.4.2 Steelcase Inc.

- 6.4.3 MillerKnoll Inc.

- 6.4.4 Sleep Number Corporation

- 6.4.5 Teknion Corporation

- 6.4.6 Haworth Inc.

- 6.4.7 Herman Miller Healthcare

- 6.4.8 OKIN Refined Electric Technology

- 6.4.9 Hi-Interiors Srl

- 6.4.10 Ori Living Inc.

- 6.4.11 Nitori Holdings Co. Ltd

- 6.4.12 Bumblebee Spaces

- 6.4.13 DeRUCCI Smart Sleep

- 6.4.14 Kettal

- 6.4.15 Shenzhen Gujia Smart Furniture

- 6.4.16 Inter IKEA Systems B.V.

- 6.4.17 Fursys Inc.

- 6.4.18 UE Furniture

- 6.4.19 La-Z-Boy Inc.

- 6.4.20 HNI Corporation

7 Market Opportunities & Future Outlook

- 7.1 AI-Integrated Furniture for Personalized Comfort & Productivity

- 7.2 Health-Monitoring Smart Beds and Ergonomic Workstations