PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906195

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906195

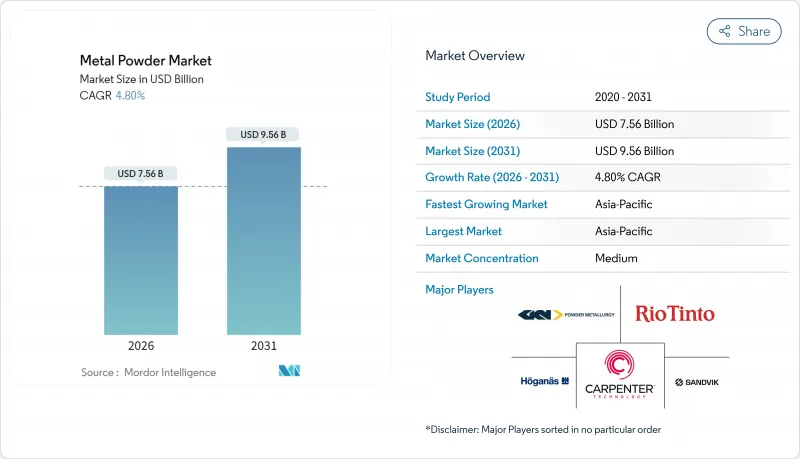

Metal Powder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Metal Powder Market size in 2026 is estimated at USD 7.56 billion, growing from 2025 value of USD 7.21 billion with 2031 projections showing USD 9.56 billion, growing at 4.8% CAGR over 2026-2031.

Demand is anchored in automotive electrification, aerospace modernization, and the industrialization of additive manufacturing, which together create a broad pull for powders ranging from low-alloy iron grades to bespoke nickel- and titanium-based compositions. Light-weighting programs in vehicles and aircraft, the proliferation of electric drive trains, and the rising adoption of 3D-printed structural parts keep consumption on an upward track. At the same time, powder makers face raw-material price swings and tightening environmental rules that boost compliance costs yet also spur investments in cleaner atomization technologies. Competitive momentum is tilting toward suppliers that can flex between high-volume press-and-sinter contracts and low-volume, high-margin additive jobs, reinforcing the need for process diversity.

Global Metal Powder Market Trends and Insights

Light-weighting Push in Auto & Aero Sectors

Automotive OEMs continue to cut vehicle mass to extend electric-vehicle range and meet Euro 7 brake-emission norms, prompting broader uptake of high-density ferrous and aluminum powders designed for soft-magnetic composites. ArcelorMittal's newly developed steel powders target low-emission braking systems, while NASA and Plansee AG's TiAl sheet program shows aviation's pivot toward 25-35% weight savings over legacy Ni-base superalloys. North American shipments underscore the trend, with 70% of ferrous powder tonnage tied to automotive orders, even as aerospace alloys command premium pricing in turbine disk and structural bracket applications.

Surge in Additive Manufacturing Adoption

The metal powder market is increasingly shaped by additive manufacturing, which demands highly spherical, flow-stable powders. Nano Dimension's agreement to acquire Desktop Metal consolidates a USD 246 million revenue base devoted to powder-bed fusion and binder-jet technologies. Tekna has commercialized coarse Ti64 fractions tailored for 60 µm and 90 µm layers to cut build times in aerospace prototypes. DOE-backed AMAZEMET rePowder converts irregular reclaimed metal into spherical feedstock, widening the usable scrap pool. Hoganas' CustomAM platform, combining plasma and nitrogen atomization, lets medical-implant designers scale bespoke powders from lab batches to tons. ASTM and ASME qualification workstream signals the maturing of powder specifications for safety-critical nuclear parts.

Occupational & Environmental Hazards

OSHA combustible-dust guidelines mandate extensive ventilation, worker training, and documentation for metal-powder sites, lifting both capital and operating spend. NFPA is transitioning multiple documents into the unified NFPA 660 standard to cover handling, finishing, and recycling of combustible metals. EPA effluent limits now require filtration on abrasive blasting plus dust minimization during grinding, while powder-coating booths must install continuous-duty sprinklers to address flash-fire risk. Collectively, these rules constrain capacity expansions in regions with stringent enforcement and speed the shift toward closed-loop, low-emission atomizers.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand for Electronics Miniaturization

- Growing Demand for Renewable-Energy Components

- Raw-Material Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Iron powders carried 43.46% of metal powder market share in 2025, aided by entrenched use in automotive synchronizers, gears, and structural parts. Volumetric heft still stems from press-and-sinter ferrous grades, supported by Pacific Metals' 15,000 t/month stainless capacity. Specialty alloys, however, claim faster growth at 5.55% CAGR through 2031 as aerospace, medical, and defense programs specify titanium, nickel, and refractory blends for elevated strength-to-weight ratios. IperionX's USD 47.1 million DoD contract to deploy Hydrogen-Assisted Metallothermic Reduction validates US ambitions for a native titanium supply chain. Hindalco's USD 10 billion aluminum build-out, including a 200,000 TPA Odisha smelter step-up, ensures capacity for electric-vehicle housings and renewable-energy cabling.

The interplay of commodity iron economics and premium alloy pricing encourages powder makers to balance output portfolios. Suppliers widen grade catalogs with pre-alloyed feeds that reduce post-press blending, improving mechanical consistency. In turn, downstream users gain repeatability essential for safety-critical parts, keeping the metal powder market in structural transition toward higher-margin mix.

Atomization retained 69.10% revenue in 2025, as gas, water, and plasma routes satisfy divergent flowability and purity demands. VDM Metals' new vacuum inert gas atomizer demonstrates ongoing capital deployment to secure aerospace-grade outputs for superalloy powder-bed fusion. Hydrometallurgical processing, while only a 5.2% CAGR pocket, recovers zinc-rich residues and nickel-bearing sludges, dovetailing with circular-economy targets.

Emergent techniques tighten particle-size bands and cut energy use. Metal Powder Works converts barstock into uniform chips without melting, trimming scrap rates and carbon footprints. Electrode-induction gas atomization yields finer spheres than legacy vacuum induction, opening new territories for ultra-thin printable layers. Meanwhile, electrolysis and reduction processes keep niche footholds for high-purity powders required in hard-facing and brazing pastes.

The Metal Powder Market Report is Segmented by Type (Iron, Bronze, Aluminum, and More), Process (Atomization, Reduction of Compounds, and More), Manufacturing Method (Press and Sinter, and More), End-User Industry (Transportation, Electrical and Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 44.05% revenue in 2025 and is projected to post the fastest 5.3% CAGR to 2031. China's copper-cathode output grew 14.27% year on year, and aluminum production rose 2.6%, underscoring resource depth. India widens capacity through JSW Steel's USD 7.8 billion Odisha complex plus a USD 660 million electrical-steel joint venture with JFE that adds 30,000 jobs. Japan and South Korea sustain electronics and precision machining leadership, while regional policy favors infrastructure investment and recycling ventures exemplified by Mitsui's stake in MTC Business.

North America shows steady, innovation-driven orders. IperionX's titanium contract secures strategic autonomy, while GE Aerospace's additive build-out clusters powder demand near jet-engine assembly hubs. Canada supplies nickel and cobalt concentrates, and Mexico remains integral for gearbox and transmission powder parts shipped into US OEM programs.

Europe balances stringent emissions rules with high-value manufacturing. Finland's hydrogen-DRI plant signals a low-carbon future for steel powders. Germany funds lightweight drivetrain powder research; France pushes turbine-blade HIP programs. Hoganas documents a 46% drop in scope 1+2 carbon since 2018, shifting 51% of feedstock to secondary streams. Central and Eastern Europe host automotive tier-2 sintering hubs, while the UK advances aerospace additive standards.

South America, the Middle East, and Africa remain emergent. Brazil's iron-ore reserves support sinter-base powders, yet infrastructure gaps slow additive uptake. Gulf nations eye hydrogen and solar investments that may translate into demand for specialty alloy powders. African states explore battery-metal mining, though logistics and policy stability condition investment timelines.

- Advanced Technology & Materials Co., Ltd.

- Alcoa Corporation

- ATI

- Aubert & Duval

- BASF

- CNPC Powder

- CRS Holdings, LLC.

- Erasteel

- GKN Powder Metallurgy

- H.C. Starck Tungsten GmbH

- Hitachi High-Tech India Private Limited

- Hoganas AB

- JFE Steel Corporation

- Kymera International

- Metalysis Ltd.

- Polema

- Linde Plc

- Outokumpu

- Rio Tinto Metal Powders

- Sandvik AB

- Seiko Epson Corporation

- Tekna

- Valimet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Light-weighting push in auto & aero sectors

- 4.2.2 Surge in additive manufacturing adoption

- 4.2.3 Increasing demand for electronics miniaturization

- 4.2.4 Growing demand for renewable-energy components

- 4.2.5 Increasing requirement for defense hypersonics alloy demand

- 4.3 Market Restraints

- 4.3.1 Occupational & environmental hazards

- 4.3.2 Raw-material price volatility

- 4.3.3 Powder consistency limits in critical parts

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 Type

- 5.1.1 Iron

- 5.1.2 Bronze

- 5.1.3 Aluminum

- 5.1.4 Silicon

- 5.1.5 Nickel

- 5.1.6 Other Types (Titanium, etc.)

- 5.2 Process

- 5.2.1 Atomization

- 5.2.2 Reduction of Compounds

- 5.2.3 Electrolysis

- 5.2.4 Other Processes (Hydrometallurgical Routes, etc.)

- 5.3 Manufacturing Method

- 5.3.1 Press and Sinter (Conventional PM)

- 5.3.2 Metal Injection Molding

- 5.3.3 Additive Manufacturing / 3D Printing

- 5.3.4 Other Methods (Hot Isostatic Pressing, etc.)

- 5.4 End-User Industry

- 5.4.1 Transportation

- 5.4.2 Electrical and Electronics

- 5.4.3 Medical

- 5.4.4 Chemical and Metallurgical

- 5.4.5 Defense

- 5.4.6 Construction

- 5.4.7 Other End-User Industries (Additive Manufacturing Service Bureaus, etc.)

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Thailand

- 5.5.1.6 Indonesia

- 5.5.1.7 Vietnam

- 5.5.1.8 Malaysia

- 5.5.1.9 Philippines

- 5.5.1.10 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Turkey

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Egypt

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 Advanced Technology & Materials Co., Ltd.

- 6.4.2 Alcoa Corporation

- 6.4.3 ATI

- 6.4.4 Aubert & Duval

- 6.4.5 BASF

- 6.4.6 CNPC Powder

- 6.4.7 CRS Holdings, LLC.

- 6.4.8 Erasteel

- 6.4.9 GKN Powder Metallurgy

- 6.4.10 H.C. Starck Tungsten GmbH

- 6.4.11 Hitachi High-Tech India Private Limited

- 6.4.12 Hoganas AB

- 6.4.13 JFE Steel Corporation

- 6.4.14 Kymera International

- 6.4.15 Metalysis Ltd.

- 6.4.16 Polema

- 6.4.17 Linde Plc

- 6.4.18 Outokumpu

- 6.4.19 Rio Tinto Metal Powders

- 6.4.20 Sandvik AB

- 6.4.21 Seiko Epson Corporation

- 6.4.22 Tekna

- 6.4.23 Valimet

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment

- 7.2 Increasing Developments in Healthcare Industries