PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906196

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906196

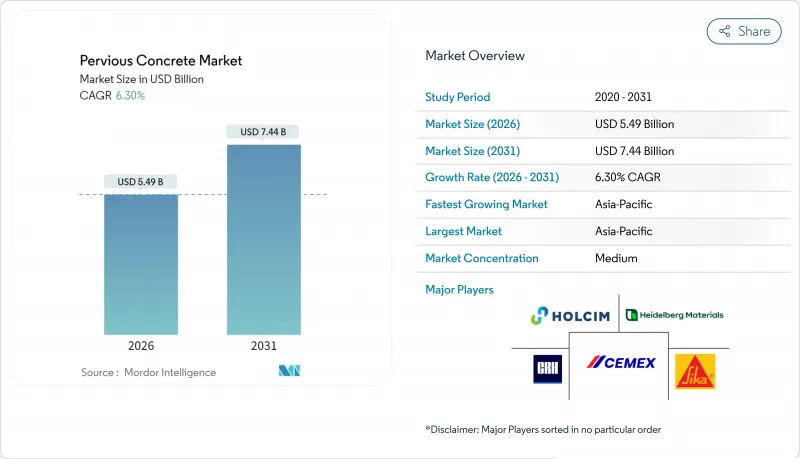

Pervious Concrete - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Pervious Concrete market size in 2026 is estimated at USD 5.49 billion, growing from 2025 value of USD 5.16 billion with 2031 projections showing USD 7.44 billion, growing at 6.3% CAGR over 2026-2031.

Rising urban flash-flood events, mandatory low-impact-development (LID) codes, and corporate commitments to sustainable construction underpin steady demand for pervious concrete across residential, commercial, and public infrastructure projects. Municipal tax incentives and sponge-city programs further accelerate adoption, while advances in mix design and polymer modification are widening the material's structural use cases. Competitive intensity remains moderate as multinational cement producers integrate permeable solutions into low-carbon portfolios and regional contractors invest in specialized placement equipment. Supply-side challenges, such as chiefly skilled-labor shortages and aggregate scarcity in megacities, continue to temper growth prospects but have not derailed the broader upward trajectory of the pervious concrete market.

Global Pervious Concrete Market Trends and Insights

Growing Urban Flash-Flood Incidents

Municipalities increasingly deploy pervious concrete to manage stormwater at its source, thereby reducing peak flows that overload aging sewer networks. The material's ability to infiltrate up to 8 gallons per square foot per minute lowers runoff volumes during cloudbursts, as evidenced by sponge-city projects that now exceed 10 000 installations across Chinese metropolitan areas. Escalating precipitation intensities linked to climate change enhance the value proposition by turning pavements into active drainage assets rather than passive surfaces. Local governments favor the dual-functionality of pervious concrete because it consolidates pavement and stormwater infrastructure into one capital outlay. Proven field performance in moderate-rainfall climates further cements its status as a cost-effective alternative to oversized gray-infrastructure pipes.

Mandatory Low-Impact-Development (LID) Zoning Codes

Regulatory momentum is shifting permeable pavements from optional sustainability features to prescriptive requirements. Los Angeles' 2024 LID Ordinance obliges sites adding or replacing large impervious expanses to meet on-parcel retention targets, positioning pervious concrete as a turnkey compliance pathway. New York City's Unified Stormwater Rule pursues a retention-first hierarchy that equally elevates the material within broader green-infrastructure frameworks. Developers gravitate toward pervious concrete because it satisfies multiple mandates-stormwater, heat-island mitigation, and LEED credits-within one specification. As more jurisdictions draft parallel codes, forecast visibility for the pervious concrete market strengthens through the end of the decade.

Need for Certified Contractors and Specialized Placement Equipment

Successful installations rely on maintaining correct void ratios and uniform compaction, tasks that differ markedly from conventional concrete practice. The NRMCA's certification framework ensures quality but restricts the pool of qualified installers, especially in emerging markets where training resources are thin. Specialized roller screeds and pavement testers elevate start-up costs for contractors, slowing capacity expansion even in regions with strong policy tailwinds. This talent and equipment bottleneck imposes project scheduling risks and can inflate bid prices, dampening near-term growth in the pervious concrete market.

Other drivers and restraints analyzed in the detailed report include:

- Tax Incentives for Porous Pavements in North America

- Rapid Expansion of Data-Center Campuses (Heat-Island Mitigation)

- Scarcity of Open-Graded Aggregates in Megacities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydrological specifications accounted for 57.20% of pervious concrete market share in 2025, anchoring the category's role as an on-site stormwater management tool for parking lots, sidewalks, and plazas. Municipal LID ordinances and sponge-city projects continue to funnel new demand into this design archetype, reinforcing its dominance in the pervious concrete market. Advances in surface infiltration testing and mix optimization are also reducing maintenance costs, preserving the appeal for public-sector buyers that operate on constrained budgets.

Structural designs, while currently smaller in absolute terms, are on course for a 6.59% CAGR to 2031, propelled by polymer-modified binders that elevate compressive strength without sacrificing void connectivity. Research pinpoints a 0.3 water-cement ratio as an inflection point where strength gains and hydraulic performance intersect, encouraging engineers to specify structural pervious pavements for low-speed roadway shoulders, parking garages, and bus stops. As field data validate these load-bearing enhancements, the pervious concrete market size for structural mixes is expected to broaden into mid-duty transit and light-industrial applications.

The Pervious Concrete Market Report is Segmented by Design (Hydrological and Structural), Application (Hardscape, Floors, and Other Applications), End-User Industry (Residential, Commercial, and Infrastructure), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific is the fastest-growing territory with a CAGR of 6.78% and also holds the largest share of 36.05%, spearheaded by China's sponge-city initiative, which alone accounts for thousands of pervious pavement kilometers across flood-prone urban districts. Indian manufacturers such as UltraTech are localizing permeable mixes to align with monsoon-drainage needs, while Japanese engineers leverage precast modular formats that shorten site installation cycles. Collectively, these innovations underscore the region's potential to eclipse North American volume midway through the forecast period.

North America's market is characterized by mature regulatory frameworks, robust contractor certification programs, and generous municipal incentives. The U.S. Environmental Protection Agency lists permeable pavements among its best-management practices, signaling federal endorsement that filters down to state procurement guidelines.

Europe posts steady, regulation-led demand as member states refine permeable pavement guidelines and integrate circular-economy principles, including recycled aggregates. German design codes published in 2024 formalize hydraulic-performance benchmarks, removing technical ambiguities that previously hampered adoption. While South America and the Middle-East and Africa contribute smaller shares for now, accelerating urbanization and climate-adaptation funding are expected to catalyze permeable-pavement pilots that will gradually scale the pervious concrete market across these emerging regions.

- A.G. Peltz Group

- Cementos Moctezuma

- Cemex S.A.B. de C.V.

- Chaney Enterprises

- Concreto Ecologico de Mexico

- CRH

- Empire Blended Products

- Frank J. Fazzio and Sons Inc.

- Harmak

- Heidelberg Materials

- Holcim

- Raffin Construction

- Sika AG

- Ultra Ready-Mix Concrete

- UltraTech Cement Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing urban flash-flood incidents

- 4.2.2 Mandatory low-impact-development (LID) zoning codes

- 4.2.3 Tax incentives for porous pavements in North America

- 4.2.4 Rapid expansion of data-centre campuses (heat-island mitigation)

- 4.2.5 Electrified last-mile warehouses favour cool pavements

- 4.3 Market Restraints

- 4.3.1 Need for certified contractors and specialised placement equipment

- 4.3.2 Limited structural load-bearing versus conventional concrete

- 4.3.3 Scarcity of open-graded aggregates in megacities

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Design

- 5.1.1 Hydrological

- 5.1.2 Structural

- 5.2 By Application

- 5.2.1 Hardscape

- 5.2.2 Floors

- 5.2.3 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Infrastructure

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 A.G. Peltz Group

- 6.4.2 Cementos Moctezuma

- 6.4.3 Cemex S.A.B. de C.V.

- 6.4.4 Chaney Enterprises

- 6.4.5 Concreto Ecologico de Mexico

- 6.4.6 CRH

- 6.4.7 Empire Blended Products

- 6.4.8 Frank J. Fazzio and Sons Inc.

- 6.4.9 Harmak

- 6.4.10 Heidelberg Materials

- 6.4.11 Holcim

- 6.4.12 Raffin Construction

- 6.4.13 Sika AG

- 6.4.14 Ultra Ready-Mix Concrete

- 6.4.15 UltraTech Cement Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment