PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906198

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906198

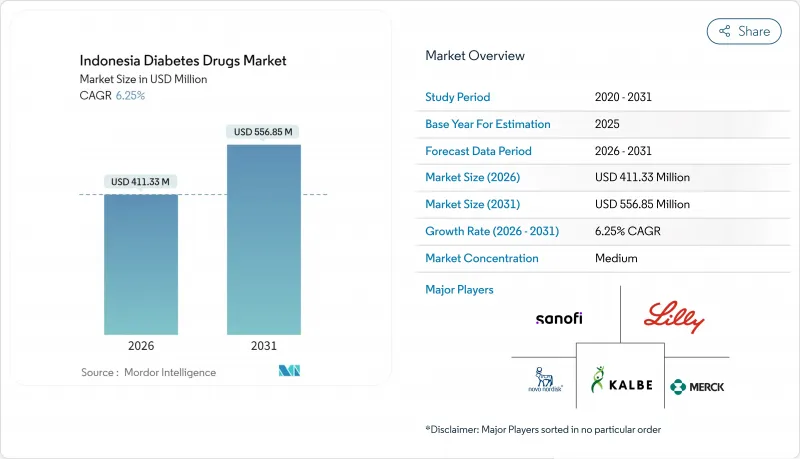

Indonesia Diabetes Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indonesia Diabetes Drugs market is expected to grow from USD 387.13 million in 2025 to USD 411.33 million in 2026 and is forecast to reach USD 556.85 million by 2031 at 6.25% CAGR over 2026-2031.

The steady climb is underpinned by the country's status as the world's fifth-largest diabetes population, universal insurance coverage through BPJS Kesehatan, and expanding local manufacturing capacity. Prescription volumes keep rising as older adults account for most new diagnoses, while novel GLP-1 and SGLT-2 agents win clinical acceptance in urban hospitals. Greater domestic production of active pharmaceutical ingredients (APIs), a push toward halal-certified drugs, and aggressive digital-health roll-outs add further momentum to the Indonesia diabetes drugs market.

Indonesia Diabetes Drugs Market Trends and Insights

Rising Diabetes Prevalence & Aging Population

Indonesia's adult diabetes prevalence jumped to 11.7% in 2024, up from 5.1% in 2011, with half of all diagnoses in the 65-74 age bracket. This long-running demographic shift fuels consistent demand across every therapeutic class and sets a stable volume base for the Indonesia diabetes drugs market. The Ministry of Health plans a sugar-tax framework to curb sweet-beverage intake, yet treatment needs remain high as lifestyle patterns change slowly. Epidemiological studies also link diabetes with higher incidences of heart, liver, and lung disease, pushing clinicians toward combination regimens that manage multiple comorbidities. These realities keep the treatment pipeline accelerating, particularly for age-tailored fixed-dose combinations that simplify daily adherence.

Government Initiatives and Insurance Programs

BPJS Kesehatan currently reimburses diabetes drugs under a unifi ed benefits schedule that reaches more than 200 million citizens. Starting 2025, an allocated Rp 3.3 trillion budget for free annual medical check-ups will likely raise early diagnosis volumes, enlarging the Indonesia diabetes drugs market. New chronic-disease screening regulations oblige primary-care clinics to follow structured follow-up protocols, maintaining steady prescription flows beyond initial diagnosis. A mandatory Standard Inpatient Class (KRIS) regime, due July 2025, eliminates tiered hospital benefits and thus levels access to newer diabetes therapies across income groups. Together, these policies close coverage gaps while nudging prescription decisions toward guideline-compliant brands.

90% API Import Dependence Inflates COGS

Local firms still source most raw materials from China and India, exposing supply chains to currency swings and freight bottlenecks. While Java's new API plants reduce vulnerability, capacity remains insufficient to cover nationwide demand, keeping unit costs elevated relative to regional peers.

Other drivers and restraints analyzed in the detailed report include:

- Uptake of Novel GLP-1 & SGLT-2 Therapies

- Growing Penetration of Branded-Generics

- High Out-of-Pocket Cost for Analogue Insulin

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Indonesia diabetes drugs market size for oral therapies reached USD 162.79 million in 2025, equal to a 42.05% revenue slice. Metformin (33.85% prescription rate) and glimepiride dominate first-line choices, aided by inclusion on the national e-Fornas list. Uptake of fixed-dose combinations is rising as physicians seek one-pill dosing to reinforce adherence among multi-morbidity seniors. In parallel, non-insulin injectables book the fastest trajectory, with an 8.45% CAGR linked to GLP-1 and dual-agonist trial activity. LeaderMed and Combiphar's Phase 3 study of LM-008-from September 2024-underscores local appetite for next-generation injectables. Premium analogue insulin retains a narrow but lucrative share because 35% of users prefer premixed pens for convenience.

Intensified competition around value-added injectables changes hospital formularies, especially in Jakarta and Bandung, where specialist panels now weigh cardiovascular-outcome data more heavily. Pharmaceutical groups answer with patient-assistance schemes and bundled glucometer packages, tactics that deepen loyalty but squeeze margins. Local API plants could improve gross margins for oral tablets; however, complex peptides for injectables still depend on imported intermediates, limiting immediate price relief.

The Indonesia Diabetes Drugs Market Report is Segmented by Drug Class (Oral Anti-Diabetics, Insulins, Combination Drugs and Non-Insulin Injectable Drugs), Diabetes Type (Type-1 Diabetes and Type-2 Diabetes), and Distribution Channel (Hospital Pharmacies, Retail Chain Pharmacies and Online Pharmacies). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Novo Nordisk

- PT Kalbe Farma Tbk

- Sanofi

- Eli Lilly and Company

- Merck

- AstraZeneca

- Boehringer Ingelheim

- Takeda Pharmaceuticals

- Pfizer

- Janssen

- Lupin

- Novartis

- Glenmark Pharmaceuticals

- PT Dexa Medica

- PT Kimia Farma Tbk

- PT Phapros Tbk

- Astellas Pharma

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Diabetes Prevalence & Aging Population

- 4.2.2 Government Initiatives and Insurance Programs

- 4.2.3 Uptake of Novel GLP-1 & SGLT-2 Therapies

- 4.2.4 Growing Penetration of Branded-Generics

- 4.2.5 Improved Medical Education and Clinical Guidelines

- 4.2.6 Local Manufacturing Partnerships and Local "fill-and-finish" Insulin Partnerships

- 4.3 Market Restraints

- 4.3.1 90 % API Import Dependence Inflates COGS

- 4.3.2 High Out-of-pocket Cost for Analogue Insulin

- 4.3.3 Physician CME Gap Slows Adoption of New Drugs

- 4.3.4 Patent-cliff Uncertainty Deters Local Investors

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Drug Class

- 5.1.1 Oral Anti-Diabetic Drugs

- 5.1.2 Insulins

- 5.1.3 Combination Drugs

- 5.1.4 Non-Insulin Injectables

- 5.2 By Diabetes Type

- 5.2.1 Type 1 Diabetes

- 5.2.2 Type 2 Diabetes

- 5.3 By Distribution Channel

- 5.3.1 Hospital Pharmacies

- 5.3.2 Retail Chain Pharmacies

- 5.3.3 Online Pharmacies

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Novo Nordisk A/S

- 6.3.2 PT Kalbe Farma Tbk

- 6.3.3 Sanofi

- 6.3.4 Eli Lilly and Company

- 6.3.5 Merck & Co.

- 6.3.6 AstraZeneca

- 6.3.7 Boehringer Ingelheim

- 6.3.8 Takeda

- 6.3.9 Pfizer

- 6.3.10 Janssen Pharmaceuticals

- 6.3.11 Lupin

- 6.3.12 Novartis

- 6.3.13 Glenmark

- 6.3.14 PT Dexa Medica

- 6.3.15 PT Kimia Farma Tbk

- 6.3.16 PT Phapros Tbk

- 6.3.17 Astellas

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment