PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906203

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906203

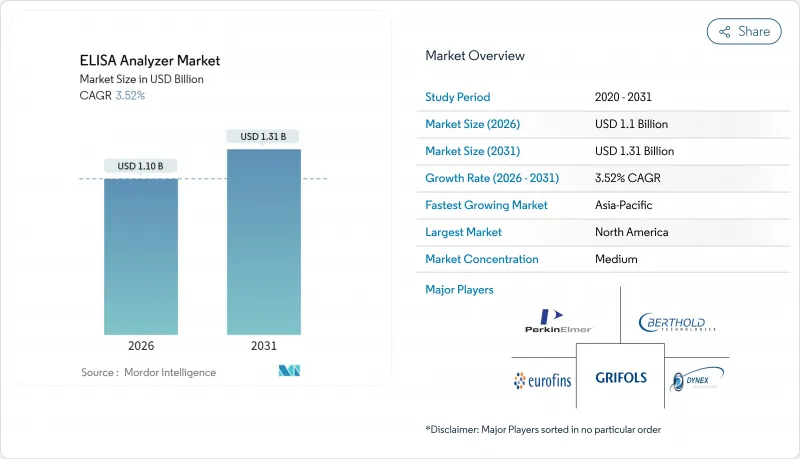

ELISA Analyzer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

ELISA analyzer market size in 2026 is estimated at USD 1.1 billion, growing from 2025 value of USD 1.06 billion with 2031 projections showing USD 1.31 billion, growing at 3.52% CAGR over 2026-2031.

Demand growth reflects laboratories' shift from manual immunoassay procedures toward integrated, high-throughput automation that reduces hands-on time, aligns with evolving regulatory documentation rules and offsets persistent staffing shortages. Automated platforms able to link clinical chemistry and immunoassay menus now anchor capital-spending decisions, while chemiluminescent detection continues to gain traction for therapeutic drug monitoring where low-abundance targets require greater sensitivity. Geographic expansion is paced by infrastructure investments in Asia-Pacific, yet North American laboratories remain the earliest adopters of high-capacity systems because audit trails built into modern analyzers simplify compliance under the 2024 Laboratory Developed Test rule. Platform purchases increasingly ride on modular designs that scale throughput as workload rises and avoid the full replacement costs that have historically discouraged technology refresh cycles.

Global ELISA Analyzer Market Trends and Insights

Growing Prevalence of Communicable and Noncommunicable Disorders

Noncommunicable diseases accounted for 74% of worldwide deaths in 2024, a burden that forces routine biomarker surveillance programs to scale rapidly. At the same time, post-pandemic surveillance protocols have elevated baseline testing volumes for communicable pathogens. ELISA platforms suit both scenarios because they combine high throughput with low per-test cost. Laboratories facing surging caseloads have therefore prioritized systems that automate plate loading, washing and reading so staff can manage larger daily runs. Vendors now bundle connectivity tools that push results directly into laboratory information systems, minimizing transcription risk while tightening audit trails demanded by payers and regulators. The double drive of chronic and infectious diseases is expected to keep utilization rates high long after the immediate pandemic effects subside.

Increasing Adoption of Automated High-Throughput Immunoassay Platforms

Laboratory consolidation and workforce attrition strengthen the business case for fully automated analyzers. Bio-Techne's Ella platform demonstrates that labor savings offset its capital price within two years in midsize laboratories, mainly by cutting manual pipetting steps. The FDA's 2024 Laboratory Developed Test rule magnifies the appeal because compliance now hinges on electronic traceability that manual ELISA cannot supply efficiently. Consequently, procurement committees increasingly select analyzers that integrate bar-code tracking, onboard quality controls and bidirectional LIS communication. Once installed, these systems often replace several legacy instruments, broadening the vendor's share of reagent spend and tying accounts into multiyear service contracts.

Limited Availability of Skilled Laboratory Personnel

The American Society for Clinical Pathology reported an 89% vacancy rate across core laboratory roles in 2024, with median technologist tenure continuing to fall. Siemens Healthineers' parallel survey suggests two-thirds of current staff plan retirement by 2034. Even with automation, laboratories need qualified scientists to review flags, troubleshoot runs and validate new assays. Staff deficits force some facilities to cap daily immunoassay volume or outsource specialized tests, delaying patient care and eroding potential analyzer revenue. Vendors respond by embedding remote-service diagnostics and guided maintenance videos, but recruiting challenges are unlikely to abate soon given constrained academic program capacity.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Pharmaceutical and Biopharmaceutical Pipelines

- Rising Utilization of Point-of-Care Diagnostic Technologies

- Intensifying Competition From Alternative Immunoassay Technologies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automated systems held 67.92% revenue in 2025, reflecting laboratories' preference for unattended batch processing and electronic QC tracking that manual stations cannot match. Demand for automated lines will expand at 5.38% CAGR as consolidation generates hub-and-spoke testing networks where throughput goals exceed human pipetting capacity. In the ELISA analyzer market size for high-volume reference labs, automated units also minimize biohazard exposure because enclosed robotics reduce operator contact with reagents and patient samples. Semi-automated instruments remain attractive to physician-office labs and small community hospitals with modest daily volumes, yet even those sites face wage pressures that narrow the ownership-cost gap. Across the ELISA analyzer industry, procurement criteria have pivoted from pure acquisition price toward lifecycle cost, uptime commitments and middleware connectivity that harmonizes results across multiple analyzers on a hospital campus.

Laboratories migrating to automation favor platforms with shared reagent packs across immunoassay and chemistry menus, a practice exemplified by Abbott's Alinity ci-series that outputs up to 1,550 tests per hour. This cross-discipline capability further embeds the analyzer into daily workflow, boosting reagent pull-through and making incumbent replacement less likely. As service contracts bundle parts, labor and software upgrades, vendors recoup R&D spend while laboratories forecast five-year budgets with fewer surprise costs. Long term, analysts anticipate full automation will dominate the ELISA analyzer market, but niche semi-automatic demand will persist where capital budgets remain constrained or sample mix warrants flexible single-plate handling.

Benchtop analyzers accounted for 61.78% share in 2025 because space premiums in renovated hospital labs favor compact chassis that slide beneath existing cabinetry. Many deliver mid-range throughput by stacking plates vertically or utilizing dual reading heads, sidestepping the size limits that once capped benchtop productivity. Stand-alone floor models nevertheless capture new installation at core labs where space is less constrained and menu breadth demands multiple parallel incubators. In this ELISA analyzer market, floor units are set to grow 5.49% CAGR owing to automated bulk loading and continuous-feed modes that free staff during peak morning draws. The ELISA analyzer market share of benchtop models thus faces only slight erosion because most replacement cycles keep to like-for-like swaps when bench space is already optimized.

Vendors meet both modality needs through shared software ecosystems so operators trained on a benchtop unit can rotate seamlessly to a floor model. Werfen's BIO-FLASH suits specialty autoimmune menus on a bench, while its QUANTA-Lyser 3000 scales identical reagent packs for high-volume centers. Such modularity underpins multiyear procurement frameworks where health networks lock in consumable pricing across diverse facility tiers yet standardize training and quality metrics. The trend reflects the ELISA analyzer industry's broader move to flexible deployment options tethered by common informatics layers.

Mid-throughput platforms that process 2-3 plates simultaneously generated 47.10% revenue in 2025 because they strike an effective cost-capacity balance for most 200-500-bed hospitals. The ELISA analyzer market size within reference labs, however, shows an accelerating pivot to high-throughput units rated for four or more plates per run, translating to a 5.69% CAGR through 2031. Drivers include test-menu expansion following oncology and neurology biomarker approvals and a rebound in elective procedures that inflate core chemistry panels. Low-throughput instruments keep pockets of demand in research institutes that prioritize assay flexibility, but falling price points on mid-range systems erode their traditional share.

Automation suppliers reinforce the throughput ladder by offering trade-in incentives that credit older mid-range systems toward top-tier models. bioMerieux's VIDAS KUBE, for instance, leapfrogs past earlier generations by doubling incubation positions without enlarging the instrument footprint. In the ELISA analyzer industry environment where personnel shortages persist, throughput upgrades can deliver service-level improvements without adding shifts, supporting health-system scaling initiatives.

The ELISA Analyzer Market Report is Segmented by Type of Operation (Automated ELISA Analyzer, and More), Modality (Bench-Top and Stand-alone/Floor-standing), Throughput (Low-Throughput, and More), Assay Format (Sandwich ELISA, and More), Detection Technology (Colorimetric, and More), Application (Vaccine Development, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 41.60% share in 2025 thanks to mature healthcare infrastructure, stringent FDA oversight and a sizable installed base of core-lab automation. Facilities taking advantage of the 2024 Laboratory Developed Test regulations invested in analyzers with built-in e-logs that streamline validation packages. Such compliance perks, coupled with reagent-rental financing, keep replacement cycles active despite capital-budget scrutiny. Canada mirrors U.S. adoption patterns but benefits from national procurement contracts that secure volume discounts across provincial networks.

Asia-Pacific is projected for the fastest 4.49% CAGR through 2031 as China and India add tertiary hospitals and regional reference labs. Government initiatives expand health-insurance coverage, prompting higher diagnostic expenditure per capita. Domestic manufacturing incentives in China reduce import tariffs on locally assembled analyzers, nudging procurement toward hybrid global-local platforms. The ELISA analyzer market size in Japan and South Korea leans toward chemiluminescent systems coherent with those markets' advanced biomarker portfolios, while ASEAN economies still emphasize cost-effective colorimetric kits for public-health programs.

Europe commands significant share rooted in pharmaceutical manufacturing clusters and food-safety standards that mandate immunoassay screening. The EU's Green Deal has further catalyzed demand for environmentally friendly consumables, prompting vendors to develop recyclable plates and low-toxic substrates. South America and Middle East & Africa remain emerging opportunities; flagship hospital projects in Brazil and Saudi Arabia specify automated immunoassay corridors, yet wider regional uptake depends on economic stability and local service infrastructure.

- Thermo Fisher Scientific

- Dynex Technologies

- Bio-Rad Laboratories

- Tecan Group

- Awareness Technology

- Berthold Technologies

- Grifols

- Eurofins

- PerkinElmer

- Hamilton Company

- Gold Standard Diagnostics

- Siemens Healthineers

- Abbott Laboratories

- Danaher Corp. (Beckman Coulter)

- Agilent (BioTek)

- BMG Labtech

- Tosoh

- Shenzhen Mindray Bio-Medical

- AXA Diagnostics

- BIOLINE Medical System

- Everex

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of Communicable and Noncommunicable Disorders

- 4.2.2 Increasing Adoption of Automated High-Throughput Immunoassay Platforms

- 4.2.3 Expanding Pharmaceutical and Biopharmaceutical Pipelines

- 4.2.4 Rising Utilization of Point-Of-Care Diagnostic Technologies

- 4.2.5 Shift Toward Multiplex and High-Sensitivity Assays

- 4.2.6 Strengthening Food Safety and Environmental Monitoring Regulations

- 4.3 Market Restraints

- 4.3.1 Limited Availability of Skilled Laboratory Personnel

- 4.3.2 Intensifying Competition from Alternative Immunoassay Technologies

- 4.3.3 Environmental Concerns over Plastic Consumables And Hazardous Reagents

- 4.3.4 Fluctuations in Raw Material and Reagent Supply Costs

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type of Operation

- 5.1.1 Automated ELISA Analyzer

- 5.1.2 Semi-Automated Analyzer

- 5.2 By Modality

- 5.2.1 Bench-top

- 5.2.2 Stand-alone / Floor-standing

- 5.3 By Throughput

- 5.3.1 Low-throughput (<=1 plate)

- 5.3.2 Mid-throughput (2-3 plates)

- 5.3.3 High-throughput (>=4 plates)

- 5.4 By Assay Format

- 5.4.1 Sandwich ELISA

- 5.4.2 Competitive / Inhibition ELISA

- 5.4.3 Indirect ELISA

- 5.4.4 Direct ELISA

- 5.5 By Detection Technology

- 5.5.1 Colorimetric

- 5.5.2 Chemiluminescent

- 5.5.3 Fluorometric

- 5.6 By Application

- 5.6.1 Vaccine Development

- 5.6.2 Immunology / Auto-immune Testing

- 5.6.3 Therapeutic Drug Monitoring & Pharma QA/QC

- 5.6.4 Other Applications

- 5.7 By End User

- 5.7.1 Diagnostic Laboratories

- 5.7.2 Pharmaceutical & Biotechnology Companies

- 5.7.3 Contract Research / CROs

- 5.7.4 Other End Users

- 5.8 Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 Europe

- 5.8.2.1 Germany

- 5.8.2.2 United Kingdom

- 5.8.2.3 France

- 5.8.2.4 Italy

- 5.8.2.5 Spain

- 5.8.2.6 Rest of Europe

- 5.8.3 Asia-Pacific

- 5.8.3.1 China

- 5.8.3.2 Japan

- 5.8.3.3 India

- 5.8.3.4 Australia

- 5.8.3.5 South Korea

- 5.8.3.6 Rest of Asia-Pacific

- 5.8.4 Middle East & Africa

- 5.8.4.1 GCC

- 5.8.4.2 South Africa

- 5.8.4.3 Rest of Middle East & Africa

- 5.8.5 South America

- 5.8.5.1 Brazil

- 5.8.5.2 Argentina

- 5.8.5.3 Rest of South America

- 5.8.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Thermo Fisher Scientific

- 6.3.2 Dynex Technologies

- 6.3.3 Bio-Rad Laboratories

- 6.3.4 Tecan Group

- 6.3.5 Awareness Technology

- 6.3.6 Berthold Technologies GmbH & Co.KG

- 6.3.7 Grifols, S.A.

- 6.3.8 Eurofins Scientific (Eurofins Abraxis)

- 6.3.9 PerkinElmer Inc. (EUROIMMUN Medizinische Labordiagnostika AG)

- 6.3.10 Hamilton Company

- 6.3.11 Gold Standard Diagnostics

- 6.3.12 Siemens Healthineers

- 6.3.13 Abbott Laboratories

- 6.3.14 Danaher Corp. (Beckman Coulter)

- 6.3.15 Agilent (BioTek)

- 6.3.16 BMG Labtech

- 6.3.17 Tosoh Bioscience

- 6.3.18 Shenzhen Mindray Bio-Medical

- 6.3.19 AXA Diagnostics

- 6.3.20 BIOLINE Medical System

- 6.3.21 Everex S.r.l.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment