PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906211

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906211

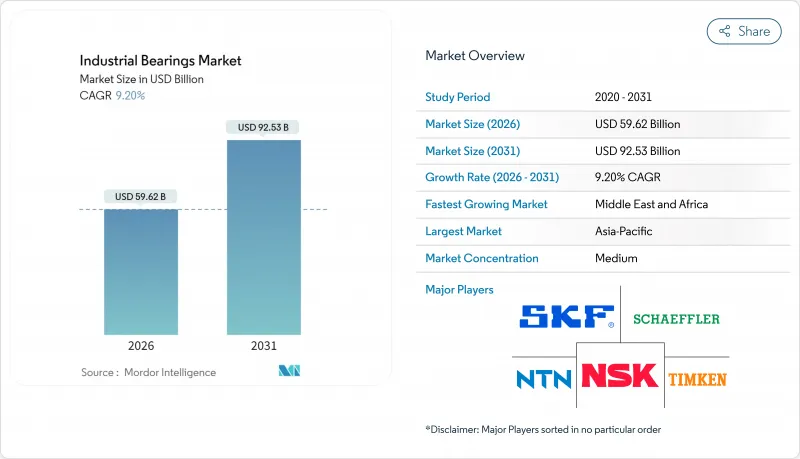

Industrial Bearings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The industrial bearings market is expected to grow from USD 54.6 billion in 2025 to USD 59.62 billion in 2026 and is forecast to reach USD 92.53 billion by 2031 at 9.2% CAGR over 2026-2031.

Growth reflects rising electrification across transport and factory equipment, accelerating automation adoption, and infrastructure upgrades that demand higher-performance mechanical components. Smart bearings equipped with sensors, miniaturised electronics and wireless connectivity shift maintenance from reactive to predictive, raising asset uptime and reducing unplanned downtime. Manufacturers also pursue lightweight materials and low-friction designs to improve energy efficiency in electric vehicles and industrial robots. Sustained capital expenditure in wind, hydrogen and semiconductor projects further increases demand for specialised, high-load and high-precision bearings that operate in harsher, faster and cleaner environments worldwide.

Global Industrial Bearings Market Trends and Insights

Rising Automotive & EV Production Rebound

Global light-vehicle output is forecast to edge up to 89.6 million units in 2025, with electric models accounting for 25% of sales. EV traction motors require electrically insulated bearings that mitigate stray-current erosion; DuPont's Vespel polyimide inserts lower cost versus full ceramic hybrids while tolerating high temperatures. Producers that build dual-capability lines for ICE and EV bearings benefit from steady legacy demand while capturing new e-powertrain volumes.

Rapid Adoption of Predictive-Maintenance-Ready Smart Bearings

Wireless sensor packages integrated into housings now monitor vibration, temperature and lubrication regimes continuously. Schaeffler's OPTIME ecosystem illustrates the shift, cutting manual inspection and raising safety by limiting physical access to rotating assets. When paired with AI analytics, factories report 30% assembly-time reduction and 15% quality gains from collaborative-robot deployments. The move to data-rich products creates recurring service revenue while raising qualification hurdles for low-cost imitators.

Volatile Alloy & Energy Prices Squeezing Margins

Nickel price spikes and energy-surcharge swings push input-cost volatility that erodes gross margins despite surcharges peaking at four-year lows. Container surcharges on inbound Chinese shipments inflate freight costs, while US steel tariffs limit spot options and lengthen mill lead times. Firms with multi-sourcing contracts and hedged energy supply outperform single-source competitors.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of On-Shore Wind Turbines

- Re-shoring of Industrial Equipment Supply Chains

- Automotive ICE-to-EV Transition Reducing Engine-Related Bearing Volumes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ball bearings held 41.55% of the industrial bearings market in 2025 thanks to broad suitability for automotive accessories, industrial motors and consumer appliances. Roller bearings remain preferred in mining and construction machinery where shock loads dominate. Plain bearings serve corrosive marine and chemical duties. Magnetic bearings represent the fastest-growing niche at 17.85% CAGR as oil-free operation eliminates wear and enables higher rotational speeds in hydrogen compressors and eVTOL turbines. NSK's gas-turbine generator solution for urban air mobility highlights early aerospace traction nsk.com. Upwing Energy's passive magnetic radial design extends downhole pump life by removing metal-to-metal contact, illustrating cross-industry adoption potential.

Growing demand for friction-less systems underpins the magnetic segment's revenue leap, although material cost and sophisticated control-electronics requirements still limit widespread deployment beyond premium applications. As OEMs integrate condition-monitoring sensors, magnetic units can embed current, temperature and vibration data directly into equipment control loops, positioning suppliers that master both mechanics and electronics for higher margins.

Alloy steel comprised 67.10% of the industrial bearings market in 2025, benefiting from global melt capacity, machinability and fatigue resistance at competitive cost. The industrial bearings market size for ceramic products remains smaller but climbs at 13.85% CAGR through 2031 on the back of EV insulation needs and high-speed spindle requirements. Research shows advanced metal-matrix-composite hydrostatic bearings deliver superior thermal conductivity, supporting ultraprecision machining at reduced weight.

Hybrid steel-ceramic designs blend silicon-nitride rolling elements with hardened-steel races to balance cost and performance, accelerating uptake in wind-turbine generators where electrical corrosion is problematic. Polymer and composite cages gain share in food-grade pumps and pharmaceutical mixers because they endure chemical washdowns and eliminate external lubrication, complying with hygiene codes.

The Industrial Bearings Market Report is Segmented by Bearing Type (Ball Bearings, Roller Bearings, Plain Bearings, and More), Material (Alloy Steel, Ceramic, Polymer/Composite, Hybrid), End-User Industry (Automotive, Aerospace, Energy, and More), Application (Rotating Equipment, Linear Motion Systems, Engine/Transmission/Driveline, and More), Sales Channel, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 46.60% industrial bearings market share in 2025, propelled by China's large-scale OEM base and India's infrastructure build-out. Localization strategies such as SKF's expanded Ningbo plant and R&D hub shorten lead times and customise designs for regional standards. Japan sustains leadership in miniaturised and high-accuracy bearings needed for electronics assembly and surgical robotics, while South Korea and Taiwan boost demand via semiconductor megafab investments. ASEAN growth accelerates as companies leverage cost-competitive labour and newly inked regional trade pacts.

North America grows above global average on the back of USD 1.4 trillion reshoring commitments and public-sector incentives like the CHIPS and Infrastructure acts. Domestic producers scale up, yet skill shortages lengthen ramp-up schedules; meantime, imports from Mexico fill interim supply gaps. Europe prioritises sustainability and high-efficiency machinery, but industrial order softness in Germany tempers near-term volume. EU policy pushes circular-economy bearings, evidenced by SKF's laser-reclad circular performance series.

The Middle East & Africa present 12.45% CAGR prospects as Gulf nations diversify into petrochemical, aluminium and renewable projects. Free-zone distributors in UAE serve as regional consolidation hubs, while localisation goals in Saudi Arabia open joint-venture opportunities. South America offers mining-driven pockets of demand, although currency volatility and political risk require flexible pricing and credit terms.

- AB SKF

- NSK Ltd.

- NTN Corporation

- The Timken Company

- JTEKT Corporation

- MinebeaMitsumi Inc.

- Regal Rexnord Corporation

- RBC Bearings Inc.

- THB Bearings Co., Ltd.

- HKT Bearings Ltd.

- Schaeffler AG

- Nachi-Fujikoshi Corp.

- CandU Group Co., Ltd.

- Federal-Mogul LLC (DRiV)

- THK Co., Ltd.

- SKF Motion Technologies

- Harbin HRB Bearing Group Co., Ltd.

- LYC Bearing Corporation

- KG International FZCO

- Others (validated)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising automotive and EV production rebound

- 4.2.2 Rapid adoption of predictive-maintenance?ready smart bearings

- 4.2.3 Expansion of on-shore wind turbines in APAC and Europe

- 4.2.4 Re-shoring of industrial equipment supply chains in North America

- 4.2.5 Niche demand for magnetic and ceramic bearings in hydrogen compressors (under-reported)

- 4.2.6 Surge in robotics and cobots requiring low-friction miniature bearings (under-reported)

- 4.3 Market Restraints

- 4.3.1 Volatile alloy and energy prices squeezing margins

- 4.3.2 Automotive ICE-to-EV transition reducing engine-related bearing volumes

- 4.3.3 IP-driven import restrictions on Chinese bearings in U.S. and EU (under-reported)

- 4.3.4 Additive-manufactured bushings replacing small roller bearings in aerospace (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Bearing Type

- 5.1.1 Ball Bearings

- 5.1.2 Roller Bearings

- 5.1.3 Plain Bearings

- 5.1.4 Magnetic Bearings

- 5.1.5 Other Bearings

- 5.2 By Material

- 5.2.1 Alloy Steel

- 5.2.2 Ceramic

- 5.2.3 Polymer / Composite

- 5.2.4 Hybrid

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace

- 5.3.3 Energy (Wind, Oil and Gas, Hydro)

- 5.3.4 Mining and Metals

- 5.3.5 Construction and Heavy Equipment

- 5.3.6 Food and Beverage

- 5.3.7 Material Handling and Logistics

- 5.3.8 Other Industries

- 5.4 By Application

- 5.4.1 Rotating Equipment (Motors, Pumps)

- 5.4.2 Linear Motion Systems

- 5.4.3 Engine, Transmission and Driveline

- 5.4.4 Chassis and Wheel Hubs

- 5.4.5 Precision and Instrumentation

- 5.5 By Sales Channel

- 5.5.1 OEM

- 5.5.2 Aftermarket / MRO

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 Israel

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 United Arab Emirates

- 5.6.4.4 Turkey

- 5.6.4.5 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Egypt

- 5.6.5.3 Rest of Africa

- 5.6.6 South America

- 5.6.6.1 Brazil

- 5.6.6.2 Argentina

- 5.6.6.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AB SKF

- 6.4.2 NSK Ltd.

- 6.4.3 NTN Corporation

- 6.4.4 The Timken Company

- 6.4.5 JTEKT Corporation

- 6.4.6 MinebeaMitsumi Inc.

- 6.4.7 Regal Rexnord Corporation

- 6.4.8 RBC Bearings Inc.

- 6.4.9 THB Bearings Co., Ltd.

- 6.4.10 HKT Bearings Ltd.

- 6.4.11 Schaeffler AG

- 6.4.12 Nachi-Fujikoshi Corp.

- 6.4.13 CandU Group Co., Ltd.

- 6.4.14 Federal-Mogul LLC (DRiV)

- 6.4.15 THK Co., Ltd.

- 6.4.16 SKF Motion Technologies

- 6.4.17 Harbin HRB Bearing Group Co., Ltd.

- 6.4.18 LYC Bearing Corporation

- 6.4.19 KG International FZCO

- 6.4.20 Others (validated)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment