PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906222

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906222

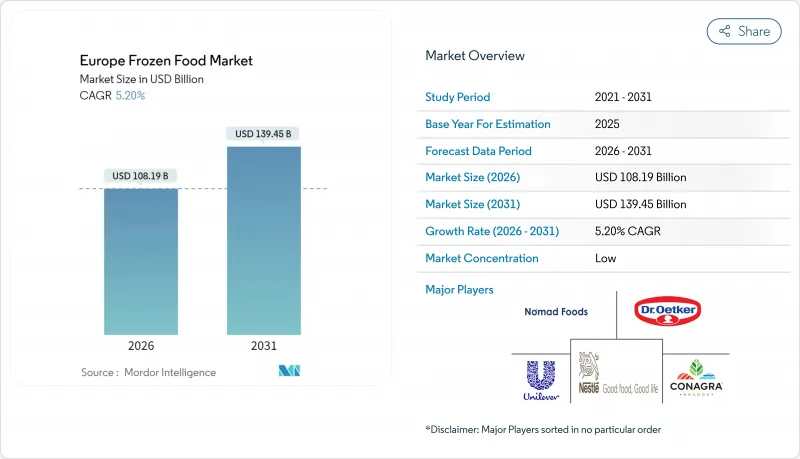

Europe Frozen Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The European frozen food market was valued at USD 102.84 billion in 2025 and estimated to grow from USD 108.19 billion in 2026 to reach USD 139.45 billion by 2031, at a CAGR of 5.20% during the forecast period (2026-2031).

This growth is primarily driven by the increasing demand for convenient, time-saving meal options, continuous advancements in individual quick-freezing (IQF) technology, and retailers' expanding focus on private-label product ranges. The introduction of plant-based product lines, premium frozen bakery items, and reformulated health-focused offerings is attracting a broader consumer base. At the same time, innovations in cold-chain logistics are helping to reduce energy consumption and minimize food waste, further supporting market growth. Ultrafast grocery delivery platforms are emphasizing frozen products as key contributors to profitability. Additionally, the European Food Safety Authority (EFSA) issued guidance in 2025 that simplifies the process for introducing new products to the market, providing further momentum to the sector. Geographically, Germany remains the largest market in terms of scale, France is experiencing the fastest growth, and Nordic countries are influencing category trends with their strong focus on sustainability initiatives.

Europe Frozen Food Market Trends and Insights

Demand for plant-based frozen meals among flexitarians

Flexitarians increasingly seek out plant-based frozen meals, driving growth in the Europe Frozen Food Market. According to the European Vegetarian Union (EVU), the demand for plant-based products has surged due to growing health consciousness, ethical considerations, and environmental concerns. The European Commission's Farm to Fork Strategy, which aims to create a sustainable food system, has further encouraged the adoption of plant-based alternatives. Additionally, a report by the European Environment Agency highlights the role of plant-based diets in reducing greenhouse gas emissions, aligning with the European Union's climate goals under the European Green Deal. Governments across Europe are also introducing policies and funding programs to support plant-based food innovation and production. For instance, Germany's Federal Ministry of Food and Agriculture has invested in research and development for plant-based food technologies. These initiatives, combined with increasing consumer awareness, are significantly contributing to the rising popularity of plant-based frozen meals among flexitarian consumers, thereby driving the market's growth.

Ultrafast grocery apps using frozen as high-margin basket driver

In the European frozen food market, ultrafast grocery apps are leveraging frozen products as a key driver for high-margin baskets. These apps capitalize on the convenience and longer shelf life of frozen foods, which appeal to urban consumers with busy lifestyles with World Bank data revealing that in 2023, urbanization in the European Union reached 76%.. Frozen vegetables, ready-to-eat meals, frozen pizzas, and frozen desserts are among the top-selling categories, as they offer quick meal solutions without compromising on quality. Companies like Gorillas, Getir, and Flink have reported increased sales in frozen food categories, attributing this growth to the rising demand for convenience and the ability to stock up on essentials without frequent trips to the store. Moreover, frozen seafood, such as shrimp and fish fillets, has gained popularity among health-conscious consumers who seek nutritious meal options that are easy to prepare.

Anti-processed food activism dampening frozen meat demand

Consumer skepticism towards processed meat products is on the rise across Europe. There is a growing preference for whole foods over prefabricated substitutes, driven by concerns over health and processing. This shift poses challenges for traditional frozen meat categories. Notably, the demand for frozen meat is particularly impacted, as consumers now link freezing more with industrial processing than with preservation. This perception persists despite technological advancements that ensure nutritional integrity. The movement, bolstered by social media campaigns and health advocacy groups, champions fresh preparation over convenience. As a result, frozen meat producers are compelled to enhance transparency and bolster educational initiatives. In response, manufacturers are reformulating products to minimize additives and spotlight natural ingredients. However, they grapple with effectively communicating the benefits of their processing methods, all while addressing valid health concerns related to sodium content and preservatives.

Other drivers and restraints analyzed in the detailed report include:

- Globalization of cuisines fueling market growth

- Advancement in freezing technology

- High sodium and fat content concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The European frozen food market in 2025 sees frozen ready meals commanding a 26.88% market share, highlighting the growing consumer preference for convenience without compromising on meal satisfaction. This segment's dominance is driven by culinary globalization, which has introduced restaurant-quality international cuisines to home freezers. The adoption of IQF technology plays a pivotal role in maintaining the texture and flavor integrity of these meals during storage and preparation. Additionally, frozen snacks and appetizers have emerged as the fastest-growing segment, with an impressive 8.22% CAGR projected through 2031. This growth is fueled by the rising 'snackification' trend, particularly among younger demographics, who increasingly seek quick and easy snack options that align with their busy lifestyles.

The frozen meat and poultry segments, however, face significant challenges in the European market. Anti-processed food activism and stringent regulations related to African swine fever have disrupted supply chains across multiple EU member states, creating headwinds for this category . On the other hand, frozen fish and seafood are experiencing robust growth, supported by their strong sustainability positioning and the promotion of omega-3 health benefits. These factors resonate well with health-conscious consumers and those prioritizing environmentally friendly food choices, further driving demand in this segment.

The Europe Frozen Food Market Report is Segmented by Product Type (Frozen Fruits and Vegetables, Frozen Meat and Poultry, Frozen Ready Meals, and More), Product Category (Ready-To-Eat and Ready-To-Cook), Distribution Channel (Foodservice and Retail) and Geography (Germany, United Kingdom, France, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nomad Foods Ltd.

- Nestle S.A.

- Dr. Oetker KG

- Unilever PLC

- Conagra Brands Inc.

- Frosta AG

- Greenyard NV

- Bonduelle SCA

- McCain Foods Ltd

- Wernsing Feinkost GmbH

- Tyson Foods Inc.

- Ajinomoto Co. Inc.

- General Mills Inc.

- Kraft Heinz Company

- Vandermoortele NV

- Agrarfrost GmbH & Co.KG

- VDB Frozen Food

- Koch Snc

- Ballineen Fine Foods Ltd.

- Young's Seafood

- Ballineen Fine Foods Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for plant-based frozen meals among flexitarians

- 4.2.2 Premium frozen bakery private-label roll-outs

- 4.2.3 Ultrafast grocery apps (Getir, Gorillas) using frozen as high-margin basket driver

- 4.2.4 Globalization of cuisines fueling market growth

- 4.2.5 Advancement in freezing technology

- 4.2.6 Health and wellness trends promoting market growth

- 4.3 Market Restraints

- 4.3.1 Anti-processed-food activism dampening frozen meat demand

- 4.3.2 High sodium and fat content concerns

- 4.3.3 Logistical challenges in cold chain management

- 4.3.4 Competition from fresh and chilled foods

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Frozen Fruits & Vegetables

- 5.1.2 Frozen Meat & Poultry

- 5.1.3 Frozen Fish & Seafood

- 5.1.4 Frozen Ready Meals

- 5.1.5 Frozen Bakery & Confectionery

- 5.1.6 Frozen Desserts & Ice Cream

- 5.1.7 Frozen Snacks & Appetizers

- 5.1.8 Other Product Types

- 5.2 By Product Category

- 5.2.1 Ready-to-Eat

- 5.2.2 Ready-to-Cook

- 5.3 By Distribution Channel

- 5.3.1 Foodservice (HoReCa)

- 5.3.2 Retail

- 5.3.2.1 Supermarkets & Hypermarkets

- 5.3.2.2 Convenience Stores

- 5.3.2.3 Online Stores

- 5.3.2.4 Other Retail Formats

- 5.4 By Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Italy

- 5.4.6 Denmark

- 5.4.7 Russia

- 5.4.8 Netherlands

- 5.4.9 Belgium

- 5.4.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Nomad Foods Ltd.

- 6.4.2 Nestle S.A.

- 6.4.3 Dr. Oetker KG

- 6.4.4 Unilever PLC

- 6.4.5 Conagra Brands Inc.

- 6.4.6 Frosta AG

- 6.4.7 Greenyard NV

- 6.4.8 Bonduelle SCA

- 6.4.9 McCain Foods Ltd

- 6.4.10 Wernsing Feinkost GmbH

- 6.4.11 Tyson Foods Inc.

- 6.4.12 Ajinomoto Co. Inc.

- 6.4.13 General Mills Inc.

- 6.4.14 Kraft Heinz Company

- 6.4.15 Vandermoortele NV

- 6.4.16 Agrarfrost GmbH & Co.KG

- 6.4.17 VDB Frozen Food

- 6.4.18 Koch Snc

- 6.4.19 Ballineen Fine Foods Ltd.

- 6.4.20 Young's Seafood

- 6.4.21 Ballineen Fine Foods Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK