PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906223

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906223

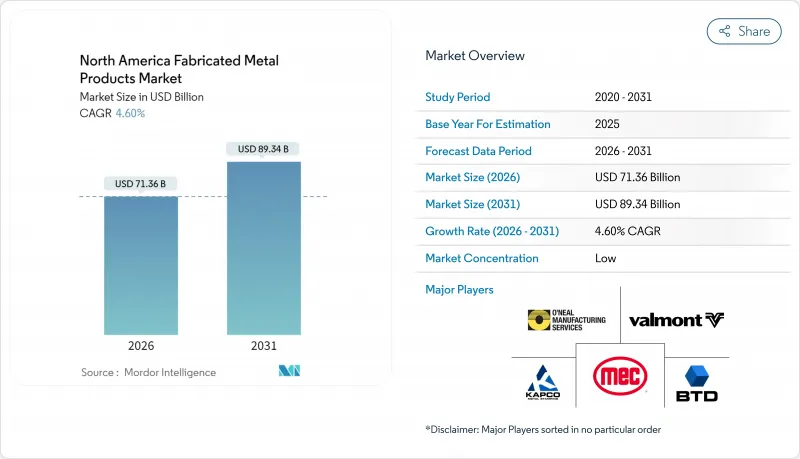

North America Fabricated Metal Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North American Metal Fabrication Market market size in 2026 is estimated at USD 71.36 billion, growing from 2025 value of USD 68.22 billion with 2031 projections showing USD 89.34 billion, growing at 4.6% CAGR over 2026-2031.

This expansion in the North American metal fabrication market is tied to unprecedented U.S. federal infrastructure spending, the reshoring of semiconductor manufacturing under the CHIPS and Science Act, and rising demand for lightweight body structures across electric-vehicle platforms. Manufacturing construction outlays touched a record USD 225 billion in January 2024, while suppliers hurried to automate amid a persistent shortage of welders and machinists. Steel remains the material mainstay, but aluminum's rapid uptake for energy-efficient vehicle designs signals a clear material shift. Additive manufacturing and high-speed stamping are gaining traction as fabricators seek tighter tolerances and reduced lead times. Meanwhile, price swings in steel and aluminum and new PFAS coating regulations continue to squeeze margins.

North America Fabricated Metal Products Market Trends and Insights

US Infrastructure & CHIPS-plus Funding Wave

A wave of federal outlays is redefining the North American metal fabrication market. The CHIPS and Science Act earmarks USD 39 billion for new semiconductor fabs, spurring robust demand for precision clean-room enclosures, stainless-steel utility skids, and vibration-free equipment housings. Treasury's 25% investment tax credit reduces capital hurdles, and more than 35 states have already secured hub funding, widening geographic demand. Coupled with record USD 225 billion manufacturing construction spending logged in 2024, fabricators are booking multi-year order backlogs for process-tool frames and utility racks. The program's scale all but guarantees a multi-year lift in structural, sheet, and tubular metal orders.

Automotive Lightweighting & EV Platform Demand

The shift to electric drivetrains keeps aluminum at the forefront in the North American metal fabrication market. Aluminum body-in-white structures weigh up to 45% less than steel-based designs, directly extending EV range. Secondary aluminum uses only 5% of the energy required for primary smelting, matching OEM carbon targets and circularity goals. Automakers also favor modular high-strength aluminum castings that reduce part counts and weld joints. Linamar's USD 825 million (CAD 1.1 billion) investment program announced in 2025 underpins hybrid drives and lightweight castings, adding thousands of jobs across Ontario plants. The clear tilt toward light alloys reinforces a durable upswing for aluminum extrusions, stampings, and large structural castings.

Steel & Aluminum Price Volatility

Spot steel prices in China rose roughly USD 100 per short ton after late-2024 stimulus, pulling U.S. prices higher despite existing tariffs. Aluminum markets face similar turbulence after the U.S. Commerce Department imposed provisional duties on extrusions from 14 countries covering 400,000 metric tons of yearly imports. Although structural steel quotes slipped through late 2024, hurricane damage in the U.S. Southeast and strong infrastructure demand keep traders wary of renewed spikes. Volatile inputs pressure fabricators' fixed-price contracts and erode margins, prompting wider adoption of hedging clauses and indexed surcharges.

Other drivers and restraints analyzed in the detailed report include:

- Automation (Laser, Water-jet, Robotics, IoT) Adoption

- Reshoring & Near-shoring Supply-Chain Strategies

- Skilled Welder/Machinist Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Steel captured 62.64% of the North American metal fabrication market share in 2025, thanks to entrenched supply chains and cost advantages in heavy construction. The North American metal fabrication market currently favors steel for bridges, pipelines, and structural frames, yet aluminum is accelerating under a 6.03% CAGR through 2031. Aluminum's recyclability, requiring only 5% of primary-production energy, aligns with OEM decarbonization targets, while its 45% weight advantage over steel boosts EV range. The North American metal fabrication market continues to amplify orders for aluminum battery enclosures, truck body panels, and aerospace interiors. Alloy Enterprises' patented Stack Forging process consolidates 6061-T6 components with near-net precision, eliminating the 80% material waste typical of powder-bed printing and slicing lead times to four weeks. Such breakthroughs promise to reduce design-to-production cycles and extend aluminum uptake across mobility, semiconductor, and industrial verticals.

Specialty metals such as titanium and copper address niche but lucrative applications. Copper busbars are in high demand for data-center power rails and renewable inverters, reflecting the North American metal fabrication industry's pivot toward electrification. Fabricators are forging tighter supplier alliances to secure high-conductor purity stock at stable prices. Titanium consumption, though modest, is buoyed by defense procurement and space-launch programs that prioritize high strength-to-weight ratios. As advanced alloys gain ground, multi-material know-how will define future competitive edges.

The North American Metal Fabrication Market Report is Segmented by Material Type (Steel, Aluminum, and Other Alloys), by Fabrication Process (Casting, Forging, Machining, and More), by End-User Industry (Manufacturing, Power & Utilities, Construction & Infrastructure, Oil & Gas, Automotive, and More), and by Geography (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- O'Neal Manufacturing Services

- Mayville Engineering Company

- Valmont Industries

- BTD Manufacturing

- Kapco Metal Stamping

- Ironform Corporation

- Matcor-Matsu Group

- Ryerson Holding Corporation

- United Steel Inc.

- PMF Industries

- Monti Inc.

- Prince Manufacturing

- Standard Iron & Wire Works

- All Metals Fabricating

- Classic Sheet Metal

- Trumpf Inc.

- DMG Mori USA

- Bystronic Inc.

- Lincoln Electric Holdings

- Flow International

- AMADA America

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 US Infrastructure & CHIPS-plus funding wave

- 4.2.2 Automotive lightweighting & EV platform demand

- 4.2.3 Automation (laser, water-jet, robotics, IoT) adoption

- 4.2.4 Reshoring & near-shoring supply-chain strategies

- 4.2.5 Offshore-wind & grid-scale battery component build-out

- 4.2.6 Data-center rack & enclosure build boom

- 4.3 Market Restraints

- 4.3.1 Steel & aluminum price volatility

- 4.3.2 Skilled welder/machinist shortage

- 4.3.3 Tightening PFAS-coating regulations

- 4.3.4 AM service-bureau substitution risk

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Insights on Production & Demand for Different Metals

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Material Type

- 5.1.1 Steel

- 5.1.2 Aluminum

- 5.1.3 Other Alloys (Titanium, Copper, etc.)

- 5.2 By Fabrication Process

- 5.2.1 Casting

- 5.2.2 Forging

- 5.2.3 Machining

- 5.2.4 Welding & Tubing

- 5.2.5 Others (Stamping, Additive Manufacturing)

- 5.3 By End-user Industry

- 5.3.1 Manufacturing

- 5.3.2 Power & Utilities

- 5.3.3 Construction & Infrastructure

- 5.3.4 Oil & Gas

- 5.3.5 Automotive

- 5.3.6 Aerospace & Defense

- 5.3.7 Other Industries

- 5.4 By Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 O'Neal Manufacturing Services

- 6.4.2 Mayville Engineering Company

- 6.4.3 Valmont Industries

- 6.4.4 BTD Manufacturing

- 6.4.5 Kapco Metal Stamping

- 6.4.6 Ironform Corporation

- 6.4.7 Matcor-Matsu Group

- 6.4.8 Ryerson Holding Corporation

- 6.4.9 United Steel Inc.

- 6.4.10 PMF Industries

- 6.4.11 Monti Inc.

- 6.4.12 Prince Manufacturing

- 6.4.13 Standard Iron & Wire Works

- 6.4.14 All Metals Fabricating

- 6.4.15 Classic Sheet Metal

- 6.4.16 Trumpf Inc.

- 6.4.17 DMG Mori USA

- 6.4.18 Bystronic Inc.

- 6.4.19 Lincoln Electric Holdings

- 6.4.20 Flow International

- 6.4.21 AMADA America

7 Market Opportunities & Future Outlook