PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906225

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906225

Europe Oriented Strand Board - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

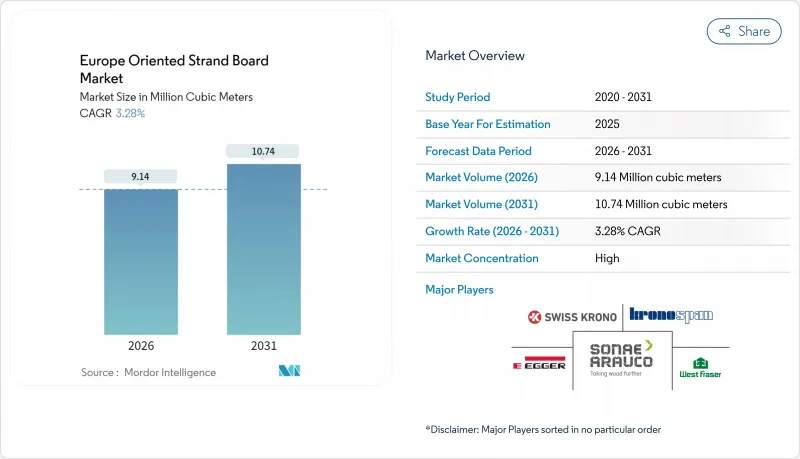

The Europe Oriented Strand Board market is expected to grow from 8.85 million cubic meters in 2025 to 9.14 million cubic meters in 2026 and is forecast to reach 10.74 million cubic meters by 2031 at 3.28% CAGR over 2026-2031.

OSB's cost advantage versus plywood, its engineered strength profile, and tightening sustainability standards together keep the Europe Oriented Strand Board market resilient even as traditional lumber supply faces climate-related volatility. Structural applications dominate because builders value OSB/3's balance of load-bearing capacity and moisture resistance, a pairing that aligns with EU energy-efficiency retrofits and modular construction trends.

Europe Oriented Strand Board Market Trends and Insights

Post-pandemic Rebound in Multi-storey Timber Buildings

European cities are approving an expanding pipeline of tall timber structures, with roughly 300 buildings of six stories or more completed globally and concentrations emerging in Paris and London. This shift pushes the Europe-oriented strand Board market toward larger, continuous-panel formats that integrate easily with CLT and glulam frames. Prague's new 62-unit BREEAM-Excellent apartment block, built almost entirely from mass-timber modules, demonstrates how OSB contributes both to structural shear resistance and to embodied-carbon reduction goals. As more municipalities adopt carbon-based building codes, developers increasingly specify OSB/3 panels for wall and floor diaphragms because they deliver predictable racking resistance while enabling rapid on-site assembly.

REPowerEU Insulation Retrofits Boosting OSB Demand

Three-quarters of EU buildings need deep energy renovation to meet 2050 carbon targets, and the REPowerEU plan channels state aid into envelope upgrades. OSB substrates serve as robust backers for external insulation systems because they resist dimensional change when moisture levels fluctuate, preserving the bond between insulation and facade. Laboratory work shows polyurethane-bonded OSB boards achieving bond strengths above 80 kPa in ETICS assemblies, exceeding European code minima. In Germany, renovation permits issued in 2024 rose 12%, with wall-sheathing OSB purchases outpacing overall construction output, confirming the retrofit pull-through for the Europe Oriented Strand Board market. When paired with bio-based insulation mats, panels store carbon while lowering operational energy, an increasingly valuable proposition as member states introduce lifecycle-emissions caps for renovated stock.

Stricter Formaldehyde and VOC Emission Caps

EU Regulation 2023/1464 fixes a 0.062 mg/m3 emission ceiling from August 2026, compelling OSB mills to replace phenol-formaldehyde resins with MDI-based systems that raise manufacturing cost by 15-20%. Sweden applies an even tighter 0.124 mg/m3 interim limit, and Denmark enforces documentation for every shipment, elevating compliance paperwork. While the Europe Oriented Strand Board market has advanced in low-emission chemistry, retrofitting older press lines remains capital-intensive, especially for small producers. Research nonetheless indicates that high-grade OSB poses minimal exposure risk when emissions stay below code, a narrative larger brands use to justify price premiums. In parallel, merchants are starting to stock dual-certified "Zero-added-formaldehyde" lines, splitting demand but also creating a value-added tier that partially offsets higher binder costs.

Other drivers and restraints analyzed in the detailed report include:

- Construction Industry Growth

- Surge in Modular Off-site Construction Factories

- Volatile Soft-wood Fibre Supply in Central Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

OSB/3 generated 83.10% of 2025 volume and will remain the backbone of the Europe-oriented strand Board market through 2031 with a 3.47% CAGR. The grade satisfies EN 300 load-bearing and humidity standards, making it the default for roof decks, wall sheathing, and flooring under both new-build and retrofit programs. Construction firms prefer OSB/3 because it offers 20-30% material savings versus plywood while delivering comparable nail-holding strength, a key cost lever as contractors navigate tight margins on modular projects. Manufacturers also optimize production scheduling around OSB/3, creating economies of scale that suppress per-unit energy use-an advantage now highlighted in Environmental Product Declarations requested by public-tender authorities.

OSB/4 retains niche demand in heavy-duty industrial flooring and mezzanine applications, capturing a modest but stable share as larger spans become common in logistics warehouses. OSB/2 continues to recede as building codes across Germany and France now require moisture-resistant sheathing even for interior partitions, effectively pushing lower-grade boards toward furniture and packaging outlets. OSB/1 occupies the bottom of the hierarchy, used mainly in non-structural decor or DIY markets where thin panels suffice. As a result, the Europe Oriented Strand Board market increasingly revolves around OSB/3, allowing producers to streamline resin systems and strand geometry for peak line efficiency.

The Europe Oriented Strand Board Market Report is Segmented by Grade (OSB/1, OSB/2, OSB/3, and OSB/4), End-User Industry (Furniture, Construction, and Packaging), and Geography (Germany, United Kingdom, France, Italy, Spain, Switzerland, Austria, and Rest of Europe). The Market Forecasts are Provided in Terms of Volume (Million Cubic Meters).

List of Companies Covered in this Report:

- Coillte

- Egger

- HEM DENMARK A/S

- Kronoplus Limited

- Sonae Arauco

- Steico SE

- SWISS KRONO Group

- West Fraser

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-Pandemic Rebound in Multi-Storey Timber Buildings

- 4.2.2 REPowerEU Insulation Retrofits Boosting OSB Demand

- 4.2.3 Surge in Modular Off-Site Construction Factories

- 4.2.4 Construction Industry Growth

- 4.2.5 OSB Price Advantage Vs Plywood

- 4.3 Market Restraints

- 4.3.1 Stricter Formaldehyde and VOC Emission Caps

- 4.3.2 Volatile Soft-Wood Fibre Supply in Central Europe

- 4.3.3 Health Concerns over Indoor Air Quality

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Grade

- 5.1.1 OSB/1

- 5.1.2 OSB/2

- 5.1.3 OSB/3

- 5.1.4 OSB/4

- 5.2 By End-user Industry

- 5.2.1 Furniture

- 5.2.1.1 Residential

- 5.2.1.2 Commercial

- 5.2.2 Construction

- 5.2.2.1 Floor and Roof

- 5.2.2.2 Wall

- 5.2.2.3 Door

- 5.2.2.4 Column and Beam

- 5.2.2.5 Staircase

- 5.2.2.6 Other Constructions

- 5.2.3 Packaging

- 5.2.3.1 Food and Beverage

- 5.2.3.2 Industrial

- 5.2.3.3 Pharmaceutical

- 5.2.3.4 Cosmetics

- 5.2.3.5 Other Packaging

- 5.2.1 Furniture

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Switzerland

- 5.3.7 Austria

- 5.3.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Coillte

- 6.4.2 Egger

- 6.4.3 HEM DENMARK A/S

- 6.4.4 Kronoplus Limited

- 6.4.5 Sonae Arauco

- 6.4.6 Steico SE

- 6.4.7 SWISS KRONO Group

- 6.4.8 West Fraser

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment