PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906232

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906232

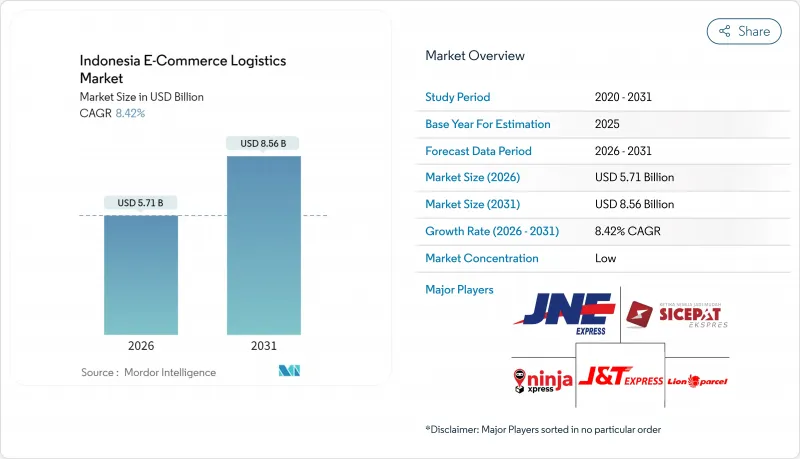

Indonesia E-Commerce Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Indonesia E-Commerce Logistics Market size in 2026 is estimated at USD 5.71 billion, growing from 2025 value of USD 5.27 billion with 2031 projections showing USD 8.56 billion, growing at 8.42% CAGR over 2026-2031.

Digital ordering volumes climbed 35% in 2024, and government programs that connect provincial logistics hubs with national platforms continue to streamline network integration. Investments in roads, ports, and automated sortation centers shorten delivery cycles, while urban consumers push providers to accelerate same-day and next-day options. Fragmented competition keeps prices low but pressures profit margins, prompting carriers to upgrade AI-driven route planning and warehouse robotics. Meanwhile, regulatory reforms for parcels below USD 1,500 ease cross-border compliance, opening new revenue channels for small exporters.

Indonesia E-Commerce Logistics Market Trends and Insights

Explosive Parcel-Volume Surge from Tier-2/3 Cities

Improved 4G coverage and smartphone affordability are propelling online shopping outside metropolitan cores, lifting parcel counts in Semarang, Malang, and other secondary markets. Providers must redesign networks to serve lower-density zones cost-effectively, blending regional depots with city-level micro-fulfillment points. Quick-commerce operators such as Tokopedia Now increasingly stock multiple pick points nearby, forcing carriers to orchestrate rapid pick-pack-ship flows across a wider geography. The National Logistics Ecosystem program supplies common data rails that link provincial warehouses to national carriers, lowering onboarding barriers for smaller players.

Government Push to Cut Logistics Cost-to-GDP to 8%

Indonesia's RPJMN 2025-2029 embeds logistics efficiency as a pillar of economic resilience. Ministries coordinate road, port, and ICT upgrades to shrink empty backhauls and administrative delays. A new National Logistics Agency bill aims to centralize policy, preventing port congestion episodes such as the 2024 container backlog that stranded 26,415 boxes. Kominfo has been assigned as a neutral data integrator, incentivizing carriers to expose API feeds that enable shipment visibility and dynamic slot booking.

Archipelagic Geography Inflates Inter-Island Last-Mile Costs

Serving 17,500 islands saddles carriers with extra sea legs, weather risks, and scarce return loads that push delivery costs 40-60% above Java norms. Short sea shipping remains underserved due to shallow ports and overlapping maritime rules, while monsoon seasons upend schedules and inventory forecasts. The Sea Toll subsidy helps, yet commercial providers still shoulder cost premiums for reliable sailings to Maluku or Papua.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Uptake of Same-Day/Next-Day Delivery Options

- IDR 400 Trillion Infrastructure Investment

- Fragmented CEP Price War Eroding Provider Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation captured 76.35% of the Indonesia e-commerce logistics market size in 2025 as road networks carry bulk intra-Java traffic and sea freight stitches together the archipelago. Yet value-added services, led by labeling and kitting, are projected to grow 6.98% CAGR, feeding brands' need for curated packaging. Operators increasingly embed robotic arms and RFID gates to elevate accuracy and shrink dwell times. Integrated setups that blend trucking, storage, and customization win large marketplace contracts.

Ongoing infrastructure upgrades enhance road reliability, but rising fuel prices and environmental targets nudge carriers to optimize routing and test electric vans. Warehousing demand clusters near Jakarta and Surabaya ports, prompting a surge in build-to-suit leases for automated hubs. Fulfillment players that can flex capacity around seasonal peaks, such as Singles Day or Ramadan, secure higher-margin slots with leading platforms.

B2C retained 73.40% of Indonesia e-commerce logistics market share in 2025 on the back of marketplace scale and urban customer density. Price sensitivity compels carriers to strip costs, spurring batch deliveries and crowdsourced riders for the final mile. B2B, forecast to rise 6.59% CAGR, benefits from manufacturers' digitizing procurement and demanding just-in-time replenishment. Providers targeting factory lines add inventory audit, quality checks, and vendor-managed stock to deepen client stickiness.

C2C stays niche but receives lift from social-commerce platforms that trade preloved fashion and crafts. Here, authentication and low-cost return loops differentiate service propositions. Marketplace-controlled networks could roll out hybrid models that pool B2C and B2B line-haul to boost truck utilization, compressing independent forwarders' margins.

The Indonesia E-Commerce Logistics Market Report is Segmented by Service (Transportation, Warehousing & Fulfilment, and Value-Added Services), Business Model (B2C, B2B, and C2C), Destination (Domestic and Cross-Border), Delivery Speed (Same-Day, and More), Product Category (Foods & Beverages, and More), City Tier (Tier 1, 2, and More), and Province (Jakarta, and More). Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- JNE Express

- J&T Express

- SiCepat Ekspres

- Ninja Xpress

- Lion Parcel

- Wahana Express

- TIKI

- Pos Indonesia

- Paxel

- DHL Express

- UPS

- FedEx

- GoSend (Gojek)

- Grab Express

- Shipper

- Shopee Express

- Lazada eLogistics

- Kuehne + Nagel

- DSV

- Kerry Logistics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive parcel-volume surge from tier-2/3 cities

- 4.2.2 Government push to cut logistics cost-to-GDP to 8 %

- 4.2.3 Rapid uptake of same-day / next-day delivery options

- 4.2.4 Indonesia's IDR 400 Trillion Infrastructure Investment Set to Boost E-Commerce Delivery Reach

- 4.2.5 Infrastructure Investments (new toll roads, ports, airports) is shrinking delivery transit times and opening tier-2/3 markets

- 4.2.6 National-capital move to Nusantara redrawing fulfilment hubs

- 4.3 Market Restraints

- 4.3.1 Archipelagic geography inflates inter-island last-mile costs

- 4.3.2 Fragmented CEP price war eroding provider margins

- 4.3.3 Indonesia's Island Geography Drives Up Last-Mile Delivery Costs

- 4.3.4 Skilled-labour gap in modern Grade-A warehouses

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Demand & Supply Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

- 4.9 Reverse / Return Logistics Insights

- 4.10 Impact of Geo-Political Events on Supply Chain Shifts

5 Market Size & Growth Forecasts

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Sea

- 5.1.2 Warehousing & Fulfilment

- 5.1.3 Value-Added Services (Labelling, Packaging, Kitting)

- 5.1.1 Transportation

- 5.2 By Business Model

- 5.2.1 B2C

- 5.2.2 B2B

- 5.2.3 C2C

- 5.3 By Destination

- 5.3.1 Domestic

- 5.3.2 Cross-border (international)

- 5.4 By Delivery Speed

- 5.4.1 Same-day (less than 24 h)

- 5.4.2 Next-day (24-48 h)

- 5.4.3 Standard (3-5 days)

- 5.4.4 Others (more than 5 days)

- 5.5 By Product Category

- 5.5.1 Foods & Beverages

- 5.5.2 Personal & Household Care

- 5.5.3 Fashion & Lifestyle (accessories, apparel, footwear)

- 5.5.4 Furniture

- 5.5.5 Consumer Electronics & Household Appliances

- 5.5.6 Other Products

- 5.6 By City Tier

- 5.6.1 Tier 1

- 5.6.2 Tier 2

- 5.6.3 Tier 3 and Below

- 5.7 By Provinces

- 5.7.1 Central Java

- 5.7.2 East Java

- 5.7.3 West Java

- 5.7.4 Jakarta

- 5.7.5 Banten

- 5.7.6 Rest of Provinces

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 JNE Express

- 6.4.2 J&T Express

- 6.4.3 SiCepat Ekspres

- 6.4.4 Ninja Xpress

- 6.4.5 Lion Parcel

- 6.4.6 Wahana Express

- 6.4.7 TIKI

- 6.4.8 Pos Indonesia

- 6.4.9 Paxel

- 6.4.10 DHL Express

- 6.4.11 UPS

- 6.4.12 FedEx

- 6.4.13 GoSend (Gojek)

- 6.4.14 Grab Express

- 6.4.15 Shipper

- 6.4.16 Shopee Express

- 6.4.17 Lazada eLogistics

- 6.4.18 Kuehne + Nagel

- 6.4.19 DSV

- 6.4.20 Kerry Logistics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment