PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906235

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906235

Egg Powder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

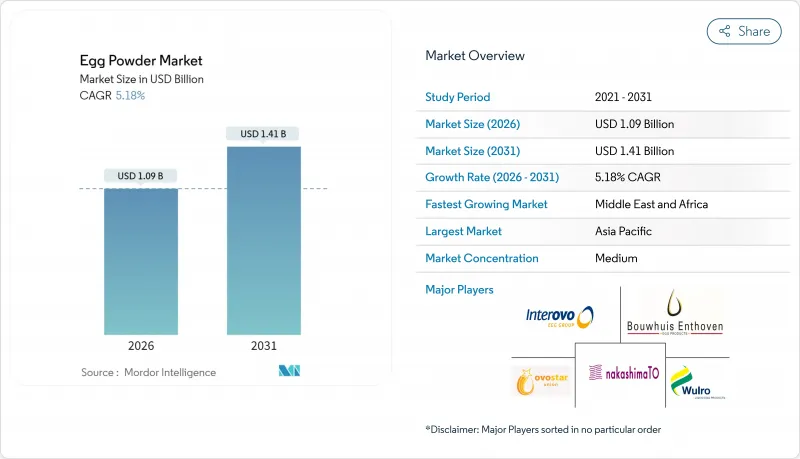

The Egg Powder Market was valued at USD 1.04 billion in 2025 and estimated to grow from USD 1.09 billion in 2026 to reach USD 1.41 billion by 2031, at a CAGR of 5.18% during the forecast period (2026-2031).

The market growth is driven by increasing demand for shelf-stable proteins, enhanced spray-drying technologies, and expanding applications across food processing industries. The versatility of egg powder in various food applications, including bakery products, confectionery, savory snacks, and ready-to-eat meals, contributes to its market expansion. Rising egg prices are prompting bakeries, confectionery manufacturers, and food processors to adopt powder formats, which help stabilize supply costs while maintaining product functionality. The extended shelf life, ease of storage, and reduced transportation costs associated with egg powder make it an attractive alternative to shell eggs. The market expansion is further supported by regulatory bodies classifying eggs as a healthy food source and the growing preference for natural emulsifiers in clean-label products. Additionally, the increasing adoption of egg powder in sports nutrition products and dietary supplements is creating new growth opportunities in the market.

Global Egg Powder Market Trends and Insights

Growing Popularity of Processed Bakery and Confectionery Products

The increasing consumer preference for convenience foods and indulgent treats is driving the demand for processed bakery and confectionery products globally. Egg powder serves as an essential ingredient in this segment, providing functional benefits such as enhanced texture, longer shelf life, and uniform quality across various applications, including cakes, pastries, cookies, and confectionery fillings. The advantages of egg powder over liquid or shell eggs, particularly in storage and handling, make it a preferred choice for manufacturers, enabling efficient large-scale bakery operations and consistent product quality. Consumer spending patterns reflect the strong market for bakery products. According to the Bureau of Labor Statistics, U.S. households allocated an average of USD 574 to bakery products in 2023, demonstrating sustained demand in this category. This consistent consumer expenditure creates opportunities for egg powder suppliers to develop products that meet the specific requirements of the bakery and confectionery industries.

Growing Demand for Functional Foods and Dietary Supplements

Heightened consumer focus on preventive health and personalized nutrition is fueling demand for functional foods and dietary supplements worldwide. This trend is particularly evident in mature markets where consumers actively incorporate supplements and fortified foods into daily routines to support immunity, digestive health, and overall wellness. According to CRN reports, the usage of dietary supplements among U.S. adults was 74% in 2023, demonstrating the broad acceptance of nutrition products that deliver targeted health benefits. Egg powder's bioactive properties, including ovotransferrin's antimicrobial and immunomodulatory effects, position it as a premium ingredient for nutraceutical applications. The rise of GLP-1 medications for weight management is further accelerating demand for high-protein foods, prompting companies like Nestle to launch specialized product lines aimed at supporting elevated protein needs. Additionally, advances in spray drying technology are enhancing the preservation of egg-derived bioactive compounds while improving solubility and bioavailability, making egg powder an increasingly attractive choice for next-generation functional food and supplement formulations.

Rise of Plant-Based Egg Replacers

The increasing availability of plant-based egg replacers poses a significant challenge to the egg powder market. Manufacturers are developing allergen-free, cholesterol-free, and vegan alternatives in response to changing consumer preferences. Products using mung bean protein, chickpea flour, and hydrocolloids now effectively replicate the binding, emulsifying, and foaming properties of egg powder, reducing its advantages in bakery and confectionery applications. The market position of egg powder faces additional pressure from plant-based brands' marketing strategies that emphasize ethical and environmental benefits, particularly resonating with younger consumers and flexitarians. Retailers' increasing allocation of shelf space to plant-based products further limits the growth potential of traditional egg-derived ingredients. These market shifts are compelling egg powder manufacturers to expand their product ranges and develop clean-label and functional variants to maintain market relevance.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Protein-Rich Products in Sports and Health Segments

- Natural Emulsifier Demand Drives Egg Powder Market Growth

- Cholesterol/Allergen Labelling Scrutiny

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Whole egg powder holds a 45.67% market share in 2025, due to its wide application in food products and cost-effectiveness for manufacturers. The segment's dominant position results from its comprehensive nutritional content and effective binding properties in bakery products, functioning as both a protein source and emulsifier. Egg albumen/white powder is experiencing the highest growth rate with a 6.52% CAGR through 2031. This growth is primarily attributed to increased demand from the sports nutrition industry and the rising preference for natural protein sources in clean-label products.

Egg yolk powder maintains consistent demand in premium food applications, particularly in confectionery and specialized food products, where its natural lecithin content provides essential emulsification properties. Blended and specialty powders occupy a smaller but expanding market segment, serving specific industrial applications that require precise protein and fat ratios. Recent advancements in spray drying technology are improving powder quality across all segments. Processing at 140°C with controlled flow rates enhances gel formation properties and water-holding capacity. Additionally, the implementation of desugarization processes for egg powders is enabling the development of specialized products with improved nutritional profiles and reduced browning potential.

The Egg Powder Market Report is Segmented by Product Type (Whole Egg Powder, Egg Yolk Powder, Egg Albumen/White Powder, and Blended and Specialty Powders), by Application (Food and Beverage, Nutraceuticals, Personal Care and Cosmetics, and Animal Feed and Pet Food) and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds a dominant 36.06% market share in 2025, primarily due to extensive egg processing operations in China and increasing protein consumption across the region. Japan and South Korea maintain established markets with advanced food processing sectors that require premium egg powder for specific applications, including bakery products, confectionery, and ready-to-eat meals. The region's expansion continues through rapid urbanization, changing dietary preferences, and rising protein demand, especially in developing economies where convenience foods are becoming more prevalent. Local manufacturers are investing in advanced processing technologies to meet the growing demand for high-quality egg powder products.

The Middle East and Africa region shows the highest growth potential with a 7.21% CAGR through 2031. This growth stems from ongoing economic development and increased protein consumption in emerging markets, supported by enhanced food processing infrastructure and higher disposable incomes that drive processed food consumption. Countries like Saudi Arabia and the UAE are witnessing significant investments in food processing facilities, while African nations are experiencing increased demand for shelf-stable protein ingredients.

North America maintains market stability despite supply chain disruptions, with the USDA forecasting a 41.1% increase in egg prices for 2025, primarily due to avian influenza outbreaks. The region's established food manufacturing sector continues to drive demand for egg powder in various applications, including sports nutrition products and processed foods. Europe shows consistent growth, influenced by clean-label preferences and regulatory support for natural ingredients, highlighted by the establishment of the first modern egg drying facility in the UK through British Lion egg powder. The European market is particularly focused on organic and free-range egg powder products, responding to consumer demand for ethically sourced ingredients.

- NAKASHIMATO CO., LTD (Kewpie Corporation)

- Thornico Food & Food Technology Group A/S (Sanovo Technology Group)

- Rembrandt Foods

- Interovo Egg Group

- Ovostar Union

- Bouwhuis Enthoven B.V.

- Wulro B.V.

- Pulviver

- Eurovo Group

- Ovobel Foods

- Adriaan Goede

- Avangardco

- Taiyo Kagaku

- Taj Agro

- IGRECA

- Ovodan Food Technology

- Cosmile Europe

- Jinan Huamei Food

- Eggway International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Popularity of Processed Bakery and Confectionery Products

- 4.2.2 Growing Demand for Functional Foods and Dietary Supplements

- 4.2.3 Demand for Protein-Rich Products in Sports and Health Segments

- 4.2.4 Natural Emulsifier Demand Drives Egg Powder Market Growth

- 4.2.5 Longer Shelf-Life Advantage Over Liquid Eggs

- 4.2.6 Expansion into Personal Care and Cosmetics

- 4.3 Market Restraints

- 4.3.1 Rise of Plant-Based Egg Replacers

- 4.3.2 Cholesterol/Allergen Labelling Scrutiny

- 4.3.3 Carbon-Footprint Pressure vs Animal Proteins

- 4.3.4 Egg Price Volatility and Avian-Flu Supply Shocks

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Whole Egg Powder

- 5.1.2 Egg Yolk Powder

- 5.1.3 Egg Albumen/White Powder

- 5.1.4 Blended and Specialty Powders

- 5.2 By Application

- 5.2.1 Food and Beverage

- 5.2.1.1 Bakery and Confectionery

- 5.2.1.2 Convenience and Ready Meals

- 5.2.1.3 Sports Nutrition

- 5.2.1.4 Meat Products

- 5.2.1.5 Dairy Products

- 5.2.1.6 Others

- 5.2.2 Nutraceuticals

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Animal Feed and Pet Food

- 5.2.1 Food and Beverage

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Netherlands

- 5.3.2.6 Italy

- 5.3.2.7 Sweden

- 5.3.2.8 Poland

- 5.3.2.9 Belgium

- 5.3.2.10 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Indonesia

- 5.3.3.7 Thailand

- 5.3.3.8 Singapore

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Colombia

- 5.3.4.5 Peru

- 5.3.4.6 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Saudi Arabia

- 5.3.5.5 Egypt

- 5.3.5.6 Morocco

- 5.3.5.7 Turkey

- 5.3.5.8 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 NAKASHIMATO CO., LTD (Kewpie Corporation)

- 6.4.2 Thornico Food & Food Technology Group A/S (Sanovo Technology Group)

- 6.4.3 Rembrandt Foods

- 6.4.4 Interovo Egg Group

- 6.4.5 Ovostar Union

- 6.4.6 Bouwhuis Enthoven B.V.

- 6.4.7 Wulro B.V.

- 6.4.8 Pulviver

- 6.4.9 Eurovo Group

- 6.4.10 Ovobel Foods

- 6.4.11 Adriaan Goede

- 6.4.12 Avangardco

- 6.4.13 Taiyo Kagaku

- 6.4.14 Taj Agro

- 6.4.15 IGRECA

- 6.4.16 Ovodan Food Technology

- 6.4.17 Cosmile Europe

- 6.4.18 Jinan Huamei Food

- 6.4.19 Eggway International

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK