PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906236

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906236

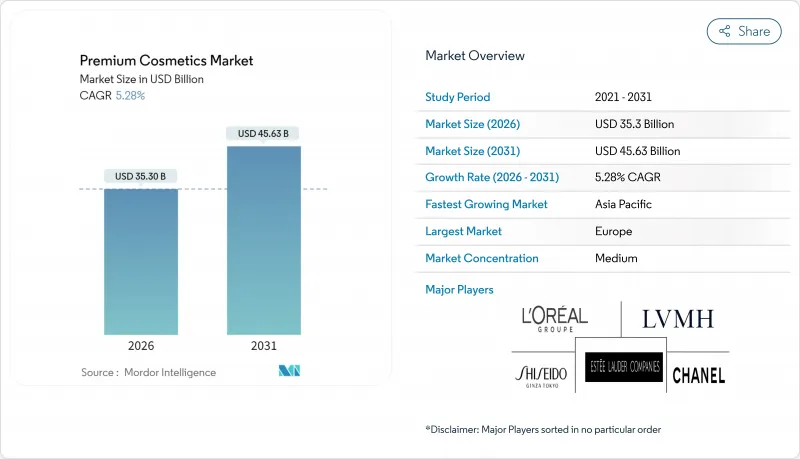

Premium Cosmetics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The premium cosmetics market size in 2026 is estimated at USD 35.3 billion, growing from 2025 value of USD 33.53 billion with 2031 projections showing USD 45.63 billion, growing at 5.28% CAGR over 2026-2031.

The market's expansion is underpinned by sophisticated consumer behavior patterns that prioritize quality over quantity, with affluent demographics increasingly viewing premium beauty products as essential rather than discretionary purchases. Regulatory modernization is reshaping competitive dynamics across key markets, with the FDA's Modernization of Cosmetics Regulation Act of 2022 expanding oversight authority and requiring enhanced safety substantiation . Simultaneously, the European Union's unified regulatory framework under Regulation EC 1223/2009 continues to set global standards for ingredient safety and product compliance . These regulatory shifts are creating barriers to entry for smaller players while benefiting established luxury conglomerates with robust compliance infrastructures. Heightened regulatory scrutiny in the United States and Europe favors established players with robust compliance infrastructure, while Asia-Pacific's expanding middle class and social-media-fueled beauty culture accelerates regional demand. Luxury houses also safeguard margin through continuous formulation innovation, sustainable packaging upgrades, and selective retail footprints that reinforce exclusivity.

Global Premium Cosmetics Market Trends and Insights

Brand Prestige and Exclusivity

The premium cosmetics sector's fundamental value proposition centers on exclusivity and heritage, with brands leveraging scarcity marketing and limited-edition releases to maintain premium positioning. Consumer research indicates that affluent buyers prioritize brand consciousness and distinctiveness when making luxury beauty purchases, with these factors significantly influencing purchasing decisions even in economically unstable regions. Louis Vuitton's planned entry into prestige cosmetics demonstrates how luxury fashion houses are expanding into beauty to capture aspirational shoppers, following strategies employed by competitors like Chanel and Dior. This trend reflects the sector's ability to command premium pricing through brand equity rather than functional differentiation. The rise of indie beauty brands launching at an average of 2 per week in France during 2023 indicates market fragmentation yet established luxury players maintain competitive advantages through distribution networks and marketing scale. Brand prestige strategies are increasingly incorporating AI-driven personalization to enhance customer experiences while maintaining exclusivity.

Elevated Packaging and Aesthetics

Premium cosmetics packaging serves as a critical differentiator, with brands investing heavily in sustainable yet aesthetically superior solutions that reinforce premium positioning. Estee Lauder Inc achieved 71% of packaging meeting recyclable, refillable, reusable, recycled, or recoverable criteria by 2023, demonstrating how sustainability can enhance rather than compromise luxury appeal. L'Oreal Groupe has transformed its manufacturing facilities over the past five years to support a 17-fold increase in refillable packaging options across its brand portfolio. In June 2025, the company launched its first global multi-brand initiative, #JoinTheRefillMovement, to encourage consumer adoption of refillable beauty products. The campaign, coinciding with World Refill Day on June 16, 2025, brings together brands including Lancome, Armani Beauty, and Kiehl's to highlight the environmental and economic advantages of refillable products, with the goal of normalizing sustainable beauty practices. Consumer willingness to pay premium prices for sustainable luxury packaging creates opportunities for brands to differentiate through environmental innovation without sacrificing margins.

Counterfeit and Low-Quality Products

The proliferation of counterfeit luxury cosmetics poses a significant threat to brand integrity and consumer safety, with a significant share of cosmetics sold being fakes, particularly through online channels and social media platforms. An August 2024 report on illegal sales from the Argentine Chamber of Trade and Services (CAC) indicated that Barrio Once represented 27.7% of total illegal street vendors in the City of Buenos Aires . The products included cosmetics, among others. Counterfeit products often contain dangerous chemicals that pose health risks to consumers, creating liability concerns for legitimate brands and undermining consumer confidence in luxury beauty products. The rise of online shopping and social media has exacerbated the issue, as many consumers, particularly young people, are drawn to cheaper alternatives without understanding the risks. Brands are responding with innovative authentication solutions, including holograms, QR codes, and blockchain technology to verify product authenticity and protect consumers. The challenge is particularly acute in emerging markets like Nigeria, where counterfeiting and piracy significantly impact brand integrity and public health, requiring coordinated efforts between brands, regulators, and public relations initiatives according to the Journal of African Research in Business & Technology. The economic impact extends beyond immediate sales losses, as counterfeit products can damage brand reputation and consumer trust, requiring substantial investments in anti-counterfeiting measures and consumer education programs.

Other drivers and restraints analyzed in the detailed report include:

- Influence of Social Media and Beauty Influencers

- Innovation in Formulations

- Consumer Skepticism Toward Overhyped Claims

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Facial cosmetics commanded 41.98% market share in 2025, reflecting consumer prioritization of color cosmetics and complexion products within luxury beauty routines. The segment's leadership stems from the convergence of color cosmetics and makeup trends, with hybrid products combining cosmetic coverage with skincare benefits appealing to nearly half of U.S. consumers. Eye cosmetics represents the fastest-growing segment at 6.08% CAGR through 2031, driven by social media influence. Lip and nail makeup cosmetics benefit from immense growth in lip products during 2024, with lip balms and oils experiencing double-digit sales increases.

Innovation in facial cosmetics centers on personalized solutions, exemplified by L'Oreal's Cell BioPrint technology that assesses skin's biological age and ingredient responsiveness to enable customized product recommendations. The development of proprietary ingredients like L'Oreal's MelasylTM for addressing localized skin pigmentation demonstrates the R&D intensity required for facial cosmetics differentiation. Eye cosmetics innovation focuses on lash enhancement technologies and multifunctional formulations, while lip products emphasize hybrid formulations combining color with skincare benefits. The segment's growth trajectory reflects consumer willingness to invest in premium facial products that deliver both immediate aesthetic benefits and long-term beauty advantages.

Female consumers maintained 88.74% market share in 2025, reflecting the historical foundation of luxury cosmetics in women's beauty routines and established purchasing patterns. However, the male segment is experiencing rapid acceleration at 8.32% CAGR through 2031, indicating fundamental shifts in gender-based beauty consumption and market opportunities. This growth trajectory suggests male luxury cosmetics could represent a significant market expansion opportunity, particularly as social acceptance of men's grooming and beauty products increases across global markets.

The male segment's acceleration reflects changing attitudes toward masculinity and self-care, with younger male demographics increasingly embracing cosmetics and grooming products previously considered feminine. Luxury brands are responding by developing male-specific product lines and marketing strategies that appeal to masculine sensibilities while maintaining premium positioning. The challenge lies in creating products that address male-specific beauty concerns and preferences while avoiding alienating core female customer bases. Female segment growth continues to be driven by innovation in anti-aging formulations, clean beauty trends, and personalized skincare solutions, with established luxury brands leveraging their heritage and expertise to maintain market leadership. The convergence of male and female beauty trends creates opportunities for unisex luxury products and gender-neutral marketing approaches that appeal to evolving consumer preferences.

The Premium Cosmetics Market is Segmented by Product Type (Facial Cosmetics, Eye Cosmetics, and Lip and Nail Make-Up Cosmetics), Gender (Female, and Male), Category (Natural/Organic, and Conventional/Synthetic), Distribution Channel (Single Brand Stores, Multi-Brand Stores, Online Retail Stores, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe remained the largest regional slice with 30.85% of revenue in 2025, underpinned by mature luxury retail networks, tourism inflows, and a cultural legacy of high-end beauty craftsmanship. Regulations harmonized under EC 1223/2009 foster consumer confidence, while heritage houses in France and Italy anchor global brand narratives. Economic softness in some European Union states has not dented premium beauty, as wealthy consumers display inelastic demand and overseas tourists resume cross-border shopping. Expansion of duty-free beauty corners in airports from Paris to Frankfurt further reinforces European share of the luxury cosmetics market.

Asia-Pacific is forecast to post a robust 7.62% CAGR through 2031, driven by rising middle-class spending power, youthful demographics, and pervasive digital engagement. China, South Korea, and Japan remain powerhouse markets, yet Southeast Asia and India are now frontiers of triple-digit absolute growth. Livestream commerce, K-beauty inspiration, and burgeoning male-grooming acceptance bolster demand. Local regulatory reforms that ease import duties on clean formulations attract foreign entrants while stoking domestic innovations.

North America commands a steady share, buoyed by high per-capita spend and vibrant indie-brand activity that often graduates into luxe tiers. Latin America and the Middle East & Africa present mixed prospects; currency volatility tempers imported product affordability, yet aspirational urban consumers seek status through branded beauty. Duty-free enclaves in Dubai and Doha, alongside rising tourism in Mexico's resort corridors, sustain niche premium sales. Overall, geographic diversification shields the luxury cosmetics market from localized economic shocks and supports consistent global expansion.

- L'Oreal S.A

- The Estee Lauder Company

- LVMH Moet Hennessy Louis Vuitton SE

- Shiseido Co., Ltd.

- Coty Inc.

- Chanel Limited

- Giorgio Armani Ltd

- Amorepacific Corp. (Sulwhasoo)

- Kao Corp. (Kanebo)

- Revlon Inc

- Clarins Group

- Kering Beauy

- LG

- Huda Beauty

- Yves Rocher International

- BareMinerals

- L'Occitane International S.A.

- Mary Kay

- Adorn Cosmetics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Brand Prestige and Exclusivity

- 4.2.2 Elevated Packaging and Aesthetics

- 4.2.3 Rising Demand for Natural and Clean Ingredients

- 4.2.4 Influence of Social Media and Beauty Influencers

- 4.2.5 Innovation in Formulations

- 4.2.6 Product Availability and Retail Expansion

- 4.3 Market Restraints

- 4.3.1 Counterfeit and Low-Quality Products

- 4.3.2 Stringent Regulatory and Safety Standards

- 4.3.3 Allergic Reactions and Sensitivities

- 4.3.4 Consumer Skepticism Toward Overhyped Claims

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Facial Cosmetics

- 5.1.2 Eye Cosmetics

- 5.1.3 Lip and Nail Make-up Cosmetics

- 5.2 By Gender

- 5.2.1 Female

- 5.2.2 Male

- 5.3 By Category

- 5.3.1 Natural/Organic

- 5.3.2 Conventional/Synthetic

- 5.4 By Distribution Channel

- 5.4.1 Single Brand Stores

- 5.4.2 Multi-Brand Stores

- 5.4.3 Online Retail Stores

- 5.4.3.1 D2C (Direct-to-Consumer)

- 5.4.3.2 Third-party E-retailers

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 South Africa

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Nigeria

- 5.5.4.5 Egypt

- 5.5.4.6 Morocco

- 5.5.4.7 Turkey

- 5.5.4.8 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Colombia

- 5.5.5.4 Chile

- 5.5.5.5 Peru

- 5.5.5.6 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 L'Oreal S.A

- 6.4.2 The Estee Lauder Company

- 6.4.3 LVMH Moet Hennessy Louis Vuitton SE

- 6.4.4 Shiseido Co., Ltd.

- 6.4.5 Coty Inc.

- 6.4.6 Chanel Limited

- 6.4.7 Giorgio Armani Ltd

- 6.4.8 Amorepacific Corp. (Sulwhasoo)

- 6.4.9 Kao Corp. (Kanebo)

- 6.4.10 Revlon Inc

- 6.4.11 Clarins Group

- 6.4.12 Kering Beauy

- 6.4.13 LG

- 6.4.14 Huda Beauty

- 6.4.15 Yves Rocher International

- 6.4.16 BareMinerals

- 6.4.17 L'Occitane International S.A.

- 6.4.18 Mary Kay

- 6.4.19 Adorn Cosmetics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK