PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906239

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906239

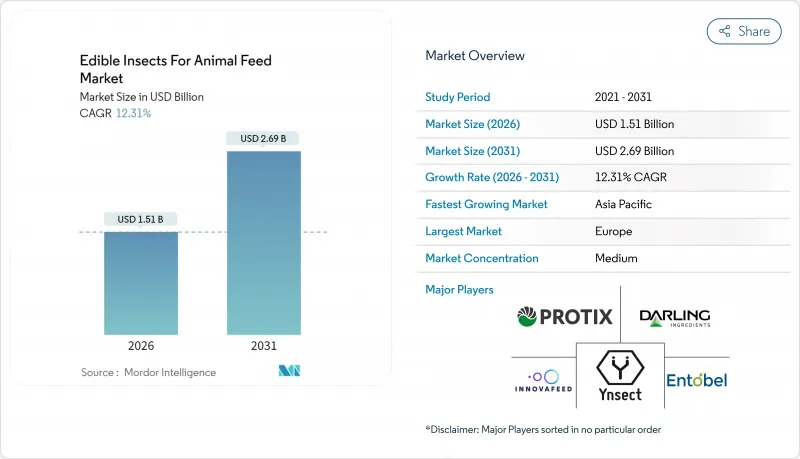

Edible Insects For Animal Feed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The edible insects for animal feed market is expected to grow from USD 1.34 billion in 2025 to USD 1.51 billion in 2026 and is forecast to reach USD 2.69 billion by 2031 at 12.31% CAGR over 2026-2031.

Scale economics in black soldier fly (BSF) facilities, along with widening regulatory clearance and sustainability mandates from global feed majors, are accelerating mainstream adoption in aquaculture, poultry, and premium pet food. Cargill's supply contracts with Innovafeed show how feed multinationals are weaving insect proteins into Scope 3 emission reduction plans . Bioengineering advances that improve feed-conversion ratios and the growing premium pet segment's demand for hypoallergenic proteins further reinforce demand. Still, the high upfront capital required for vertical insect farms and biosecurity concerns associated with monoculture species temper growth.

Global Edible Insects For Animal Feed Market Trends and Insights

Rapid Cost Decline in Large-scale Black Soldier Fly (BSF) Farming

Automation and vertical farm design improvements have cut unit production costs by more than 35% since 2023, placing BSF meal within striking range of soybean concentrate on a protein-adjusted basis. Macquarie University's gene-edited larvae research lifts feed-conversion ratios and decreases mortality, sharpening economic viability. Innovafeed's Phase 3 expansion in Nesle, France's facility quintuples capacity while cutting energy intensity per metric ton of protein. Denmark's Enorm facility produces more than 10,000 metric tons annually with minimal climate impact, illustrating how scale and eco-footprint can improve concurrently . Automated larval handling, AI-driven feeding, and optimized substrates are projected to shave a further 15% off cash costs by 2027. These dynamics enhance competitiveness across the edible insects for the animal feed market, especially in price-sensitive aquaculture.

Regulatory Green Lights for Insect Meal in Aquafeed

The European Food Safety Authority's clearance of multiple insect species and the European Commission's 2025 approval of UV-treated mealworm powder set strong precedents. Singapore's authorization of 16 insect species and Thailand's BSF meal standards add regional momentum. Industry group IPIFF coordinates data-sharing to accelerate approvals, while Indonesia drafts quarantine rules that could streamline trade lanes. Faster approval cycles shorten commercialization timelines for new facilities, enabling the edible insects for animal feed market to tap the vast aquafeed segment that consumes 40 million metric tons of compound feed yearly. Harmonized rules reduce compliance costs and encourage cross-border investment.

Slow Inclusion Limits for Poultry and Swine Feed in the United States

FDA evaluations for insect proteins in monogastric diets demand multi-year safety dossiers, delaying commercial roll-out beyond aquaculture. Comparative studies in Europe already show no prion-related risks, creating regulatory disparity. Post-Brexit United Kingdom rules keep insect proteins limited to fish and pets, further restricting volume. United States' producers therefore channel output to smaller, higher-margin segments such as pet food while awaiting broader approvals, slowing overall edible insects for animal feed market penetration.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability Mandates From Global Feed Majors

- Growth in Premium Pet Food Requiring Hypoallergenic Proteins

- High Upfront Capex for Vertical Insect Farms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Black soldier fly secured 41.37% of the edible insects for animal feed market share in 2025. The species converts a wide spectrum of organic waste streams into protein with feed-conversion efficiencies above 90%, and regulators in Europe, Asia, and North America increasingly approve its use across livestock classes. The edible insects for animal feed market size for BSF-based ingredients is projected to climb 13.36% CAGR through 2031 as automated facilities roll out in France, Netherlands, Singapore, and Illinois. Recent studies demonstrate that adding fruit fermentation liquid enhances larval growth and cuts ammonia emissions by 24.4%, bringing performance metrics closer to high-grade fishmeal.

Mealworm demand remains anchored in premium pet food, where its neutral flavor supports palatability. Genetic selection programs aimed at faster growth cycles and higher lipid content could push mealworms into poultry diets. Cricket protein stays niche but finds traction in specialty aquafeed due to chitin's gut-health benefits. Niche species such as silkworms and grasshoppers together form less than 5% of the edible insects for animal feed market size yet attract R&D for region-specific waste streams.

The Edible Insects for Animal Feed Market Report is Segmented by Insect Species (Black Soldier Fly, Mealworms, Crickets, and More), by Form (Whole Dried, Powdered Meal, and More), by Application (Aquafeed, Poultry Feed, Swine Feed, and More), and by Geography (North America, Europe, Asia-Pacific, South America, Africa, and Middle East). The Report Offers the Market Size and Forecasts in Terms of Value (USD).

Geography Analysis

Europe commanded 39.68% of the edible insects for animal feed market in 2025, reflecting robust regulatory foundations and mature aquaculture demand. Innovafeed's Nesle megafactory and Protix's Zeeland site illustrate how France and Netherlands serve as continental hubs. Denmark's Enorm facility shows northern nations can align scale with low carbon footprints. As carbon-pricing tightens, European feed formulators increasingly lock in insect meal purchase contracts, stabilizing demand but moderating growth rates.

Asia-Pacific is the fastest-growing territory, posting a 13.35% CAGR to 2031. Singapore's 2024 approval of 16 insect species and Thailand's black soldier fly production standards attract investors into Malaysia, Vietnam, and Indonesia, each leveraging abundant waste substrates. Regional aquaculture output surpasses 60 million metric tons, creating sustained pull for low-carbon ingredients. Entobel's cross-border supply chains and Nasekomo's neonate shipping service exemplify a pan-regional model of distributed production and centralized genetics.

North America also occupied a significant share in 2025 but holds latent upside. Ynsect's United States dog-food clearance removes a key hurdle. Beta Hatch's Washington plant signals industrial-scale capacity is emerging domestically. Federal grants to Innovafeed for insect-based fertilizers show policy support in adjacent markets. Harmonizing FDA inclusion limits with aquaculture precedents will be pivotal for substantial uptake in poultry and swine feeds.

- Ynsect SAS

- Innovafeed SAS

- Protix B.V.

- Entobel

- Darling Ingredients Inc (EnviroFlight)

- nextProtein SA

- Hexafly

- Sentara Group

- Beta Hatch Inc

- FlyFarm Worldwide Ltd.

- Maltento (Pty) Ltd.

- Inseco Private Limited

- Nasekomo B.V

- Aspire Food Group

- Keetup

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid cost decline in large-scale black soldier fly (BSF) farming

- 4.2.2 Regulatory green lights for insect meal in aquafeed

- 4.2.3 Sustainability mandates from global feed majors

- 4.2.4 Growth in premium pet food requiring hypoallergenic proteins

- 4.2.5 Waste-to-protein circular-economy incentives

- 4.2.6 Synthetic biology breakthroughs improving insect feed conversion

- 4.3 Market Restraints

- 4.3.1 Slow inclusion limits for poultry and swine feed in the United States

- 4.3.2 High upfront capex for vertical insect farms

- 4.3.3 Consumer ethical concerns on insect welfare

- 4.3.4 Supply-chain bio-security risks from mono-culture insect species

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Insect Species

- 5.1.1 Black Soldier Fly

- 5.1.2 Mealworms

- 5.1.3 Crickets

- 5.1.4 Others

- 5.2 By Form

- 5.2.1 Whole Dried

- 5.2.2 Powdered Meal

- 5.2.3 Oil

- 5.2.4 Extracts and Hydrolysates

- 5.3 By Application

- 5.3.1 Aquafeed

- 5.3.2 Poultry Feed

- 5.3.3 Swine Feed

- 5.3.4 Ruminant Feed

- 5.3.5 Pet Food

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Netherlands

- 5.4.3.5 Norway

- 5.4.3.6 Spain

- 5.4.3.7 Italy

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Indonesia

- 5.4.4.6 Thailand

- 5.4.4.7 Vietnam

- 5.4.4.8 Australia

- 5.4.4.9 New Zealand

- 5.4.4.10 Rest of Asia-Pacific

- 5.4.5 Middle East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Turkey

- 5.4.5.4 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Kenya

- 5.4.6.3 Nigeria

- 5.4.6.4 Rest of Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Ynsect SAS

- 6.4.2 Innovafeed SAS

- 6.4.3 Protix B.V.

- 6.4.4 Entobel

- 6.4.5 Darling Ingredients Inc (EnviroFlight)

- 6.4.6 nextProtein SA

- 6.4.7 Hexafly

- 6.4.8 Sentara Group

- 6.4.9 Beta Hatch Inc

- 6.4.10 FlyFarm Worldwide Ltd.

- 6.4.11 Maltento (Pty) Ltd.

- 6.4.12 Inseco Private Limited

- 6.4.13 Nasekomo B.V

- 6.4.14 Aspire Food Group

- 6.4.15 Keetup

7 Market Opportunities and Future Outlook