PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906244

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906244

Polyvinyl Butyral (PVB) Interlayers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

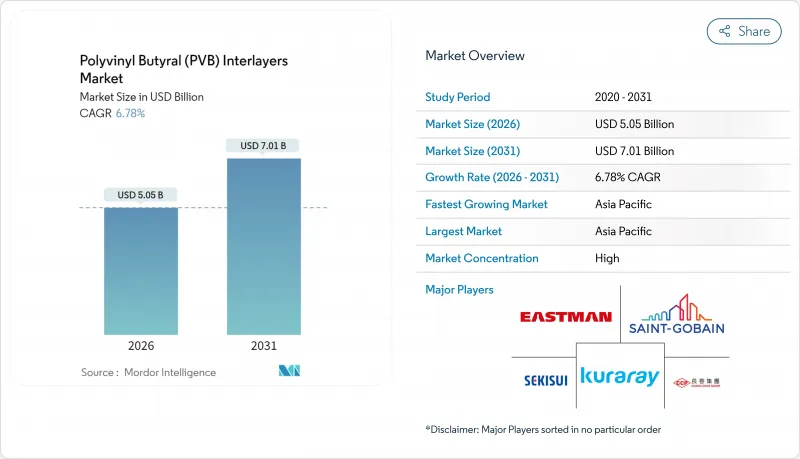

The Polyvinyl Butyral Interlayers market is expected to grow from USD 4.73 billion in 2025 to USD 5.05 billion in 2026 and is forecast to reach USD 7.01 billion by 2031 at 6.78% CAGR over 2026-2031.

Rising safety regulations, sustainability mandates and the push for lighter vehicles and greener buildings anchor this expansion. Electric-vehicle programs are widening the glazing envelope from the windshield to every window, while LEED-driven construction specifies high-performance laminated facades that curb solar heat gains and block ultraviolet radiation. Manufacturers are unveiling multi-functional films that combine acoustic damping, solar control and bird-collision deterrence, thereby enlarging the addressable opportunity for the polyvinyl butyral interlayers market. At the same time, raw-material cost swings and still-nascent recycling routes squeeze margins and spur vertical integration among leading suppliers.

Global Polyvinyl Butyral (PVB) Interlayers Market Trends and Insights

Growing Adoption of Laminated Safety Glass in Automotive and Construction

Electric-vehicle programs remove the masking effect of engine noise, intensifying OEM demand for side and rear glass that integrates acoustic polyvinyl butyral layers. SEKISUI's latest S-LEC series blocks near-infra-red radiation to trim cabin heat and extend driving range. Architects simultaneously specify oversized laminated panels in high-rise facades, where the interlayer absorbs impact energy and keeps shards bonded for occupant safety. Trans-sector technology transfer shortens development cycles and reinforces the polyvinyl butyral interlayers market as innovations in one end-use quickly migrate to the other.

Regulatory Mandates for Vehicle-Occupant Safety and Glass Strength

The U.S. NHTSA Federal Motor Vehicle Safety Standard 217a comes into effect in 2027 and compels advanced glazing on long-distance buses, materially enlarging the downstream pool for the polyvinyl butyral interlayers market. Similar ECE revisions in Europe focus on pedestrian safety and rollover integrity, driving OEMs toward thicker multi-layer laminates with higher-modulus interlayers. Regulations heighten per-vehicle material loading and reward suppliers capable of formulating impact-resistant films that remain clear under wider temperature ranges.

Price Fluctuations in Polyvinyl Butyral Resins and Additives

SEKISUI raised S-LEC film list prices by 6-15% in October 2024, followed by Eastman adding USD 0.04/lb on plasticizers from April 2025. China's January 2025 tariff lift on PVC imports to 5.5% imposes an incremental USD 22.95-23.85/t cost burden on resin processors. Because OEM contracts often lock prices for model cycles, downstream fabricators face margin compression, prompting consolidation and deeper vertical integration to secure feedstock and hedge volatility across the polyvinyl butyral interlayers market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Energy-Efficient Glazing and UV Protection

- Expansion of Green Buildings and LEED-Certified Construction

- Limitations in Recycling of End-of-Life PVB Interlayers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Standard films delivered 61.62% of 2025 revenue, underscoring their ubiquity in safety glass. Meanwhile acoustic formats are growing at 7.48% CAGR as electric-vehicle drivetrains expose wind and tire noise. Saflex Q reduces cabin sound pressure by up to 7 dB without process retooling. Multi-functional hybrids that embed acoustic, solar and structural properties in one stack entice automakers to curb part counts. The polyvinyl butyral interlayers market size for acoustic solutions is projected to climb from USD 0.5 billion in 2026 to USD 0.71 billion in 2031, illustrating a shift in value mix. UV-screening and hurricane-rated grades stay niche yet profit-rich, particularly in coastal U.S. and Caribbean construction markets vulnerable to extreme weather.

In competitive terms, portfolio breadth is overtaking unit cost as the decisive lever. Producers offering interchangeable cores that switch from standard to acoustic by adjusting plasticizer ratios optimize plant utilization and win dual-sourcing awards with global OEMs. This capability accelerates cannibalization of legacy films but anchors supplier lock-in, which supports pricing leverage within the polyvinyl butyral interlayers market.

Sheet and roll goods supplied 84.10% of 2025 shipments due to mature logistics and lamination tooling. Yet tailored-cut films, dispensed in project-specific dimensions, are gaining 7.55% CAGR as facade contractors demand waste minimization and faster line speeds. Digital knife and laser systems enable custom layouts that mirror BIM models, reducing on-site trim. The polyvinyl butyral interlayers market share for tailor-made formats reached 15.90% in 2025 and could top 20% by 2031 as urban megaprojects proliferate. Transporting jumbo panels wider than 3.2 m calls for local lamination hubs, encouraging regionalisation of production footprints and alliances between film makers and facade glaziers.

Value creation shifts from resin tonnage to service. Suppliers bundling structural simulation, on-time kit delivery and on-site technical support monetize intangible differentiators difficult for commodity entrants to match. Those capabilities elevate average selling prices even when resin indices soften, insulating margins across the polyvinyl butyral interlayers market.

The Polyvinyl Butyral (PVB) Interlayers Market Report is Segmented by Type (Standard PVB, Acoustic PVB, and More), Form (Sheet/Roll Form, Custom-Cut/Pre-laminated Film), Application (Automotive Windshields, Side and Rear Automotive Glazing, and More), End-User Industry (Automotive and Transportation, Building and Construction, and More), and Geography (Asia-Pacific, North America, and More).

Geography Analysis

Asia-Pacific produced 44.35% of global revenue in 2025 and is growing at 7.84% CAGR, powered by China's 25-million-unit vehicle output and record-breaking urban construction pace. The January 2025 hike in PVC import tariffs to 5.5% adds USD 23/t to resin costs, nudging glass processors toward domestic PVB film suppliers. India's vehicle-sales expansion and smart-city programs feed additional momentum, albeit from a lower base. Japanese and South Korean champions inject acoustic and solar-control innovation that diffuses through regional supply chains. Meanwhile ASEAN countries attract new lamination capacity, leveraging lower labor costs yet remaining inside Asia's logistical orbit.

North America represents a steady replacement market where stringent NHTSA rules elevate specification levels. The forthcoming 2027 bus-glazing mandate is set to lift demand volumes and complexity. Building retrofits for energy savings, especially in the U.S. Sun Belt, favor solar-control PVB that offsets peak cooling loads. Canada's federal carbon-pricing scheme further tilts renovation choices toward high-insulation glass, widening the addressable slice of the polyvinyl butyral interlayers market.

Europe remains technology-centric, with Extended Producer Responsibility schemes escalating recycling expectations. Tarkett's 2024 breakthrough in reclaiming lamination offcuts shrinks carbon intensity by 25 times relative to virgin PVB. Such advances reposition recycled content from compliance burden to marketing gain. Demand growth is modest, yet product-mix enrichment toward multi-functional and low-carbon interlayers keeps value rising ahead of volume.

South America, the Middle East and Africa together account for under 10% of global turnover but deliver double-digit growth off small bases. Brazil's auto-recovery and Gulf construction mega-projects require heat-resistant, sand-abrasion-tolerant glazing. Suppliers that tailor formulations to tropical climates lock in early influence as regional regulations tighten, setting the stage for future scale in the polyvinyl butyral interlayers market.

- Chang Chun Group

- Eastman Chemical Company

- Everlam

- Genau Manufacturing Company LLP (GMC LLP)

- Guangzhou Aojisi New Material Co., Ltd.

- Huakai Plastic (Chongqing) Co., Ltd.

- Jiangsu Daruihengte Science & Technology Co., Ltd.

- Jinjing (Group) Co., Ltd.

- KB PVB

- Kuraray Co., Ltd.

- Saint-Gobain

- SEKISUI CHEMICAL CO., LTD.

- ZHEJIANG DECENT NEW MATERIAL CO., LTD

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption of laminated safety glass in automotive and construction

- 4.2.2 Regulatory mandates for vehicle-occupant safety and glass strength

- 4.2.3 Rising demand for energy-efficient glazing and UV protection

- 4.2.4 Expansion of green buildings and LEED-certified construction

- 4.2.5 Increasing replacement rate of windshields and architectural glass panels

- 4.3 Market Restraints

- 4.3.1 Price fluctuations in Polyvinyl Butyral (PVB) resins and additives

- 4.3.2 Limitations in recycling of end-of-life Polyvinyl Butyral (PVB) interlayers

- 4.3.3 Logistical challenges in transporting large-format rolls

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Standard Polyvinyl Butyral (PVB) Interlayers

- 5.1.2 Acoustic Polyvinyl Butyral (PVB) Interlayers

- 5.1.3 Solar-Control Polyvinyl Butyral (PVB) Interlayers

- 5.1.4 Colored and Tinted Polyvinyl Butyral (PVB) Interlayers

- 5.1.5 UV-Resistant / High-Performance Polyvinyl Butyral (PVB) Interlayers

- 5.2 By Form

- 5.2.1 Sheet / Roll Form

- 5.2.2 Custom-Cut / Pre-laminated Film

- 5.3 By Application

- 5.3.1 Automotive Windshields

- 5.3.2 Side and Rear Automotive Glazing

- 5.3.3 Architectural Glazing (Windows, Facades, Roofs)

- 5.3.4 Interior Decorative Glass and Partitions

- 5.3.5 Specialty (Bullet-, Blast-Resistant)

- 5.4 By End-user Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Building and Construction

- 5.4.3 Defense and Security

- 5.4.4 Consumer Electronics and Smart Displays

- 5.4.5 Other End-user Industries (Rail, Aerospace, Marine)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Nordic Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles {(includes ... Recent Developments)}

- 6.4.1 Chang Chun Group

- 6.4.2 Eastman Chemical Company

- 6.4.3 Everlam

- 6.4.4 Genau Manufacturing Company LLP (GMC LLP)

- 6.4.5 Guangzhou Aojisi New Material Co., Ltd.

- 6.4.6 Huakai Plastic (Chongqing) Co., Ltd.

- 6.4.7 Jiangsu Daruihengte Science & Technology Co., Ltd.

- 6.4.8 Jinjing (Group) Co., Ltd.

- 6.4.9 KB PVB

- 6.4.10 Kuraray Co., Ltd.

- 6.4.11 Saint-Gobain

- 6.4.12 SEKISUI CHEMICAL CO., LTD.

- 6.4.13 ZHEJIANG DECENT NEW MATERIAL CO., LTD

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growth in smart-glass and switchable Polyvinyl Butyral (PVB) technologies

- 7.3 Advancement in bio-based and recyclable interlayers