PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906245

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906245

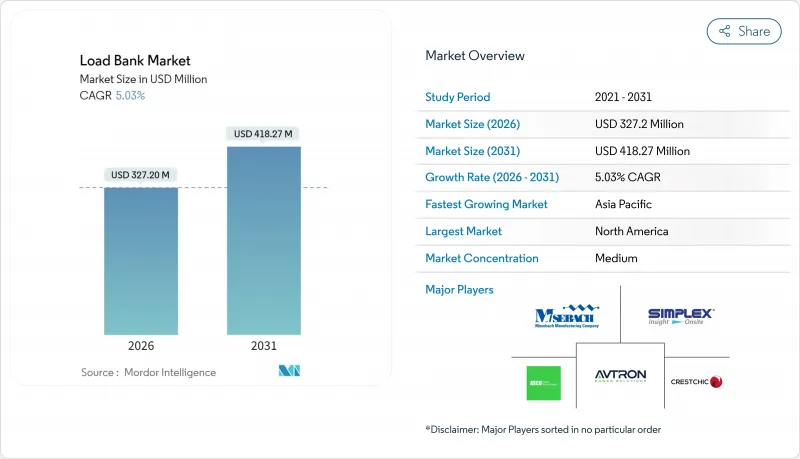

Load Bank - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Load Bank Market size in 2026 is estimated at USD 327.2 million, growing from 2025 value of USD 311.53 million with 2031 projections showing USD 418.27 million, growing at 5.03% CAGR over 2026-2031.

Momentum originates from hyperscale data-center build-outs, renewable-rich grids requiring stability validation, and stricter performance mandates for mission-critical facilities. Data-center operators are raising power-density benchmarks, prompting multi-stage validation that expands rental opportunities for load-bank service providers. Renewable integration adds demand for resistive-reactive and electronic systems that can simulate dynamic load profiles for wind, solar, and storage projects. Manufacturers respond with regenerative designs that recover up to 96% of test energy, a feature increasingly requested in new utility and microgrid procurements. At the same time, raw-material inflation and short project timelines pivot many buyers toward asset-light rental models, influencing competitive strategy across the load bank market.

Global Load Bank Market Trends and Insights

Rapid Data-Center Capacity Additions

Annual data-center construction spending stood at USD 31.5 billion in 2024, and the global pipeline is nearing 50 million ft2 of new space. Hyperscale operators now demand sequential acceptance tests that start at the factory and end with integrated system validation, significantly lifting the utilization of rental load banks. Temporary fleets are routinely redeployed during maintenance windows to sustain service-level agreements, generating recurring revenue. AI workloads lift power density, forcing facilities to commission higher-capacity standby generators that require multi-megawatt load tests. Early pre-leasing of colocation space accelerates the commissioning schedule, compressing test timelines and elevating the premium on fast-deploy load bank market offerings.

Grid-Stability Needs Amid Renewable Surge

Utilities integrating wind and solar must show compliance with IEEE 1547-2018 interconnection protocols, which emphasize active power management and frequency response.Wind-farm projects such as Brazil's Morro Dos Ventos used a 3.3 MVA load bank to validate 145 MW of turbine output before grid tie-in. Photovoltaic installations now include curtailment testing under varying irradiance profiles, driving demand for programmable electronic units that can replicate rapid load ramps. Energy-storage systems complicate scenarios; seamless transition between battery discharge and generator backup is verified through hybrid load tests. Utilities in Asia and South America seek portable high-capacity rigs to service multiple substations, bolstering the addressable load bank market.

Short Project Cycles Favor Rentals Over Purchases

Commissioning teams increasingly source load banks for only a few weeks, undermining the case for capital purchases. Storage, maintenance, and depreciation costs tilt life-cycle economics toward renting, especially when multiple projects run concurrently. Large rental houses leverage volume-purchase discounts with OEMs, tightening margin pressure on standalone manufacturers. Facilities management groups prefer bundled service contracts that fold testing into wider energy-infrastructure deals, reducing direct equipment demand. This structural swing toward services constrains unit volumes as overall load bank market revenues grow.

Other drivers and restraints analyzed in the detailed report include:

- Resiliency Mandates for Mission-Critical Facilities

- Expansion of Rental/Temporary Power Fleet

- Volatility in Raw-Material Prices (Copper, Stainless Steel)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hybrid units held 44.60% of the load bank market share in 2025 by combining resistive and reactive elements inside one enclosure, allowing contractors to complete a wider range of commissioning tasks with a single rental. Though smaller in installed base, electronic systems are forecast for an 7.78% CAGR through 2031 as their regenerative architecture returns up to 96% of absorbed energy to the grid, trimming test-cycle operating costs and lowering on-site heat rejection needs. Pure resistive products remain the entry-level option for straightforward generator pull-down checks where power-factor correction is unnecessary, while reactive models provide precise inductive or capacitive loading for motor-control and UPS validation.

The electronic category is gaining ground fastest inside hyperscale data halls that must limit cooling loads and shorten outage windows; operators increasingly embed rack-level regenerative units that synchronize with building-management software. Meanwhile, hybrid designs stay popular with rental fleets because a single skid can simulate real and reactive components, improving utilization and cutting logistics. Pure reactive offerings persist as a niche for utilities that verify power-factor compensation banks. Tektronix's April 2024 acquisition of EA Elektro-Automatik expanded its regenerative platform to 3.8 MW with >=96% round-trip efficiency, underscoring industry convergence on high-efficiency, digitally controlled solutions.

Units above 2,000 kW will expand at a 6.62% CAGR, mirroring the surge of hyperscale campuses exceeding 100 MW utility feeds. These facilities require multi-megawatt generator strings and commensurate load banks capable of full-system testing in a single pull-down. Conversely, sub-500 kW devices maintained 39.30% of 2025 revenue, underpinned by routine UPS and standby-generator checks in hospitals and commercial buildings. The load bank market size for 501-2,000 kW equipment advances steadily as mid-tier data-centers proliferate, though growth moderates relative to extremes at both ends.

Economies of scale favor manufacturing higher-capacity skids, but transport logistics and site-handling constraints remain limiting factors. Smaller platforms preserve demand due to low cost and ease of mobility, particularly in rental fleets that service distributed customer bases. Polarization between the smallest and largest segments underscores divergent procurement criteria across industries, reinforcing product-portfolio diversification as a competitive necessity.

The Load Bank Market Report is Segmented by Type (Hybrid Load Banks, Electronic Load Banks, and More), Load Capacity (Up To 500 KW, Above 2, 000 KW, and More), Form Factor (Portable, Rack-Mounted/Modular, and More), Application (Data Centres and Cloud, Renewable-Energy Integration and Microgrids, and More), End-User (Utilities, Rental and Service Providers, and More), and Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America controlled 35.10% of 2025 revenue, underpinned by Schneider Electric's USD 700 million manufacturing expansion pledge through 2027, which enhances domestic supply chains serving data centers and utilities. Regulatory frameworks such as NFPA 110 prescribe full-load generator tests for critical infrastructure, sustaining baseline demand. Tariffs on copper raise cost pressure and prompt localization moves that shorten lead times. Mature rental ecosystems support rapid deployment, differentiating the region's service capability.

Asia-Pacific is projected to have the quickest 7.45% CAGR thanks to a 22% annual increase in data-center inventory reaching 2,996 MW across metro hubs like Tokyo, Sydney, Mumbai, and Seoul. National strategies encouraging AI and cloud adoption elevate backup-power investments, while diverse climates necessitate equipment able to endure high humidity and wide temperature swings. China's new data-center energy-efficiency rules and Singapore's restart of the project collectively stimulate the procurement of advanced regenerative units.

Europe exhibits steady progression anchored in stringent environmental policy. Directive 2000/14/EC caps noise emissions for outdoor equipment, pushing OEMs to integrate improved baffling and low-RPM fan designs. Renewable-capacity targets under REPowerEU accelerate grid-support trials for distributed energy resources, widening the application scope. Market participants leverage modular container solutions compatible with urban noise and footprint constraints, aligning with broader green-infrastructure ambitions.

- ASCO Power Technologies (Schneider Electric)

- Crestchic Loadbanks

- Avtron Power Solutions (Vertiv)

- Simplex (Cummins)

- Mosebach Manufacturing

- Load Banks Direct

- Eagle Eye Power Solutions

- Kaixiang Power

- Sephco Industries

- Powerohm Resistors (AMETEK)

- Hillstone Products

- Tatsumi Ryoki

- Shenzhen KSTAR

- ComRent International

- Hitec Power Protection

- Nordhavn Power Solutions

- Pite Tech

- Johnson Controls (Load Bank Division)

- Trystar Load Banks

- Pacific Power Source

- Powerhaul International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid data-centre capacity additions

- 4.2.2 Grid-stability needs amid renewable surge

- 4.2.3 Resiliency mandates for mission-critical facilities

- 4.2.4 Expansion of rental/temporary power fleet

- 4.2.5 Rise of hybrid AC-DC microgrids in remote sites

- 4.2.6 Growing preference for regenerative load banks to curb fuel burn

- 4.3 Market Restraints

- 4.3.1 Short project cycles favour rentals over purchases

- 4.3.2 Volatility in raw-material prices (copper, stainless steel)

- 4.3.3 Limited interoperability standards across OEMs

- 4.3.4 Noise & heat-dissipation compliance hurdles in urban sites

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Resistive Load Banks

- 5.1.2 Reactive Load Banks

- 5.1.3 Hybrid Load Banks

- 5.1.4 Electronic Load Banks

- 5.2 By Load Capacity (kW Rating)

- 5.2.1 Up to 500 kW

- 5.2.2 501 to 1,000 kW

- 5.2.3 1,001 to 2,000 kW

- 5.2.4 Above 2,000 kW

- 5.3 By Form Factor

- 5.3.1 Portable

- 5.3.2 Trailer-Mounted/Mobile

- 5.3.3 Stationary

- 5.3.4 Rack-Mounted/Modular

- 5.4 By Application

- 5.4.1 Power Generation and Commissioning

- 5.4.2 Data Centres and Cloud

- 5.4.3 Manufacturing and Industrial

- 5.4.4 Marine and Shipbuilding

- 5.4.5 Oil and Gas and Petrochemical

- 5.4.6 Renewable-Energy Integration and Microgrids

- 5.4.7 Defence and Aerospace Ground Support

- 5.4.8 Healthcare and Other Mission-Critical Facilities

- 5.5 By End-user

- 5.5.1 Utilities

- 5.5.2 Commercial and Industrial Owners

- 5.5.3 Rental and Service Providers

- 5.5.4 Defence and Government

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 NORDIC Countries

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 ASEAN Countries

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 South Africa

- 5.6.5.4 Egypt

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 ASCO Power Technologies (Schneider Electric)

- 6.4.2 Crestchic Loadbanks

- 6.4.3 Avtron Power Solutions (Vertiv)

- 6.4.4 Simplex (Cummins)

- 6.4.5 Mosebach Manufacturing

- 6.4.6 Load Banks Direct

- 6.4.7 Eagle Eye Power Solutions

- 6.4.8 Kaixiang Power

- 6.4.9 Sephco Industries

- 6.4.10 Powerohm Resistors (AMETEK)

- 6.4.11 Hillstone Products

- 6.4.12 Tatsumi Ryoki

- 6.4.13 Shenzhen KSTAR

- 6.4.14 ComRent International

- 6.4.15 Hitec Power Protection

- 6.4.16 Nordhavn Power Solutions

- 6.4.17 Pite Tech

- 6.4.18 Johnson Controls (Load Bank Division)

- 6.4.19 Trystar Load Banks

- 6.4.20 Pacific Power Source

- 6.4.21 Powerhaul International

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment