PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906248

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906248

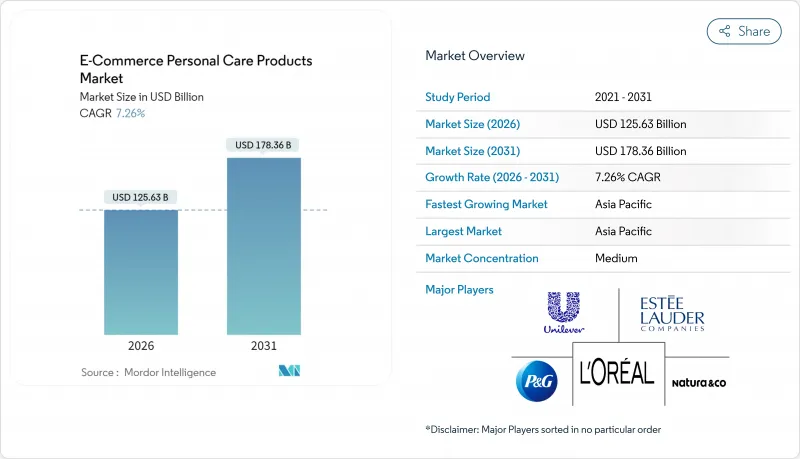

E-Commerce Personal Care Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The global e-commerce personal care products market size in 2026 is estimated at USD 125.63 billion, growing from 2025 value of USD 117.13 billion with 2031 projections showing USD 178.36 billion, growing at 7.26% CAGR over 2026-2031.

This growth stems from multiple factors transforming consumer behavior and industry dynamics. The increased adoption of digital technologies and broader internet access have made online shopping more accessible. Furthermore, the widespread use of smartphones and enhanced logistics networks enables efficient purchasing processes. Consumers demonstrate a strong preference for e-commerce platforms due to their convenience, product variety, and transparency in comparing products, prices, and reviews. The market's expansion is primarily driven by AI-enabled personalization features, including product recommendations, virtual try-ons, and customer service chatbots that enhance the overall shopping experience. Direct-to-consumer (DTC) brands are strategically utilizing these digital capabilities to implement competitive pricing strategies and establish direct customer relationships without traditional retail intermediaries, thereby contributing significantly to the market's continued growth trajectory.

Global E-Commerce Personal Care Products Market Trends and Insights

Influence of Social Media and Influencer Marketing

The E-commerce personal care products market has transformed its promotional strategies, with social commerce emerging as a key growth driver. Digital payment system integration has accelerated this transformation. In October 2024, Press Information Bureau reported that Unified Payments Interface (UPI) processed INR 16.58 billion financial transactions in a single month, demonstrating its importance in India's e-commerce digital transformation . This change is significant for international beauty brands targeting younger consumers, who discover products through digital content creators rather than traditional advertising channels. Nano-influencers, content creators with smaller but highly engaged international followings, have become valuable partners for global beauty brands seeking authentic consumer connections. These influencers deliver higher engagement rates and conversion metrics compared to macro-influencers while providing brands with targeted reach at lower costs. International brands such as Rare Beauty exemplify this strategy's success in the e-commerce space, gaining significant market share through creator-driven content despite recent market entry.

Flexible and Diverse Payment Options

The availability of flexible payment options drives growth in the e-commerce personal care products market by transforming consumer shopping behavior and increasing conversion rates. Consumers expect secure and customized payment experiences with options ranging from traditional credit cards to digital wallets. Digital wallets now facilitate a significant portion of global online payments, offering one-click purchasing and enhanced security that reduces transaction friction and cart abandonment rates. According to the United States Securities and Exchange Commission, PayPal's global payment transaction volume increased by over 5% in Q3 2024 compared to Q3 2023. The integration of diverse payment solutions remains essential for e-commerce platforms to maintain market competitiveness and meet evolving consumer preferences in the personal care products segment. As digital payment technologies continue to advance, businesses that adapt to these payment trends position themselves for sustained growth in the online personal care products marketplace.

Proliferation of Counterfeit Products Undermines Consumer Trust

The expansion of the global e-commerce personal care products market is significantly impeded by the prevalence of counterfeit merchandise, which presents substantial risks to consumer well-being and corporate brand integrity. This critical issue manifests predominantly within third-party e-commerce platforms, where product authentication mechanisms remain insufficient. The Food and Drug Administration (FDA)'s implementation of the Modernization of Cosmetics Regulation Act (MoCRA) has established enhanced enforcement protocols, with 589,762 active cosmetic product listings documented by January 2025, facilitating the identification of fraudulent products . E-commerce platforms are subject to increased regulatory accountability under revised frameworks, including the elimination of the de minimis exemption for low-value shipments, which has strengthened customs surveillance and necessitated the implementation of more rigorous seller verification protocols. Despite these challenges, the e-commerce personal care products market continues to evolve through enhanced regulatory compliance, improved authentication systems, and strengthened supply chain protocols, ensuring sustained market development and consumer protection.

Other drivers and restraints analyzed in the detailed report include:

- Promotion and Discounts Enticing Consumer to Make Purchase

- Demand for Clean, Suitable and Ethical Products

- Logistical Challenges in Fulfillment and Delivery

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The skin care segment maintains market dominance with a 41.12% share in 2025, attributed to consumer emphasis on preventive wellness solutions and ingredient efficacy rather than traditional color cosmetics. The hair care segment demonstrates the highest growth trajectory, registering an 8.02% CAGR through 2031, primarily driven by technological innovations exemplified by L'Oreal Groupe's AirLight Pro, a professional-grade hair drying instrument introduced in January 2024. The lip care segment exhibits significant recovery, corresponding to the resumption of social activities in the post-pandemic period, generating increased demand for products that deliver both hydration and aesthetic enhancement.

The oral care segment demonstrates sustained growth through the implementation of subscription-based business models and the integration of electric toothbrushes with mobile applications for dental hygiene monitoring. The men's grooming segment exhibits substantial expansion, notably in Asian markets, where male consumers demonstrate increased adoption of skincare and cosmetic products. The fragrance market undergoes transformation through the implementation of personalization technologies, facilitating customizable scent development, while premium offerings emphasize therapeutic and psychological benefits.

In 2025, conventional/synthetic ingredients dominate the global e-commerce personal care products market with a 71.78% market share. This position stems from established supply chains that provide consistent product availability and cost efficiencies for manufacturers and retailers. Synthetic formulations maintain their appeal through proven efficacy, stability, and scalability, particularly among price-sensitive consumers in mass market segments where affordability and consistent results are essential. Major brands utilize these advantages to maintain wide distribution networks and competitive pricing, making conventional products the primary choice for consumers globally. The market position of synthetic ingredients remains strong due to consumer familiarity and established trust.

The natural and organic formulations segment is expected to grow at a 8.95% CAGR through 2031. This growth reflects increased consumer focus on health, wellness, and environmental sustainability, along with greater demand for clean-label products without synthetic chemicals. Millennials and Gen Z consumers prioritize transparency in ingredient sourcing and manufacturing processes, increasing demand for plant-based, cruelty-free, and environmentally conscious products. Manufacturers are developing new formulations, implementing sustainable packaging solutions, and obtaining certifications to meet consumer preferences. The combination of premium natural and organic products with digital marketing strategies is driving adoption across both developed and emerging markets.

The E-Commerce Personal Care Products Market is Segmented by Product Type (Skin Care, Hair Care, Lip Care, Oral Care, and More), Ingredients (Conventional, and Natural/Organic), Category (Mass, and Premium), Platform Type (Third Party Retailer, and Company's Own Website), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific region commands 42.10% market share in 2025 and demonstrates a projected growth rate of 9.88% CAGR through 2031, attributed to China's digital retail market evolution. Southeast Asia is establishing its position as a significant beauty e-commerce market, underpinned by demographic shifts toward middle-class expansion and increased internet infrastructure development. The regional market demonstrates notable advancement through the integration of livestreaming and social commerce capabilities, with platforms such as Alibaba providing essential market access in developing regions. International beauty corporations, including L'Oreal and Estee Lauder, have realized substantial returns on their digital infrastructure investments.

North America retains its market leadership position in e-commerce personal care products, exhibiting sustained growth trajectories notwithstanding political market variables. This market expansion is fundamentally supported by elevated disposable income levels, established personal care routines, and increasing consumer focus on dermatological and hair maintenance requirements, driving demand for multifunctional product innovations. Market development continues through digital platform optimization, enhanced e-commerce user experiences, and strategic integration of social media marketing and celebrity product endorsements.

European markets maintain a significant market presence in online beauty commerce operations. The region demonstrates pronounced environmental consciousness, evidenced by IfD Allensbach data indicating 21.91 million German-speaking consumers expressing willingness to increase expenditure on environmentally sustainable products in 2024 . South America, and Middle East and Africa regions present emerging market opportunities, characterized by expanding middle-class demographics and increasing disposable income levels. However, these regions experience growth limitations due to infrastructure deficiencies and regulatory framework complexities.

- L'Oreal S.A.

- Procter & Gamble Company

- Unilever PLC

- Colgate-Palmolive Company

- Estee Lauder Companies Inc.

- Natura & Co Holding SA

- Kenvue Inc.

- Beiersdorf AG

- Shiseido Co. Ltd.

- Oriflame Holding AG

- Kao Corporation

- Coty Inc.

- Amorepacific Corporation

- Edgewell Personal Care Company

- Mary Kay Holding Corporation

- Glossier Inc.

- Reckitt Benckiser Group PLC

- Church & Dwight Co. Inc.

- Honest Company Inc.

- Function of Beauty Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Influence of Social Media and Influencer Marketing

- 4.2.2 Flexible and Diverse Payment Options

- 4.2.3 Promotion and Discounts Enticing Consumer to Make Purchase

- 4.2.4 Demand for Clean, Suitable and Ethical Products

- 4.2.5 Increasing Trend of Online Shopping

- 4.2.6 Personalization and Product Recommendations

- 4.3 Market Restraints

- 4.3.1 Proliferation of Counterfeit and Unsafe Products

- 4.3.2 Logistical Challenges in Fulfillment and Delivery

- 4.3.3 Intense Price Competition Reduces Profit Margins

- 4.3.4 Data Privacy Concerns Limit Personalization Opportunities

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Skin Care

- 5.1.2 Hair Care

- 5.1.3 Lip Care

- 5.1.4 Deodorant and Antiperspirant

- 5.1.5 Bath and Shower

- 5.1.6 Oral Care

- 5.1.7 Men's Grooming

- 5.1.8 Perfumes and Fragrances

- 5.2 By Ingredients

- 5.2.1 Conventional

- 5.2.2 Natural/Organic

- 5.3 By Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Platform Type

- 5.4.1 Third-Party Marketplace

- 5.4.2 Company-owned Platform

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 L'Oreal S.A.

- 6.4.2 Procter & Gamble Company

- 6.4.3 Unilever PLC

- 6.4.4 Colgate-Palmolive Company

- 6.4.5 Estee Lauder Companies Inc.

- 6.4.6 Natura & Co Holding SA

- 6.4.7 Kenvue Inc.

- 6.4.8 Beiersdorf AG

- 6.4.9 Shiseido Co. Ltd.

- 6.4.10 Oriflame Holding AG

- 6.4.11 Kao Corporation

- 6.4.12 Coty Inc.

- 6.4.13 Amorepacific Corporation

- 6.4.14 Edgewell Personal Care Company

- 6.4.15 Mary Kay Holding Corporation

- 6.4.16 Glossier Inc.

- 6.4.17 Reckitt Benckiser Group PLC

- 6.4.18 Church & Dwight Co. Inc.

- 6.4.19 Honest Company Inc.

- 6.4.20 Function of Beauty Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK