PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906252

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906252

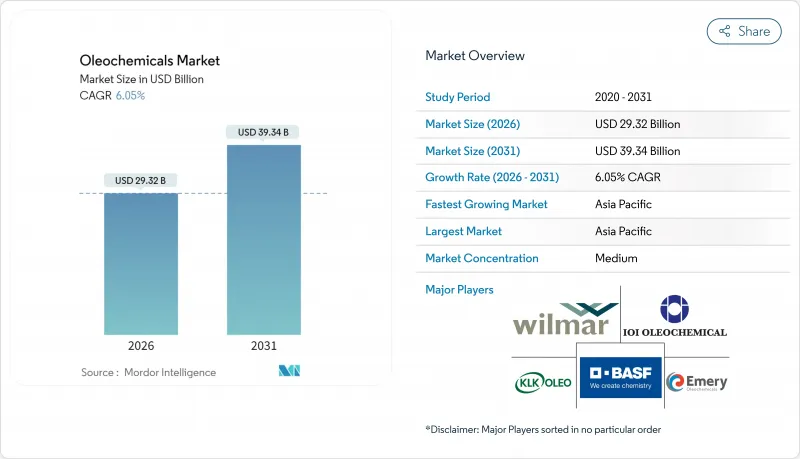

Oleochemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Oleochemicals Market was valued at USD 27.65 billion in 2025 and estimated to grow from USD 29.32 billion in 2026 to reach USD 39.34 billion by 2031, at a CAGR of 6.05% during the forecast period (2026-2031).

Current expansion reflects policy-driven demand for bio-based surfactants, biodiesel blending mandates, and accelerating consumer preference for natural ingredients across home and personal care applications. Indonesia's B40 program alone redirects more than 15 Million kilolitres of palm-based methyl esters into energy use, tightening supply for conventional chemical uses. Concurrently, the European Union (EU) Deforestation Regulation raises compliance costs and spurs investment in traceable, certified supply chains. Synthetic-biology routes that convert sugars or methanol into fatty acids and alcohols are emerging, promising feedstock diversification and lower land-use impacts. Asia-Pacific remains the focus of production and demand, supported by integrated palm infrastructure and fast-growing personal-care consumption in China and Southeast Asia.

Global Oleochemicals Market Trends and Insights

Growing Surfactants Capacity in Asia-Pacific

Surfactant manufacturing projects in China, Indonesia, and Malaysia are scaling rapidly, lifting baseline demand for C12-C18 fatty acids and alcohols. KLK OLEO's recent 200 ktpa expansion in Zhangjiagang underscores the region's feedstock and logistics advantage. Local personal-care brands are moving upmarket, incorporating naturally derived emulsifiers to meet domestic "clean beauty" standards. Export-oriented producers capture cost-sensitive orders from Europe as petro-inflation raises synthetic surfactant prices. Governments are promoting specialty chemicals under value-addition roadmaps, further anchoring new oleochemical units. The cumulative effect is a structural uplift in baseline offtake that cushions the oleochemicals market against cyclical swings.

Expanding Personal-Care and Cosmetics Demand

Global retail skin-care sales rose 9% in 2024, and formulating chemists increasingly specify plant-based emollients, esters, and emulsifiers. BASF's Verdessence line illustrates how waxy plant polymers replace microplastics without compromising sensory profiles . North American consumers rank biodegradability second only to efficacy in purchase drivers, pushing brand owners to reformulate legacy stock keeping unit (SKUs). Asian multinationals mirror this shift, aiming for ECOCERT and COSMOS accreditation on flagship lines. Bio-surfactant commercial trials using rhamnolipids show double-digit growth potential, signalling a medium-term substitution of synthetic ethoxylates. Collectively, premiumisation and sustainability converge to keep price elasticity favourable for specialty oleochemicals.

Feedstock Price Volatility

Crude palm oil futures swung between USD 780 and USD 970 per ton in 2024 following El Nino-linked yield drops, eroding gross margins for splitters and distillers. Coconut oil prices also spiked after typhoon damage to Philippine plantations, pressuring lauric acid derivative costs. North American buyers turned to Brazilian tallow, but a 377% export surge lifted local fat prices by 18%. Producers responded by shortening contract tenors and introducing price-escalation clauses. Persistent volatility complicates inventory planning and can trigger demand destruction when costs overshoot end-use price points.

Other drivers and restraints analyzed in the detailed report include:

- Biodiesel Mandates for Fatty Acid Methyl Esters

- Shift Toward Biodegradable, Plant-Based Chemicals

- NGO and Regulatory Pressure on Unsustainable Palm Oil

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Global fatty acids retained 37.65% Oleochemicals market share in 2025 on the back of solid detergent and personal-care demand. The Oleochemicals market size for methyl esters, however, is projected to rise at a 7.68% CAGR, supported by mandatory biodiesel programs across Indonesia, Brazil, and the EU. Fatty alcohol innovation through fermentation could recalibrate cost curves, yet commercial volumes will remain limited until late decade. Glycerine oversupply from biodiesel yields downward price pressure, encouraging its uptake in pharma and food applications. As policy-driven energy demand is largely price-inelastic, methyl ester offtake continues even during economic slowdowns. Conversely, specialty fatty acid derivatives such as azelaic and sebacic acids enjoy premium streams, benefiting integrated producers able to valorise by-products.

Methyl esters' rapid growth diverts feedstock away from soap noodles, occasionally forcing price pass-throughs in consumer staples. Market participants thus explore route-to-market synergies: integrated agribusinesses with crushing, biodiesel, and oleochemical assets optimise allocation daily. Fatty alcohol demand intersects with rising sulfate-free cosmetic trends, reinforcing alcohol's relevance despite ester acceleration. Net effect is a nuanced competitive landscape where product categories no longer operate in silos, but rather interlink through feedstock and coproduct economics within the wider Oleochemicals market.

The Oleochemicals Market Report is Segmented by Product Type (Fatty Acids, Fatty Alcohols, Methyl Esters, Glycerine, and More), Feedstock Source (Vegetable Oils and Animal Fats), End-User Industry (Personal Care and Cosmetics, Food and Beverages, Pharmaceuticals, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 47.12% Oleochemicals market share in 2025, anchoring the Oleochemicals market courtesy of integrated palm clusters and cost-efficient logistics. Regional CAGR of 7.92% will continue as China's surfactant complexes ramp up and Southeast Asian disposable incomes climb. Yet export-centric players must meet EU and North American sustainability thresholds or risk margin-eroding discounts. Indonesian biodiesel uptake diverts feedstock and fosters domestic refinery investments that lift local value capture. Malaysia's specialty chemicals roadmap aims to double downstream revenue by 2030, though skilled-labour shortages could constrain execution. South Asia shows rising demand for soap noodles, but quality specifications still lag the Organization for Economic Cooperation and Development (OECD) markets, tempering price realization.

North America and Europe balance mature consumption with technological innovation. EU policy bans high-ILUC palm, incentivising waste-oil and animal fat-based oleochemicals, while venture-backed fermentation start-ups secure offtake agreements with cosmetic multinationals. US renewable diesel growth sequesters tallows, prompting local oleochemical players to import lauric oils despite freight premiums. South America, led by Brazil, grows fastest after Asia-Pacific (APAC); expanding crush capacity ensures ready soybean oil supply, although domestic biodiesel uptake absorbs a significant slice. Middle East and Africa lag in production capacity but present incremental demand, with Gulf states encouraging bio-lubricant uptake in marine and mining sectors, offering gradual yet stable pull for exporters.

- BASF

- Berg+Schmidt GmbH & Co. KG

- Cargill Inc.

- Croda International Plc

- Emery Oleochemicals

- Evonik Industries AG

- Godrej Industries Group

- IOI Oleochemical

- Kao Corporation

- KLK OLEO

- Kraton Corporation

- Musim Mas Group

- Oleon NV

- Procter & Gamble

- PT Ecogreen Oleochemicals

- VVF Ltd.

- Wilmar International Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Surfactants Capacity in Asia-Pacific

- 4.2.2 Expanding Personal-care and Cosmetics Demand

- 4.2.3 Biodiesel Mandates for Fatty Acid Methyl Esters

- 4.2.4 Shift Toward Biodegradable, Plant-based Chemicals

- 4.2.5 Synthetic-biology Routes to Low-cost Fatty Alcohols

- 4.3 Market Restraints

- 4.3.1 Feedstock Price Volatility

- 4.3.2 NGO and Regulatory Pressure on Unsustainable Palm Oil

- 4.3.3 Petrochemical Price Competition in Bulk Applications

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 Product Type

- 5.1.1 Fatty Acids

- 5.1.2 Fatty Alcohols

- 5.1.3 Methyl Esters

- 5.1.4 Glycerine

- 5.1.5 Other Product Types

- 5.2 Feedstock Source

- 5.2.1 Vegetable Oils

- 5.2.2 Animal Fats

- 5.3 End-user Industry

- 5.3.1 Personal Care and Cosmetics

- 5.3.2 Soap and Detergent

- 5.3.3 Food and Beverages

- 5.3.4 Pharmaceuticals

- 5.3.5 Polymers

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Berg+Schmidt GmbH & Co. KG

- 6.4.3 Cargill Inc.

- 6.4.4 Croda International Plc

- 6.4.5 Emery Oleochemicals

- 6.4.6 Evonik Industries AG

- 6.4.7 Godrej Industries Group

- 6.4.8 IOI Oleochemical

- 6.4.9 Kao Corporation

- 6.4.10 KLK OLEO

- 6.4.11 Kraton Corporation

- 6.4.12 Musim Mas Group

- 6.4.13 Oleon NV

- 6.4.14 Procter & Gamble

- 6.4.15 PT Ecogreen Oleochemicals

- 6.4.16 VVF Ltd.

- 6.4.17 Wilmar International Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Increased Use of Biofuels